Messari: Bitcoin may reach $1 million, but you need to go through a serious bear market first

Reprinted from panewslab

03/12/2025·1MAuthor: mikeykremer , researcher Messari

Compiled by: ChatGPT

A glimpse:

- Globalization has ended and your financial assets have been liquidated.

- Non-traditional assets are your redemption.

- Bitcoin could reach millions of dollars.

From the outbreak of World War II (1939) to Trump’s second election victory (2024), we have experienced an unprecedented super bull market. This continued rise has shaped generations of passive investors who habitually believe that "the market will never have problems" and "the market will only rise." However, I think the feast is over and many people are about to usher in a liquidation.

How did we get to this point?

This super bull market from 1939 to 2024 was not accidental, but was a complete reshaping of the global economy due to a series of structural changes, and the United States always stood at the center.

Rising into a global superpower after World War II

World War II pushed the United States from a middle-class power to an undisputed leader. By 1945, the United States had manufactured more than half of the world's industrial products, controlled one-third of the world's exports, and mastered about two-thirds of the world's gold reserves. This economic hegemony laid the foundation for growth over the next decades.

Unlike the isolationism of the United States after World War I, the United States actively embraced the role of global leader, promoted the establishment of the United Nations, and implemented the "Marshall Plan", injecting more than $13 billion into Western Europe. This is not just aid—through investment in post-war state reconstruction, the United States has created new markets for its own products while establishing its own cultural and economic dominance.

Labor expansion: Women and minorities

During World War II, about 6.7 million women entered the labor market, causing the female labor participation rate to increase by nearly 50% in just a few years. Although many women left their jobs after the war, this massive mobilization permanently changed society’s perception of women’s employment.

By 1950, the trend of large-scale employment among married women was becoming increasingly obvious, with the labor participation rate of women in most ages increasing by an unprecedented 10 percentage points. This is not just a wartime exception, but the starting point for a fundamental change in the US economic model. The “marriage ban” (a policy that prohibits married women from working) has been abolished, the increase in part-time jobs, technological innovations in housework, and higher education have all prompted women to transform from temporary workers to long-term participants in the economic system.

Similar trends also occur in minority groups, who gradually gain more economic opportunities. These labor expansions have effectively boosted the U.S. production capacity and supported decades of economic growth.

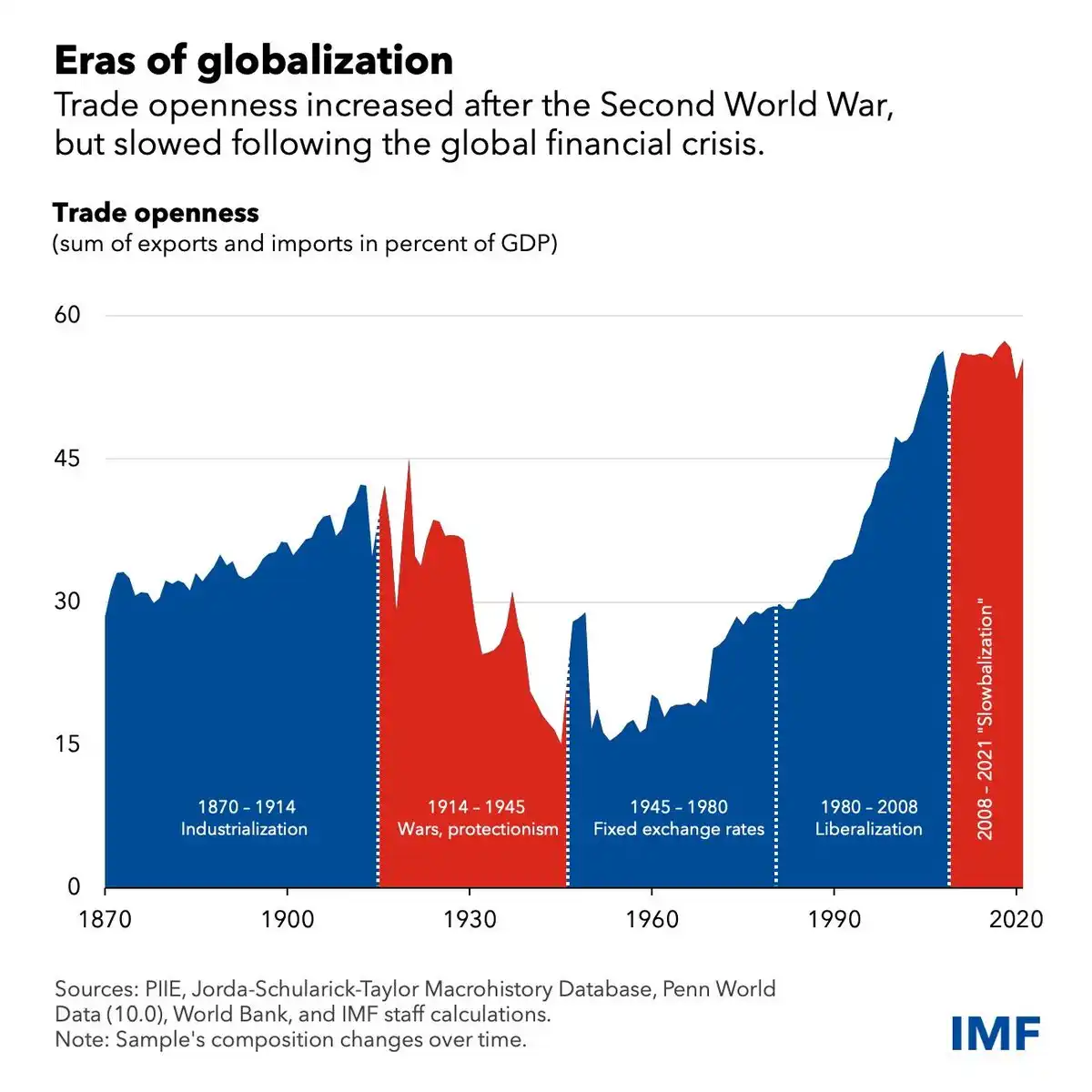

Cold War Victory and the Wave of Globalization

The Cold War shaped the political and economic role of the United States after World War II. By 1989, the United States had formed military alliances with 50 countries and stationed 1.5 million troops in 117 countries around the world. This is not only for military security, but also to establish the United States' economic influence on a global scale.

After the collapse of the Soviet Union in 1991, the United States became the only superpower in the world, entering an era that many people regard as a unipolar world. This is not only an ideological victory, but also an opening up of the global market, so that the United States can dominate the global trade pattern.

From the 1990s to the early 20th century, American businesses expanded greatly to emerging markets. This is not a natural evolution, but a result of long-term policy choices. For example, in countries where CIA intervened during the Cold War, the United States' imports increased significantly, especially in industries where the United States had no obvious competitive advantage.

Western capitalism’s victory over Eastern communism did not rely solely on military or ideological advantages. The Western liberal democratic system is more adaptable and can still effectively adjust the economic structure after the 1973 oil crisis. The Volcker Shock in 1979 reshaped the United States' global financial hegemony, making the global capital market a new engine for the growth of the United States in the post-industrial era.

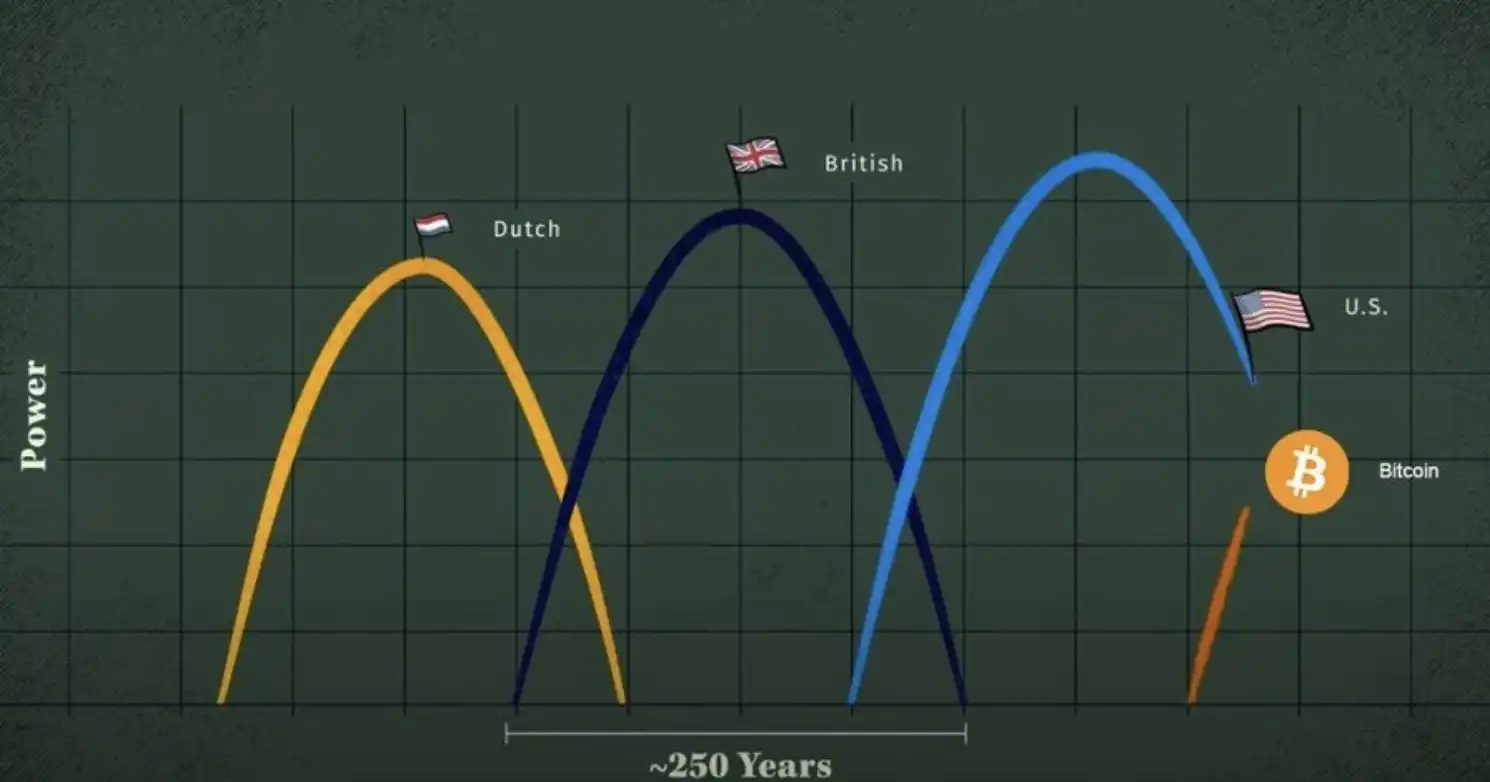

These structural changes—the rise of superpowers after World War II, women and minorities joining the labor market, and the victory of the Cold War—that together drove this unprecedented super bull market for financial assets. However, the core problem is that these transformations are all one-time events and cannot be repeated. You can't get women into the labor market again, you can't beat the Soviet Union again. Now, both parties are promoting deglobalization, and we are witnessing the final support of this super-long cycle of growth being pulled away.

What will happen next?

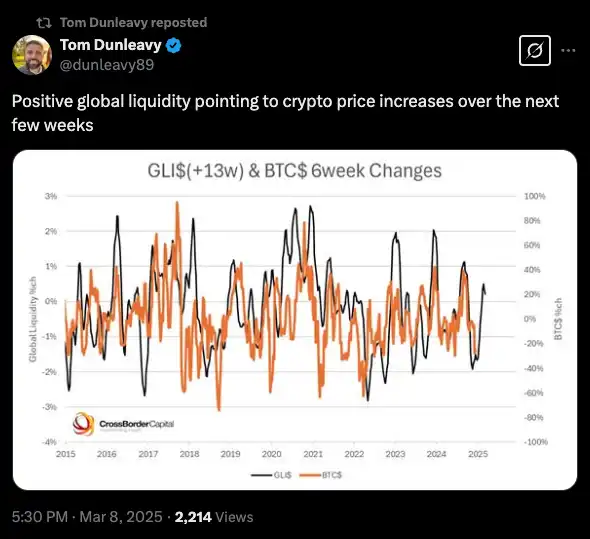

I like Tom, he is my TradFi sentiment indicator in Crypto

Unfortunately, however, everyone is praying that the market will return to historical normality. The market consensus is: the situation will get worse, and then the central bank will release the money again, and we can continue to make money... But the reality is: this group of people are heading towards the slaughterhouse.

The bull market for nearly a century has been built on a series of unrepeatable events (the bull market cannot continue), and some of these factors are even reversing.

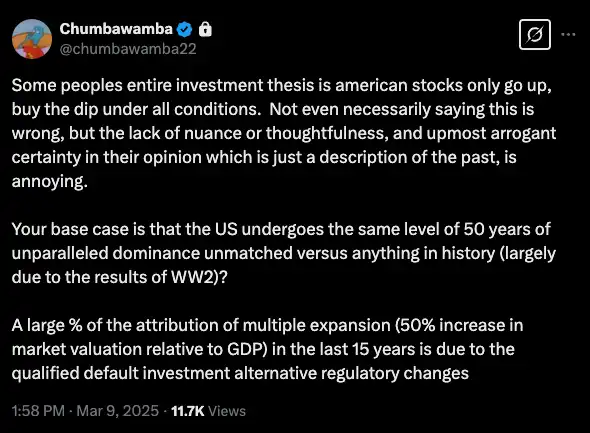

Chumba is **right** on this point

- Women won’t enter the labor market on a large scale again: In fact, women’s labor participation may fall back as Musk and the progenital elite push for higher fertility rates.

- Minorities will not be absorbed into the labor market again: In fact, the Democrats’ position on immigration policy is almost as tough as the Republicans, which has become a cross-party consensus.

- Interest rates will not fall again: In fact, every elected leader knows that inflation is the biggest threat to their reelection. Therefore, governments will try their best to avoid interest rate cuts and rekindle inflation.

- We won't be further globalized: in fact, Trump is moving in the exact opposite direction. And, I expect the Democrats to copy this policy in the next election (don't forget that most of Biden's policies directly copy Trump's first term policy).

- We won't win another world war: In fact, it looks like we might even lose the next war. Anyway, I don't want to verify this conjecture.

My point is simple: all the global macro trends that have driven the stock market up in the past century are now reversing. What do you think the market will go?

Goblin Town

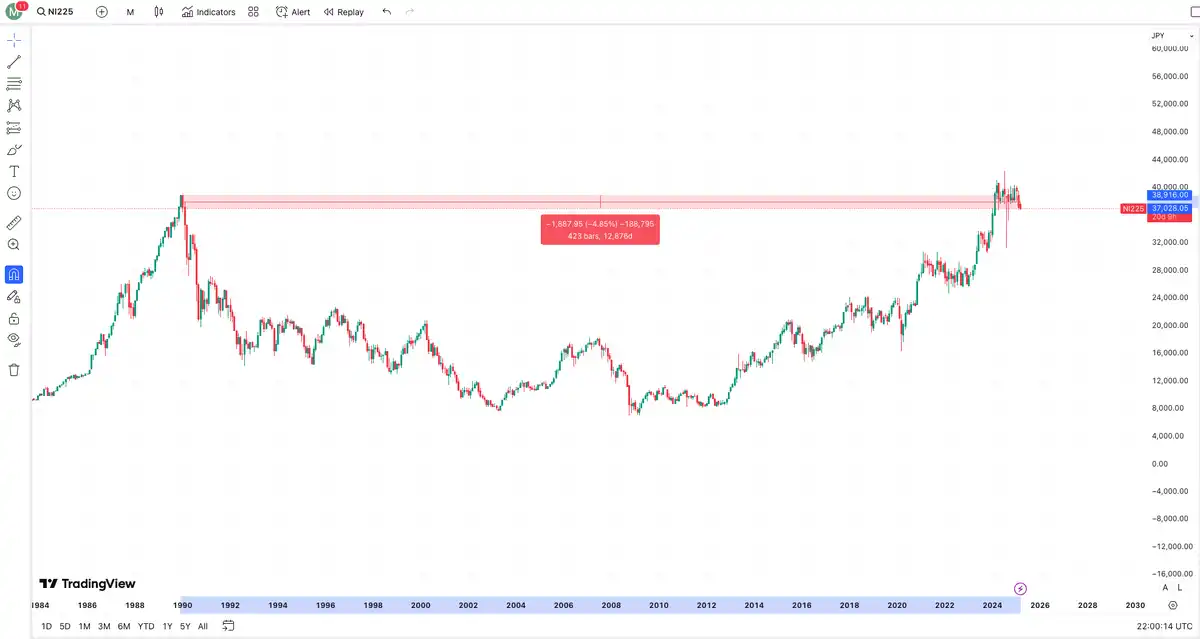

When an empire is in decline, life is really hard to endure - you can ask Japan. If you buy and hold the Nikkei 225 index at the all-time high in 1989 and hold it to date, 36 years have passed, your return is about -5%. This is a typical "buy and hold, it's painful." I think we are on the same path.

Worse, you should be prepared to face policies of capital controls and fiscal repression. The market will not rise does not mean that the government will accept the reality. When traditional monetary policies fail, the government will turn to more direct means of financial control.

Upcoming capital controls

Financial suppression refers to allowing savers to get returns below inflation so that banks can provide cheap loans to businesses and governments and reduce debt repayment pressure. This strategy is particularly effective in government liquidating local currency debt. In 1973, Stanford University economists first used this term to criticize emerging market countries’ policies to curb economic growth, but these strategies are increasingly emerging in advanced economies, such as the United States.

This may sound like a joke, but you should think hard about why Monero\'s K-line chart looks so perfect now

As the U.S. debt burden breaks through 120% of GDP, the possibility of repaying debt through traditional means is declining. The "playbook" of financial suppression has begun to be executed or tested, including:

- Direct or indirect restrictions on government debt and deposit rates

- Government controls financial institutions and establishes competition barriers

- High reserve requirement

- Create a closed domestic debt market that forces institutions to buy government bonds

- Capital controls restrict cross-border flow of assets

This is not a theoretical assumption, but a real case. Since 2010, the U.S. federal funds rate has been below inflation for more than 80% of the time, which is actually forcibly transferring savers’ wealth to borrowers (including governments).

Your retirement account: The next goal of the government

If the government cannot rely on printing money to buy bonds and drive down interest rates to avoid a debt crisis, they will be eyeing your retirement account. I can completely imagine a future: tax preferential accounts such as 401(k) will be mandatory to configure more and more "safe and reliable" government bonds. The government does not need to print money anymore, it just needs to directly misappropriate existing funds in the system.

This is exactly the script we've seen in the past few years:

- Assets Freeze: In April 2024, Biden signed a law authorizing the government to confiscate Russia's reserve assets in the United States, setting a precedent for the government to freeze foreign exchange reserves at any time. In the future, this approach may not be aimed at geopolitical opponents only.

- Canadian Freedom Fleet protests: The government has frozen about 280 bank accounts without court approval. Finance officials acknowledged that this was not only intended to cut off the flow of funds, but also to “deter” the demonstrators and ensure they “make a decision to leave.” When asked how the account freeze affects innocent families, the government responded: “They just have to leave.”

Gold levy and monitoring

It is no surprise that American history is full of similar actions:

In 1933, Roosevelt issued an executive order, mandating citizens to hand over gold, otherwise they would face imprisonment. Despite limited enforcement efforts, the Supreme Court supports the government's right to seize gold. This is not a "voluntary purchase plan", but a "forced wealth requisition", but it is packaged into a "fair market price" transaction.

Government monitoring capabilities expanded rapidly after the 9/11 incident. The FISA Amendment gives the NSA almost unlimited power to monitor international communications of U.S. citizens. The Patriot Act allows the government to collect phone records for all Americans every day. Article 215 even allows the government to collect your reading history, study materials, purchase history, medical records and personal financial information without any reasonable doubt.

The question is not "will financial suppression come" but "how serious it will be." As the economic pressure on deglobalization intensifies, government control over capital will only become more direct and strict.

Gold and Bitcoin

The golden monthly chart since 1970 is currently the strongest K-line chart in the world.

Based on the exclusion method, the most suitable financial assets to buy are already obvious - you need an asset that has no historical correlation with the market, is difficult to confiscate by the government, and is not controlled by the Western government. I can think of two, one of which has increased its market cap by $6 trillion in the past 12 months. This is the most obvious bull market signal.

Global Gold Reserves Competition

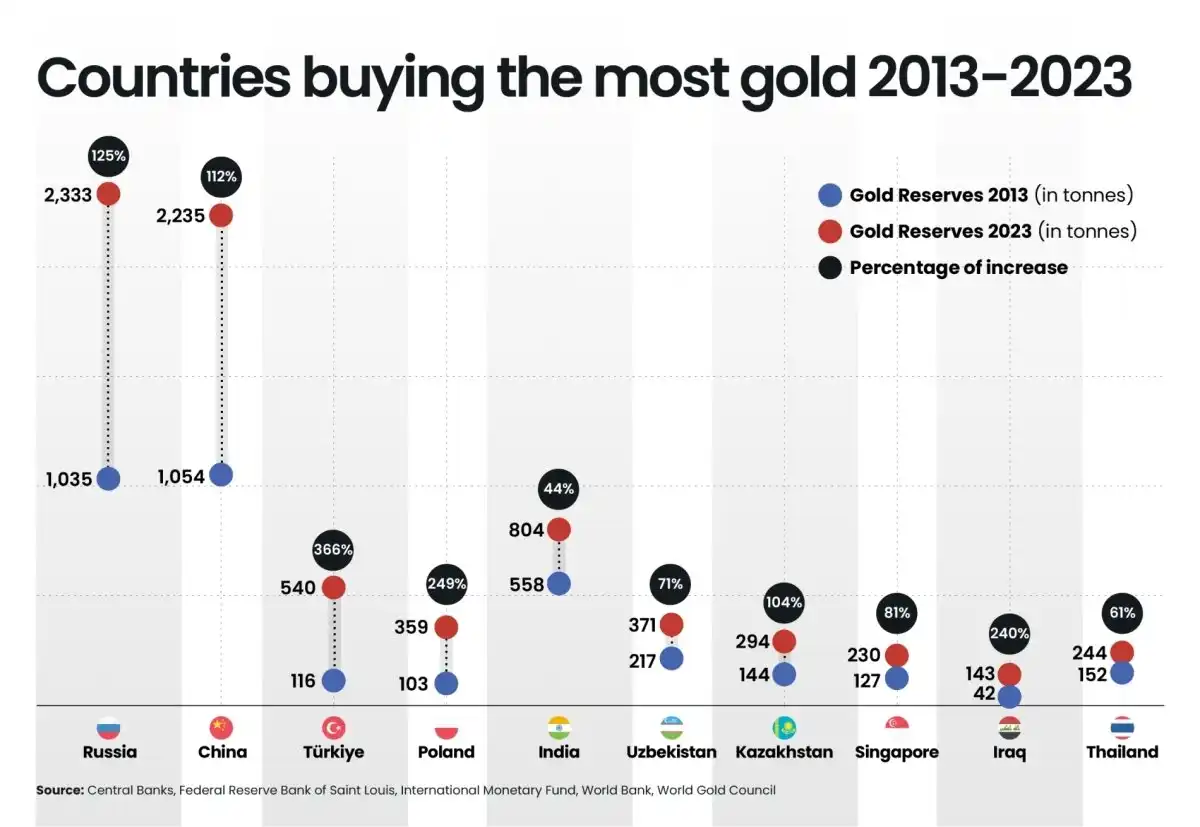

Countries such as China, Russia and India are rapidly increasing their gold reserves to cope with changes in the global economic landscape:

- China: In January 2025, it increased its holdings by 5 tons in a single month, and net buying for three consecutive months, with a total holding of 2,285 tons.

- Russia: Controls 2,335.85 tons of gold, becoming the world's fifth largest gold reserve.

- India: Ranked eighth in the world, holding 853.63 tons and continuing to increase its holdings.

This is not arbitrary behavior, but a strategic layout. Central banks around the world have noticed this after the G7 frozen Russia's foreign exchange reserves. A survey of 57 central banks showed that 96% of respondents viewed the credibility of gold as a safe-haven asset as a motivation to continue investing. When assets denominated in US dollars can be frozen by a single sum of money, physical gold stored in the country becomes extremely attractive.

In 2024 alone, Türkiye increased its gold reserves by 74.79 tons, an increase of 13.85%. Poland's gold reserves rose by 89.54 tons, an increase of nearly 25%. Even small countries like Uzbekistan added 8 tons of gold in January 2025, bringing their gold holdings to 391 tons, accounting for 82% of their foreign exchange reserves. This is not a coincidence, but a coordinated move aimed at ridding the potentially weaponized financial system.

Governments are most at ease with gold because they have established a system to use it for reserves and trade settlements. The total gold holdings of central banks in BRICS countries account for more than 20% of global central banks' gold holdings. As the governor of the Central Bank of Kazakhstan stated in January 2025, they are transitioning to “monetary neutrality of gold reserves” with the goal of increasing international reserves and “protecting the economy from external shocks.”

Bitcoin

This gold-dominated era may last for months or even years, but ultimately, its limitations will emerge. Many small and medium-sized countries do not have enough banking systems and navies to manage the global logistics of gold, and these countries may become the first to adopt Bitcoin to replace gold.

- El Salvador: Become the first country to use Bitcoin as a fiat currency in 2021 (later announced cancellation), and by 2025, its Bitcoin reserves have grown to more than $550 million.

- Bhutan: Using hydropower mining, Bitcoin reserves have exceeded US$1 billion, accounting for one-third of the country's GDP.

As the world becomes more chaotic, it is unlikely that countries will entrust gold to their allies. The risk of confiscation is too high, and Venezuela's failed attempt to recover gold from the Bank of England is proof of it. For smaller countries, Bitcoin offers a compelling alternative – it can be stored without physical vaults, transferred without boats, and protected without military force.

This transition period will push us to the next stage of Bitcoin adoption, but you have to be patient. The world will not change overnight, and so will the monetary system. By 2025, we have seen the beginning of this shift, with bitcoin adoption rates growing in countries such as Argentina, Nigeria and Vietnam as the population seeks protection against inflation and financial instability.

The path forward is clear: first, gold, then Bitcoin. As more countries realize the limitations of physical gold in an increasingly digital and fragmented world, Bitcoin’s proposal as digital gold becomes even more compelling. The question is not whether this shift will happen, but when – and which countries will lead the way.

$1 million in Bitcoin is coming, but you have to be patient. Be prepared and face a severe bear market first.

chaincatcher

chaincatcher

jinse

jinse