Q1 Encrypted Narrative Observation: No main line, only real benefits

Reprinted from panewslab

03/04/2025·2MThere was no consensus at the Hong Kong Consensus Conference in February 2025. The crypto market in Q1 25 has no main line.

In 24 years, Solana strictly implemented the Memecoin strategy formulated by Messari, and the transaction volume of the single chain surpassed the entire Ethereum ecosystem, becoming the first L1 in history to win the block space war with the Ethereum ecosystem.

However, the foundation of Solana's victory is not solid. The Memecoin fundamentals, composed of attention-Fomo emotions-liquidity trinity, have been reduced rapidly due to the festival effect. After the on-chain trading volume has dropped rapidly due to the holiday effect, the weak LP pool cannot support the high FDV/LP ratio, and in February 25, a retreat market greater than Dunkirk was staged.

The old king has fallen, and the new king is still behind the scenes. Standing at the moment of March, a changing month, we blindly guess the main line of the future.

There is a clue emerging in the chaotic market structure: funds are pouring from PVP on the narrative-only chain to YieldFarming with fundamental support.

There are three categories of representative projects:

--Sonic's neoclassical Yield Farming, the power-enhanced version of Ve(3, 3);

--The new (3,3,3) model of BeraChain and Initia, the chained version of the (3,3) mechanism of Olympus DAO;

--The DePIN project represented by Aethir, YiledFarming with real income and positive externalities.

The Mindshare markets of Sonic, BeraChain and Initia are both quite high, while the market discussions are missing after a year of silence in the DePIN track.

However, the most Bullish track in Messari's 25 Annual Outlook Report is DePIN, and it is recommended that Solana return its strategic focus to DePIN in 25 years.

As we all know, the trick to obtaining Alpha's benefits is to walk through narrow doors and cultivate thin fields. The more no one cares about DePIN, the more worthy of our in-depth layout.

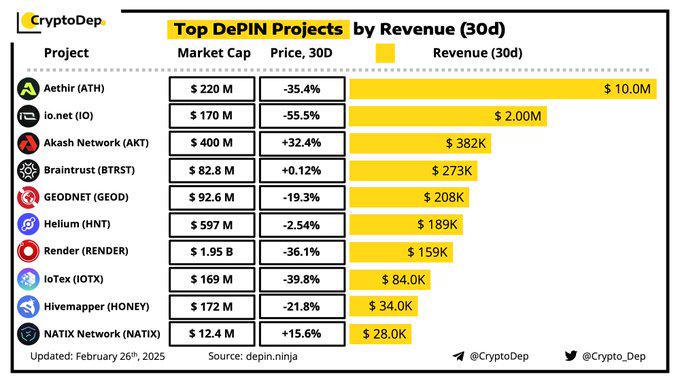

The above picture is the TOP DePIN project data compiled by CryptoDep. Among the top 5 revenue rankings, in addition to the familiar Aethir, io.net, and Akash, two rookies, Braintrust and GEODNET, are also shortlisted.

Among them, Aethir ranked first in the DePIN project with a 30-day income of $10M. I checked Aethir's GPU Dashboard, and the project has achieved annual revolving revenue (ARR) of $105 million, provided 487 million hours of computing power, and distributed more than 3.6 billion ATH token rewards, with nearly 1 million on-chain transactions.

I thought the real income model pricing would have to wait for years in the crypto market to be recognized, but seeing Aethir's growth trajectory, perhaps this day would come earlier than we thought.

The reason why Aethir is so successful is on the one hand because of Aethir's differentiated competitive strategy. It did not follow the route of other DePIN projects focusing on edge device networks + long-tail market demands, but chose to use NVIDIA high-performance GPUs (such as NVIDIA H100) to build a decentralized cloud computing platform to provide enterprise-level GPU computing power for AI and game developers around the world; on the other hand, the Aethir team seized the AI x Crypto trend in Q1 in 24 years and successfully raised funds and used them to purchase a large number of high-end GPUs, creating Aethir's moat and helping Aethir realize network effects as soon as possible. Aethir's network effect has attracted more enterprise-level GPU computing power suppliers to join.

Recently, there has been a circulating in the market that open source low-cost models such as DeepSeek will reduce the demand for high-end graphics cards in NVIDIA. This has led to many investors worrying about the sustainability of Aethir's income. But this view is actually a market noise intentionally created by financial market operators some time ago, and it is a bit too much to worry about it.

Nvidia's "leather yellow" has long publicly refuted this view, and there is also the "Jevins effect" to play a role. Simply put, open source models such as DeepSeek will not only not reduce the demand for high-end GPUs, but will instead stimulate demand growth. After DeepSeek became popular, the scale of the domestic Maas (model-as-a-service) inference market has surged, saving many almost unpredictable computing power centers.

Moreover, paradigm innovation in the field of AI is in full swing. In addition to LLM, Embodied AI has become a hot topic for capital. Embodied intelligence will become the engine to ignite the second growth curve of Aethir due to the need for low latency, high reliability computing power and multi-layer network structure that integrates edge devices and cloud.

Therefore, on the demand side, there is no need to worry about Aethir. The Aethir team's current work focus is on the supply side. They are trying their best to access more enterprise-level high-end GPU computing power suppliers on the network. To this end, Aethir also specially launched the Aethir AVS network to provide compliance support for GPU computing power suppliers and exempt staking thresholds.

In addition to AI-related projects such as Aethir, io.net, and Akash, DePin has also very good fundamentals, but due to its geographical location information service, the niche market limits its imagination space. We do not conduct in-depth analysis, and if you are interested, you can Grok3 by yourself.

To sum up, DePin has iterated from a "epic scam" for 23 years to a physical device collaboration network with real income + positive externalities, but the market has not yet Price in this regard. And this is a good hitting point.

above.