Seven Deadly Sins, Troubleshooting Bitcoin Ecology

Reprinted from chaincatcher

05/22/2025·24DAuthor: Fairy, ChainCatcher

Edited by: TB, ChainCatcher

Friendly reminder: The "Seven Deadly Sins of Bitcoin Ecology" listed in this article are purely ridiculous, not intentionally slandering, nor intent to slander Bitcoin's belief attributes. We respect Satoshi Nakamoto and respect time. If there is a harsh view, I hope the ecological builders will be convinced.

Pizza Festival ushered in its 14th year, and Bitcoin also broke through $110,000 today, setting a new record. Bitcoin is going upwards, but the Bitcoin ecosystem seems to be going downwards.

Bitcoin has grown from a white paper to a new anchor for global assets, and the story of the Bitcoin ecosystem has also changed from a simple technological narrative to a complex picture of human nature, market, power and belief. But under the hustle and bustle, few people raise the real problem.

Pizza Festival is worth remembering and reflecting on. At this node, we might as well take a closer look at the "seven deadly sins" hidden behind the Bitcoin ecosystem.

The light of ideals shines into reality

Bitcoin’s market value returned to the trillion dollar mark at the beginning of 2024, and has been around for nearly a year and a half, but its ecological activity is seriously unbalanced with its asset size.

As of now, only 13 projects in the Bitcoin ecosystem have completed financing in 2025, compared with 72 in the same period last year, and as high as 126 for the whole year. The amount of financing is almost halved, and capital enthusiasm is rapidly ebbing.

Source: RootData

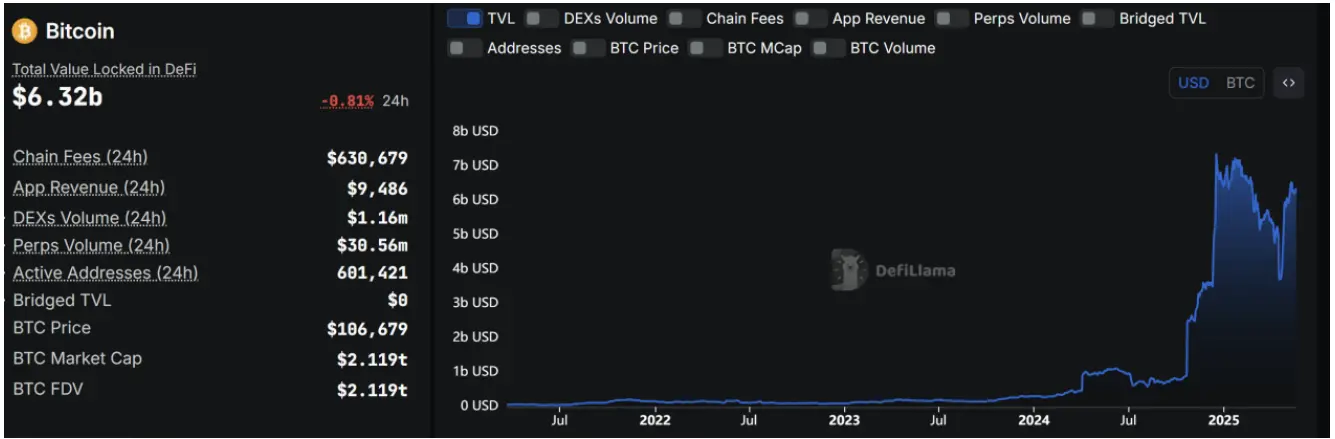

Looking at the data on the chain, DefiLlama shows that the current TVL of the Bitcoin ecosystem is only US$6.3 billion, which is one-tenth of the Ethereum ecosystem (US$62.3 billion). Among them, Babylon contributed US$5 billion, accounting for more than 80% of the ecological structure, and the ecological structure is extremely concentrated.

If TVL is compared with token market value, the problem is even more dazzling: BTC's TVL/market value ratio is only 0.2%, far lower than the average level of mainstream public chains. Chains such as Ethereum, Solana, and TRON are generally maintained at more than 10%, and the efficiency of capital use is significantly higher than that of Bitcoin.

Source: DefiLlama

In addition, looking back at the star projects of the Bitcoin ecosystem, such as Stacks and Merlin Chain in the L2 direction, Solv Protocol, Babylon, BounceBit in the pledge track, Inscription Assets ORDI, SATS, etc., most of them continue to be sluggish in price performance.

Although Bitcoin is the "golden signboard" of the crypto market, it is almost a hollow tower in ecological construction. The following are the "Seven Deadly Sins" we have sorted out.

The first sin - the sin of ecological bubble

From the end of 2023 to 2024, the Bitcoin ecosystem ushers in a wave of "massive" awakening narratives. From inscriptions, L2, to re-pled, it seems that overnight, the silent BTC ecosystem suddenly became a hotbed of innovation. But when the market boom fades, the results that have truly settled are still thin.

Many protocols do not themselves have disruptive innovations, neither reconstructing the original paradigm nor creating truly new market demands. A large number of projects are just new packaging for old concepts, with weak underlying structure, rough design and out of use scenarios. The relevant teams are uneven, and very few people truly have the willingness and ability to build a long-term basis.

As community member @blapta said: "From the commercial results, almost none of these so-called technologically advanced projects have been implemented. Whether the agreement is established is no longer a focus. After the financing round, the story will be over. This is not only a technical failure, but also a cultural silence."

The second sin— the sin of dogmatism and internal strife

Idealism has never been absent from the Bitcoin ecosystem, but when it merges with dogmatism, it quietly deteriorates into closure and self-limiting. In this system that boasts of "decentralized belief", once a technical route, consensus mechanism and even development direction are touched by a certain "fundamentalism" position, it is very likely to evolve into a black and white camp struggle.

Almost every major upgrade of the Bitcoin network has gone through a long process of acceptance. SegWit only covered about 50% of transactions after two years of activation, and only approached 80% after four years; Taproot activated in November 2021 was also slow, with less than 1% adoption at the beginning of 2023 and only reached 39% by early 2024. Developers and the community are extremely cautious about the evolution of the protocol.

Source: Ki Young Ju, founder of CryptoQuant

The historical BCH and BSV fork incidents also confirm the deep roots of the early concept tear and factional conflict between the Bitcoin community. At the same time, some community members are resistant to innovation directions such as smart contracts and asset issuance. There are always long-term games and differences between "adhering to the Satoshi Nakamoto's route" and "promoting functional upgrades".

The third sin - the crime of talent exhaustion

If the developer is a dream maker and foundation builder of a public chain ecosystem, then Bitcoin is experiencing a chronic talent loss crisis. Unlike the vigorous development enthusiasm and business momentum shown by Ethereum, Solana and other ecosystems, the development landscape of Bitcoin is becoming increasingly thin.

This shrinking development power is partly due to its long-term reliance on donation-driven development model. It lacks a stable and sustainable incentive system, which is difficult to attract fresh blood and retain experienced veterans.

According to DeveloperReport data, there are only 359 full-time developers in the BTC ecosystem, of which 9.1% have dropped by 2 years of experience, and 4% have also dropped by 2%. By main chain developers only (excluding EVM and SVM stack), Bitcoin ranks fifth among all chains, far lower than the number one Ethereum (2181 people), which has 6 times the number of developers that are Bitcoin.

What is more noteworthy is that among the limited developers, up to 42% focus on scaling solutions, which means that the construction of Bitcoin native application layer and other aspects is even scarce.

Source: Developerreport

The fourth sin: the sin of value retention

The huge BTC stock has not been converted into financial productivity, but has been deposited into "dormant capital" on the chain. According to the latest research by Binance Research, only 0.79% of BTC is actually used in DeFi, and Bitcoin that has not been transferred in the past year has accounted for more than 60% of the total supply, and this proportion is still rising.

The proportion of Bitcoin that has not been moved in the past year, source: Binance Research

This not only reflects the further stability of Bitcoin’s “digital gold” positioning, but also exposes the serious gap in its ecosystem in financial availability. There are very limited ways for BTC holders to use assets, mainly focusing on centralized lending platforms or cross-chain WBTC, etc., but these paths generally face problems such as low yields, high centralization risks, and insufficient security, which lacks attractiveness.

In contrast, Bitcoin’s financial ecosystem has not yet established a sustainable asset use mechanism, which cannot meet investors’ multi-level needs such as income acquisition, risk management and strategic deployment. This "value retention" is becoming a key shackle that limits the evolution of Bitcoin ecosystem.

The fifth sin ****: The sin of attention

mismatch****

The recent escalation of the Bitcoin community has fallen into a vicious circle of "high heat and low efficiency": few people have raised proposals that truly have technological depth and development potential, but some "irrelevant" issues have been repeatedly debated.

Taking BIP177 as an example, although it is just an adjustment to the unit display method, it has caused long-term disputes in the community; while those proposals that may really drive the leap in protocol capabilities, such as the combination of asynchronous payments and optional payment paths, BIP360 (resistance to quantum attacks) that meet future security challenges, are not popular.

The BIP system, which was originally not very efficient in the Bitcoin governance mechanism, has become increasingly rigid under this mismatch of attention. The core upgrades that really require extensive testing, evaluation and collaboration to promote are quietly silent in the competition for discourse. Community member @blapta said: "I hope that the Bitcoin community discussion will return to normal discussions as soon as possible, and development will be old if it is dragged on."

The Sixth Deadly Sin: The Sin of Narrative Closure

******** Under the fast pace of the crypto industry, the narrative of the Bitcoin ecosystem seems particularly monotonous. The "digital gold" narrative plays a role in stabilizing consensus and transmitting value, but it should not evolve into a framework that limits innovation and expands imagination.

In contrast, other chain ecology has continuously stimulated new interests and new narratives around the direction of Restaking, Meme, DePIN, AI, etc., driving the continuous flow of community vitality and funding attention.

Although Taproot Assets, Ordinals and others briefly stimulated the imagination space, the lack of continuous narrative promotion and systematic support ultimately failed to form a solid growth curve.

********The Seventh Deadly Sin: The Sin of Missing Repulsiveness

In the capital-seeking market system, "investability" determines the final flow of funds. Speculation is the most authentic and honest flow logic of on-chain funds. The Bitcoin ecosystem has extremely obvious shortcomings in this regard: complex deployment, weak liquidity, and original trading mechanisms, making it difficult for market makers, arbitrageurs and hot money to enter and exit efficiently.

It can also be seen from the data side: except for the briefly attracted capital attention due to the Ordinals and Runes boom in 2024, the financing performance of the Bitcoin ecosystem in the rest of the years was unreasonable. It is particularly worth noting that large-scale financing projects above 10 million US dollars are rare, which directly reflects the doubts and reservations of mainstream investment institutions about the "investability" of the BTC ecosystem.

Face the problem and go further

We look back on our original intention and face reality. Today's Bitcoin ecosystem is not only a midfield review of a technical experiment, but also a mirror of culture and order. The statement of "Seven Deadly Sins" is just a joke. The real starting point is to expect the ecology to be revitalized and find a direction for continuous growth.

jinse

jinse