Trading Moment: Tonight's US GDP and upcoming non-farm data became the market focus, and institutions were bullish on BTC to $120,000 in the second quarter

Reprinted from panewslab

04/30/2025·1M

1. Market Observation

Keywords: ALPACA, MIKAMI, BTC

The May Day holiday is coming soon, and the United States will release GDP data for the first quarter of 2025 tonight, which will be an important assessment of the economic situation in Trump's early years in office. Morgan Stanley lowered its first-quarter GDP forecast from zero growth to a year-on-year decline of 1.4%, Goldman Sachs lowered its GDP from -0.2% to -0.8%, and JPMorgan Chase adjusted to -1.75%. Amid the surge in buying wave triggered by Trump's tariff threat, the surge in corporate imports has led to an increase in the deficit. Analysts believe that pre-tariff hoarding distorts economic data and the actual damage may be exaggerated. In addition, the U.S. non-farm employment data will be released on May 2, becoming another market focus. Economists warned that the tariff war launched by the Trump administration could lead to violent turmoil in the U.S. labor market, increasing the possibility of the Federal Reserve's interest rate cut in June. Sloke, chief economist at Wall Street asset management agency Apollo, predicts that the U.S. labor market may weaken significantly in the coming months. The market generally believes that tariff disputes may exacerbate inflation, increase unemployment, and even trigger a recession.

Bitcoin has fluctuated around $94,000-95,000 for a week, re-establishing its short-term holder cost base level (about $92,900). Most institutions are currently optimistic about Bitcoin. Among them, Geoffrey Kendrick, head of global digital assets research at Standard Chartered Bank, predicts that Bitcoin is expected to reach an all-time high of about $120,000 in the second quarter. Bernstein analysts believe that it is the time to buy and maintain the target price of $200,000 at the end of the year. It is predicted that Bitcoin will reach $500,000 by the end of 2029 and $1 million by the end of 2033. This optimism resonates with MicroStrategy's massive $1.42 billion increase in holdings last week, which bought 15,355 bitcoins at an average price of $92,737. In addition, Japanese fashion brand ANAP, American real estate company Cardone Capital, and Brazil's largest commercial bank Itaú have also announced to join the ranks of Bitcoin reserves recently. It is worth noting that Trump's executive order "Bitcoin Strategic Reserves" will also usher in a key node on May 5. QCP Capital analyzed that this capital inflow led by traditional financial institutions makes this round of market more sustainable than before.

Binance recently launched the Alpha Points System has become a new battlefield for airdrop hunters, but the new project speed is getting faster and faster, and the difficulty of obtaining points has gradually increased. The recently launched projects such as Sign, MilkyWay, Haedal Protocol, B² Network have made players call it "becoming more and more difficult". The market jokingly said that Binance must have guidance from experts behind this move. In addition, ALPACA will stage a "death struggle" before it will be removed from Binance on May 2, and the price plummeted and the price has become the norm, with nearly US$40 million in 24 hours. After the BONK project launches Letsbonk.Fun, NFT Whale Dingaling’s upcoming boop.fun platform attempts to continue the community frenzy with its promise of “will airdrop at startup.” Japanese actress Yua Mikami has issued the Meme currency MIKAMI again after launching NFT, but it has clearly stated that it is not aimed at the Japanese market. Looking back on the past, many similar actresses' coin issuance projects ended in failure, and the market is cautious about their prospects.

2. Key data (as of 12:00 HKT on April 30)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN)

-

Bitcoin: $95,039.82 (+1.56%), daily spot trading volume $24.702 billion

-

Ethereum: $1,808.70 (Year-Date--45.91%), daily spot trading volume is $13.769 billion

-

Corruption index: 56 (neutral)

-

Average GAS: BTC 2.25 sat/vB, ETH 0.35 Gwei

-

Market share: BTC 63.5%, ETH 7.3%

-

Upbit 24-hour trading volume ranking: PUNDIX, SIGN, XRP, SAFE, DRIFT

-

24-hour BTC long-short ratio: 1.03

-

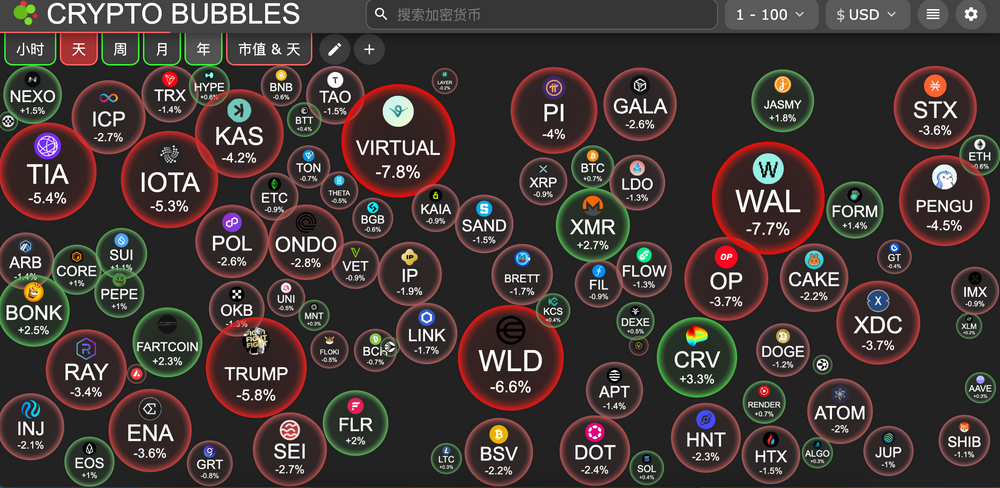

Sector rise and fall: NFT sector fell 3.5%, Layer2 sector fell 2.22%

-

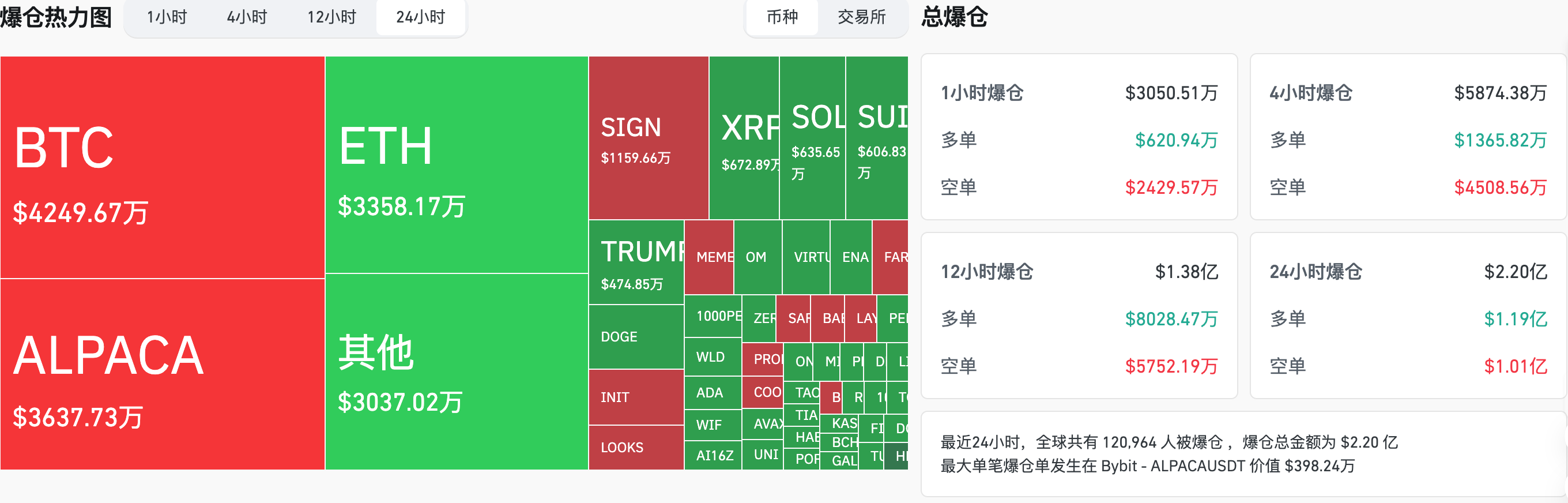

24-hour liquidation data: 120,964 people worldwide were liquidated, with a total liquidation amount of US$220,000, and its BTC liquidation was US$42.49 million, ETH liquidation was US$33.58 million, and ALPACA liquidation was US$36.37 million.

-

BTC medium- and long-term trend channel: upper line ($92403.85), lower line ($90574.07)

-

ETH medium and long-term trend channel: upper line ($1761.90), lower line ($1727.01)

*Note: When the price is higher than the upper and lower edges, it is a medium- and long-term bullish trend, and vice versa is a bearish trend. When the price passes through the cost range repeatedly in the range or in the short term, it is a bottom or top state.

3.ETF flow direction (as of April 29)

-

Bitcoin ETF: US$170 million (continued inflows on 8 days)

-

Ethereum ETF: US$18.4008 million (continued inflows for 4 days)

4. Looking forward today

-

Optimism (OP) will unlock approximately 31.34 million tokens at 8 a.m. on April 30, a ratio of 1.89% to the current circulation, worth approximately US$25.7 million;

-

Renzo (REZ) will unlock approximately 527 million tokens at 7 p.m. on April 30, a ratio of 19.57% to the current circulation, worth approximately US$7.4 million;

-

Kamino (KMNO) will unlock approximately 229 million tokens at 8 pm on April 30, with a ratio of 16.98% to the current circulation and a value of approximately US$14.5 million;

-

Gunz (GUN) will unlock approximately 83.33 million tokens at 10 pm on April 30, a ratio of 13.79% to the current circulation, and is worth about $5 million.

-

Sui (SUI) will unlock approximately 74 million tokens at 8 a.m. on May 1, with a ratio of 2.28% to the current circulation, and a value of approximately US$267 million;

-

ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8 a.m. on May 1, a ratio of 5.67% to the current circulation, worth approximately US$11.3 million;

-

dydx (DYDX) will unlock approximately 8.33 million tokens at 8 a.m. on May 1, with a ratio of 1.09% to the current circulation and a value of approximately US$5.4 million;

The United States will release its first-quarter GDP data on April 30

The number of people who requested initial unemployment benefits in the United States to April 26 (10,000) (May 1 20:30)

- Actual: To be announced/Previous value: 22.2/Expected: 22.5

The U.S. unemployment rate in April (May 2 20:30)

- Actual: To be announced/Previous value: 4.2% / Expected: 4.2%

The non-farm employment population in the United States after the seasonal adjustment in April (10,000) (May 2 20:30)

- Actual: To be announced/Previous value: 22.8/Expected: 13.5

The biggest increase in the top 500 market value today: ALPACA rose 250.49%, HOUSE rose 79.09%, CTK rose 37.16%, SIGN rose 34.26%, and PUNDIX rose 31.88%.

5. Hot News

-

Standard Crypto partner transferred 2000 MKR and 20000 AAVE to Coinbase 1 hour ago

-

Coinbase executive: Gold appreciation could lead to US Treasury buying Bitcoin earlier than expected

-

Cardone Capital sets up a real estate fund with 10 assets to acquire more than 1,000 Bitcoins

-

El Salvador says it will still buy bitcoin after the IMF agrees

-

Tether adds 2 billion USDT to the Ethereum network in the early morning

-

Bitcoin exchange supply drops to its lowest level in seven years