Will companies deflate their BTC by buying a large amount of money?

Reprinted from jinse

05/13/2025·1MAuthor: Martin Young, CoinTelegraph; Translated by: Tao Zhu, Golden Finance

Latest research shows that businesses are the largest net buyers of Bitcoin so far, surpassing exchange-traded funds (ETFs) and retail investors.

According to Bitcoin investment firm River, companies like Michael Saylor's Strategy have purchased more Bitcoins this year than any other category of investors. According to Strategy, the total amount of Bitcoin held by enterprises increased by 157,000, worth about $16 billion at current prices.

The company reported on X on May 12 that Strategy contributed 77% of the group's growth, adding that it's more than just big companies.

“We’re seeing businesses from all walks of life signing up with River. They’re optimistic about Bitcoin and how Bitcoin can change their future,” the company noted.

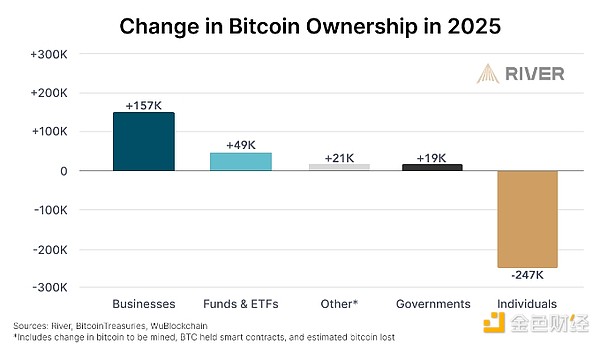

River reports that the second largest category after businesses is ETFs, with ETFs increasing their net Bitcoin holdings by 49,000 bitcoins to be worth $5 billion. It is reportedly followed by governments, with bitcoin holdings rising by about 19,000, while retail investors or individuals have dropped by 247,000 this year.

Changes in BTC ownership in 2025. Source: River

The company said that business ownership has increased by 154% overall since 2024 and has been segmented by its customers' business category.

The company revealed that financial and investment companies are the largest buyers of the asset, accounting for 35.7% of the total buyers, followed by technology companies, accounting for 16.8%, professional and consulting companies account for 16.5%, and the rest are real estate, nonprofits, consumer and industrial, health care, and energy, agriculture and transportation companies.

Recently, companies have made several large acquisitions, such as Strategy’s purchase of 13,390 bitcoins for $1.34 billion, while Metaplanet’s increase in holdings by 1,241 bitcoins in its vault, surpassing El Salvador on May 12.

New forces entering the Bitcoin market in 2025 include Rumble, a video streaming platform that purchased Bitcoin for the first time in March, Hong Kong construction company Ming Shing and Hong Kong investment company Hong Kong Asia Holdings Limited.

Bitwise reported in April that at least 12 publicly traded companies purchased Bitcoin for the first time in the first quarter of 2025. The company added that the number of bitcoins held in the books of listed companies increased by 16% during this period, with more than 95,000 new bitcoins added to the corporate portfolio.

Is Bitcoin moving towards deflation?

Analysts say the purchase of Bitcoin by these large companies will put pressure on supply and demand because supply is limited, while miners can only produce 450 bitcoins a day.

Ki Young Ju, CEO and market analyst at CryptoQuant, said Strategy 's increase in Bitcoin was faster than miners' total output, resulting in an annual deflation of -2.3%.

Meanwhile, writer Adam Livingston recently said Strategy is synthesizing the halving of Bitcoin by overtaking miners’ supply by high demand.

chaincatcher

chaincatcher

panewslab

panewslab