Analysis of Strategy's new financing plan: the "unlimited bullet library" to purchase Bitcoin?

Reprinted from panewslab

03/18/2025·3MAuthor: Scof, ChainCatcher

Recently, Strategy (formerly known as MicroStrategy) officially filed documents with the U.S. Securities and Exchange Commission, planning to issue up to $21 billion Series A perpetual preferred shares. This move has attracted market attention because it not only involves large-scale fundraising, but also has a profound impact on Strategy's Bitcoin buying strategy.

According to official documents, the preferred shares have a face value of US$100 per share, an annualized interest rate of 8%, and a dividend payment can be in cash, common stock or a combination of both. In addition, preferred shares can be converted into common shares at a ratio of 10:1, i.e. every 10 preferred shares can be converted into 1 common shares.

This preferred stock issuance will adopt the "market issuance plan" model, which means that the company can sell preferred stock directly on the market, similar to the ATM issuance of common stocks. This means that Strategy now has ATM financing channels for both common and preferred stocks.

So what is the difference between the issuance of preferred stocks this time and the past? Will this innovative financing method bring new variables to the Bitcoin market? This article will provide an in-depth interpretation of this.

The evolution of Strategy's financing method

Before analyzing Strategy's latest financing methods, a brief review of its past ways to buy Bitcoin.

In the early stages, Strategy, as a software company, purchased Bitcoin using idle cash on the books. The first three investments in this stage bought 40,700 bitcoins.

As companies invest in Bitcoin, they began to finance using convertible priority bonds (convertible bonds). Convertible bonds allow investors to convert bonds into corporate stocks under specific conditions, providing both downside protection (principal and interest can be recovered when the bond is maturing), and also providing potential gains from rising stock prices. This method bought 119,481 bitcoins.

In addition to convertible bonds, Strategy has also issued priority guaranteed bonds, a collateralized debt instrument that is less risky than convertible bonds, but has a more fixed income model. Using this model to raise funds, the company bought 13,005 Bitcoins

As MSTR stock price rises, starting from 2021, the company has been more using market share issuance (ATM) for financing. ATM is a widely used financing method in the United States, which allows listed companies to issue new shares directly on the open market at current market prices to raise funds.

On February 20 this year, Strategy issued $2 billion in convertible priority notes, the review process required for this financing method is more complex and time-consuming than ever before, so the market speculated that Strategy would slow down its purchase of BTC.

However, the US$21 billion perpetual preferred stock submitted for review has once again raised the market's expectations for Strategy to return to the "buy, buy, buy" model.

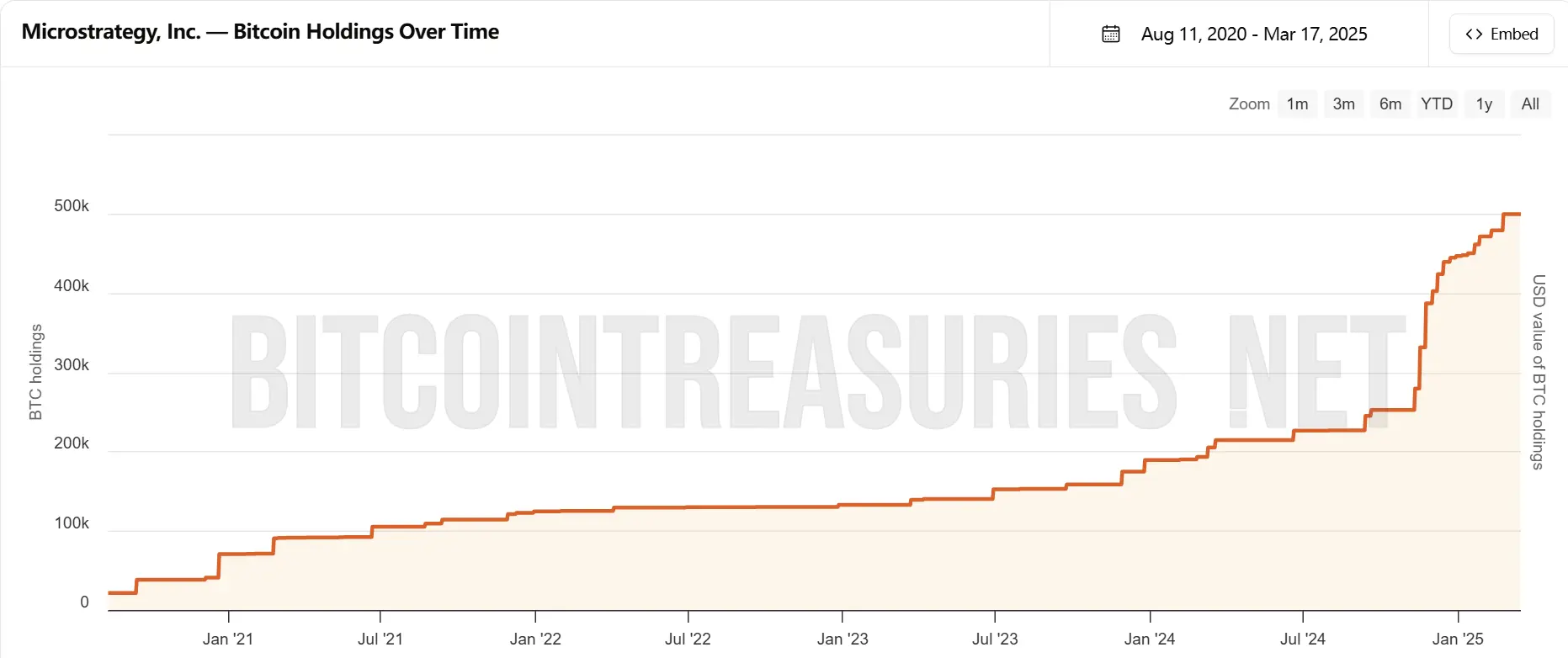

The amount of BTC held by Strategy. Source: bitcointreasuries.net

What are the differences between preferred stocks?

Compared with previous financing methods, the perpetual preferred stocks applied for by Strategy this time are significantly different in structure. In the past, companies mainly relied on debt financing and additional stock issuance to obtain funds, and this preferred stock issuance found a new balance between traditional equity financing and debt financing.

The biggest difference between preferred stock and common stock is that it neither relies entirely on company performance nor has a fixed maturity date and repayment requirements. It is more like a financial instrument "in between" where holders can regularly receive fixed dividend earnings while converting into common stock under certain conditions.

For Strategy, this means it can continuously raise funds through additional preferred shares without the need to bear the maturity repayment pressure on traditional debt financing. Compared with previously issued convertible bonds and preferred guaranteed bonds, this financing method provides greater flexibility and reduces short-term financial burden.

Of course, this model is not without its price. The annualized interest rate for preferred stocks is set at 8%, which is obviously higher than the 0%-0.75% convertible bonds issued by Strategy in the past and the 6.125% priority guaranteed bonds. The core question of this market is how the company pays this considerable dividend cost.

Analysts speculate that Strategy may make up for the funding gap through the ATM’s additional issuance of common shares, or even pay dividends directly with the new stock. Although this model allows companies to raise funds in a short period of time, it may also bring about the problem of dilution of common shareholders' equity.

Is it a good time to place a bet?

If Strategy's perpetual preferred stock is approved, it will undoubtedly bring new impetus to the Bitcoin market.

Simply put, this preferred stock is equivalent to a company finding a more flexible and lasting way to raise funds, and the money will eventually be used to buy Bitcoin.

Compared to the past when issuing bonds or selling stocks to raise money, there is no fixed maturity date for perpetual preferred stocks. Companies can always use it to raise funds and do not need to repay their principal regularly like repaying debts. At the same time, since this preferred stock adopts a model similar to the additional issuance of common stocks, Strategy can sell preferred stocks to raise funds at any time according to market conditions, without waiting for approval or looking for specific investors like bond financing.

This means that Strategy may buy Bitcoin faster in the future, and it can even continue to buy more stably.

But under the current sluggish market conditions, is it appropriate to launch such a more radical financing method?

"Strategy's $21 billion preferred stock issuance plan shows Sail's extreme optimism about Bitcoin, but such high leverage operation may exacerbate the risk of volatility in the current market downturn," said James Carter, senior analyst at Goldman Sachs.

Michael Evans, a financial technology researcher at Citigroup, believes that "against the overall pressure on the cryptocurrency market, Strategy's choice shows its judgment on future trends. If the market rebounds, its returns may be amazing, but it is necessary to pay attention to capital flows and changes in market sentiment."

Due to the complex structure of perpetual preferred stock financing, SEC approval can take months. The ChainCatcher editorial department will continue to follow up on progress.

chaincatcher

chaincatcher