What are the new players attracted by TRUMP? Do you lose or make a profit?

Reprinted from panewslab

02/18/2025·2MAuthor: Jaleel Garlier

Back to January 17, there are only two days left before the new US pro-cryptocurrency president takes office.

On this day, without any warning, Trump suddenly announced the launch of an encrypted MEME coin called $TRUMP without warning through his social platform Truth Social.

At a speed of minutes and seconds, $TRUMP detonated the start of the crypto market in 2025 and became the best celebrity coin ever. Within 24 hours of its launch, it was given a green light all the way and quickly entered the top trading platforms such as Coinbase and Binance. The 24-hour trading volume exceeded US$10 billion, more than three times the 24-hour trading volume of Bitcoin.

In addition to the cabal, the 24-hour online currency speculation forward was the first person to make money on $TRUMP. Even among the various suspicions that "Trump's official account must have been stolen", 0xsun is the However, a group of people represented acted quickly and bought early with the on-chain data monitoring capabilities accumulated over the years. About the 10th minute of the issuance of $TRUMP, 0xSun started buying, buying $600,000 in half an hour, with an average cost of only $0.6, and a profit of more than $27.5 million. He won the gods in one battle.

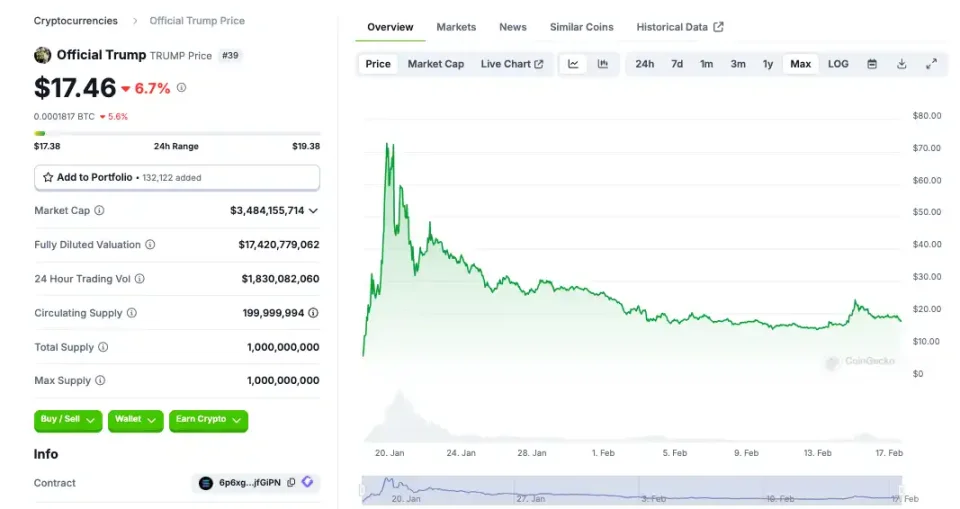

But the problem is that the MEME currency market is a typical zero-sum market, without the support of technological innovation, no fundamentals, no value creation, and only the difference between time to buy sooner or later, so not everyone can be as lucky as 0xsun. With the decline in popularity and the issuance of Trump's wife currency in disguise, the price of the $TRUMP has been falling from a maximum of US$72 and is currently maintaining around US$17.

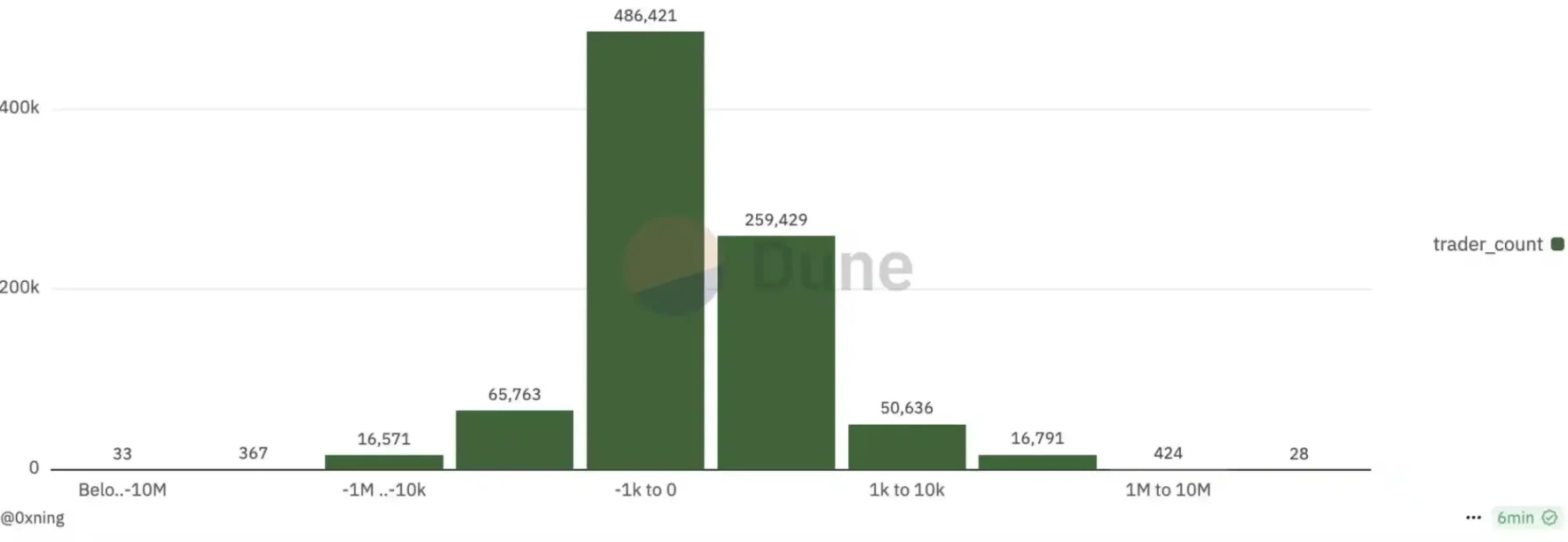

According to early statistics, the data of profit addresses was significantly normal, with 560,000 still losing money, and only 300,000 profits were achieved.

Source: Dune

PHD You can't escape being trapped even if you have a child

The market is not always so friendly to everyone. KOHA is an example, he is one of these 560,000 trapped people.

KOHA is a science and engineering PhD studying in Canada. He occasionally makes some investments in the US stock market. In 2024, he bought the DJT stock of Trump's company in advance because he bets that Trump would be elected president, and eventually made a small profit. One turn. This success made him feel confident in Trump's business model and made him mistakenly believe that the $TRUMP coin will have long-term value like DJT stocks.

However, the market pace in the currency circle is much faster than that in the US stock market.

The $TRUMP coin was issued on Saturday morning in Beijing time, but in the US and Canada time zones were late Friday night. Like many locals in resting states, KOHA did not pay attention to the incident at the first time. When I learned that $TRUMP was released, it was already the second day of KOHA.

Because Trump often makes unfriendly policy adjustments to the study abroad circle, and the close relationship between Canada and the United States, the lucky KOHA is in an environment that pays great attention to Trump's behavior. The next day, when KOHA learned about Trump’s issuance of coins in the sub-group, $TRUMP had risen from its initial price to $28.

He immediately acted and tried to buy $TRUMP through the Moonshot platform, but due to KYC operations such as identity authentication, uploading driver's licenses, and learning how to buy, the price had risen to $30 by the time he finally successfully bought it. Despite this, he decided to enter without hesitation.

"The four-year term has just begun. Trump has a very centralized rule in this regime. The US president can only have two terms, so everyone recognizes that the second term is to make money and do business. , the whole world is a person who wants to do business with him. Whoever wants to do business with him in the future? $TRUMP is a way and threshold. "KOHA's logic is very simple.

In KOHA's view, the more people want to establish connections with Trump through this approach, the higher the price of Trump's currency will be. "This plate is obviously much easier to control than DJT, so you don't need to declare the SEC for sale. The total supply is 1 billion, and only 200 million pieces are circulated, and 80% of the tokens are still in my hands. I immediately sold all DJTs , bought $TRUMP coins. ”

KOHA is not the only investor who believes Trump’s business model can reappear in the crypto market. In fact, many people also believe that Trump’s $TRUMP issuance is part of his financial strategy.

"Trump can't squeeze in, nor can he integrate, and he can't integrate. His opposition with his youngest daughter Ivanka is actually an opposition to the two factions in financial ideology. The rebellion between capital cannot even integrate blood ties." KOHA analyzed that in his opinion, the traditional financial market is controlled by Jewish capital of Wall Street and the Democratic Party, and Trump has never been able to integrate into this system, and his only way out is swords. Take a different approach and use the decentralized characteristics of virtual currencies to establish your own financial order.

KOHA's understanding of the crypto industry is "two capital opposition unexpected beneficiaries." Trump has indeed shown a friendly attitude in policies: relaxing cryptocurrency supervision to provide a more free trading environment for the market; Bitcoin exceeded $75,000, and the entire crypto market ushered in a bull market carnival; Republican lawmakers promoted the establishment of a Bitcoin strategy Reserves further enhance market confidence. All these factors gave KOHA a grand investment narrative that convinced him that $TRUMP was a long-term asset.

KOHA found that $TRUMP was in a rising state and he increased his position again at $40, but by the Monday business day two days later, $TRUMP had entered the profit-taking phase from the FOMO (missing fear) phase. The liquidity in the market declined and the purchase orders decreased. The coins in KOHA gradually became trapped liquidity, with an average price of US$36.

This cycle is a clear bet

Li Yi is also trapped like KOHA.

However, unlike KOHA, who has no experience in the currency circle or even knows which major trading platforms there are, Li Yi has been struggling in this market for a while. Compared with those newcomers who are not even familiar with trading platforms, Li Yi at least knows where to trade, and also knows that the logic of the currency circle is not important, and emotions are the only decisive factor. Li Yi is involved in multiple currency trading exchange groups, paying attention to market trends at all times, and following the transactions of some traders who call themselves "old cryptocurrency circles".

He did make a fortune.

In the early market of $TRUMP, he completed the sale at a low of $17 with the operation of "no wisdom, he must follow", and successfully sold it after the price soared, making a profit. However, after making money, he was a little overconfident.

After making money, Li Yi did not choose to leave, but began to look for "next $TRUMP".

Sure enough, the Trump family did not disappoint Li Yi. Two days after the issuance of Trump's currency, the Trump Wife currency Melania Coin ($MELANIA) was issued. At the same time, in the currency speculation exchange group, the concept of "family coin" has become popular.

Although it has not received official support, the name of Trump's youngest son Barron was under the banner of "Trump family" by the community, and boasted about "the future presidential coin" against the backdrop of the surge in the price of $TRUMP. There are even rumors that Trump's nanny has issued coins, which has quickly attracted a batch of funds to enter the market. And Li Yi is one of them.

He naively believes that the logic of these coins, like $TRUMP, can also rise like $TRUMP. So he invested most of his profits into his wife's coins and his son's coins.

But the market did not give him a second chance.

The other family coins quickly returned to zero, Li Yi's principal was trapped, and his profits evaporated instantly. At present, he began to inquire about how to buy World Liberty Financial (WLFI, the Trump family's decentralized financial project), and tried to make a comeback based on new speculative projects. "Another bet, WLFI may continue the orthodox nature of Trump's currency," said Li Yi.

The biggest change in this cycle is that everyone has shown up.

There is no longer need to package, no longer pretend to be a technologically innovative project, nor does it require spending 5,000 yuan to find a gunman to write a high-end English white paper, pile up a bunch of obscure new concepts.

The gameplay of this bull market is simple and crude - directly speculating on emotions, celebrities, topics, and poor cognition. Use FOMO emotions to create a series of new altcoins and harvest them with the fantasy of new leeks.

In the past, Xinlian's project factory would do a little effort to disguise itself as a seemingly innovative project. Looking back at the beginning of the launch of the new BSC, Aptos and Arbitrum, the market experienced the same picture - a bunch of anonymous "innovation project factories" flocked to the top, using the new chain effect to harvest TVL and users, and then shut down directly when the market popularity fades away. The community and websites took away funds and disappeared without a trace.

Behind these projects are often a group of familiar faces, but after changing a vest and changing a few codes, they become new popular currencies. They were the first popular projects of a new public chain at the beginning, anonymous and mysterious, without a well-known investor or audit by large companies, but they can always be praised by KOLs. Relying on the FOMO sentiment of the community, they have hyped up a new project. Waves of wealth myths.

But now, the market seems to have reached another consensus: this is a new bet, a wealth transfer game.

No one talks about "technical revolution", no one talks about "changing the world", everyone is tacitly aware of it - if you lose this game, just wait for the next bet, and you will accept the loss, and you will come. The currency circle is Used to make this. It is said that the guys at the Hangzhou nightclub know that they are going to short the altcoins.

And Li Yi is just another participant in this wealth transfer game.

Whoever short sells is the winner?

Among the new cryptocurrency circles who entered the circle from Trump coins in this interview, only Professor L in the end made money.

In the storm of $TRUMP coins, most people are betting on the rise and desperately rushing to the top, but end up being trapped at the high point. However, some people have chosen the opposite direction - short selling and have successfully made profits against the trend amid the market fanaticism.

Professor L, a professor of finance, is also a senior futures trader. He has long studied market structure and knows that the price fluctuations of cryptocurrencies are much more severe than those of traditional financial markets. As a MEME currency, $TRUMP itself has no fundamental support and relies entirely on market sentiment to drive it, which means it is likely to rise in the short term. After plunging.

But his trading strategy is not simply betting on the market decline, but a basic "held" hedging trading strategy in futures trading:

He bought spot for $50,000 to make sure he didn't miss the rising profits. At the same time, he shorted the $TRUMP contract with 5 times of $10,000 as a risk hedge. If $TRUMP continues to rise, its spot income can cover the contract's losses. If $TRUMP plummets, his short orders can make up for the losses and even bring excessive returns.

Professor L does not agree with the gambling leveraged trading of many retail investors. "The essence of a contract is to diversify risks, not to amplify returns." But most people do not understand this truth.

At the same time, Professor L strongly agrees with Peter Lynch's view: "The large short-selling funds will not short at the highest point, but after the market is cut in half, the short-selling funds will be short when retail investors say that the decline is no longer moving and start buying at the bottom. I like to short at such a position. "This is why Professor L chose to close short positions after the rapid decline after the $TRUMP surge and did not rush to close short positions.

In the currency trading group, there are always people who show off their high-leverage record: "I opened another 50 times leverage short order today, and I made $2,000!", "Yesterday, long orders were overturned, and I made another short order today!" But The truth is, this strategy is gambling after all.

Professor L's success is in sharp contrast with those retail investors who blindly open high leverage and bet on destiny. The sharp fluctuations in the market, combined with high leverage, only one reverse market is required to instantly reset the account to zero. Many retail investors frantically opened long leverage at the high point of $TRUMP, fantasizing that the price continued to soar, but were defeated by the market and directly liquidated the position and cleared it.

Finally, Professor L's hedging strategy allowed him to make steady profits when the high point of $TRUMP fell. He does not earn dividends by being ahead of time like 0xSun, nor is he cheated in FOMO emotions like Li Yi. Instead, he relies on rational risk management to survive the extreme market in the currency circle and make money steadily.

How many pitfalls do newcomers have to step into the currency circle?

In this round of Trump coins, it is not only the inexperienced novices who enter the market, but also many old players from the traditional investment market. They have struggled in the A-shares, commodity futures, and even tea speculation markets, and have seen various capital games.

Professor L is lucky, but not all veterans can reproduce their past success in the currency circle based on their past experience. In other words, they have to step on many pitfalls before they officially start trading.

"A stocks are short and bears are long, and the way to survive is to trade small and poor." This is the consensus of many domestic investors, including "Super Bill". For a long time, the speculative style of A-shares has made him accustomed to short-term band operations, low-price picking of chips, and market sentiment.

When Brother Suppin saw $TRUMP, a currency with a strong hype concept, he immediately felt familiar - "Isn't this a small-cap stock with high control?" So he decided to "take a try." ”.

He bought more than 4,000 RMB TRUMP at a high of $69, trying to calculate the possibility of making a return. As the price of the coin fell all the way, during the interview with BlockBeats, the price of $TRUMP was $26 per coin, which means that if it rose by 5%, he would need to add 50,000 yuan to lower the cost price. But he himself knew that this was just a "leek-like fantasy".

After being trapped, Brother Suppin realized that the rules of the game in the currency circle are much crueler than that of A-shares: "There is no limit, there is no rule for capital entry and exit, and the market makers can wash the market in an instant; there is no supervision, and market makers can draw at any time. Main liquidity, control the market at will; there is no time window, 24-hour trading, the market is endless, retail investors have no chance to breathe. "Supai Brother is feeling a little emotional and wishes he could complain for three days and three nights.

Many investors who are used to the short-term strategy of A-shares not only failed to make money in $TRUMP, but instead tried to trade swings and repeatedly entered and exited, and eventually lost their principal.

But the currency circle is a place where people eat and don’t spit out their bones. After overcoming the unfamiliarity of traditional stock trading and currency trading, Brother Suppin found that he had struck another pit.

"I felt hopeless to get back, so I was going to cut my money, but I found out that I bought fake coins." Before I could go online to spot trading platform, Brother Suppin followed the big guys in the trading group to buy it with a web3 wallet of a trading platform. The first $TRUMP was made.

Because he had never used a web3 wallet before, he always looked at everyone's quotes in the group, and after buying it, he didn't take the initiative to take a look. After knowing that he was about to sell it, he realized that his money had not flowed into the real market at all. , but was swallowed up by the "counterfeit currency contract" deployed by the hacker.

This is a relatively simple way to cut leeks in the currency circle. After that, there are more pitfalls waiting for "Brother Sui Bird".

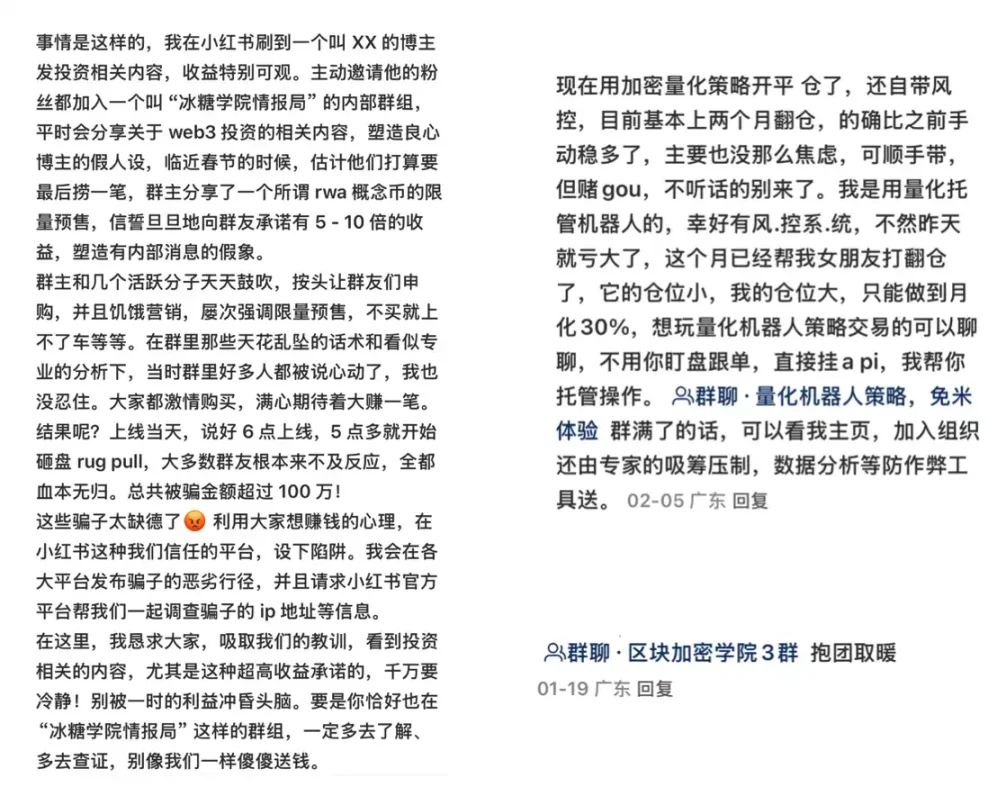

The coin-fried currency payment exchange group with varying quality is boiled in warm water. It was free at the beginning, using some beautiful photos of female bloggers, similar screenshots of making money, or photos of picking up a car and buying a house to attract traffic. The big brother inside will enthusiastically teach newbies how to open an account and how to trade on the trading platform. At this point, the big brothers will You can receive a tuition fee through the trading platform rebate.

It is quite good to use retail investors' funds to make orders and brush handling fees, and the most direct one is to take orders and cut leeks. It claims to have "precise insider information", but in fact it is all designed to harvest. There is also the most scam on Xiaohongshu at present, which is the so-called "quantitative robot trading strategy", claiming that monthly production can achieve 30%.

The currency circle is a completely different world. The game here is a high-frequency confrontation in units of "seconds", and every second you miss it may mean a huge loss. What’s worse is that many old players often adopt the strategy of “large capital heavy betting” with their strong funds, but they become the target of the “top” of the market. Those big dealers who control the market were ready long before they entered the market, waiting for these "big fish" to take the bait and quickly absorb their funds.

In this PVP showdown without gunpowder, the flow of funds and the control of the market are always in the hands of a few people. For those players who are still stuck in traditional market thinking, the rules of the currency circle often catch them off guard. Because here, risks and opportunities coexist, but more often, are risks.

When these old players came to their senses, they found that not only did they not make a fortune in the currency circle through years of experience, but instead became a typical example of "being harvested upon entry". Those rules of thumb that were once accustomed to have become useless in the face of this brand new market.

And these are the tuition fees they must pay when entering this industry.

jinse

jinse

chaincatcher

chaincatcher