With funds pouring in and 11.4 million contracts making history, is the Base chain hype coming?

Reprinted from panewslab

03/15/2025·3MRecently, Base—the Ethereum Layer 2 network incubated by Coinbase—is attracting market attention with a rapid momentum. Funds and users continue to pour in, ecological activity has increased significantly, and transaction volume and total locked value (TVL) have been rising steadily, revealing signs of an "big event" coming. Industry insiders call it "Base Season", and this wave may become the highlight of the crypto market in 2025. This article will start from the latest data, analyze the logic behind Base growth, explore why funds are flocking, and recommend several investment directions worth paying attention to, providing investors with forward-looking insights.

Data outline growth picture

Base's recent performance can be described as "explosive growth", with multiple key indicators pointing to its potential "big event" possibilities.

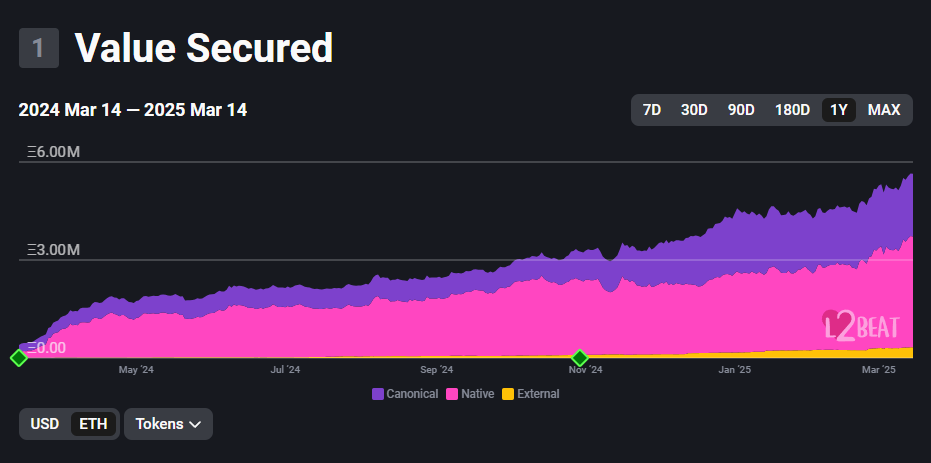

- TVL's rapid growth: Base's total lock-in value (TVL) surged from $518 million at the beginning of 2024 to more than $4 billion today, surpassing Arbitrum and Optimism at one point to becoming the leader in the Layer 2 field. This shows that funds are inflowing faster and Base’s ecological appeal has increased significantly.

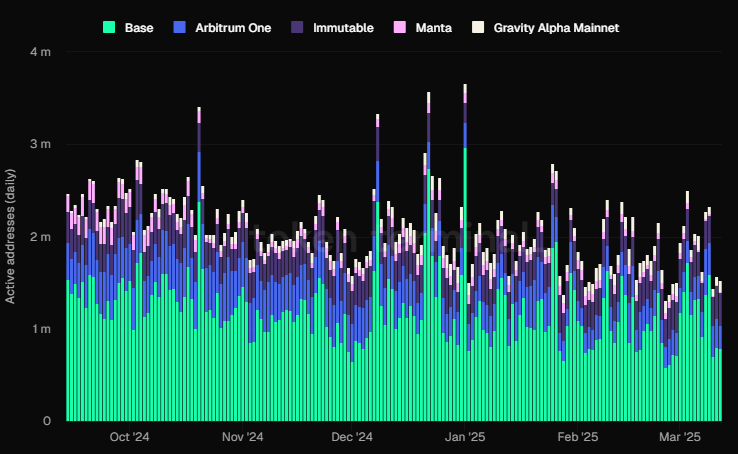

- Active Address: Base's daily active addresses have always been at the top of L2, with the average daily active addresses reaching 796,000, far exceeding Arbitrum One (243,500), Immutable (121,500), and other networks such as Manta and Gravity Alpha Mainnet (about 10,000 respectively). The total active addresses have exceeded 1.5 million, showing a rapid increase in user participation, especially in recent peak periods, the number of addresses has exceeded 3.5 million many times, highlighting the vigorous vitality of the Base ecosystem.

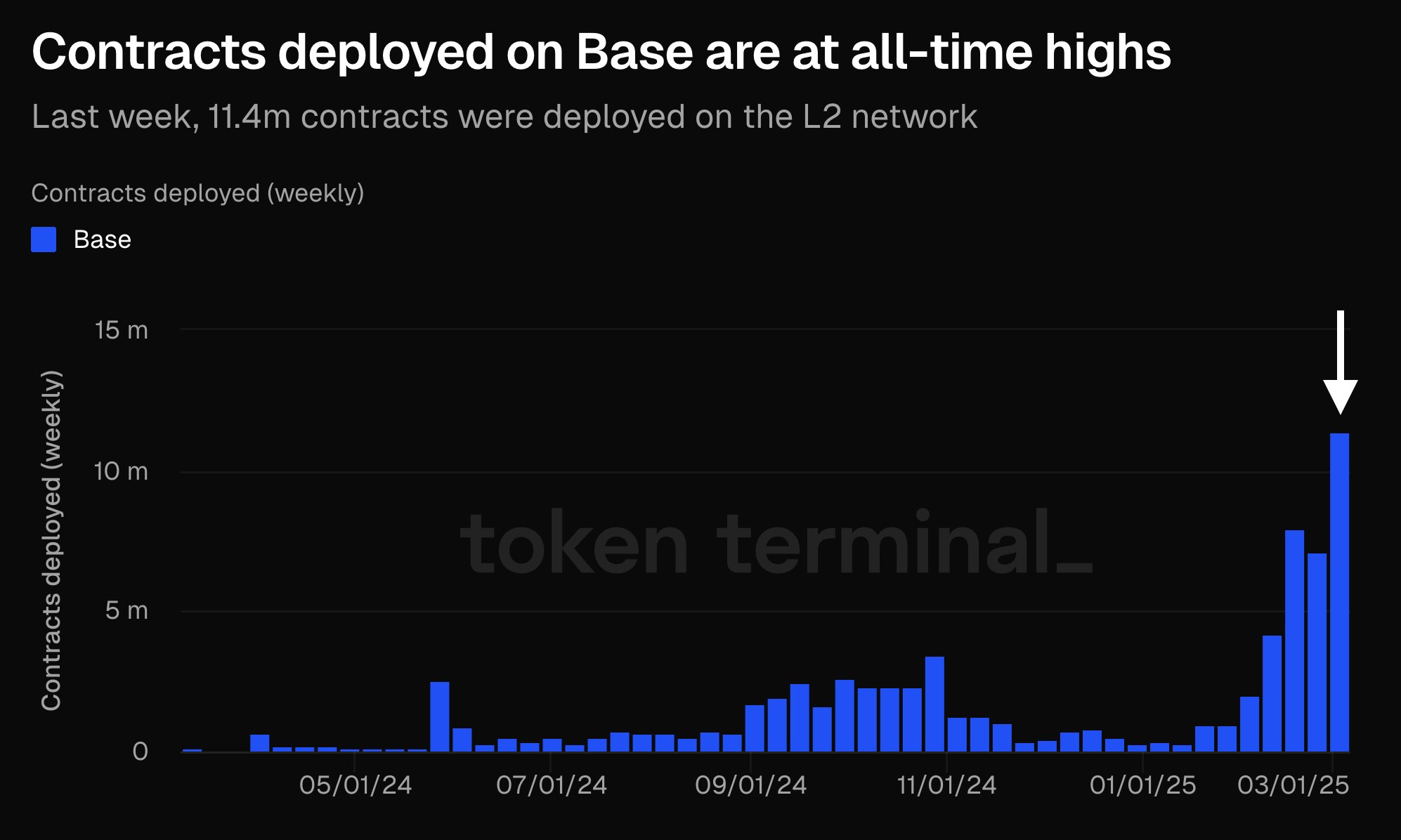

- Contract deployment sets record: On March 14, 2025, Token Terminal disclosed the number on X platform

- The Base network allegedly deployed 11.4 million contracts last week, a record high. This figure shows developers' favor with the Base technology stack, and the diversity of the ecosystem and innovation capabilities are rapidly improving.

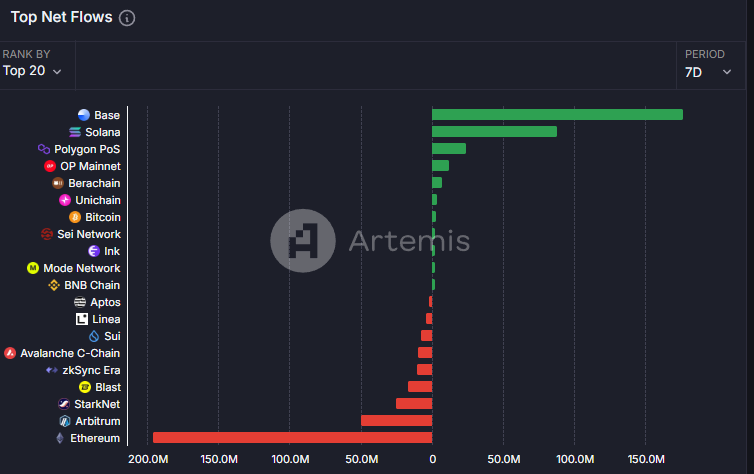

- Incredible speed of capital inflows: According to the latest data provided by Artemis, Base tops the list with net inflows of more than $20 billion in the last seven days, far exceeding second place Solana (about $15 billion) and other networks such as Polygon, OP Mainnet and Berachain.

Behind these data, Base's meme coin boom and the prosperity of the DeFi ecosystem are indelible. High activity not only attracts speculative capital, but also provides fertile ground for developers. However, TVL's rapid growth may be mixed with speculative elements, and the occasional network rollback problem under high transaction volumes also reminds people that Base's infrastructure still needs to be polished. Nevertheless, these signals together outline a picture where Base may usher in a major turning point, perhaps officially kicking off Base Season in the second quarter of 2025.

Why does funds favor Base?

The ability of Base to attract so much capital is inseparable from Coinbase's strategic support. As the first cryptocurrency exchange listed in the United States, Coinbase gives Base a strong brand effect and user base. Its collaboration with Stripe introduces USDC support, making Base an ideal choice for low-cost cross-border payments, so traditional funds can be easily entered. There are also market rumors that Base may divest and issue independent tokens from Coinbase, an expectation that further ignited the enthusiasm of early users.

At the technical level, Base is built on Optimism's OP Stack. The recently launched Flashblocks technology shortens the block time to 200 milliseconds, and the transaction speed is even higher than Solana. Transaction fees as low as 1 cent compared to Solana's high costs and Ethereum's congestion has become the key to funding favor. In addition, the Base ecosystem covers popular fields such as DeFi, meme coins and SocialFi, and behind the surge in trading volume is the fanaticism of speculative capital. Someone on X joked that the dealer may think that Solana is too expensive and turned his attention to Base's low threshold and high returns.

The macro environment also plays a role in fueling the fire. 2025 is in the early stages of Trump’s new term, and its policy uncertainty may prompt funds to flow into crypto markets, and Base, as Coinbase-led Layer 2, became the first choice for compliance and stability.

Investment opportunities worth paying attention to

B3

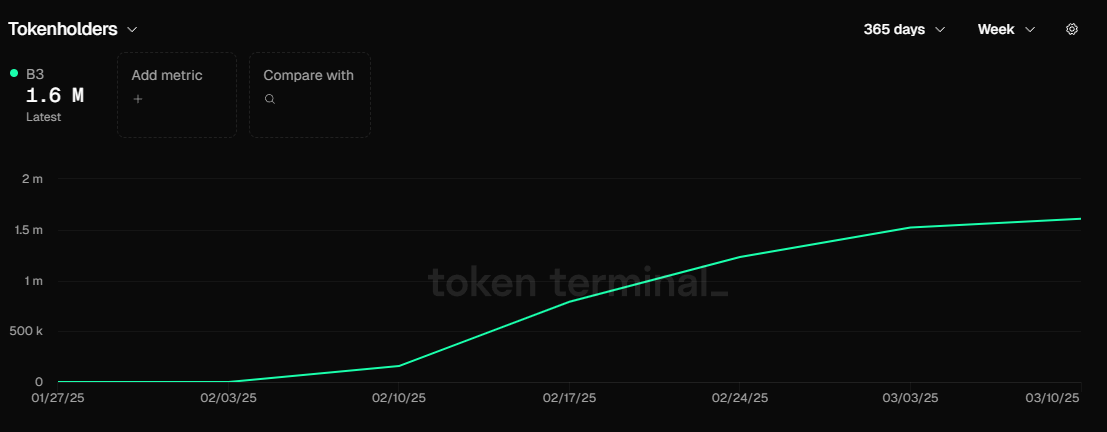

In the wave of the Base ecosystem, several projects stand out and deserve investors' attention. First of all, this token represents Base's Layer 3 ambitions and mainly serves the gaming field. After launching on Coinbase and Bybit in February 2025, the price of $B3 soared by 50%. Although subsequent prices fell due to the market, the coin holding address still maintained steady growth, showing the market's recognition of its prospects. The support of Flashblocks technology and the expansion of the Layer 3 application chain may bring new growth space for game projects, although its success still depends on user acquisition and ecological integration.

CLANKER

Another highlight is CLANKER. The AI-powered @Clanker tool has deployed about 4,700 tokens and has a market value of $113.8 million. Discussions on X believe CLANKER is undervalued, especially in its rebound, outperforming other tokens, perhaps with opportunities due to Coinbase’s listing expectations.

In addition, Aerodrome in the DeFi field should not be missed. As Base's largest decentralized exchange, its TVL exceeds US$1 billion, accounting for half of the ecological lock-up value. Earnings farming and liquidity incentives have attracted the attention of institutions and retail investors, and despite the fierce competition in the DeFi track, its growth is still worth looking forward to.

Investment advice and summary

The arrival of Base Season is due to the explosive growth of TVL and trading volume, the strategic support of Coinbase, and the resonance of technological innovation and the meme coin boom. Funds flow from Solana and Bitcoin to Base reflects the market's recognition of its low cost and high potential. However, centralized risks, technical bottlenecks and regulatory uncertainty remind investors to stay calm.

For investors, you may wish to pay attention to $CLANKER and $B3 in the short term to capture the speculative opportunities brought by meme coins and Layer 3. The key is to control positions, avoid losses caused by high volatility, and keep up with Coinbase's official dynamics and grasp the market rhythm. Base's growth is not smooth, its future depends on technological upgrades and the continued prosperity of the ecosystem. In this possible wealth feast, the balance of data-driven insights and risk management may be the key to winning.