What factors have brought BTC to a new high of $110,000? How much will it increase in the future?

Reprinted from jinse

05/22/2025·24DDeng Tong, Golden Finance

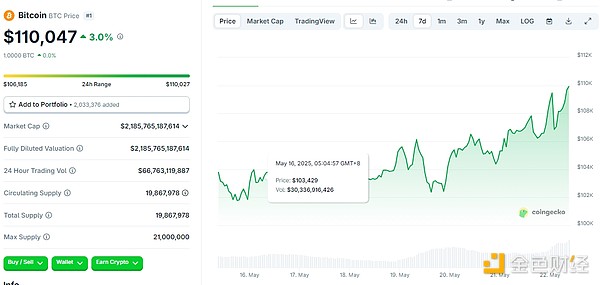

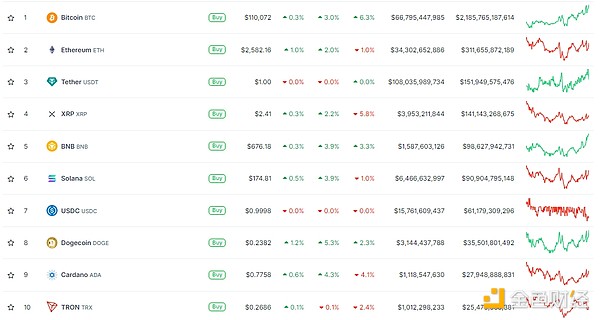

On May 22, 2025, the price of BTC exceeded US$110,000 after more than four months, setting a record high. The BTC high also drove the entire crypto market to rise. Trump posted a message on Truth Social to celebrate this historic moment: "BITCOIN ALL TIME HIGHS, ENJOY!!".

What factors have helped BTC reach a new high of $110,000? How much more will it increase in the future?

1. The Hong Kong Legislative Council officially passed the "Stablecoin

Bill" after the third reading

On May 21, 2025, the Hong Kong Legislative Council officially passed the "Stablecoin Bill" in its third reading. The bill will take effect as long as the Chief Executive of Hong Kong signs and publishes it in the Gazette. This means that Hong Kong will formally implement stablecoin regulation. Anyone who issues fiat currency stablecoins in Hong Kong or issues fiat currency stablecoins that claim to anchor the value of the Hong Kong dollar in or outside Hong Kong must apply for a license from the Hong Kong Financial Management Commissioner. According to the current progress, the crypto industry may see the birth of a compliant Hong Kong stablecoin in the crypto industry before the end of 2025.

The Stablecoin Bill paves the way for a regulated framework that could make the region a global leader in digital assets and Web3 development.

For details, please see: "Hong Kong Compliant Stable Coin is Coming to Come and View its Process and Main Content"

2. The CENIUS Act ends the debate

On May 20, the U.S. Senate passed the final debate on the GENIUS Act with 66 votes and 32 votes against it, with 16 Democratic lawmakers voting in favor across party boundaries. The bill provides a solid regulatory framework for U.S. stablecoins.

In addition to the Bitcoin spot ETF approved in January 2024, this is the most important regulatory progress in cryptocurrency history, and may even be more important than that.

The bill gives federal support for stablecoins, allowing big banks to issue stablecoins and allowing merchants to accept them.

Matt Hougan, chief investment officer of Bitwise, believes that once we achieve normal transfer of the US dollar on the blockchain network—and the world's largest financial institutions are involved—it will only be a small step to transfer stocks, bonds and other financial assets on the same track.

Details can be viewed: "Bitwise: The impact of GENIUS Act is comparable to BTC spot ETFs, Wall Street and cryptocurrencies are in marriage"

3. The Texas House of Representatives has passed the SB 21 bill after

third reading

The Texas House of Representatives has read the SB 21 bill, which aims to build strategic bitcoin reserves in the state. The bill was passed with 101 votes in favor and 42 votes against, and will be submitted to Texas Governor Greg Abbott for signing into law or veto.

The bill allows the auditor-general to invest in any cryptocurrency with a market capitalization of more than $500 billion in the past 12 months. Currently, the only cryptocurrency that meets this requirement is Bitcoin.

Before the vote, state Rep. Giovanni Capriglione told the Senate that the bill “passed strategic bitcoin reserves, which is crucial to cementing Texas’ leadership in the digital age. Now, we embrace a modern asset that has traditional attributes in order to achieve future development.”

If Abbott signs the SB 21 Act, Texas will become the second state in the United States to allow the establishment of cryptocurrency reserves. On May 6, New Hampshire became the first state to allow the establishment of cryptocurrency reserves after Gov. Kelly Ayote signed House Bill 302.

At present, 26 states in the United States have issued 47 strategic Bitcoin reserve bills, and 13 effective bills have been issued at the federal level.

4. Trade war eases

On May 12, the Sino-US-Geneva Economic and Trade Talks Joint Statement pointed out that China will modify the adjudication tariffs imposed on US goods as stipulated in the 2025 No. 4 of the Tax Commission Announcement: Among them, 24% of the tariffs will be suspended within the initial 90 days, while retaining the remaining 10% tariffs on these goods, and canceling the additional tariffs on these goods according to the Tax Commission Announcement No. 5 and No. 6 of 2025; taking necessary measures to suspend or cancel non- tariff countermeasures against the United States from April 2, 2025.

Bitcoin soared to an all-time high after a temporary trade deal between the United States and China eased macroeconomic concerns and boosted investor confidence.

Aurelie Barthere, chief research analyst at crypto intelligence platform Nansen, believes: The 90-day tariff suspension and the tone of cooperation in negotiations eliminate the risk of a “sudden escalation”, which has a significant impact on the risk appetite of traditional and cryptocurrency investors.

Details can be viewed: "Joint Statement on Economic and Trade Talks between China and the United States"

5. Russia-Ukraine ceasefire negotiations

On May 15, Ukrainian President Zelensky pointed out that Kiev is ready to conduct "negotiations of any kind" to end the conflict with Russia. Trump has said: I will continue to work with Russia and Ukraine to end the conflict. A Kremlin spokesman also pointed out that Russia and Ukraine must have direct dialogue to find a way to a ceasefire.

Jag Kooner, head of derivatives at Bitfinex exchange, said Bitcoin was "a near-perfect state in May, catalyzed by rare factors such as geopolitical downgrades, improved regulatory environments and macroeconomic tailwinds." “The ceasefire negotiations between Russia and Ukraine have resolved one of the main engines of geopolitical unrest over the past two years.”

6. Three kills of stocks, bonds and exchanges

The US dollar, US stocks and US bonds fell simultaneously - the US dollar fell for three consecutive days, the 10-year US bond yield exceeded 4.6%, and the US stock market also experienced its largest single-day decline in the past month. Last night, the U.S. Treasury Department issued $16 billion in 20-year Treasury bonds with a winning yield of 5.047%. This is the only second 20-year Treasury bond auction with a yield of more than 5%, 24 basis points higher than the 4.810% in April.

This is a harsh question of the US financial credibility and global pricing system. If even stable long-term government bonds cannot obtain enough demand, the real "overwhelming moment" of the financial market may be closer than we imagined. In the next few days, every percentage point of the 10-year yield will be a key touchstone for whether the market will regain confidence.

For details, please see: "A straw that broke the back of the United States"

7. Trump dinner is about to begin

In the early morning of the 23rd Beijing time, the "Trump Dinner" will officially start. Trump will invite the 220 people with the largest number of "Trump coins" to attend the dinner, while the top 25 people with the largest number of shares will have the opportunity to visit the White House. "This will be a once-in-a-lifetime unforgettable night with US President Trump."

According to data analysis by blockchain analytics company Nansen, the tickets are expensive, and these "winners" spend on Trump's official cryptocurrency token $TRUMP, ranging from $55,000 to $37.7 million. These “winners” totaled $394 million on Trump’s official cryptocurrency, although some of them had sold some or all of their positions after the competition.

Details can be viewed: "Trump Crypto Dinner: Average spending over one million US dollars is not Americans? 》

8. How much will BTC rise in the future?

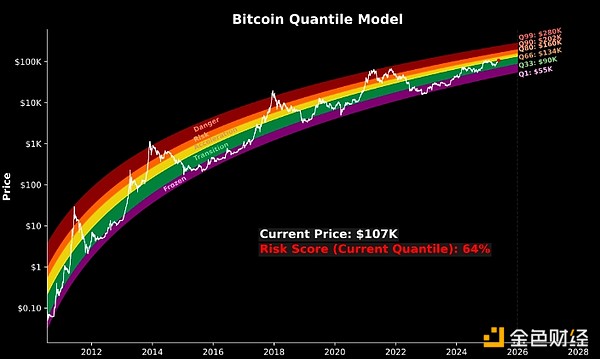

- Bitcoin Quantile Model Updates show that the Bitcoin market reflects the same "hotness" as the highs driven by spot ETFs after US President Donald Trump's election and in the fourth quarter of 2024. The model uses quantile regression to map the price phase of Bitcoin on a logarithmic scale, indicating that the cryptocurrency is in a transition zone, a critical moment before the acceleration phase. In the fourth quarter of 2024, Bitcoin rose 45% after entering a price discovery period above $74,500. Once the acceleration phase is entered, it may trigger the next phase or medium-term trend of BTC, usually in the range of 33% to 66%. According to the model, BTC is expected to gradually reach its target price range of $130,000 and $163,000 in the next few months.

-

MN Capital founder Michael van de Poppe: The price of BTC could rise to $200,000 , "because more and more people are tired of the continued depreciation of the dollar."

-

Anonymous Bitcoin analyst apsk32 said: The target price of more than $200,000 in 2025 is a "reasonable" expectation.

-

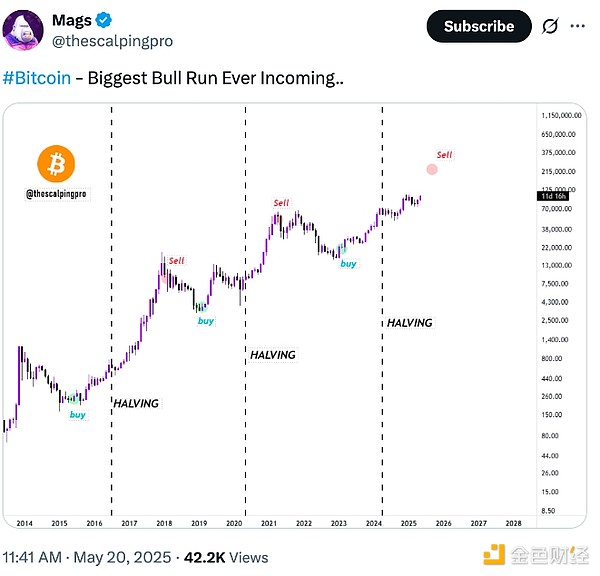

Analyst Mags said: Bitcoin price is entering the "largest bull market ever" and the highest price is expected to reach around $215,000 based on the Bitcoin four-year halving cycle.

chaincatcher

chaincatcher