Trading moment: Bitcoin has a supply gap in the range of 70,000 to 80,000 yuan, and FOMC interest rate resolution has become the focus of the market

Reprinted from panewslab

03/18/2025·3M

1. Market Observation

Keywords: FOMC, ETH, BTC

Yesterday YZi Labs announced its investment in Plume Network, driving the RWA sector to rebound. QCP Capital's latest analysis shows that despite the constant market noise, Bitcoin remains stable above $80,000, showing strong resilience. Standard Chartered Bank even said that if Trump's "crypto reserve" plan is successfully implemented in 2025, combined with the halving effect of Bitcoin supply, it may push the price of Bitcoin to soar to $500,000.

CryptoQuant founder Ki Young Ju believes that the Bitcoin bull market cycle has ended and the price is expected to show a 6-12-month bearish or sideways trend. He pointed out that every on-chain indicator predicts the arrival of a bear market. LMAX Group strategist Joel Kruger is cautious about the market outlook, warning that global trade tensions and concerns about the slowdown in the U.S. economy may lead to continued adjustments in U.S. stocks, which will drag Bitcoin back to the $73,000-74,000 range. In contrast, David Duong, research director of Coinbase Institutional, is relatively optimistic, believing that the current market sell-off is mainly affected by macro factors and liquidity, and the situation is expected to improve in the next quarter. He specifically pointed out that as bank reserve levels approach the 10-11% range of GDP, the Fed may adjust its quantitative tightening (QT) plan to maintain financial stability, which will support asset prices.

From a technical perspective, Glassnode data shows that Bitcoin has a significant supply gap in the range of $70,000 to $80,000. The area has short trading hours, fewer positions, and weak support. At present, about 20% of the Bitcoin supply is in a loss-making state, with a holding cost higher than the current price of $83,000. If it falls below the $80,000 support level, $73,000 will become the key support level.

In the Ethereum market, Standard Chartered Bank recently significantly lowered its ETH price forecast at the end of 2025, adjusting from $10,000 to $4,000. This adjustment mainly takes into account factors such as the Layer 2 expansion plan weakening the ETH market value and the possibility of continuing to decline in the ETH/BTC ratio. It is worth noting that the Ethereum Foundation is actively listening to community feedback and exploring operational changes to adapt to market changes.

In terms of regulation and policy, QCP Capital said that the US CPI data was lower than expected last week, although it provided a temporary respite, the possibility of the Fed turning to dovish amid continued tariff risks and inflation concerns is still limited. The market generally expects the Fed to keep interest rates unchanged at the FOMC meeting on Wednesday, but market volatility may remain at a high level amid policy uncertainty.

Macquarie's latest report warned the overall market, pointing out that Trump's economic policies could trigger a sharp adjustment in the stock market. Unless trade policy turns to moderate and reduces spending, real U.S. consumer spending may slow significantly. Currently, the S&P 500 has fallen nearly 8% from its previous month's high, and the Nasdaq has pulled back nearly 12% from its peak in December last year. Against this backdrop, the market closely monitors the results of this week's Fed FOMC meeting, especially potential adjustments to the quantitative tightening plan, which could have a significant impact on the cryptocurrency market trends.

2. Key data (as of 13:30 HKT on March 18)

-

Bitcoin: $82,671.90 (-11.31% during the year), daily spot trading volume $24.471 billion

-

Ethereum: $1,894.96 (-42.82%), daily spot trading volume is $11.089 billion

-

Corruption Index: 34 (Fear)

-

Average GAS: BTC 2 sat/vB, ETH 0.4 Gwei

-

Market share: BTC 60.7%, ETH 8.5%

-

Upbit 24-hour trading volume ranking: XRP, UXLINK, AUCTION, BTC, CARV

-

24-hour BTC long-short ratio: 0.9681

-

Sector rises and falls: RWA sector rises 9%, BSC Ecology rises 2.68%

-

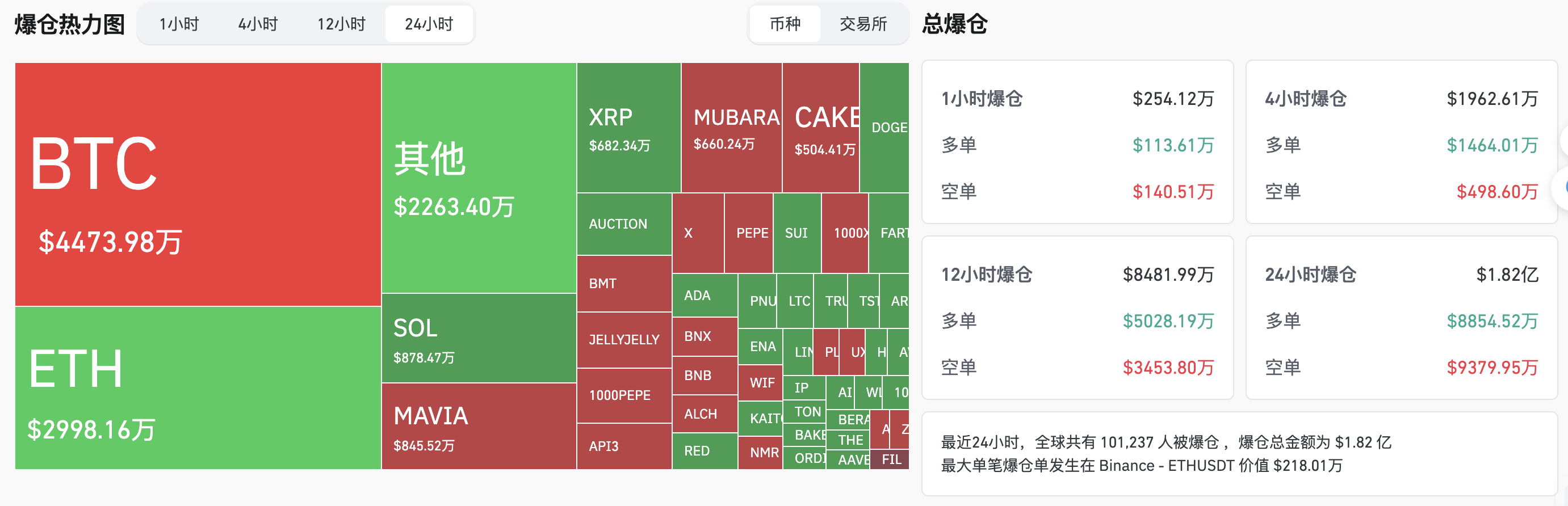

24-hour liquidation data: 101,237 people worldwide were liquidated, with a total liquidation amount of US$182 million, with a BTC liquidation of US$44.73 million and ETH liquidation of US$29.98 million

3.ETF flow direction (EST as of March 17)

-

Bitcoin ETF: $275 million

-

Ethereum ETF: -$7.29 million

4. Looking forward today

-

Binance will launch DF/USDC, EPIC/USDC, GMX/USDC, MKR/USDC and RPL/USDC trading pairs

-

Binance will support Kadena (KDA) network upgrades and hard forks

-

Sui Foundation SuiNS RFP Program Application Deadline is March 18 at 15:59

-

Binance supports BinaryX (BNX) name change and token exchange to Four (FORM)

-

Babylon will extend airdrop registration deadline to March 19

-

Fasttoken (FTN) unlocks 20 million tokens, with a ratio of 4.65% to the current circulation, and is worth approximately US$79.8 million;

-

QuantixAI (QAI) unlocks approximately 566,000 tokens, with a ratio of 3960.24% to the current circulation, and is worth approximately US$41.4 million;

-

Melania Meme (MELANIA) unlocks 26.25 million tokens, with a ratio of 17.50% to the current circulation, and is worth approximately US$17.6 million;

-

Nvidia CEO Hwang Jong-hoon will deliver a keynote speech at 1:00 am on March 19

-

The biggest gains in the top 500 market cap today : X Empire (X) rose 118.14%, Mubarak (MUBARAK) rose 66.48%, Bubblemaps (BMT) rose 58.14%, API3 (API3) rose 37.31%, Cheems (CHEEMS) rose 27.86%

5. Hot News

Spot gold is at $3,010 per ounce, setting a record high

Blur unlocked on January 1, 4 hours ago unlocked 21.69 million BLUR

Vitalik sells 5000 DHNs for 65.19 ETH

Bithumb will launch BMT tokens in the Korean won market

Nvidia GTC conference is about to be held to focus on the iteration of AI computing power

Metaplanet announces issuance of 2 billion yen zero-interest ordinary bonds to buy more Bitcoin

CryptoQuant CEO believes Bitcoin bull cycle has ended

Canary has submitted S-1 documents to apply for launching Canary SUI ETF

YZi Labs announces investment in Plume Network

MicroStrategy increases its holdings of 130 bitcoins, with an average purchase price of $82,981

Base chain contract deployment volume reached 11.4 million last week, setting a record high