Bull market avoidance cheats: 21 fatal psychological traps in the transaction

Reprinted from panewslab

01/24/2025·3MAuthor: Route 2 FI

Compiled by: Vernacular Blockchain

Trading Psychology reveals the hidden psychological game behind successful cryptocurrency trading. As a trader, your mind can be your most powerful tool—or your greatest weakness.

Your personal biases, such as confirmation bias and overconfidence, can quietly undermine your financial decisions without you even realizing it.

The most successful traders are not necessarily the smartest, but those who understand their own mental patterns, control their emotions, and make rational choices under pressure.

By recognizing your brain's natural reaction patterns, you can develop discipline, manage risk more effectively, and transform trading from an emotional roller coaster to a strategic, precise operation.

Let’s dig into it next!

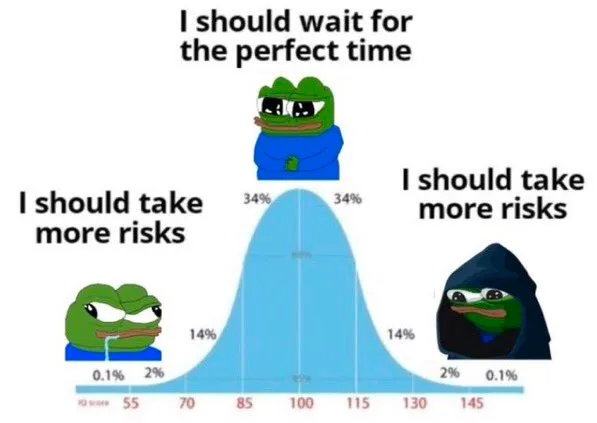

Where are you on the IQ curve above, and which Pepe type do you belong to?

Trading psychology reveals traders’ psychological reactions when faced with market events and various factors that affect trading.

The psychological state of traders not only determines their trading decisions, but also affects the development of their trading careers to a great extent.

You may already know that the key to success is not high IQ, but psychological factors such as patience, perseverance, self-discipline, and a healthy mental state.

Faced with the same market conditions, different traders may react very differently.

1. Transaction type

For example, when the price of Bitcoin ($BTC) drops sharply, some people panic sell, while others choose to buy the dip, confident that the price will rebound. Therefore, based on psychological characteristics, traders can be roughly divided into the following categories:

- Impulse traders

This type of trader does not have a thorough plan and makes quick decisions, but often ignores the consequences. They are easily influenced by emotions, leading to potentially huge losses.

- Cautious traders

This type of trader will comprehensively analyze the market situation and their own financial situation before trading. They are usually emotionally stable and have good self-management skills. However, they are sometimes too conservative and lack the spirit of risk-taking, and appropriate risk-taking can often bring higher returns.

- Practical traders

Practical traders combine risk-taking with careful analysis. They know how to manage risk and can trade with confidence. This type of trader is the ideal type: one who neither over-analyzes nor can reasonably evaluate whether each trade has a positive expected value (+EV).

You may have identified yourself among these types and can reflect on how your own psychological characteristics affect your trading results.

There is no doubt that trading psychology is an integral part of successful trading.

2. Trading bias

Trading biases are cognitive errors that traders may make during their decision-making process, often significantly affecting trading performance and final results.

Here are a few common trading biases:

- Confirmation Bias

Traders tend to look for information that supports their existing opinions while ignoring evidence that contradicts them. This bias can lead to poor decisions or overtrading.

For example: say you hold a large amount of Ethereum ($ETH). Typically, you might look to platforms like Crypto Twitter to find support for “Ethereum is a good asset” without looking into the reasons why Ethereum might not be the best choice. The result is that you are more likely to engage with content that is consistent with your existing views rather than engage in a thorough and objective assessment.

Trading psychology not only helps you better understand the market, but also allows you to understand your own behavior patterns and help improve your trading performance.

- Availability bias

In cryptocurrency trading, availability bias is when investors base decisions on easily recalled or recently acquired information rather than thorough analysis. A typical example is when traders rush to buy a cryptocurrency because it is frequently mentioned on social media or news platforms, without considering its fundamentals.

For example, if a particular altcoin blows up on Twitter due to a celebrity endorsement or a viral meme, traders may overestimate its potential and invest heavily in it, even though the coin may lack a solid technical foundation or practical applications. scene.

This bias can lead to poor investment decisions because readily available information may not accurately reflect an asset's true value or long-term prospects. Another example is when traders overreact to recent market events. If Bitcoin prices suddenly spike, availability bias could lead investors to believe such quick gains are common and easy to achieve, leading to overly optimistic trades.

This can lead to chasing short-term trends at the expense of more stable long-term investment strategies.

- Anchoring bias

A classic example of anchoring bias in cryptocurrency trading is when investors buy Bitcoin at $100,000 at a market high, and they remain stuck on “$100,000” even when market conditions change and the price drops significantly. "This anchor price. This mentality may lead to the following wrong decisions:

Hold on to your position when it's obvious you need to sell, hoping the price will return to $100,000.

Ignore new market information or analysis and only believe in your obsession with the $100,000 price.

Anchoring bias can lead to huge financial losses because traders fail to adapt to market changes and miss opportunities to cut losses or take profits at lower prices.

Another common anchoring bias is related to net worth figures. As a trader, you are exposed to profit and loss (PnL) fluctuations every day. Let’s say your crypto net worth is $100,000. If you lose $20,000, you can easily be trapped by the fact that your "account has shrunk" and find it difficult to get back to the original level. This mentality can lead you to adopt an overly defensive approach to the market, and even in trading opportunities that appear to have potential, you scale back your risk for fear of losing money again.

- Loss aversion bias

Traders usually feel the pain of losses more strongly than the pleasure of profits, which often leads them to hold on to losing positions for too long or to close profitable positions too early.

The loss aversion bias is particularly evident in crypto trading. Suppose a trader buys Bitcoin for $100,000, expecting the price to rise, but instead the price drops to $80,000. Although market indicators indicate that prices may continue to fall, traders are reluctant to take action in the hope that prices will return to their buying points.

This reluctance to cut losses stems from the psychological pain of realizing losses, even when the trend is clearly negative.

Another manifestation is that when a coin rises by 10%, traders will sell quickly to lock in profits, fearing profit taking; but when a coin falls by 20%, they hesitate to sell and hold on to their profits. The illusion of a price rebound.

This behavior reflects that traders feel the pain of losses much more than the pleasure of equivalent gains. In volatile crypto markets, loss aversion can lead to:

Hold underperforming assets for the long term.

Missing out on other potential profit opportunities.

Increased emotional stress and irrational decision-making.

To be honest, this is one of the classic traps I fall into every day. For example, right now I am shorting some weak altcoins. If I currently make a profit of $10,000, but the price corrects slightly, causing the profit to drop to $5,000, I will often fall into the mentality of "never close the position until it reaches more than $10,000." Because it made me feel like I was $5,000 in the red, even though the trade was still profitable overall. I believe many people can relate to this.

- Overconfidence Bias

- Overconfidence Bias: Traders often overestimate their knowledge and abilities, which may lead to excessive risk-taking and frequent trading.

A classic example occurred during the 2021 Bitcoin bull run. Many traders are overconfident in their ability to predict market trends and therefore increase their leverage significantly, believing that the price of Bitcoin will continue to rise.

When the price of Bitcoin topped $60,000 in early 2021, many investors became overly optimistic due to the recent upward trend, convinced that the price would continue to climb. They ignore potential risks and the possibility of market volatility.

However, when the market eventually corrected and Bitcoin prices fell below $30,000 a few months later, these overconfident traders suffered significant losses.

- Fear and Greed

Fear and greed can cause traders to exit a trade prematurely for fear of losing money, or to hold a position too long in an attempt to maximize profits.

Needless to say, this is intuitive and self-explanatory.

- Recent news bias

Traders tend to give more weight to recent events or information, thereby ignoring longer-term trends or historical data.

For example, you may overreact to short-term price fluctuations and make irrational decisions. Suppose that after the price of Ethereum ($ETH) drops sharply, traders may think that the downward trend will continue and rush to sell their positions, thereby missing the opportunity for the market to recover. Think about Crypto Twitter (CT). After a few days of decline, everyone will say the market is over and you should have sold, but eventually the market tends to reverse.

- Herd bias

Traders follow public behavior and do not make decisions based on their own analysis. This is very common in the crypto market and is also a classic CT behavior pattern.

A case in point is Ethereum’s price performance during 2020-2021. From around $130 at the start of 2020 to its all-time high of $4,859 in November 2021, Ethereum price increased by a staggering 3,756%.

This price surge reflects a variety of herd behavior:

FOMO (Fear of Missing Out): As the price of Ethereum continues to rise in 2020 and 2021, more and more investors are flocking in, not wanting to miss out on potential gains.

Market Sentiment: Bitcoin’s performance and institutional adoption have driven positive sentiment across the crypto market, spreading to Ethereum as well.

Technological progress: Ethereum’s transformation to Ethereum 2.0, and the implementation of EIP-1559 in August 2021 (which introduces a burning fee mechanism), have further stimulated market interest.

DeFi boom: As a major platform for decentralized finance (DeFi) applications, Ethereum has seen a significant increase in demand and usage.

Institutional Interest: Growth in institutional adoption and the launch of Ethereum futures by Chicago Mercantile Exchange (CME) in February 2021 has brought more credibility to the asset.

It should be noted that after peaking in November 2021, Ethereum experienced a significant correction in 2022, with the price falling to approximately $900 in June, catching many investors off guard.

- Frame effect

- Framing Effect

The way information is presented affects trading decisions, and traders may make different choices depending on whether the data is presented positively or negatively.

Taking Solana as an example, the following is a typical case of framing effect in crypto trading:

"Solana is up 10% in the past 24 hours, highlighting its strong ecosystem growth."

"Despite a 10% gain, Solana has failed to regain all-time highs."

These two sentences describe the same 10% increase, but they are presented in completely different ways. The first piece of news highlights positive information that may encourage traders to buy or hold Solana, while the second piece of news highlights potential shortcomings that may make investors hesitate or even choose to sell.

This different framework can have a significant impact on a trader's decision-making. For example, after reading the first news piece, a trader might think that the Solana network is growing strongly and be inclined to invest. After reading the second piece of news, traders may be hesitant to invest or even opt out of the gains.

- Illusion of Control

Traders overestimate their influence on market outcomes, leading to excessive risk taking.

For example, a trader might spend hours studying the price action of a token called “Fartcoin” and think they have discovered a perfect market timing strategy. Based on this "insight", they may bet a large portion of their portfolio, under the mistaken belief that they can control the outcome of the trade.

This illusion of control is especially evident during bull markets. When the overall crypto market is in an upward trend, most tokens will grow with it. Traders may attribute success to their own abilities rather than the overall movement of the market. For example, they may confidently say, "I know this altcoin will rise 30% today because of my technical analysis," but in reality, this growth may just be a result of the overall market trend.

Personally, I don't believe in technical analysis at all, because it has been proven time and time again that the real driver of the market is the news, not that "invisible line" you draw.

- Clustering Illusion

Traders see patterns in random market data that don't exist and develop faulty strategies.

A typical example is this: a crypto trader notices that the price of a certain coin has increased for five consecutive days. Based on this short-term pattern, he believes that a bullish trend has formed and decides to invest heavily in the asset. However, this five-day rise could be completely random and not represent any real trend.

This example reveals the core of the aggregation illusion:

Traders see a pattern in a small sample of data (five days of price action).

They attach meaning to the pattern while ignoring the broader market context or long-term data.

Investment decisions are based on the assumption that this pattern will continue, without considering that market fluctuations may be random.

In the highly volatile environment of crypto trading, prices fluctuate wildly due to a variety of factors. Mistaking short-term random price movements for meaningful trends can lead to poor investment decisions.

Let’s be honest, we’ve all been there. But after all, our analysis must be based on some basis, right?

- Negativity Bias

Traders tend to focus more on the negative aspects of a trade or strategy and may miss opportunities.

For example: Let’s say a trader has been trading extremely well over the past few months, with most trades achieving positive returns. However, one day they suffered a major loss as the market plummeted due to negative regulatory news.

Although the overall performance was still successful, the trader became overly focused on the negative experience and:

Become too cautious and miss out on potential profit opportunities even if market conditions improve.

Constantly anticipating similar negative events and thus selling positions prematurely or overusing stop-loss orders.

Ignore positive market indicators or good news and focus only on potential threats or headwinds.

This bias also manifests itself in some traders selling assets in which they were previously bullish. They may start fear-mongering (FUD) in an attempt to justify their decision and hope that the asset will not continue to rise (after all, they have already sold).

- Self-Attribution Bias

Traders attribute successful trades to their own abilities and failed trades to external factors, thereby hindering learning and improvement.

A classic example is: a trader bought Bitcoin for $80,000 and sold it for $105,000, making a considerable profit. He attributes this success to his excellent market analysis and trading skills. However, when the same trader bought Ethereum at $3,500 and the price dropped to $3,000, he blamed the loss on market manipulation, unexpected regulatory news, or “whale” selling.

We see this phenomenon almost every day on Crypto Twitter (CT) (hint: it’s everyday!).

- Hindsight Bias

Traders believe past events are more predictable than they actually are, which can lead them to be overconfident in future predictions.

For example, a trader bought Solana (SOL) for $200 in early January 2025. By mid-January, the price had risen to $250. Looking back, this trader thought: "I knew Solana would go up 25%. The market sentiment and technical indicators were so clear."

This reflects several characteristics of hindsight bias:

Traders overestimated their ability to predict Solana’s price movement.

Ignoring the inherent volatility of the crypto market, especially altcoins like Solana.

Ignore external factors that influence price increases, such as overall market conditions or specific news events.

This bias may lead to the following consequences:

Overconfidence in future transactions

Ignore potential risks or contrary indicators

Failure to effectively diversify its crypto portfolio

3. Problems I experienced in trading

These biases often appear in my trading process. By becoming aware of the existence of these biases, we can help us better reflect on our trading behavior and improve our strategies.

- Random Reinforcement

Sometimes, amateur traders (like myself) can make big profits in a row, while experienced traders have a losing streak. Although this situation is essentially a game of luck, traders may mistakenly believe that it is due to their own abilities, or on the contrary, have serious doubts about their abilities, and then fall into the psychological trap of random reinforcement.

Random heavy positioning is a destructive psychological phenomenon that is very common among traders. This phenomenon can cause traders to misunderstand their own abilities, blur their judgment, and lead to overconfidence or extreme lack of confidence. The problem is that novices may mistakenly believe that they have found an easy way to make profits, while veterans may begin to doubt their skills, trading plans, and even shake their entire trading knowledge system.

An example of a mistake I often make:

Let's say my trading day starts with a huge gain on $TIA. This can happen with any asset, but generally if there are big profits initially, I become overconfident and more likely to start trading frequently without clear trading logic.

My thinking is this: "I've made a lot anyway, and now I can take bigger risks. It doesn't matter if I lose money, because I'm betting with my 'free money' now."

Can you see the flaw in this thinking?

Stochastic reinforcement allows traders to ignore the randomness of the market and mistakenly believe that short-term success is entirely due to their own abilities, leading to more high-risk decisions without rigorous strategies. This mentality can lead to:

Ignore market risks and trade frequently.

Overestimating your skills and ignoring potential warning signs.

Experiencing significant losses when markets shift.

- Fear of missing out (FOMO)

Everyone is familiar with FOMO. Social media, the news, and the herd mentality make us obsessed with the idea that we can make a lot of money if we just act now, which is where panic trading begins. Trading out of FOMO precludes rationality and rationality.

Frankly, I feel this sentiment almost every day on Crypto Twitter (CT). There is always a Token that may want to "fly to the moon".

A reader once wrote to me and said:

"I haven't taken a vacation since 2019 because I feel that once I leave for a week, the market will skyrocket in my absence. I believe many people have similar feelings and are unable to fully enjoy life due to FOMO."

This sounds sad, but I understand it. This feeling is especially strong when I am not fully committed to the market, or during a bear market unwind.

If you feel FOMO on the green days... then by the red days, you may be out of ammunition. If you must have FOMO, choose a day when stocks fall into red.

- Revenge Trading

This type of trading is very detrimental to the trader's financial situation and often aggravates losses.

Suppose your trading went smoothly this week and you made stable profits. However, over the weekend, you suddenly lose all your profits and more.

The reaction that followed was one of "vindictiveness."

The target of revenge is the market itself. So you try to make up for your losses as quickly as possible, trade junk coins crazily, and often make some unforgivable mistakes.

I define revenge trading as: after losing on one trade, trying to recoup the loss through multiple low-quality trades.

suggestion:

Prioritize quality, don’t rush for quick results. Finding good trading opportunities takes time, don't be hasty because of emotions.

Pause trading and re-evaluate your strategy. After suffering a loss, stop and reflect on what went wrong. Analyzing your trades to identify where you went wrong can help you avoid making the same mistakes in the future. Tools like CoinMarketMan and TradeStream can help you record and analyze trading data.

Ask for help. If you find yourself having trouble breaking out of the cycle of losing money and revenge trading, consider finding a mentor or coach. They can provide valuable guidance and help you develop a more effective trading strategy.

- Gambling Psychology

First, let’s admit that all of us are gamblers to one degree or another.

The essence of trading is planning, strict discipline and continuous learning, but some traders view it as gambling. Traders with a gambling mentality often do not consider establishing a suitable trading strategy, but instead trade as they please and rely on luck. They are driven by the adrenaline rush of winning the "bet" and have a complete disregard for systemic operations.

This gambling mentality is common among novice traders as well as some professional traders who are eager to get something for nothing.

Gambling psychology causes traders to make impulsive decisions without careful consideration, ultimately leading to inevitable losses and emotional breakdown.

- Herd Instinct

Herd mentality is an important issue in the field of psychology. In trading, herd mentality is often based on the fear of failure. As a result, traders often rely on group decisions rather than conducting comprehensive market analysis. This reliance can lead to panic trading, irrational operations, and ultimately losses.

To be a successful trader, you always need to pay attention to your mental state. This simple formula should be your guiding light on your trading journey: Rational Analysis > Herd Behavior.

An example of herd mentality:

Let’s say Ansem tweets about a new coin. Immediately, the price of the token began to soar. Soon, other opinion leaders in the crypto field also began discussing the token. Because the whole group is coming, you feel safe and you go with the flow. However, if you are not vigilant enough, you may suffer losses when you end up being "smashed." This is always the case.