LIBRA farce: DEX, insider team and investor trust crisis and breaking the road

Reprinted from jinse

02/18/2025·2MAuthor: Revc, Golden Finance

Quick review of the timeline: LIBRA event context

At 6 a.m. on February 14: Argentine President Mile announced the LIBRA Meme coin on its official X account, and the price of the coin rose rapidly.

10:00 a.m. on February 14: LIBRA price plummeted after reaching its peak, with trading volume reaching US$1.2 billion in 4 hours.

February 14 at 11:30 am: Mile deleted LIBRA tweets, and the coin price fell rapidly.

February 14 at 11:38 am: Milei said he was "uninformed by the LIBRA project" and condemned the behind-the-scenes manipulation.

February 14 at 11:36: LIBRA team KIP Protocol clarified that Mile was not involved in the development.

At 12:54 pm on February 14: Solayer founder revealed the loss and exposed the core members of KIP Protocol.

February 15th at 1:42 am - February 17th: Jupiter and Meteora clarified that they did not participate in the LIBRA release; Solayer founders continued to reveal behind-the-scenes information; YouTube reporters revealed that the LIBRA team admitted to being a rush to the scene.

February 16 at 11:38 am: The Argentine Presidential Office stated that it would investigate the issuance of LIBRA, and Mile asked the Anti-Corruption Office to intervene.

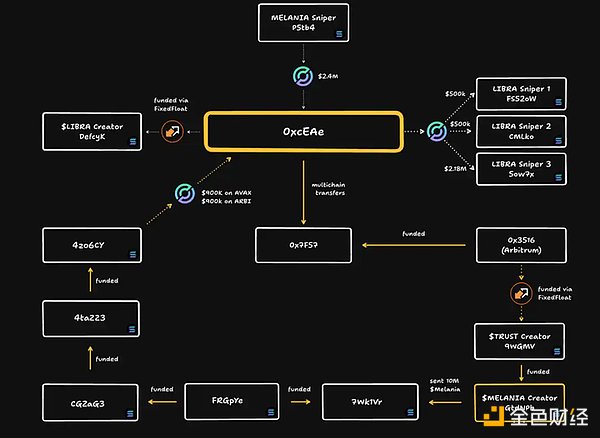

14:24 pm on February 16: LIBRA's relationship chart reveals the issuer's relationship with multiple Meme coins insider trading.

On the evening of February 16: LIBRA consultant Kelsier plans to buy back and destroy it with US$100 million; the opposition threatens to impeach Mile.

February 17-February 18: Bubblemaps and Solayer founders accused LIBRA of being manipulated by the MELANIA team; Coffeezilla disclosed that LIBRA team admitted to rushing; Argentine law firms filed complaints with the US DOJ and FBI; Mile TV program responded, "In the case of Act in good faith” and then forwarded the LIBRA purchase tutorial.

Reexamine the roles of each party:

Javier Milei - President of Argentina: From the initial platform propaganda to the rapid cutting and clearing, the attitude reversal and the role complex, his behavior directly affected the market trend and trust of LIBRA.

Hayden Davis (Kelsier Ventures): LIBRA issuance consultant, actual trader, admitted to "sniping" behavior, but defended it as the normal state of the industry and project protection, mastered a large amount of project funds, and the refund plan was controversial.

KIP Protocol: LIBRA's main sponsor, disconnecting from token issuance and market making, emphasizing only providing technical support, in an attempt to reduce the negative impact of the incident on its reputation.

MELANIA Team: The most suspect behind the scenes, the evidence on the chain points to LIBRA and MELANIA operating for the same team, suspected of building a "harvest chain" and conducting insider trading.

Jupiter & Meteora: The platform provider, Jupiter provides transactions for LIBRA, and Meteora is used for token issuance. Both declare that it is only a technical platform and has no interest in the project party, so it will promptly clarify and maintain its reputation.

Chaofan Shou (founder of Solayer): The core exposer of the LIBRA incident, he questioned and continued to track it through technical analysis and tracked it, exposes inside information, promotes the fermentation of the incident, and is a victim himself.

Coffeezilla (YouTube reporter): In-depth interview with Hayden Davis, trying to dig out the truth, and the interview content has become an important window for the outside world to understand the inside story of the LIBRA incident.

Investors (retail investors): The biggest victim of the LIBRA incident, who entered the market due to FOMO sentiment and celebrity effects, suffered huge losses, and trust in the market dropped to freezing point.

KOLs (Dave Portnoy, etc.): Some KOLs (mainly European and American regions, the same below) have ambiguous roles in the incident, and are informed in advance or participated in promotion, but information disclosure is not transparent and their credibility is damaged.

CEXs (Centralized Exchange): The exchange's currency listing review mechanism is questioned again and faces pressure to reflect and assume investor education responsibilities.

VC (VC Institution): Although it is not conspicuous in the LIBRA incident, in the Meme currency field, the role of VC is worth paying attention to, and its early advantages are in contrast to retail investors' risks.

**1. Emotional opposition and trust crisis: Multi-party game between

insider team, DEX, KOL and investors**

The core contradiction of the LIBRA incident is the complex emotional game and trust crisis between the insider team, DEX, KOL and investors:

Investors vs. DEX: Investors flocked to DEX to participate in MEME currency trading. As the platform, DEX lacked responsibilities in auditing, risk warnings and investor protection, which caused investors to be dissatisfied. Investors question whether DEX is willing to allow or even condone high-risk MEME currency transactions in order to pursue traffic and fee income.

Investors vs. KOL: Some KOLs played the role of "inducing the fire" in the LIBRA incident and used their own influence to promote it, but information disclosure is not transparent and there may even be interest transfer. Investors' trust in KOL has dropped to freezing point, questioning its "independence" and "objectivity".

Within the investor group: There is also an emotional opposition between new investors and experienced old leeks. New leeks suffer heavy losses due to lack of risk awareness, and old leeks are disappointed and angry at the chaos in the market. Investor groups generally feel anxious, confused and crumbling in trust.

This trust crisis has exposed the blurred boundaries of responsibility for key roles in the crypto community ecosystem. DEX, KOL and project parties must assume corresponding responsibilities while pursuing interests and establish a more transparent and responsible industry ecosystem. Investors also need to improve their own risk awareness, participate in the market rationally, and not blindly believe in the "myth of getting rich".

2. The tragedy of excessive financialization of the crypto industry

The LIBRA incident sounded the alarm again: MEME currency speculation is a microcosm of excessive financialization in the crypto industry. The ultimate PVP game and interest groups harvesting retail investors will ultimately damage the foundation of the industry. Only when Web3 truly develops application-level entity business can this situation be fundamentally improved:

Over-financialization vs. dApp application: In the current crypto industry, a large amount of funds and energy are concentrated on financial speculation and speculative trading, while the development of Web3 entity applications is relatively lagging behind, and there is a lack of application scenarios that have truly commercial value and user base.

MEME currency is an extreme manifestation of "financialization": MEME currency has no actual value support and relies entirely on market sentiment and capital speculation. It is an extreme manifestation of crypto-financial speculation. The LIBRA incident is the inevitable consequence of this extreme financialization.

Web3 application is the key to breaking the deadlock: The real potential of Web3 lies in building an open, transparent, and decentralized digital world. It requires empowering blockchain technology to all walks of life and create real value, rather than just staying in financial idleness and concept hype.

dApp improves user experience and value precipitation: The development of Web3 applications can improve users' awareness and acceptance of blockchain technology, guide users' attention from "making money trading" to "app value", and promote the Internet of value The real realization of

Web3 needs to get rid of the trap of excessive financialization and return to the original intention of technological innovation and application value creation. The industry needs to pay more attention to the construction of application layers and infrastructure, and incubate more Web3 projects with practical application scenarios and user value in order to build a healthier and more sustainable development ecosystem.

**3. The close connection between Web3 and Web2: the dilemma of business

model, commercialization and user experience**

The LIBRA incident also reflects that there is still a clear gap between Web3 projects in terms of business model, commercialization and user experience compared with mature Web2 products. The true "close connection" between Web3 and Web2 still faces many challenges:

Sustainability of business models: Meme coin projects like LIBRA lack practical application scenarios and endogenous value. Their value is entirely based on market sentiment and hype, and it is difficult to form a sustainable business model, and it is inevitable that the bubble will burst.

Exploration of commercialization paths: The commercialization path of Web3 projects is not yet clear, the profit model is single, and excessive reliance on token issuance and transaction fees is difficult to support long-term healthy development.

The gap in user experience: crypto wallet operations are complex and transaction thresholds are high. There is still a huge gap in user experience compared with the convenience and friendliness of Web2 products, hindering the large-scale popularization of Web3. During the LIBRA incident, a large number of investors suffered losses due to unfamiliar with the rules and risks of crypto markets, which also reflects the shortcomings of user education and experience optimization.

Competition with Web2 giants: In terms of user experience, business model maturity, etc., the Web3 project currently does not have the strength to compete with Web2 giants, and is at a disadvantage in terms of traffic, user habits, etc. Web3 must truly "connect with Web2". We still need to make continuous breakthroughs in business model innovation and user experience improvement.

The future development of Web3 not only depends on technological innovation, but also requires the maturity of business models and the improvement of user experience. How to build a sustainable economic model, explore diversified profit models, lower the threshold for user use, and improve user experience is the key to Web3 becoming popular. The LIBRA incident also reminds practitioners that they should not only focus on the hype of political and economic concepts, but also return to the essence of business and improve the practicality and user-friendliness of Web3 applications.

4. PVP Game and Insider Trading: The "Last Carnival" of Zerosum Games

The collapse of public chain Meme coins such as BSC and Solana, as well as the outbreak of LIBRA incidents, all indicate that the PVP (Player vs Player) game in the asset issuance field has reached a white-hot stage, insider trading has become the industry's "unspoken rule", and the market is experiencing zero sum The "Last Carnival" of the game:

The essence of zero-sum game: The Meme currency market is highly speculative, and the fancy funding game is essentially a zero-sum game. A very small number of "insiders" and early participants make profits. Most retail investors who enter the market later are destined to be "taken over" "Haven".

Professional "harvest" team: A professional "harvest" team has been formed in the market, from project packaging, data fraud, wallet address allocation to KOL marketing, forming a complete "leek-cut" industrial chain, and retail investors have weak identification capabilities.

The normalization of insider trading : The Meme currency issuance mechanism has natural insider management loopholes. Project parties, KOLs, and internal personnel of the exchange are easy to obtain insider information, and make advance layout and interest transfer. Insider trading has almost become the industry's "unspoken rule".

The "last moment" of PVP game: The bad impact of the LIBRA incident and the awakening of investor protection awareness indicate that the ultimate PVP game model of Meme coins may have come to an end, and the market urgently needs healthier and more sustainable asset issuance and trading mode.

The LIBRA incident is a concentrated outbreak of the PVP game and insider trading chaos in the Meme currency market, and is also a profound warning to the existing market mechanism and participants. Excessive speculation and zero-sum game models will eventually be unsustainable. The market needs to return to value investment and establish a fairer and more transparent trading environment in order to reshape investor confidence and promote the healthy development of the industry.

**5. The theory of crypto asset issuance evolution: fission and bubbles

from POW, POS, Friendtech to Pump.fun**

The evolution of blockchain asset issuance methods is a history of interweaving technological innovation and market game. From POW to Pump.fun, the issuance threshold has been continuously lowered, and participation has continued to increase, but it has also accelerated the expansion of the market bubble:

POW (Proof-of-Work) - Proof of Work:

Issuance method design: By competing for accounting rights by calculating hash problems, successful people will receive block rewards (Singapore currency), relying on computing power competition and energy consumption.

Participation threshold: High, requiring professional mining machines, power resources and technical knowledge. Early participants are mainly technical geeks and professional miners.

Consensus convergence: Based on cryptography and economic incentives, network security and operation are maintained through decentralized mining to form early community consensus.

Value foundation: early consensus, scarcity, decentralized characteristics, and narrative as "digital gold".

Network operation: Relying on miners to maintain network security, transaction speed and scalability are limited.

Evolutionary significance: Lay the foundation for issuance of crypto assets and establish the principles of decentralization and fair issuance, but the high threshold limits the scope of participation.

POS (Proof-of-Stake) - Proof of Stake:

Issuance method design: Users who hold tokens and pledge will receive accounting rights and interest rewards based on the ratio and duration of the currency, reducing their dependence on computing power.

Participation threshold: Medium, lowering the hardware and energy threshold, but still need to hold a certain amount of tokens and technical knowledge, and the range of participants is expanded.

Consensus Gathering: Based on the rights and community governance of coin holders, token holders participate in network maintenance and decision-making to form a broader community consensus.

Value foundation: The consensus mechanism is more energy-saving and environmentally friendly, improves network performance, expands application scenarios, and the value narrative moves from "digital gold" to "value Internet infrastructure".

Network operation: Improve transaction speed and scalability and reduce energy consumption, but there may be centralized risks and the "rich are richer" effect.

Evolutionary significance: Improve network performance and scalability, lower participation thresholds, and promote the prosperity of the public chain ecosystem, but the token allocation and governance model of the POS mechanism still needs to be improved.

Friendtech - Social Tokens:

Issuing method design: Based on social relationships and KOL influence, users purchase "Shares" to support KOL, and the KOL income is linked to Shares' value to tokenize personal influence.

Participation threshold: Lower, users only need to have a social account and encrypted wallet to participate, making the issuance more convenient and social.

Consensus Gathering: Based on KOL’s personal influence and fan economy, the initial consensus was established quickly, but it also relies heavily on KOL’s personal reputation and continuous operational capabilities.

Value basis: KOL's influence, fan economy, social interaction, the value basis is relatively fragile and is easily affected by KOL's personal risks and market sentiment fluctuations.

Network operation: Operating based on existing public chains (such as Base), it has strong social attributes, but actual application scenarios and network effects still need to be expanded.

Evolutionary significance: Innovate asset issuance methods, tokenize personal influence, expand the boundaries of crypto asset application, but also exposes the sustainability and value support issues of the social token model.

Pump.fun - One-click coin issuance platform:

Issuance method design: Extremely simplifies the issuance process. Users do not need code knowledge and issue Meme coins in one click and automatically inject liquidity.

Participation threshold: Extremely low, almost zero threshold, anyone can issue coins, and the speed and convenience of issuing coins are extremely high.

Consensus convergence: Relying entirely on market sentiment and FOMO effect, consensus establishment is very fast but fragile, and is susceptible to market sentiment and "harvest" behavior.

Value basis: There is almost no actual value basis, pure MEME cultural and emotional value, and it is highly dependent on market speculation and expectation of "get rich".

Network operation: Based on public chains such as Solana, the transaction speed is fast, but the security and decentralization are questioned and are easily manipulated by project parties and insiders.

Evolutionary significance: Promoting asset issuance to "popularization" and "entertainment", but it also accelerated the expansion of the Meme coin bubble and market risks were out of control.

Data evidence: MEME coins create wealth 24 hours a day and bubble risk

Platforms such as Pump.fun have lowered the threshold for issuing coins to freezing point, and the issuance speed and wealth-making effect of MEME coins are astonishing: MEME coins such as LIBRA can soar to billions of dollars within 24 hours, attracting countless investors to enter the market. , but it also lays huge bubble risks.

The 24-hour "creating wealth" myth: Meme coins such as LIBRA have surged and plummeted in the short term, staged an extreme market of "early wealth" and "instant return to zero", attracting speculators and "gamblers" to enter the market.

The risk of bubble formation is intensifying: Platforms such as Pump.fun have fueled the Meme coin bubble, and a large number of low-quality and worthless Meme coins have been poured into the market, accelerating the expansion of the bubble, and ultimately it is difficult to escape the fate of collapse.

Regulatory arbitrage and risk spillover: A low-threshold coin issuance platform may have regulatory arbitrage behavior, which aggravates market risks and spills risks to the entire crypto industry.

**6. Current stage of the market: Nash equilibrium dilemma and the end of

the model**

The LIBRA incident and the chaos in the Meme currency market may indicate that the current Meme currency "fast issuance of coins - emotional hype - rapid collapse" model is approaching the end of the situation, and the market is sliding towards the dilemma of Nash equilibrium:

Nash equilibrium status: In the current market, the project party pursues "fast harvest", snipers are waiting for an opportunity to "buy low and sell high", KOLs "paid orders", CEXs "profit-seeking coins", retail investors "enter the market", all participating All of them pursue their own interests in the Meme zero-sum game, but the end result is in inefficiency, chaos in the entire market and the continuous loss of investor confidence. Like the classic game theory model of Nash equilibrium, individual rational behavior leads to collective irrational results, and the market falls into prisoner's dilemma.

Model unsustainability: The bad impact of the LIBRA incident and the awakening of investor protection awareness have made the Meme currency "harvest" model unsustainable. Retail investors no longer blindly FOMO, KOLs' credibility declines, CEXs may tighten the listing standards, and the "Meme currency's myth of getting rich" is gradually shattered.

The market urgently needs a new paradigm: The "Nash equilibrium" dilemma of the Meme currency market indicates that the market needs new innovations or paradigm changes to break the deadlock, reshape investor confidence, and promote the industry to a healthier and more sustainable development track.

7. Looking forward to a new dawn: health asset issuance and a new industry order

Although the LIBRA incident is a "pain" for the crypto industry, it may also breed new hope:

Short-term pains create long-term demand: The chaos of Meme coins such as the LIBRA incident will hit investors ' confidence in the short term, but in the long term, it will prompt the market to reflect on the drawbacks of the existing model, force the industry to accelerate changes, and investors are safer and more The need for a transparent and fairer asset issuance and trading model will be more urgent.

New stage of asset issuance and health management: The era of "wild growth" of Meme coins may end, and the industry will enter a new stage of asset issuance and health management. The market will pay more attention to project quality, value support and long-term development rather than short- term speculation and sentiment Harvest.

The dawn begins: The negative impact of the LIBRA incident may force supervision to strengthen, promote industry self-discipline, accelerate investor education, and promote technological innovation, bringing a new dawn to the crypto industry after the decline of MEME coins, and giving birth to healthier and more affordable Continuous development future.

Conclusion

The LIBRA incident is a mirror that reflects the various chaos and deep problems in the current crypto Meme currency market. From emotional opposition, regulatory resistance, Web3 business model dilemma, PVP game and insider trading, to asset issuance evolution theory and market Nash equilibrium state, the occurrence and evolution of the LIBRA incident has sounded a wake-up call for us and provided a healthy future development of the industry. A profound revelation. Short-term pain is inevitable, but in the long run, this crisis may become a turning point for the crypto industry to mature and standardize, and a new dawn may come after storms.

chaincatcher

chaincatcher

panewslab

panewslab