Will AC’s return with FlyingTulip create the next DeFi summer?

Reprinted from panewslab

03/12/2025·1MAuthor: Scof, ChainCatcher

Edited by: TB, ChainCatcher

On March 10, Andre Cronje, founder of Sonic Labs, Yearn Finance, Keep3rV1, modified his personal social platform profile to join the title of "Flyingtulip Founder".

As a competitor of Hyperliquid, FlyingTulip attracted much attention as soon as it debuted. It adopts adaptive curve AMM, providing lower funding rates, better borrowing and lending ratios, and higher LP returns, and relies on SonicLabs to achieve higher TPS.

Andre Cronje: "Madman" and Subversive in the DeFi field

To introduce FlyingTulip, we have to introduce its legendary founder Andre Cronje.

Andre Cronje, a legendary figure in the DeFi circle who is well known, will always heat up market sentiment quickly once his name appears. But unlike programmers in the traditional sense, Cronje was originally a law student and graduated from the law major of Stellenbosch University in South Africa.

However, fate made a joke, which made him accidentally come into contact with computer science, but he became a self-taught and even became a lecturer. This jumping growth trajectory also laid the foundation for his future style in the DeFi field - playing cards without following common sense, being extremely creative and a bit crazy.

After entering the crypto world, Cronje quickly showed his technical talent and extreme execution. His masterpiece Yearn Finance (YFI) was born in 2020. With the concept of fair launch (no pre-digging, no team allocation), it quickly became one of the most influential projects in DeFi history. Since then, he has led or participated in many well-known projects such as Keep3r Network, Solidly, Fantom, etc., igniting market sentiment again and again.

Today, FlyingTulip has become another bold attempt in the field of derivatives trading agreements. Faced with this developer who coexisted with "genius" and "madman", the market is still waiting for the answer: Can he launch a DeFi transformation again?

What is FlyingTulip?

FlyingTulip is a DeFi integrated platform based on automatic market makers (AMMs), integrating trading, liquidity provision, lending and other functions. Its core feature is to eliminate liquidity fragmentation. Users can conduct spot trading, leveraged trading, perpetual contracts and other operations within the same AMM system without converting funds between multiple protocols. This one-stop liquidity solution improves capital utilization, makes trading experience smoother while reducing transaction costs.

In terms of lending functions, FlyingTulip adopts a dynamic LTV (loan-value ratio) model based on AMM. Compared with traditional DeFi lending protocols, it not only considers the price of collateral, but also combines market depth and volatility to make real-time adjustments to ensure the balance of loan security and capital efficiency.

Adaptive curve AMM: Make liquidity management simpler

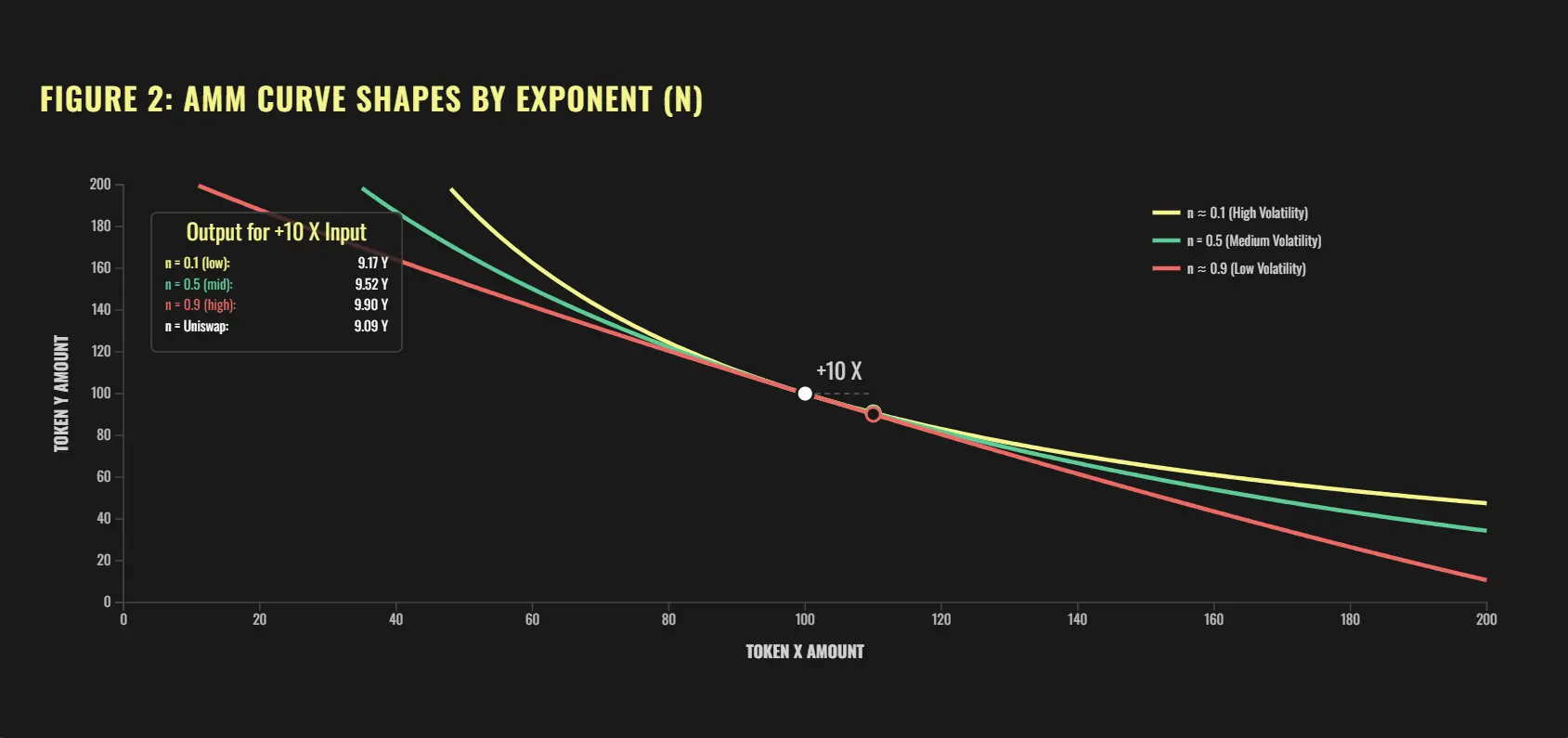

Traditional AMM models, such as Uniswap V2, use the constant product formula of X * Y = k. This mechanism, although simple, will result in liquidity being evenly distributed across all price ranges, while in fact most transactions are concentrated within certain specific price ranges. Therefore, liquidity is often not efficiently utilized. Uniswap V3 introduces centralized liquidity, allowing LPs (liquidity providers) to choose specific price ranges to provide funding, but this approach requires high financial knowledge, is more complex for ordinary users, and when prices fluctuate significantly, LPs may face serious impermanent losses.

FlyingTulip solves this problem through a dynamic AMM mechanism. It can automatically adjust the shape of the curve according to market volatility, allowing liquidity to intelligently match market demand:

- When the market is stable (low volatility), liquidity will automatically concentrate near the current price, similar to the "constant and curve" in the form of X + Y = K, which can increase capital utilization and make transaction costs lower.

- When the market fluctuates violently (high volatility), liquidity will automatically disperse, approaching the "constant product curve" of X * Y = K to adapt to possible large price changes and reduce losses caused by unilateral market fluctuations.

FlyingTulip relies on oracles to continuously monitor the market's real-time volatility (rVOL) and implicit volatility (IV) and dynamically adjusts the liquidity distribution based on these data. LP does not need to manually set complex price ranges, just deposit liquidity, and the system will automatically optimize the allocation so that they can get the best rate of return in different states of the market, while significantly reducing impermanent losses.

This mechanism makes FlyingTulip a more friendly DeFi platform for ordinary users—even if you are not familiar with the LP mechanism, it can easily provide liquidity without worrying about complex operations or potential losses.

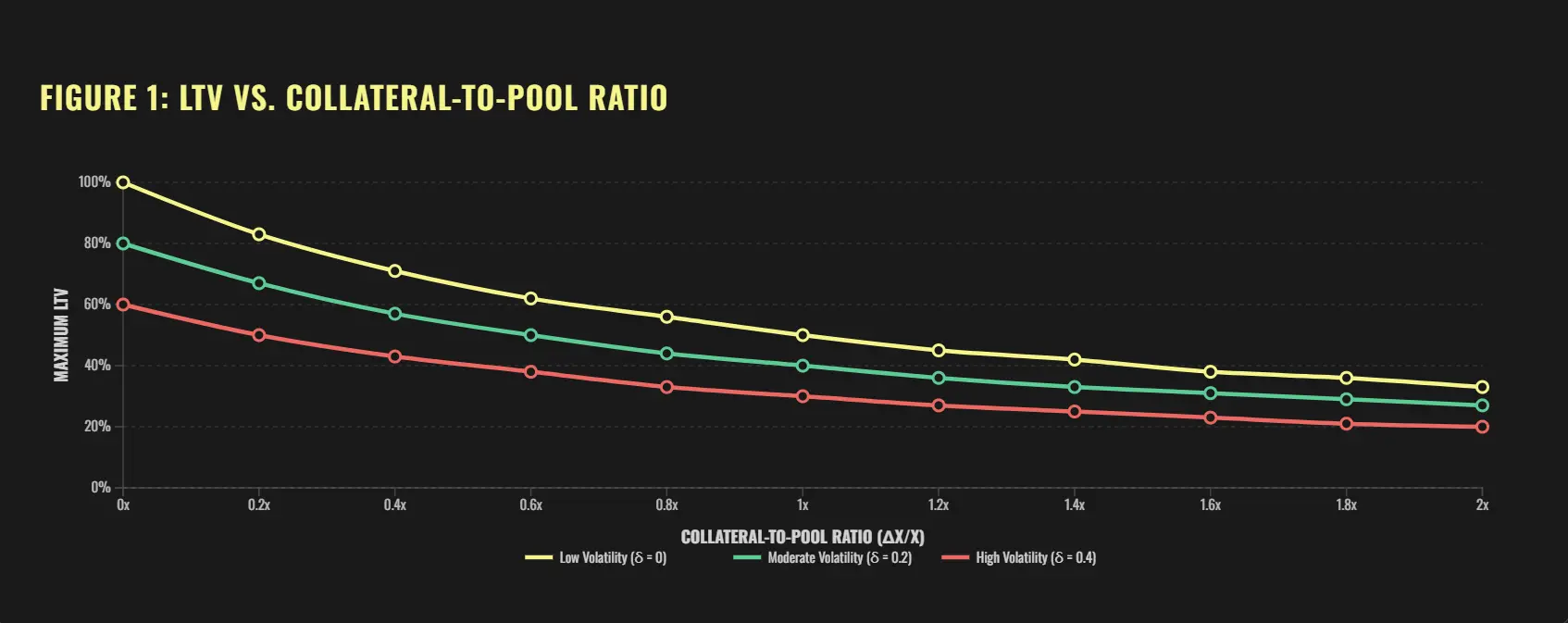

AMM-based dynamic LTV model: a more flexible lending method

In traditional DeFi lending protocols, LTV (loan-value ratio) is a fixed value, usually set according to the risk level of the token. For example, if a token is considered to be moderately risky, the user can only borrow up to 70% of the collateral value. However, this fixed LTV ignores two key factors:

- Market Depth - If the amount of borrowing is too large, it may significantly affect the price of the token, resulting in a sharp drop in market liquidity.

- Real-time volatility – When the market fluctuates violently, fixed LTV may cause assets to quickly fall below the liquidation threshold, increasing liquidation risks.

FlyingTulip solved this problem through an adaptive AMM mechanism, creating a dynamic LTV model that can adjust the lending quota in real time according to market conditions. For example:

- When the market is stable (low volatility, sufficient liquidity): Users can get higher LTV, such as 80%, which means $2,000 in ETH, and lend $1,600.

- When market turbulence (volatility increases): LTV will automatically drop to 50%, i.e. the same $2,000 ETH can only borrow $1,000 to reduce liquidation risk.

- When collateral is too large (too high proportion of market liquidity): LTV may be further reduced, such as 45%, ensuring that large borrowing will not have an excessive impact on market prices.

This dynamic LTV adjustment makes lending more flexible. Users do not need to pay attention to market changes or frequently adjust positions. The system will automatically optimize the lending quota according to market conditions. This not only reduces the risk of market collapse caused by large investors' liquidation, but also makes the entire DeFi ecosystem more stable, creating a safer environment for borrowers and liquidity providers.

Opportunities and risks coexist, are market carnivals or deep pits?

When the market began to heat up whether FlyingTulip would issue coins, the discussion on X was getting worse. Looking back at AC’s past projects, almost all rely on token incentives and community-driven rapid rise, so it seems only a matter of time before FlyingTulip launches “Tulip Coins” in the future. At present, various speculations surrounding TGE are emerging one after another, and information such as public offering prices and private offering discounts are constantly fermenting in the community.

However, AC projects have always coexisted with high returns and high risks. YFI soared to a thousand times myth after fair launch, but EMN (Eminence Finance) was also tragically reduced to zero due to loopholes. Under market fanaticism, how to balance speculative impulses and risk management is the question that rational players need to think about.

In addition, AC still continues his "mysterious marketing" style this time, not making clear publicity, but instead makes the market restless through subtle actions. For example, he recently liked Magpie Protocol (another related DEX project) on X, which immediately sparked speculation. The KOLs of the Chinese-speaking community have also begun to pay attention to and discuss FlyingTulip to promote market sentiment.

The charm of DeFi lies in the coexistence of high risks and high returns. In past impressions, AC can always bring new imagination space to this field. But whether FlyingTulip can replicate the glory of YFI, perhaps only the market will give the answer.

chaincatcher

chaincatcher