2024 Encrypted Crime Yearbook: Fraudulent behaviors emerge, and the scale of black and gray industry transactions remains unabated

Reprinted from panewslab

04/30/2025·1M2024 is a milestone year for the Web3 industry. Crypto's market capitalization scale and industry infrastructure adoption have reached unprecedented levels, and the crime industry is also beginning to use Crypto infrastructure to optimize its businesses or create new crime paradigms. This report calls on the industry and government to pay attention to the harm caused by crypto crime by statistics and disclosure of the scale of major crypto crimes and clarify the impact of compliance facilities on the scale of the crime industry.

Due to space, this article only displays some of the conclusions and data of the report. Welcome to the official website of Bitrace to download the full version.

Cryptocurrency crime remains severe

High-risk address charges stablecoins

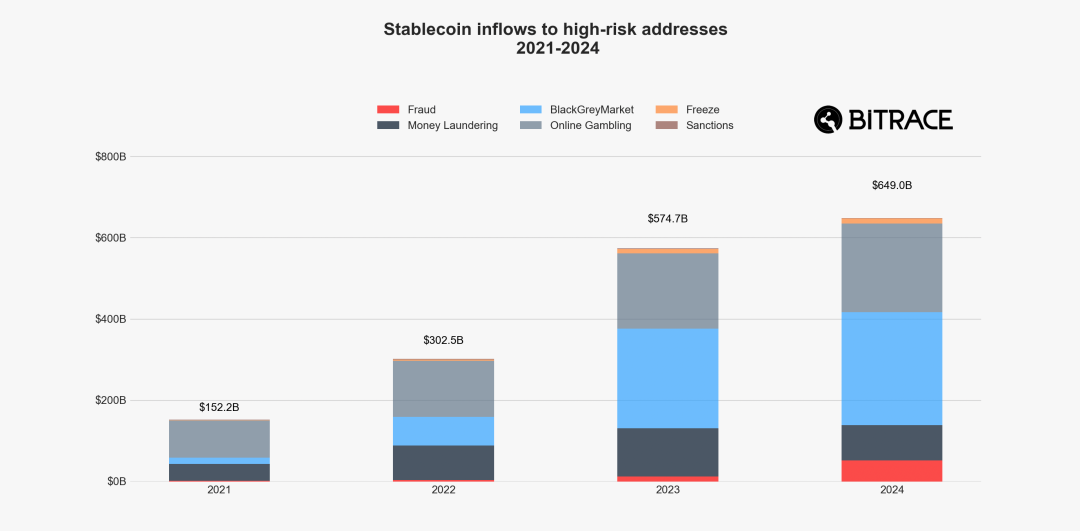

Considering that risk activities mainly occur in Ethereum and Tron networks, Bitrace defines the blockchain address of illegal entities in these two networks for receiving, transmitting and storing stablecoins (erc20_usdt, erc20_usdc, trc20_usdt, trc20_usdc) as high-risk addresses. In the past 2024, the total collection scale of such high-risk addresses reached US$649 billion, slightly higher than last year.

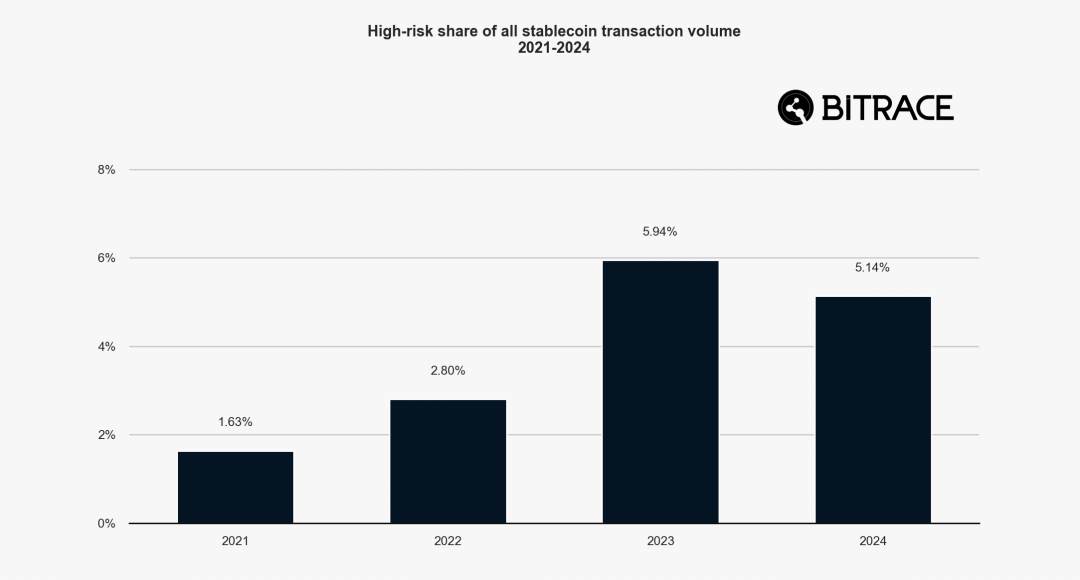

High-risk activities account for the total transaction size of stablecoins

Calculated by transaction volume, this part of high-risk activities accounted for 5.14% of the total stablecoin trading activities that year, a decrease of 0.80% compared with 2023, but is still significantly higher than in 2021 and 2022.

High-risk address charging stablecoin classification

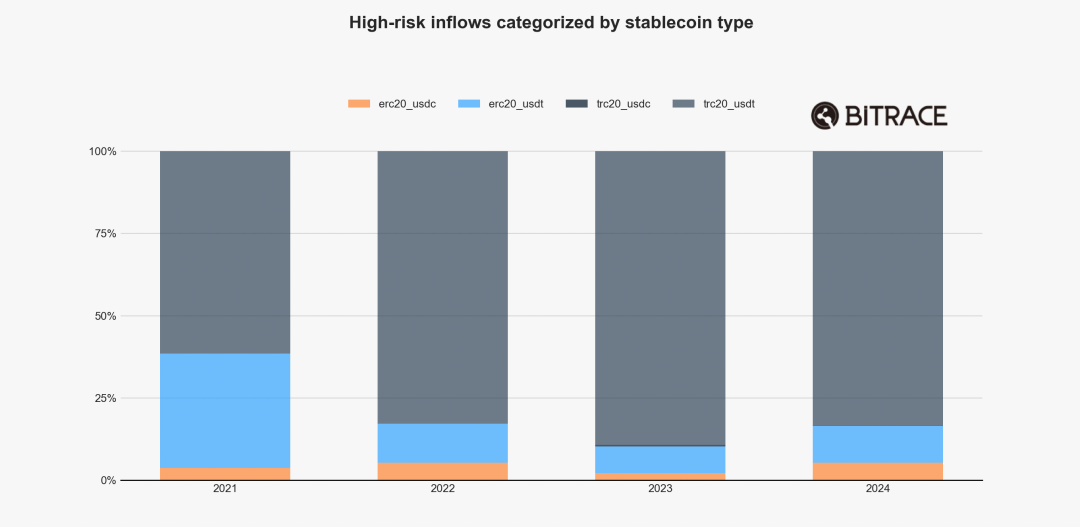

Calculated according to the stablecoin type, USDT in Tron networks accounted for the most important share in 2021-2024. However, in 2024, the shares of USDT and USDC in the Ethereum network have increased.

Online gambling continues to grow

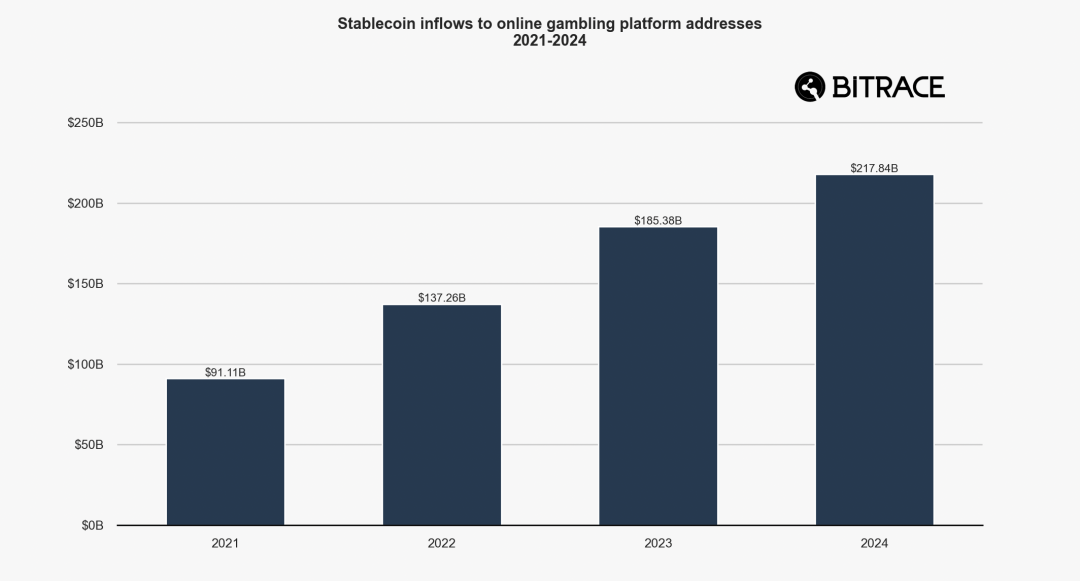

The number of stablecoins collected by online gambling platforms

In 2024, the funding scale of online gambling platforms and payment platforms that provide deposit and withdrawal services reached US$217.8 billion, an increase of more than 17.50% compared with the scale in 2023.

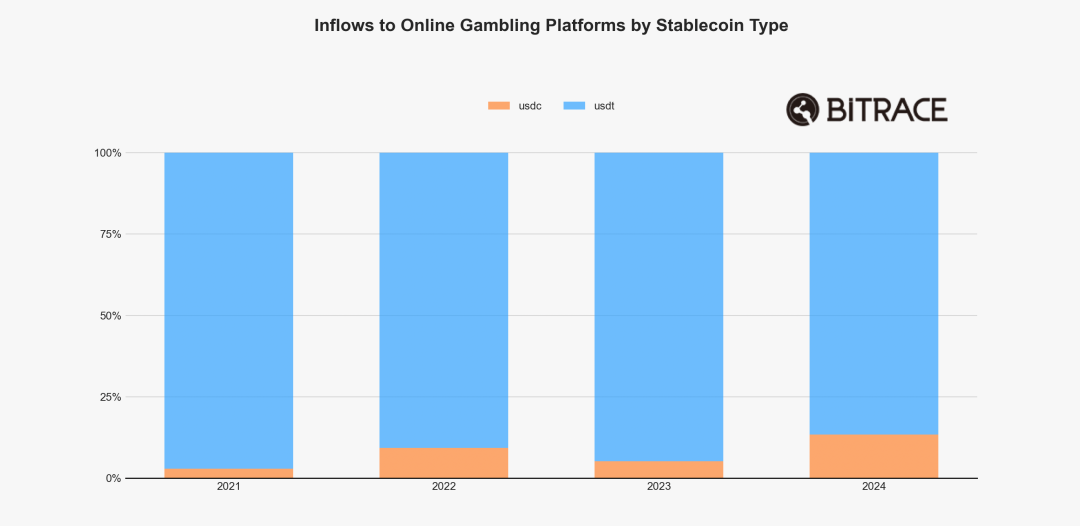

Online gambling platforms collect stablecoins classification

According to statistics on the stablecoin types used by online gambling platforms, the share of USDC increased significantly in 2024, reaching 13.36%, far higher than 5.22% in 2023. This shows that as USDC's market share increases, its adoption in the field of online gambling has also increased significantly, although it is issued and regulated by compliant entities.

The scale of black and gray industry transactions remains unabated

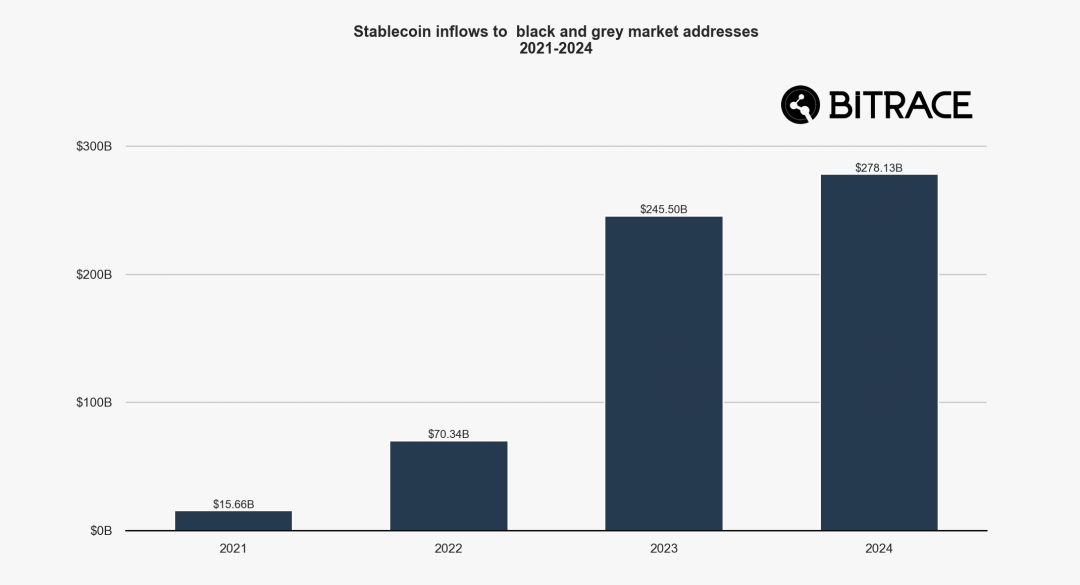

The number of stable coins collected by black and gray industry trading address

In 2024, business addresses related to black and gray transactions collected more than US$278.1 billion in Ethereum and Tron networks, slightly higher than in 2023, and the transaction scale in the past two years far exceeded 2021 and 2022.

Inseparable from the development of the black and gray industry is the cryptocurrency guarantee trading platform. Such institutions can provide guarantee services for almost all links upstream and downstream of the black and gray industry and build trust among criminals.

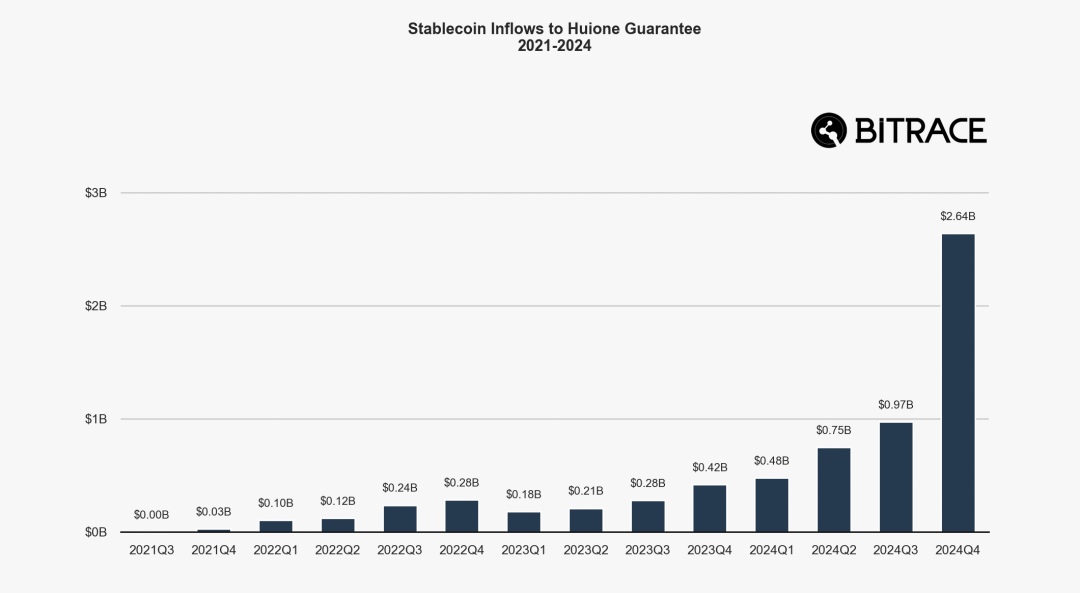

Haowang guarantees the amount of stablecoins collected

Haowang Guarantee and its competitors in Southeast Asia are emerging with the gradual popularity of stablecoins in real local economic activities, a trend that was particularly evident in 2024, with its business scale expanding to US$2.64 billion in the fourth quarter of that year.

The scale of encryption fraud has increased dramatically

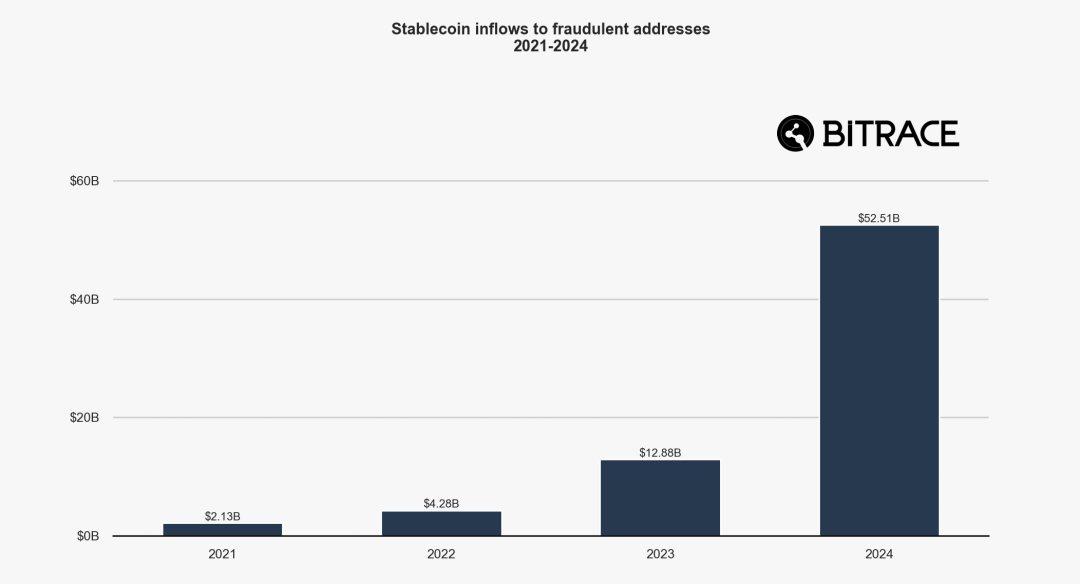

The number of stablecoins charged by fraudulent addresses

In 2024, the scale of stablecoin collections has seen an explosive growth in the blockchain address associated with fraudulent activities. Compared with 2021-2023, the scale of funds that year has reached US$52.5 billion, exceeding the total of previous years.

But this amazing growth trend may not be completely accurate, because the statistics are limited by the statistical methods of security vendors and the improvement in the level of fraud in illegal entities. For example, with the support of security manufacturers for many new public chains, more criminal incidents will be observed, which means that events that have occurred in the past may not be included in the statistics; cases that occur in centralized institutions and have not been disclosed by the victims cannot be included in the statistics.

With the improvement of statistical methods and the increase in case disclosure, this batch of data will further grow in the investigation report in the next year.

Money laundering begins to shrink

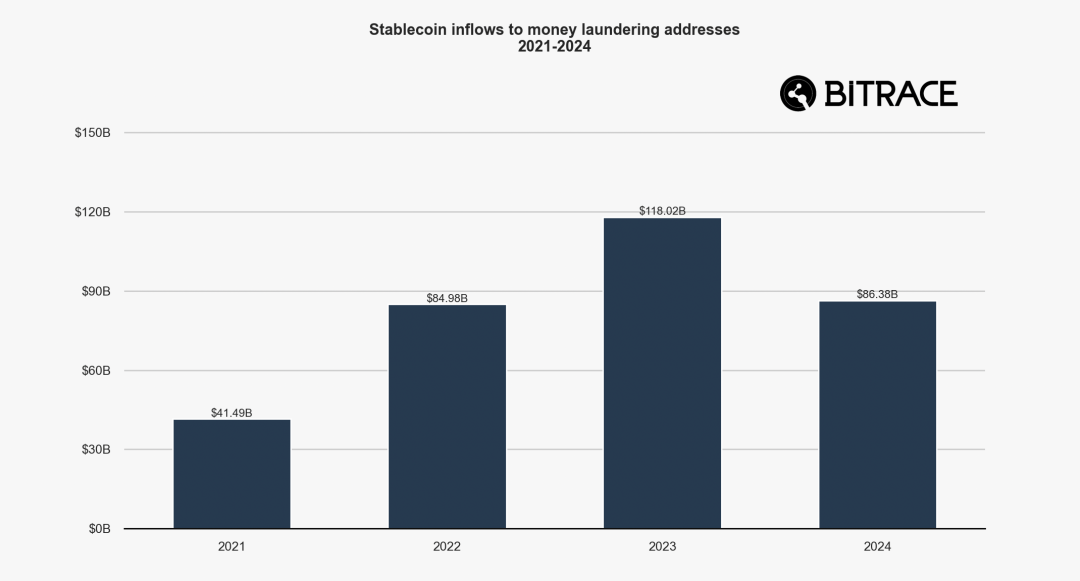

Money laundering address charges the number of stable coins

Blockchain addresses related to money laundering activities in 2024 received a total of US$86.3 billion worth of stablecoins, slightly lower than in 2023 and the same as in 2022. This figure may indicate that major law enforcement activities that have occurred in the past two years and regulatory legislative activities of major policy entities have effectively suppressed the crime of money laundering in the crypto industry.

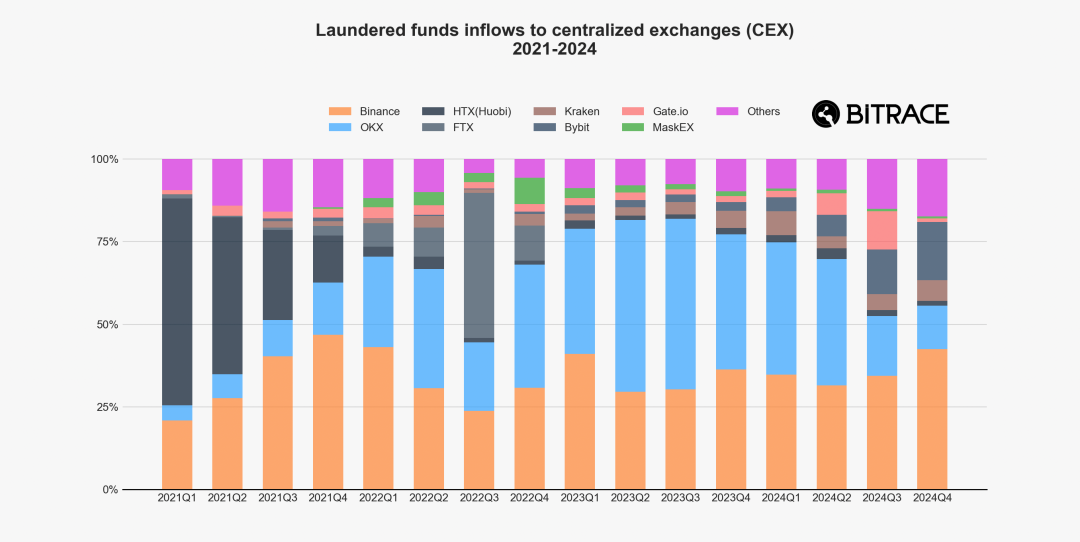

The proportion of the scale of money laundering stablecoins collected by major centralized trading platforms

Considering that centralized exchanges have unique advantages over other entities in terms of capital monetization and are more susceptible to money laundering gangs, Bitrace conducted a fund audit of the hot wallet addresses of major centralized cryptocurrency trading platforms.

The results are similar to the investigation in the fraud chapter. The scale of money laundering funds received by the platform is generally proportional to the scale of its business, but OKX's share in recent quarters has dropped significantly, which may be the result of its compliant operations.

Freeze activity on stablecoin chain increases significantly

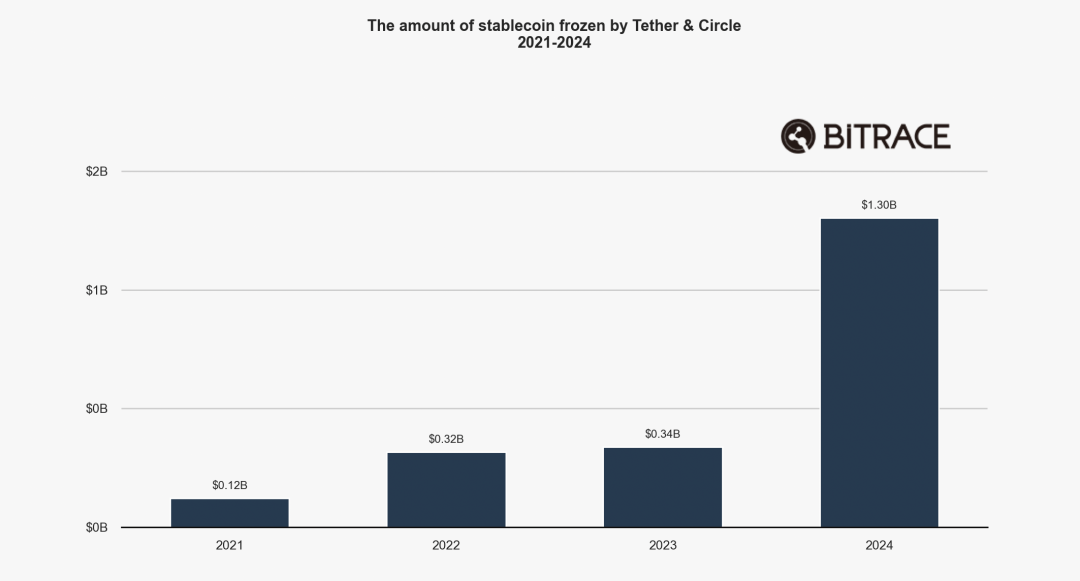

The number of stablecoins frozen by Tether and Circle

2024 is a year when stablecoin issuers actively cooperate with law enforcement. Tether and Circle have frozen stablecoins worth more than US$1.3 billion in Ethereum and Tron networks, twice the scale of the previous three years.

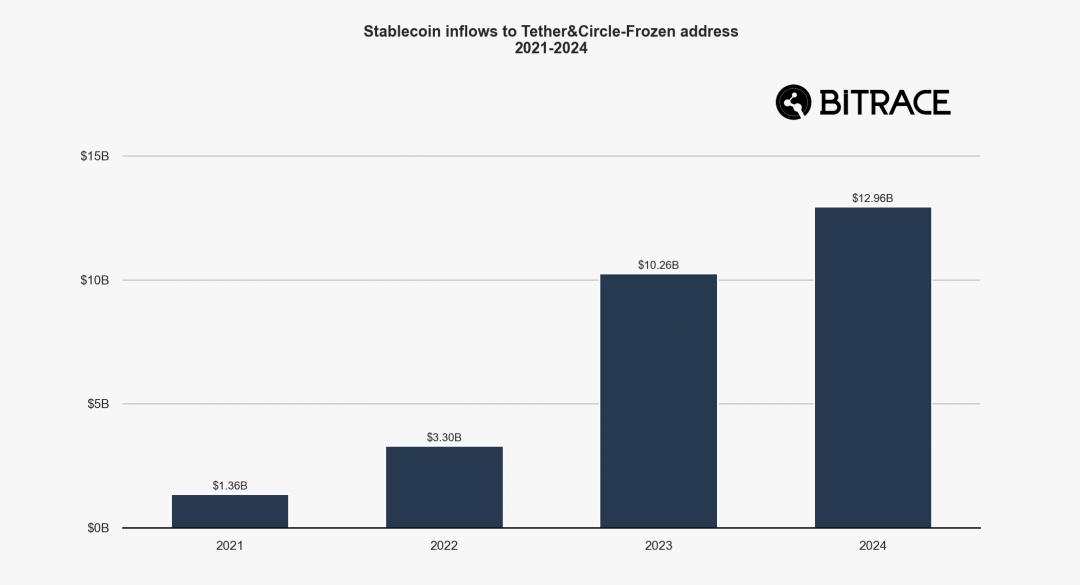

Freeze address to collect stable coins in that year

According to statistics on the funds transfer activities of frozen addresses in that year, the transaction size in 2024 reached US$12.9 billion, and is basically the same as in 2023, indicating that on-chain crypto crime activities had already begun to be active several years ago, but they did not start to be effectively hit until 2024.

*It is worth stressing that not all the drivers of frozen addresses are cases involved. Bitrace did not exclude this part in this statistics, so the actual scale will be slightly smaller.

OFAC and NBCTF sanctions trends

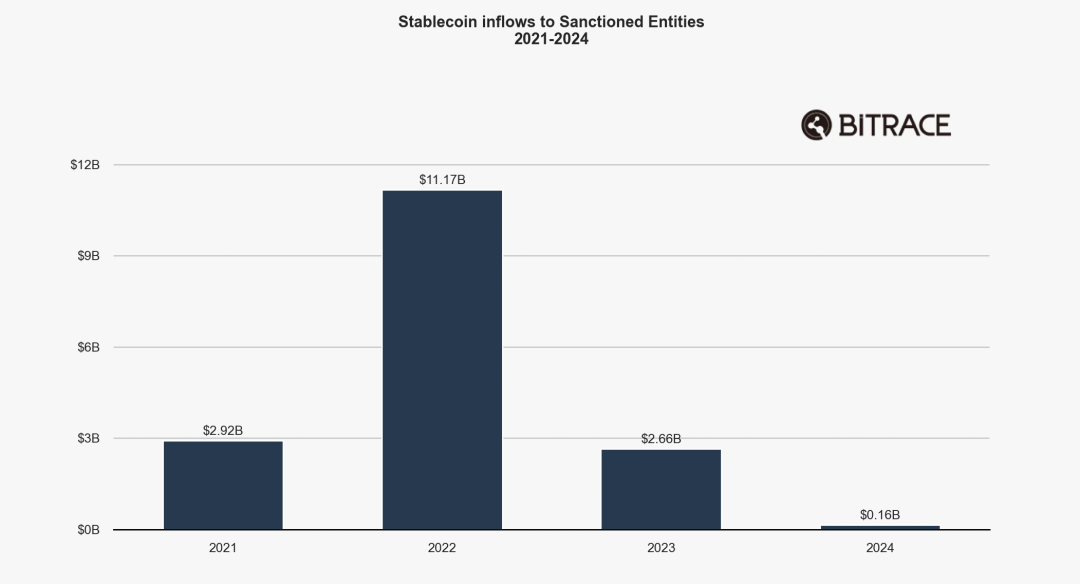

OFAC collects stablecoins at the address associated with NBCTF sanctions entity

The Office of Foreign Assets Control (OFAC) under the U.S. Treasury Department and the National Counter-Terrorism Financing Agency (NBCTF) are two agencies related to sanctions and counter-terrorist financing. They have more cooperation in combating terrorist financing and financial networks related to terrorist organizations (such as Hamas). They conduct funding statistics on the blockchain addresses disclosed by these two organizations related to sanctioned entities. The overall funding scale reached its highest in 2022 and has declined year by year since then.

Although government regulatory measures can have a huge impact on the business of sanctioned entities, it will be of little effect for criminal groups that use these infrastructures to conduct illegal activities, because the anonymity and unnecessary nature of encryption technology determine that such entities are difficult to be sanctioned and highly replaceable. Regulatory departments should conduct more in-depth investigations into crypto crimes and take corresponding law enforcement actions against criminal gangs.

Regulation has a positive impact on Hong Kong

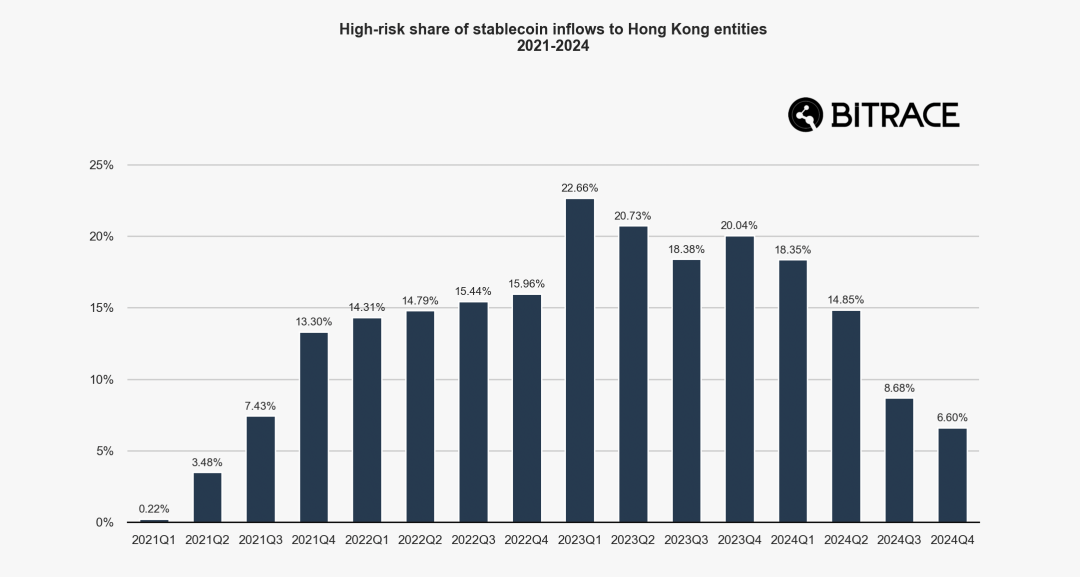

2024 is the year when the crypto industry accelerates compliance. From a global perspective, the attitude of major regulators towards cryptocurrencies has shifted from waiting and watching to more active intervention, pushing the industry toward a more standardized and transparent direction. Take Hong Kong as an example—

Hong Kong's compliance policy has built a safer and more controllable crypto ecosystem through clear legal requirements, customer fund protection, combating illegal activities, attracting institutional funds and integrating with international standards. This not only reduces direct fund losses caused by hacker attacks, platform bankruptcy or legal penalties, but also reduces indirect risks by enhancing market trust and stability. For crypto entities, although compliance costs increase in the short term, they significantly reduce the possibility of funds being exposed to uncontrollable risks in the long term.

The proportion of high-risk funds in Hong Kong\'s Web3 entity stablecoin revenue

Funding analysis was conducted on VATP and VAOTC addresses that mainly serve Hong Kong customers. The data showed that the proportion of risk stablecoins flowing into the local area decreased sharply after the third quarter of 2023, which shows that local stablecoin trading activities related to risk activities have been effectively suppressed after the release of compliance policies and several landmark currency-related cases.

Summarize

2024 is a year of comprehensive revival of the industry and an important year for major economies to begin to face up to the industry. Although the scale of crypto crime has not diminished, top-down compliance regulatory policies and bottom-up industry self-discipline have already had a positive impact on the crypto industry in some countries or regions.

The industry will usher in a safer and more trustworthy future, which we think is self-evident.

jinse

jinse