Fidelity: Has Bitcoin reached the peak of this cycle?

Reprinted from panewslab

04/02/2025·1MAuthor: Zack Wainwright, Fidelity analyst (original text first published on March 19)

Compiled by: Felix, PANews

As the current market cycle advances, investors are closely watching potential signs of Bitcoin’s rise after the U.S. election.

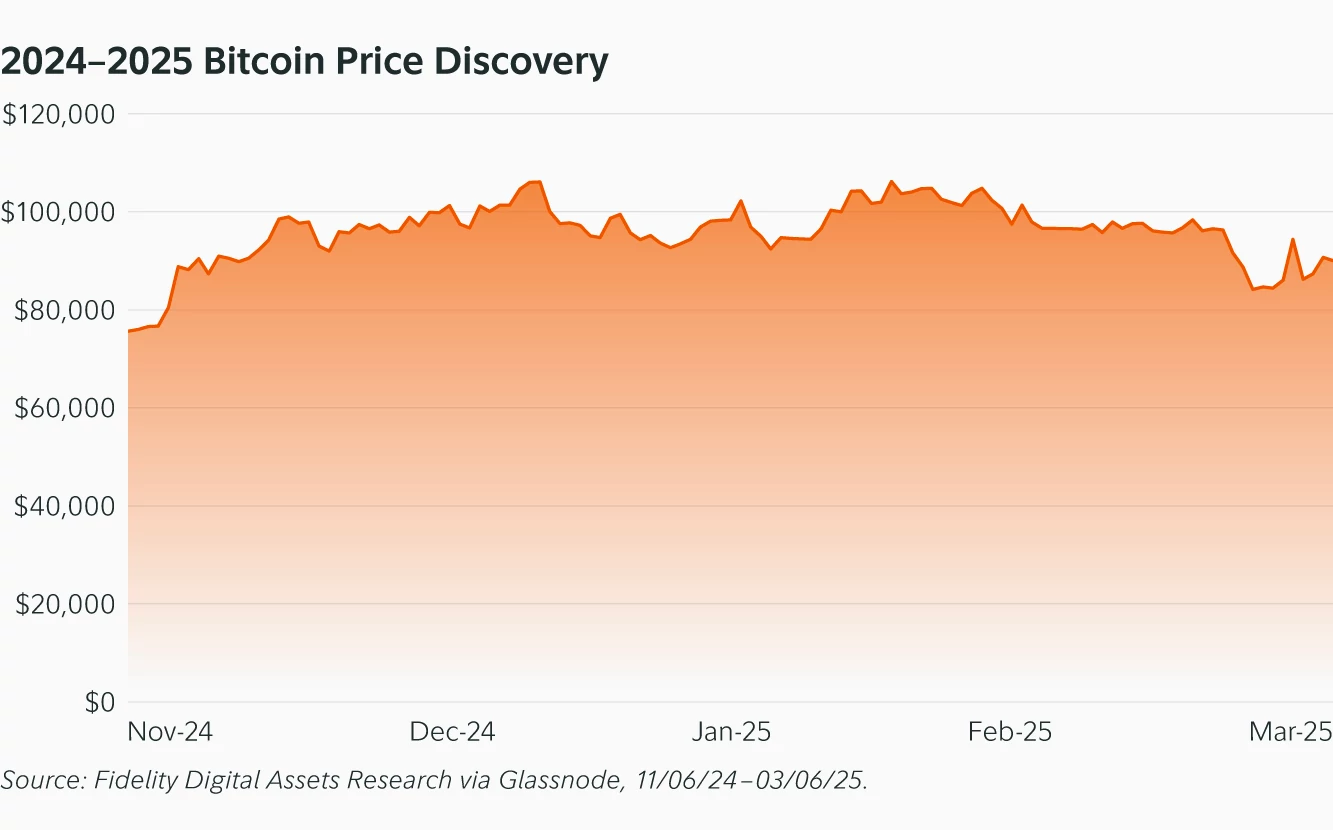

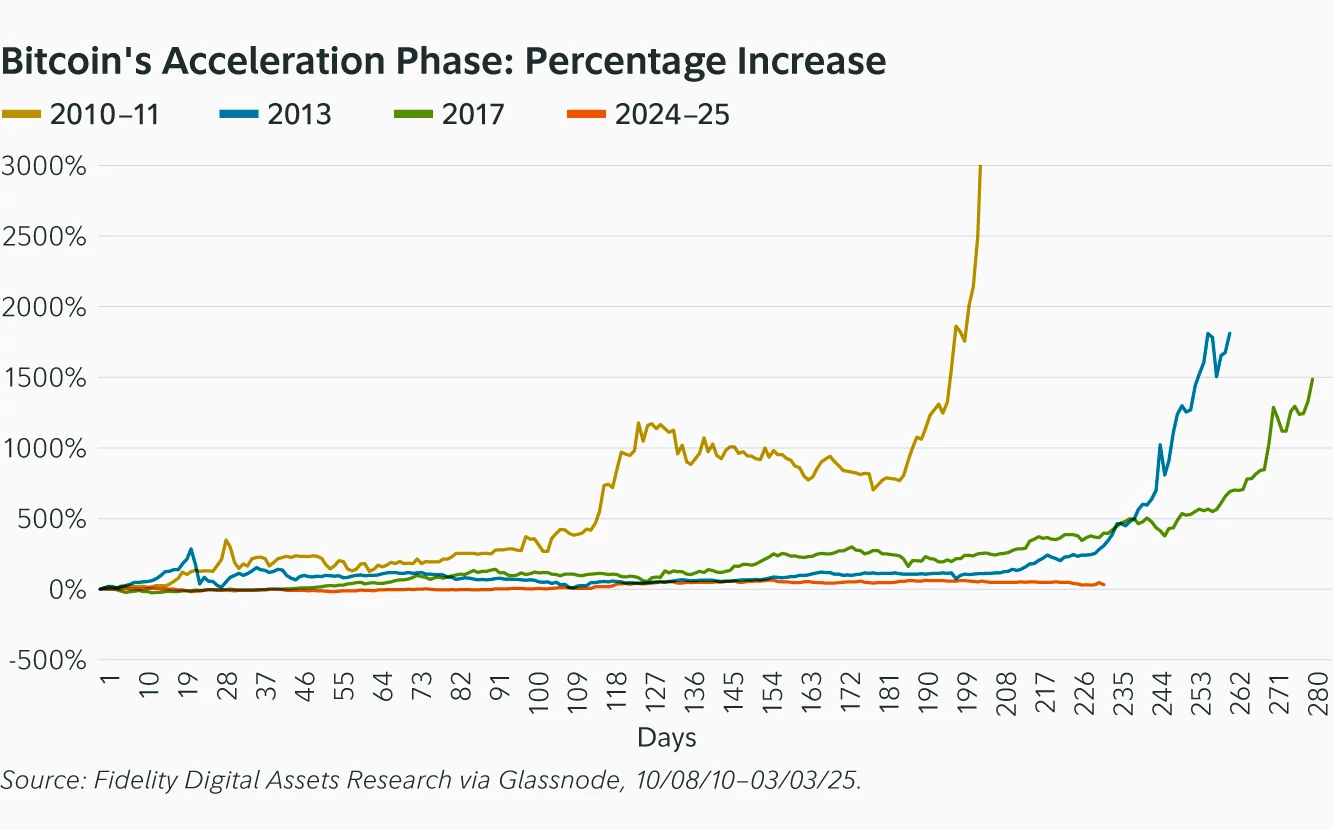

In November 2024, according to Glassnode's closing price, Bitcoin broke through the previous all-time high set in March 2024, entering the real price discovery phase for the first time since it broke through $20,000 in December 2020. Historically, this shift has occurred in previous acceleration phases, a period characterized by high volatility and high profits in the Bitcoin price cycle.

The key question now is: Has Bitcoin reached the top of this cycle, or is there still room for further upside?

Bitcoin rebound and historic rise after election

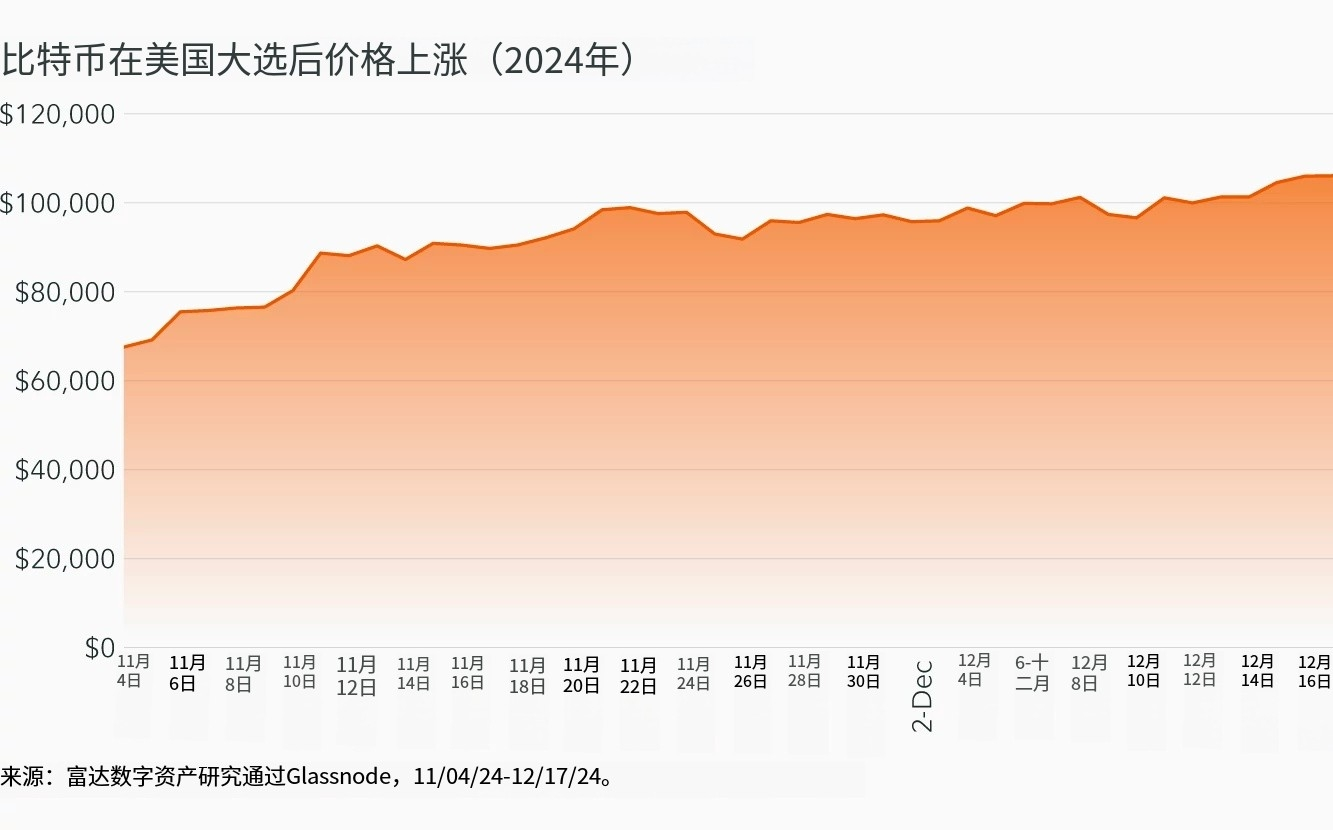

Bitcoin rose 56% in its November 2024 rebound, entering a price discovery period, reminiscing of the rise in the past acceleration phase, as shown in the chart “Bitcoin Rises After the U.S. General Election (2024)”.

Historically, Bitcoin broke through $30 for the first time in 2013, and its price surged to an all-time high of $229 before starting to cool down. Bitcoin also broke through $1,100 in 2017, entering a price discovery period, with the asset rising to nearly $3,000 before cooling down.

Both breakthroughs highlight the volatility and profit patterns that usually occur during the acceleration phase. After each rise, there is a sideways trend. In 2013 and 2017, sideways finally broke out for a second increase.

Although the current cycle trajectory has not yet fully unfolded, these historical similarities suggest that a similar uptrend is likely to occur.

Volatility levels continue to rise

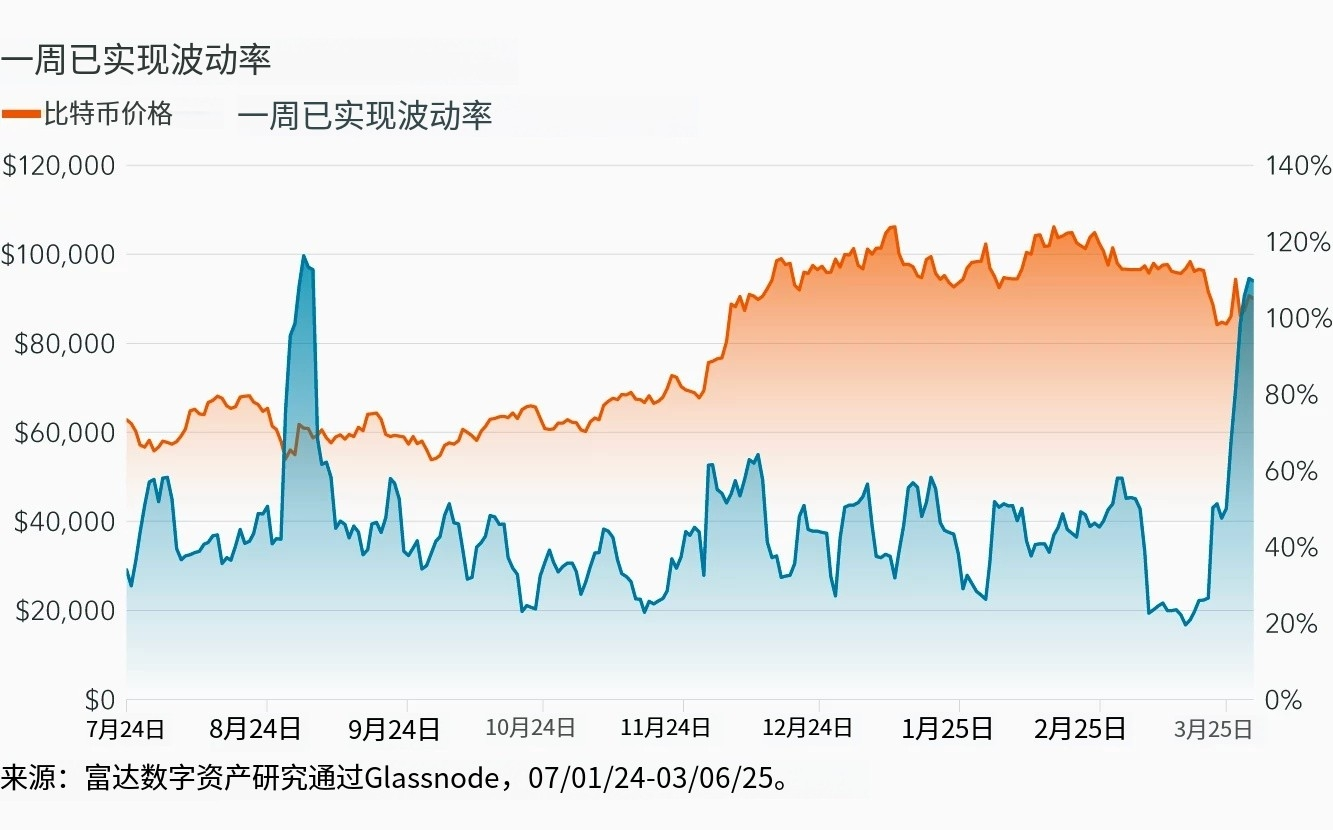

From a weekly perspective, Bitcoin’s real volatility has risen rapidly, which may indicate that sideways in the past few months may be about to end. This is consistent with the behavior observed in the acceleration phase. Historically, the actual volatility in the acceleration phase has been rising for a year. From the acceleration phase on July 15, 2024 to March 6, 2025, the real volatility in one year increased from 45% to 51%.

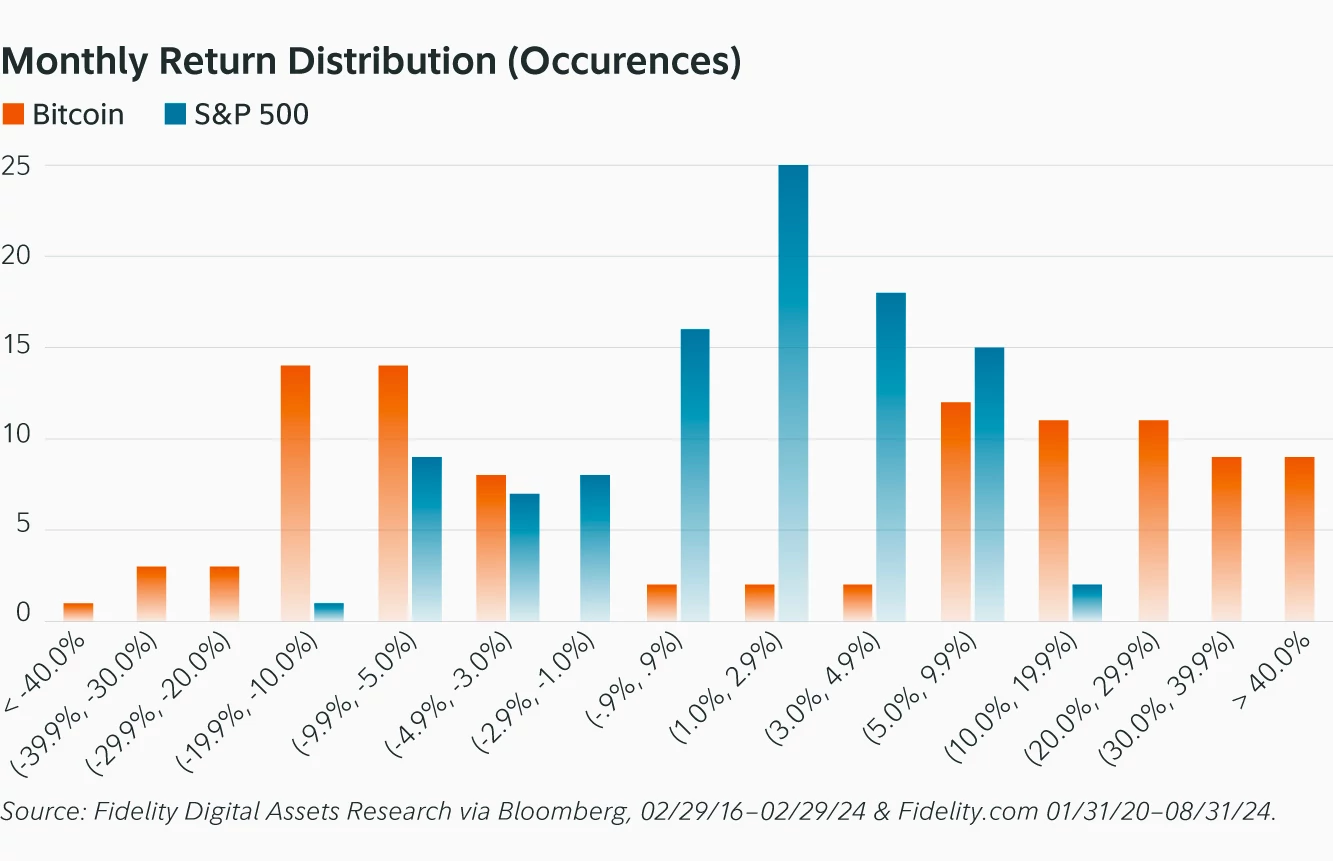

In addition, Bitcoin's volatility has historically tended to rise. Judging from the monthly returns, with the S&P 500 as a reference point, Bitcoin has seen higher levels in both directions, but it has risen more frequently and has a greater amplitude.

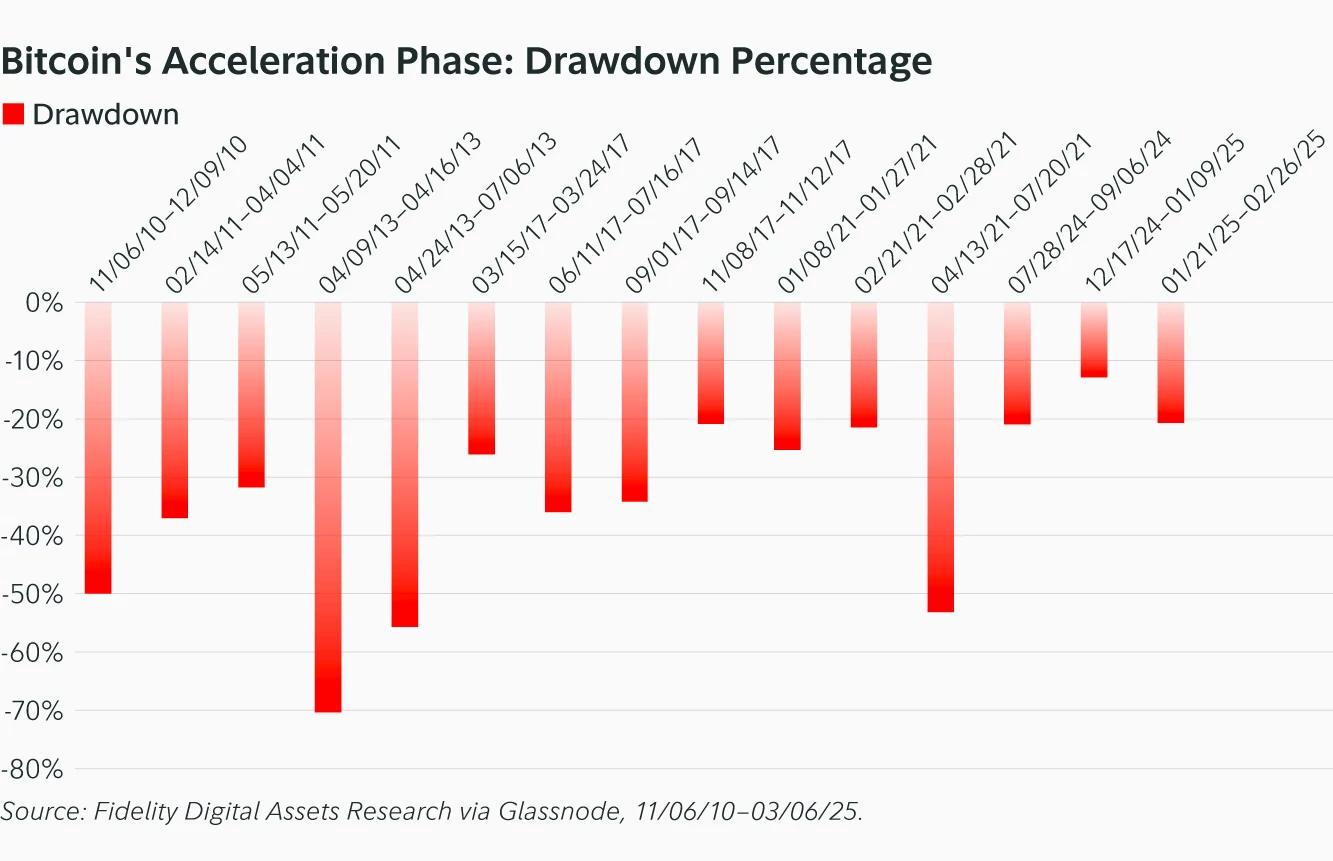

Nevertheless, the pullback is a "necessary" event in the acceleration phase -which can be challenging for investors. However, Bitcoin has experienced a relatively average drawdown recently compared to previous cycles. This suggests that as Bitcoin matures, volatility may weaken in both directions.

Is it approaching the end of this cycle?

Although the future remains uncertain, historical experience shows that as the acceleration phase extends, the possibility of explosive peaks increases. As of March 3, Bitcoin has entered the 232nd day of the latest acceleration phase, approaching the peak of the previous phase and a sudden reversal. The acceleration phases in 2010-11, 2013 and 2017 peaked on days 244, 261 and 280, respectively, indicating a slight extension of the acceleration phase for each cycle.

This does not necessarily mean that the current phase will end within this specific time frame. However, history shows that Bitcoin’s acceleration phase may end with a sharp, dramatic rebound (similar to the finale of a fireworks show) before quickly losing momentum and entering a reversal phase.

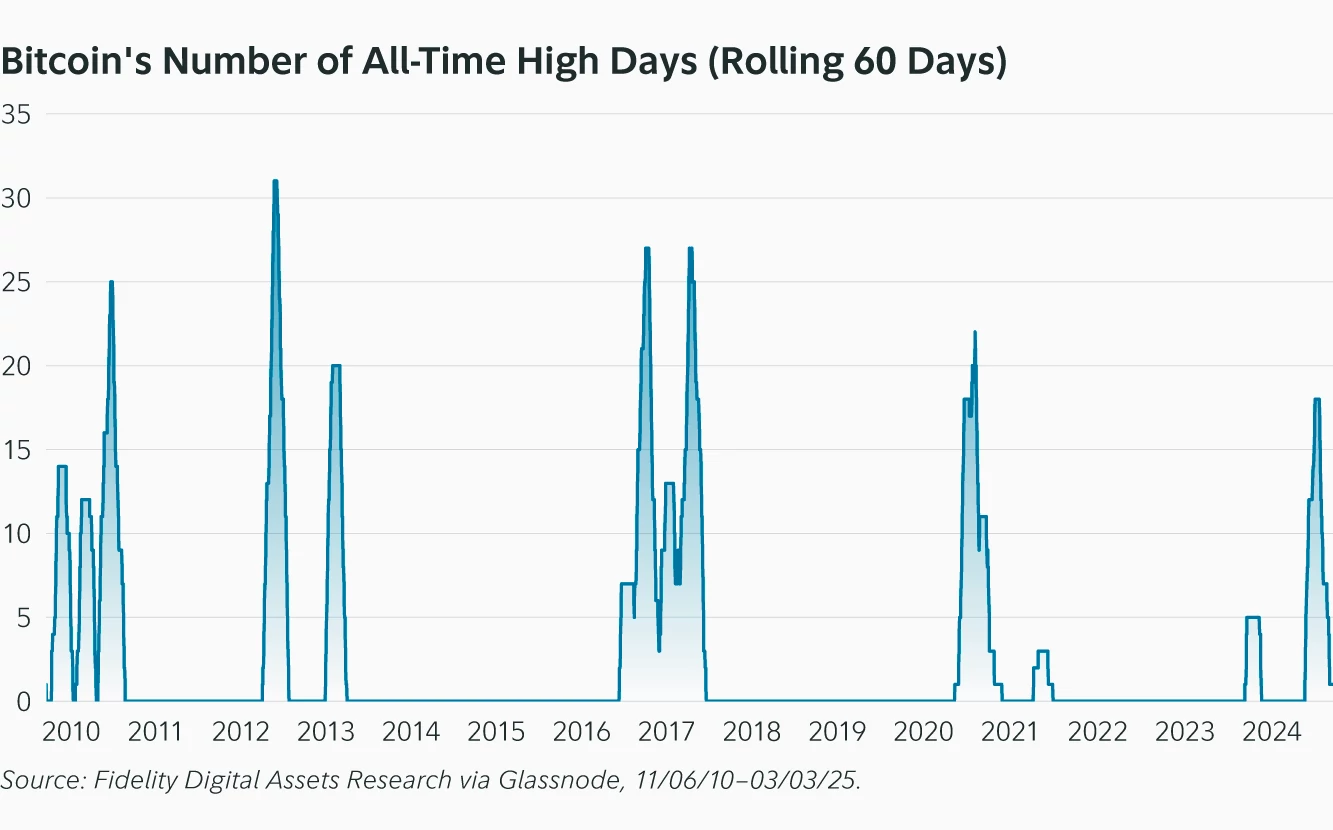

A key metric to focus on in the acceleration phase is the number of days that Bitcoin has reached an all-time high for 60 consecutive days. During the previous acceleration phase, Bitcoin usually experiences two big gains, the first time after the general election. If it is about to hit an all-time high, its starting price will be close to $110,000.

It is worth noting that the only time the second rebound failed to achieve was in November 2021. While continuing to monitor the current cycle, it is important to observe whether Bitcoin follows its historical pattern or begins to show signs of differentiation.

Related Readings: BTC is approaching 80,000 US dollars, where is the bottom?

chaincatcher

chaincatcher