US stocks evaporated by 1.5 trillion and cryptocurrency evaporated by 300 billion. Trump made a "big news"

Reprinted from panewslab

03/04/2025·2MAuthor: 0xFacai

Last night, the Dow Jones Index opened up 300 points, then took a sharp turn and fell 1,100 points in a few hours. Between 10:00 a.m. and 3:30 p.m. ET, the market capitalization of the S&P 500 evaporated by $1.5 trillion. Meanwhile, the market value of cryptocurrencies has evaporated by nearly $300 billion.

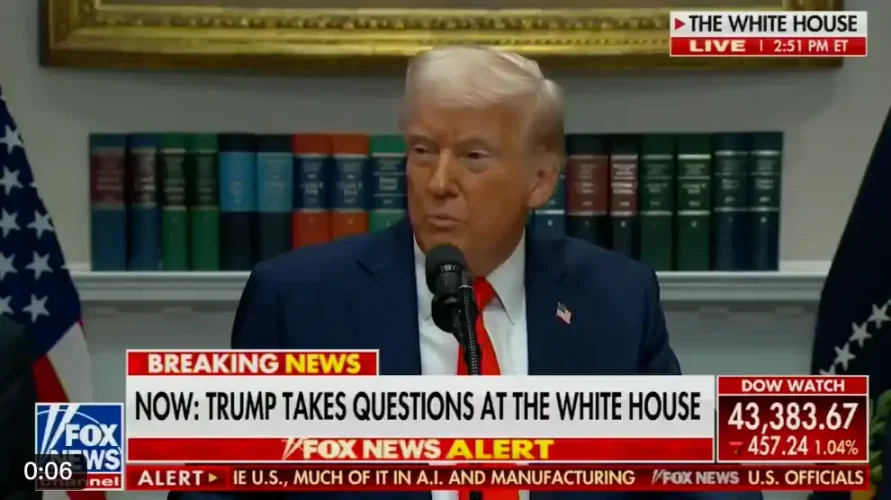

After Trump announced on Sunday that he would establish strategic reserves for cryptocurrencies such as SOL, XRP, and ADA, Trump quickly gave the US stock market another "reverse cleanup", and the crypto market could not escape the sharp drop, and the entire capital market was once again "rape" by the President. What exactly happened? All this seems to be due to a press conference held by Trump...

Invest in TSMC and loosen Russia

Last night, the S&P 500 opened up about 30 points, continuing its trend on Friday. However, not long after, the Trump administration issued an "investment statement", and market selling pressure began to emerge.

Trump announced that TSMC invested $100 billion in the United States, which includes:

1. Establish 5 factories in Arizona;

2. Create thousands of jobs;

3. Make TSM's total investment in the United States reach US$165 billion;

4. Create “hundreds of billions of dollars in economic activity”

In the announcement, Trump said the investment plan will promote the long-term goal of the United States, which is to revive the US semiconductor industry. For the capital market, this will undoubtedly exacerbate the Taiwan Strait issue that the current capital market is extremely worried about.

Meanwhile, when President Trump issued a statement last night, the Wall Street Journal published a report about Ukraine, saying that the Trump administration has officially stopped funding the sale of new weapons to Ukraine. According to a subsequent report by Reuters, the United States is also formulating a plan to relax sanctions on Russia.

Before this, the Ukrainian crisis was deadlocked due to the "live quarrel" between the two presidents. At this time, the loosening policy against Russia was regarded as favoritism to Russia, which was not conducive to the further development of peace talks.

Crazy tariffs

After completing the announcement of the investment announcement, Trump immediately turned to the Q&A session, causing further panic and selling.

First, Trump confirmed that it will impose a 25% tariff on Canada and Mexico starting on March 4. A reporter then asked: "Will Canada and Mexico still have room to reach an agreement before midnight?" Trump said that there is no room for negotiation and negotiation on tariffs against Mexico and Canada.

Subsequently, Trump announced that he would impose tariffs on imported agricultural products starting from April 2. To make matters worse, he said he would impose tariffs on countries that "take currency devaluation" to impose sanctions. A few minutes later, the White House issued an announcement saying that Trump had signed an executive order to raise tariffs on China to 20%.

This means that tariffs on China have risen by 20 percentage points in two months. By contrast, it took Trump two years during his first term to raise tariffs on China to such a high level. Under the impact of the tariff stick, the US stock market instantly evaporated by 1.5 trillion US dollars...

Strategic reserves may be difficult to realize

At this announcement meeting, Trump did not mention a single word about the previously mentioned cryptocurrency strategic reserves. This also makes the market doubt about its sincerity and the real ability of this government.

BitMEX founder Arthur Hayes mentioned in a tweet some time ago that the fundamental problem with the government hoarding any assets is that they buy and sell assets mainly for political interests, not financial interests. And those who build truly decentralized technologies and applications don’t have enough financial resources to play with politics at a critical moment in this cycle.

Yesterday, Arthur further issued a statement saying that it believes that the government has no money to buy the crypto assets needed for strategic reserves. "There is nothing new here, it's just empty talk. Let's talk about it when the crypto working group gets approval from Congress to borrow money or revalue gold prices." Arthur believes that unless Trump passes through the "bitcoin" national reserves, the market will move in a worse direction.