Why is it difficult for crypto liquidity to outperform Bitcoin in this cycle?

Reprinted from jinse

05/13/2025·1MSource: Blockworks; Translated by: Deng Tong, Golden Finance

The following is the first part of a series of articles on the current state of the cryptocurrency liquidity market, based on multiple conversations with liquidity funds.

It is an open secret that most cryptocurrency liquidity funds have performed poorly.

Liquidity funds operate in a similar way to traditional hedge funds: choose market direction, deploy funds, and exceed benchmarks.

Unlike hedge funds, however, the measurement is not a comprehensive benchmark like the S&P 500. The goal of cryptocurrency liquidity funds is to surpass Bitcoin.

For example, Bitcoin appreciated by about 110% in 2024. Any liquidity fund that performs below this benchmark is underperforming or at best it can be considered average.

Bitcoin has remained stable overall so far this year, while other altcoin markets have fallen to the bottom.

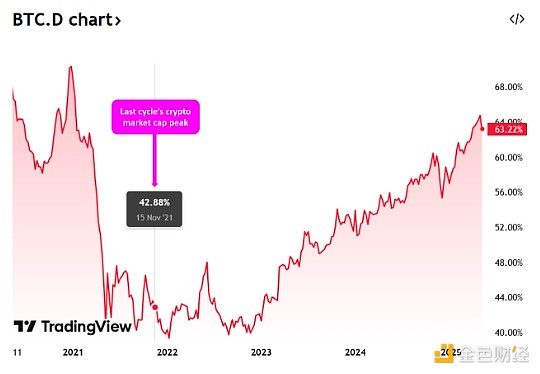

Taking Bitcoin (BTC.D) as an example, its dominance has steadily risen in the past year, and currently accounts for 63% of the total market value of cryptocurrencies of US$3.3 trillion.

In contrast, the peak market cap of the previous cycle occurred in November 2021, when BTC accounted for between 40% and 45%.

Venture capitalists like Jon Charbonneau of DBA even question the value of BTC as a benchmark. Charbonneau said in the 0xResearch podcast that the appropriate benchmark could be a weighted average basket of altcoins such as ETH, SOL and BNB.

This may explain why, despite Bitcoin hovering around all-time highs, there is a clear bearish sentiment in the cryptocurrency Twitter echo chamber. Many investors who pursue higher risks believe that the altcoins will rise more than Bitcoin and are therefore "excluded" from the rise of BTC.

Pantera's Cosmo Jiang told me: "It's not so good at the moment. Most targeted liquidity funds may have a negative view of BTC. The industry average is irrelevant for market-neutral liquidity funds. However, they 're not doing well this year, which means their performance is generally flat, not positive."

Almost all liquidity funds I have communicated with believe that Bitcoin has positioned itself as an institutional/macro asset, or “digital gold.”

“We are at an interesting point in the Bitcoin adoption rate S curve, and penetration is rising rapidly due to the strategic reserves of ETFs and the U.S. government. Last year, Bitcoin inflows exceeded the Nasdaq’s QQQ inflows, which was crazy,” Jiang said. “Most players still don’t realize that BTC’s performance is a huge difference from other cryptocurrency markets.”

It's not just an orange coin problem, it happened to rise 11% this week.

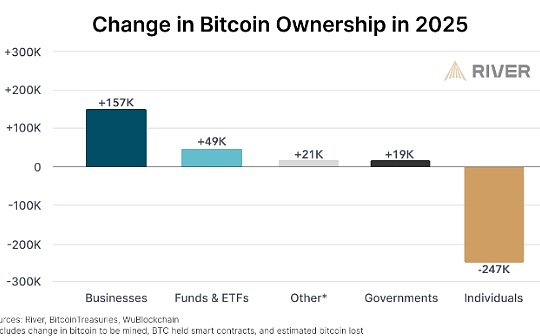

Most liquid funds have performed poorly, affected by the clouds shrouded above the altcoin market. Arthur Cheong of Defiance Capital told me that the surplus of existing and about to be unlocked coins such as L1/L2, DeFi, DePIN, AI and meme coins, heralds a bleak prospect.

“It is expected that all altcoins will unlock plans except ETH, with the next two years, to reach $1 billion a month. The demand for altcoins is simply not large. The total capital of all cryptocurrency liquidity funds is about $10 billion to $15 billion,” Cheong said.

These structural dynamics also affect liquidity funds focused on market neutral strategies.

“Even if the project tries to sell its locked tokens on OTC at a 30% to 40% discount, it is difficult to find a buyer. The market generally expects altcoin prices to plummet,” said Min Jung, a research analyst at Presto.

Presto wrote last year that it would take $60 billion in purchasing pressure to maintain the price of the top 10 tokens (STRK, ENA, JUP, ONDO, etc.) launched in 2024.

This supply-demand mismatch means liquidity funds must work harder to pick the “right” winners.

The phenomenon of "water rise and ship rise (BTC)" in the past cycle no longer exists.

In the second part of this series, we will discuss:

How can liquidity funds use fundamentals to adapt to market changes?

What cryptocurrency areas are liquidity funds focusing on?

Has the four-year cycle ended?

Has the L1 valuation premium disappeared?

Stay tuned for the second part of the 0xResearch newsletter later this week.

chaincatcher

chaincatcher

panewslab

panewslab