AI financial analysis platform Edgen is officially launched to create the "Bloomberg terminal" in the Web3 era

Reprinted from chaincatcher

05/16/2025·17DMay 14, 2025 - Edgen, the world's leading AI financial analysis platform supported by top institutions such as Framework Ventures, North Island Ventures, Portal Ventures, Hivemind Capital Partners, Moonrock Capital, etc., announced the end of closed testing and is officially open to global users. As the first native AI-driven "financial cognitive operating system", Edgen provides retail investors, traders and analysts with institutional-level market insights through its original intelligent decision-making model (EDGM, Efficient Decision Guidence Model), helping users gain a cognitive advantage in the crypto market where information explosion occurs.

AI restructures financial decisions, allowing ordinary investors to have

a "quantitative team"

In traditional financial markets, hedge funds and quantitative teams have long been advantageous with advanced data analysis tools, while retail investors are often passive due to information lag or insufficient analysis capabilities. The birth of Edgen is to break this imbalance.

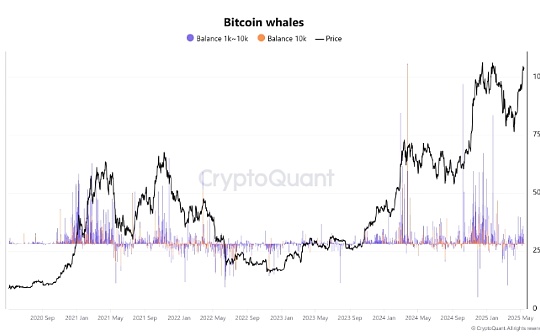

Its core EDGM system adopts a lightweight real-time routing architecture, which can dynamically integrate multi-dimensional data such as social sentiment, on-chain capital flow, market fundamentals, etc., and generate executable transaction insights.

Co-founder Sean Tao gave an example: "When a small-cap token changes in the market, Edgen can analyze the smart money trends, community discussion popularity and fundamental changes behind it in seconds, which is equivalent to equip each user with an AI analyst team that operates around the clock."

Four core functions to create a closed-loop cognitive ecosystem

Edgen has designed four major interactive interfaces in a breakthrough manner: Instant Search, Token Radar, Insights and Smart Network (Aura). These modules form a closed-loop cognitive ecosystem through the EDGM system, and users continue to optimize platform intelligence every time they search, viewpoint release and strategy interaction. Users' high-quality analysis on different platforms can be evaluated by Aura by algorithms and fed back to AI training, forming a positive cycle of "the more you use it, the smarter it is." Transform high-quality market insights into training data so that AI can truly learn the actual thinking of traders.

Open Eco-Strategy: Allows everyone to customize exclusive AI transaction

assistants

In addition to core functions, Edgen simultaneously launched the Edgentic Marketplace, allowing developers to develop customized AI agents, data analysis modules and automated trading strategies based on the EDGM system. This means that both ordinary investors, professional traders, or quantitative teams can use this open platform to build intelligent investment tools that meet their own needs.

"In the traditional financial era, Bloomberg terminals are the information barriers for institutions; in the Web3 era, Edgen will become everyone's cognitive accelerator." Sean Tao said, "We believe that the future market advantage does not lie in the scale of funds, but in the speed of thinking and decision-making efficiency."

Conclusion: Redefining “smart money”

In the financial market with information overload, simple data pileup can no longer bring advantages. The real competitiveness lies in how to quickly refine effective signals and make precise decisions. Edgen's vision is to allow every investor to think like a top hedge fund and take the lead in this competition of cognitive efficiency.

“The future of the crypto market belongs to those who can understand narratives faster and predict trends more quickly,” Sean Tao concluded. “And Edgen is the ultimate weapon to help users win this mental competition.”

About Edgen

Edgen is a leading AI-driven market intelligence operating system in the field of encryption. Through the independently developed efficient decision-making guidance model (EDGM), Edgen transforms high-threshold institutional-level strategies into universal intelligent tools. The platform pioneered the "Cognition as a Service" (CaaS) architecture, integrating multimodal AI proxy clusters, real-time social emotional pulse scanning and discrete learning of on-chain data, providing retail investors and independent analysts with decision-making advantages beyond traditional hedge funds.

Edgen is jointly invested by crypto-native funds such as Framework Ventures and North Island Ventures. The technical team is composed of the former Wall Street quantitative trading group and the core developers of the Web3 protocol to build the cognitive infrastructure of the next generation of open finance.

panewslab

panewslab

jinse

jinse