Trump set up a presidential digital asset work group to evaluate the possibility

Reprinted from panewslab

01/24/2025·3MWritten by: Li Dan

Source: Wall Street Insights

After taking office, Trump took action against cryptocurrencies and signed a presidential executive order aimed at promoting the development of the cryptocurrency industry. In addition, there is good news in the currency circle from the U.S. Congress: a congressman who first proposed the establishment of a Bitcoin strategic reserve in the United States last year was "promoted."

On Thursday, January 23, Eastern Time, the White House announced that U.S. President Trump signed an executive order titled "Strengthening U.S. Leadership in Digital Financial Technology." The order calls for the establishment of a presidential “Working Group on Digital Asset Markets” within the National Economic Council, an agency that advises the president.

The above-mentioned working group will be led by David Sacks, Trump’s appointed “artificial intelligence (AI) and cryptocurrency czar” – the White House’s first special adviser on AI and cryptocurrency. Members of the working group also include heads of government departments and regulators or their designees, including the U.S. Secretary of the Treasury, the Attorney General, the Secretary of Commerce, the Chairman of the U.S. Securities and Exchange Commission (SEC), the Chairman of the Commodity Futures Trading Commission (CFTC) and other government departments and regulators.

The executive order also explicitly mentions that the Trump administration is considering whether to use Bitcoin as a national reserve for the United States. The executive order reads that the above-mentioned working group will submit a report to Trump within 180 days after the issuance of the executive order and put forward relevant suggestions for supervision and legislation. The report should focus on: managing the issuance and management of U.S. digital assets including stablecoins. A federal regulatory framework for operations that considers provisions for market structure, supervision, consumer protection and risk management, and

The task force "should evaluate the possibility of establishing and maintaining a national digital asset reserve and propose criteria for establishing such a reserve, which may originate from cryptocurrencies lawfully seized by the federal government through law enforcement efforts."

But amid the market excitement, a key question remains: whether the executive order simply creates a national Bitcoin reserve based on existing funds seized from criminal activity over the years , or establishes one that can buy more Bitcoin over time. Larger reserves.

The executive order also explicitly prohibits central bank digital currencies (CBDC). The executive order reads:

“Each (federal government) agency is hereby prohibited from taking any action to establish, issue, and promote a CBDC within or outside the United States, except to the extent required by law.”

The executive order requires that any government agency that is conducting plans or initiatives related to the establishment of a CBDC within the United States should immediately terminate it and be prohibited from taking further action to develop or implement such plans or initiatives.

Sacks said the new task force will “make the United States the world capital of cryptocurrencies” under Trump and that actions on AI will allow the United States to “dominate and lead the world in AI.” Trump Talks said of these actions that they "will make a lot of money for the United States."

U.S. Senate Banking Committee’s new Digital Assets Committee focuses on

strategic Bitcoin reserves and other legislation

Earlier on Thursday, U.S. Senate Banking Committee Chairman Tim Scott appointed Wyoming Senator Cynthia Lummis to chair the committee’s new digital assets committee. Lummis later released a statement announcing that the new committee dedicated to digital assets will focus on two areas:

- Pass bipartisan digital asset legislation that promotes responsible innovation and protects consumers, including legislation on market structure, stablecoins, and strategic Bitcoin reserves;

- Conduct rigorous oversight of federal financial regulators to ensure these agencies comply with the law, including ensuring that Operation Chokepoint 2.0 does not occur again.

Operation Chokepoint 2.0 is said to be a coordinated effort by U.S. federal agencies to remove cryptocurrency companies from the traditional banking system, and so far there has been no official documentation confirming its existence.

In July last year, Trump promised at the Bitcoin 2024 conference to list Bitcoin as a strategic reserve asset of the United States. Lummis, a Trump ally in the Senate, first proposed the Strategic Bitcoin Reserve Act that month to establish a U.S. national strategic Bitcoin reserve. The bill calls for selling part of the Federal Reserve's gold reserves and purchasing 1 million bitcoins to establish the "strategic bitcoin reserve" proposed by Trump without increasing the government deficit. Based on the current currency price, it would cost approximately US$90 billion.

In Thursday’s statement, Lummis once again mentioned legislation related to Bitcoin strategic reserves. She said:

“Digital assets represent the future, and if the United States hopes to remain a leader in global financial innovation, Congress needs to urgently pass bipartisan legislation that establishes a comprehensive legal framework for digital assets and strengthens the U.S. dollar through strategic Bitcoin reserves. … I look forward to sending bipartisan legislation to President Trump this year to secure our financial future.”

News of Lummis’ appointment quickly detonated the cryptocurrency market. The trading price of Bitcoin (BTC) against the U.S. dollar rose during the session on Thursday.

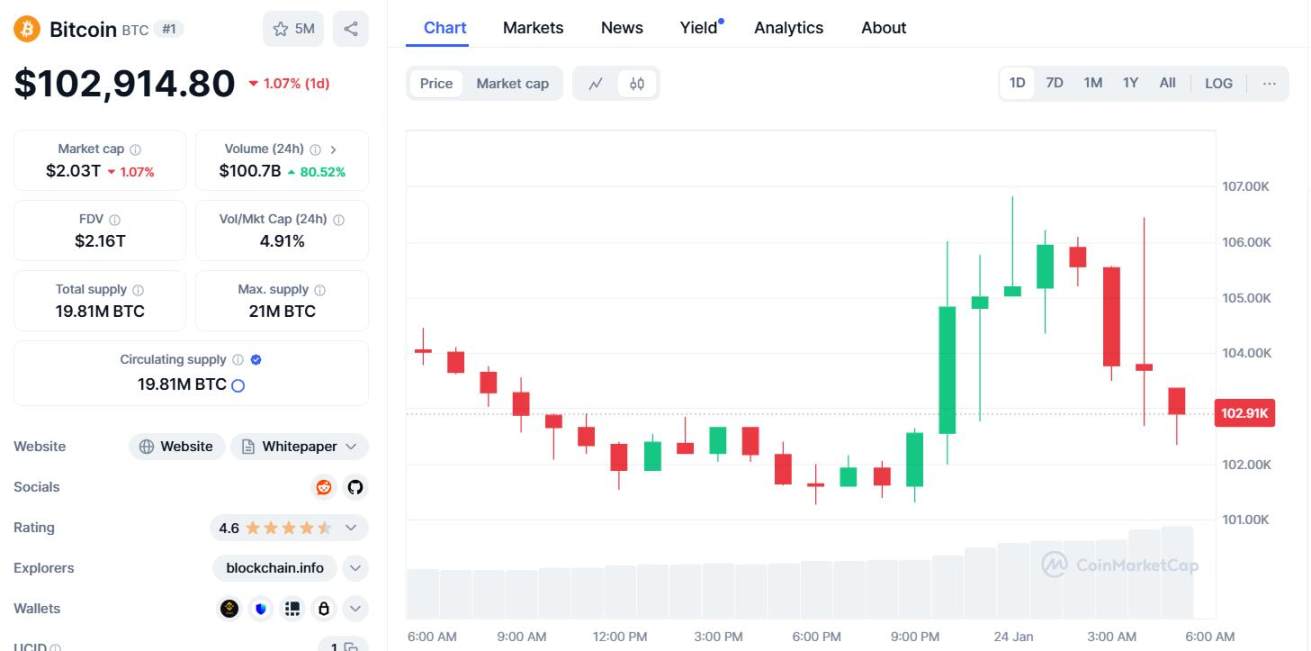

CoinMarketCap data shows that the spot trading price of Bitcoin against the U.S. dollar first fell below US$101,300 in European stock markets, setting a new daily low. U.S. stocks accelerated their rebound after the opening, and rose above US$106,800 at the end of early trading, setting a new daily high. It rose more than the daily low. 5,000 US dollars, up more than 5%, starting to approach the intraday record high set on Monday when it rose above 109,000 US dollars. However, U.S. stocks resumed their decline in late trading. U.S. stocks fell below $103,000 after closing, and fell by more than 1% in the last 24 hours.

chaincatcher

chaincatcher