Trading moment: Tariff policy is about to be announced, and analysis says Bitcoin $110,000 may be the starting point

Reprinted from panewslab

04/02/2025·1M

1. Market Observation

Keywords: ACT, ETH, BTC

ACT crashed on Binance yesterday, and the coin price was almost halved. Wintermute, as the market maker of ACT, also withdraws multiple ACT tokens from Binance after the plunge and sells them on the chain. Market fluctuations are not individual cases, and many tokens such as DF, LEVER, MUSK, and GUN also saw a decline of 20%-50%.

Bitcoin has been fluctuating for several days. Fidelity Digital Assets analyst Zack Wainwright pointed out that although Bitcoin is still in an acceleration stage, the cycle is coming to an end. He expects that if the cycle reaches a new high, it may start at a benchmark price around $110,000. BitMEX co-founder Arthur Hayes is more optimistic, believing that if the Federal Reserve policy shifts from quantitative tightening to quantitative easing of Treasury bonds, Bitcoin is expected to bottom out from $76,500 it hit last month, then rise to $110,000, and then gradually climb to the target price of $250,000 at the end of the year.

Institutional investment attitudes are also differentiating. Although the market faces many uncertainties, institutions such as Strategy, Metaplanet, and MARA are still continuing to increase their holdings of Bitcoin. GameStop also plans to issue US$1.5 billion convertible bonds to purchase Bitcoin. However, BlackRock CEO Larry Fink is cautious about Bitcoin, warning it may damage the international status of the US dollar, but also recognizes the advantages brought by tokenization. In terms of regulation, the three major EU regulators, ESMA, etc., recently released a joint report, pointing out that the US's increasingly friendly crypto policies are deepening the linkage between crypto assets and traditional financial markets, which may increase systemic risks.

At the macroeconomic level, Trump will announce a new global trade tariff policy at 4 a.m. on April 3, and is expected to impose a comprehensive tariff of 20% on all trading partners. Major financial institutions responded to this policy in a mixed response. Former Bank of America's economic research director believes that this may be just the beginning of a trade war, Pepperstone research director warned that tariffs could exacerbate the risk of stagflation in the United States, while Wells Fargo economists note that tariff expectations have pushed up the manufacturing price index, and continued uncertainty is suppressing market demand. Changes in these macroeconomic factors are expected to continue to affect the trend of the cryptocurrency market, and market participants need to pay close attention to policy development and their ripple effects.

2. Key data (as of 13:30 HKT on April 2)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

-

Bitcoin: $84,119.27 (-10.17%), daily spot trading volume $25.592 billion

-

Ethereum: $1,857.62 (-44.17%), daily spot trading volume is $16.19 billion

-

Corruption index: 44 (neutral)

-

Average GAS: BTC 1 sat/vB, ETH 0.43 Gwei

-

Market share: BTC 61.8%, ETH 8.3%

-

Upbit 24-hour trading volume ranking: XRP, COMP, BTC, MASK, MEW

-

24-hour BTC long-short ratio: 0.9223

-

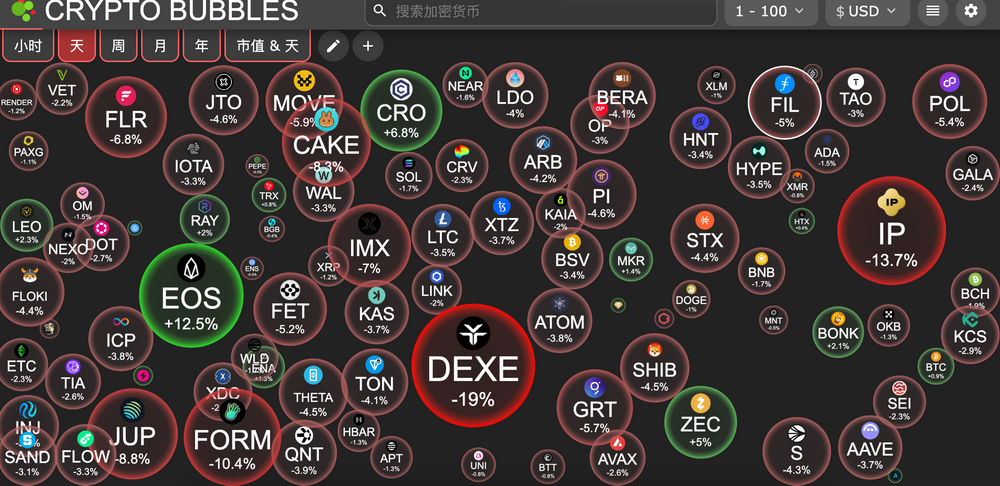

The sector rises and falls: The crypto market generally fell, with the AI Meme sector falling 7.2% and the SocialFi sector falling 4.5%

-

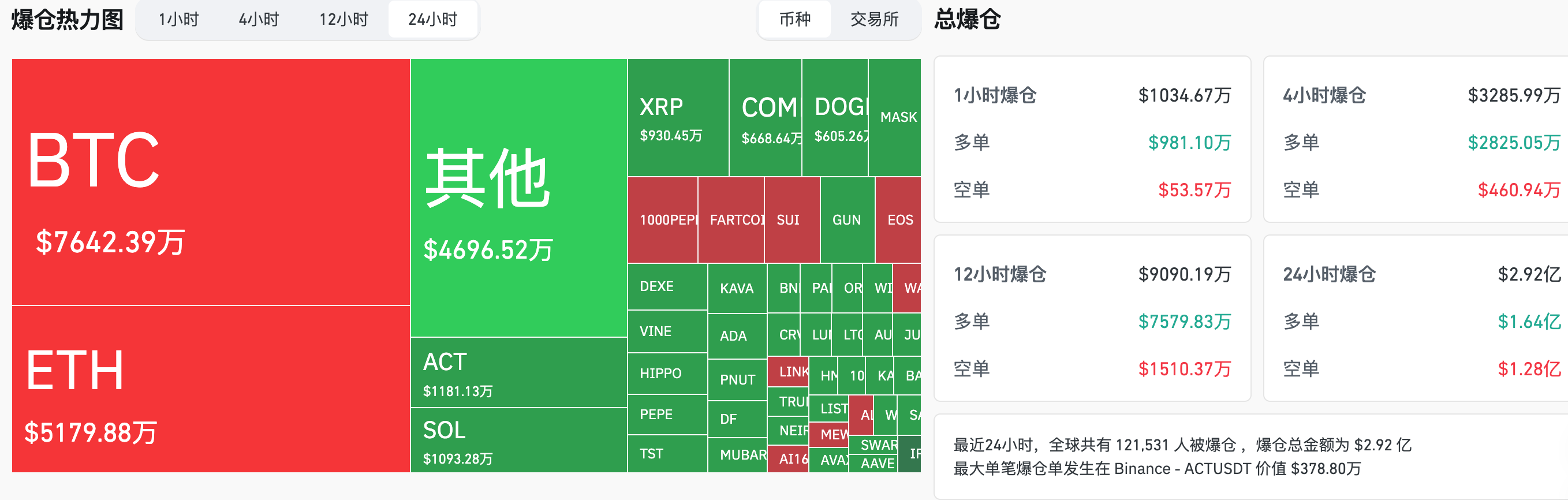

24-hour liquidation data: 121,531 people worldwide were liquidated, with a total liquidation amount of US$292 million, and its BTC liquidation was US$76.42 million and ETH liquidation was US$51.79 million.

-

BTC medium- and long-term trend channel: upper route ($85,497.74), lower route ($83,804.72)

-

ETH medium- and long-term trend channel: upper channel ($1,951.99), lower channel ($1,913.34)

*Note: When the price is higher than the upper and lower edges, it is a medium- and long-term bullish trend, and vice versa is a bearish trend. When the price passes through the cost range repeatedly in the range or in the short term, it is a bottom or top state.

3.ETF flow direction (EST as of April 1)

-

Bitcoin ETF: -$157 million

-

Ethereum ETF: -$3.58 million

4. Looking forward today

-

The U.S. House Financial Services Committee is expected to review draft stablecoin legislation today

-

Ethena (ENA) unlocks 95.31 million tokens worth approximately US$33.5 million

-

Jupiter (JUP) unlocks 53.47 million tokens worth approximately US$25.4 million

-

Trump will announce reciprocal tariffs and industry-specific tariffs at 4 a.m. on April 3

The number of people who requested initial unemployment benefits in the United States to March 29 (10,000) (20:30 on April 3)

- Actual: Not announced/Previous value: 22.4 / Expected: 22.5

The biggest gains in the top 500 market cap today: Alchemist AI (ALCH) rose 23.74%, WhiteRock (WHITE) rose 23.72%, Cat in a Dog's World (MEW) rose 15.28%, EOS (EOS) rose 11.87%, and 0x0.ai (0x0) rose 10.79%.

5. Hot News

-

GameStop raises $1.5 billion convertible bonds to buy Bitcoin

-

Tether announced Bitcoin address, holdings of over 90,000 BTC worth US$7.7 billion

-

Metaplanet purchased 696 BTC, and its total holding increased to 4046

-

EOS breaks through US$0.8, with an increase of more than 31% in 24 hours

-

Metaplanet announced an increase in holdings of 160 Bitcoins, with a total holding of 4,206

-

US think tanks propose to issue "BitBonds" to support Trump's Bitcoin reserve plan

-

PumpBTC releases PUMP token model, 9% is used for initial application

-

Binance announces KernelDAO (KERNEL) as the fourth Megadrop project

-

Backpack completes the acquisition of FTX EU and starts the user funds return process today