Messari: Why can't buybacks stop token prices from falling sharply

Reprinted from jinse

03/21/2025·2MWritten by: AIMan@Golden Finance

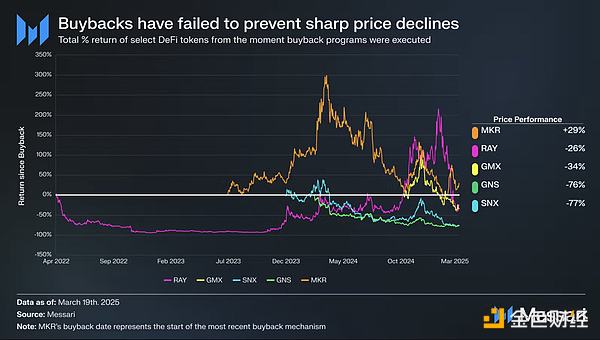

Messari analyst DeFi MONK research found that buybacks cannot prevent a sharp decline in token prices.

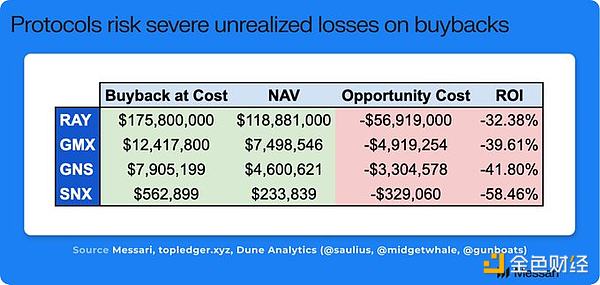

DeFi MONK further analyzed the repo data and price performance of RAY, GMX, GNS and SNX. RAY, GMX, GNS and SNX have repurchased millions of tokens through programs, and these tokens are now worth much less than they were at the time of repurchase.

DeFi MONK then analyzes the paradox that cannot prevent the tokens from being inherent:

1. Price has nothing to do with repurchase, price is driven by revenue growth and narrative.

2. When the revenue is strong and the price is good, the project party will eventually spend more cash reserves to buy back the tokens at an unfavorable price.

3. When prices and income are bad and cash is needed to invest in innovation and restructuring, the project party lacks excess capital to do so. Worse, the project team is suffering huge unrealized losses, as the net asset value of the buyback is now much lower than the cost.

Repurchase is a bad capital allocation. The mindset should be to achieve growth at all costs or to allocate actual value to holders in a stable/main form (see veAERO or BananaGun).

panewslab

panewslab