TON in the Desolation: Historical Boundary and the Road to Reconstruction

Reprinted from panewslab

05/13/2025·1MOver the past two years, TON (The Open Network) has completed the transition from silence to explosion at an astonishing speed. It relies on Telegram’s hundreds of millions of user base to quickly establish a strong sense of presence in the encrypted community. The gamified ecology, robot economy, Stars payment system, official voice - TON's narrative tension was once full. However, in the face of the reality of currency price fluctuations, market value declines, and activity declines, TON also exposed its deep structural problems: concentrated chips, homogeneity of ecology, and weak infrastructure.

This article will systematically sort out TON's chip distribution, token economy, user and capital flow, development ecology and TAC architecture, and try to answer a core question: Does TON's short-term prosperity have a structure that supports its long-term value?

TON The chips are extremely concentrated: the rift between giant whales

and retail investors

TON is a project that has not started well. It has been carrying structural problems such as huge chip concentration and historical miners' lockdowns from the beginning, but now it is trying to reshape itself in these "sunken costs". We can get a glimpse of the real picture of its ecological development from its chip structure, token trends and capital flows.

TON history has led to most of the chips being in the hands of a few miners. TON official made up for this problem through OTC: TON was founded in 2018 and was banned by the SEC when it was preparing to issue coins and launch the main network in 2019. The project was officially terminated in May 2020, but it was restarted by the developer team new TON. TON coin was also dug by POW during this period (as of June 22) and has now been transferred to POS.

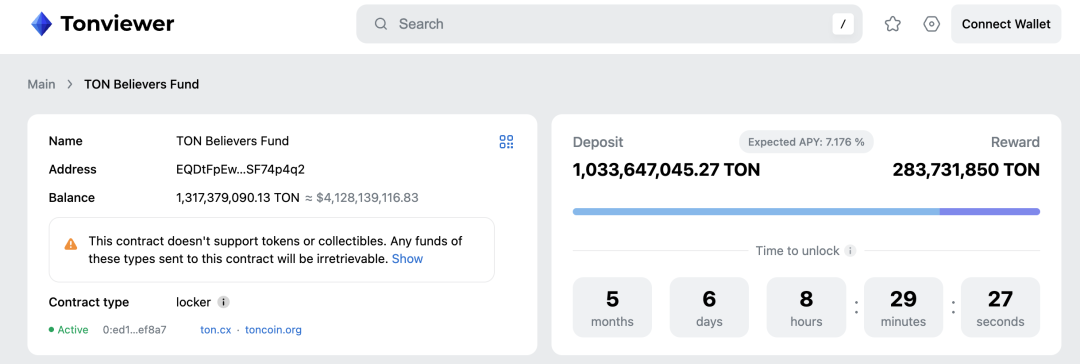

The assets marked "TON Believers Fund" were confirmed to be frozen until October 12, 2025. The data showed that a total of 1317 mTON was locked (about 52%). In order to stabilize the selling pressure, the APY given to these frozen assets was as high as 7.176%;

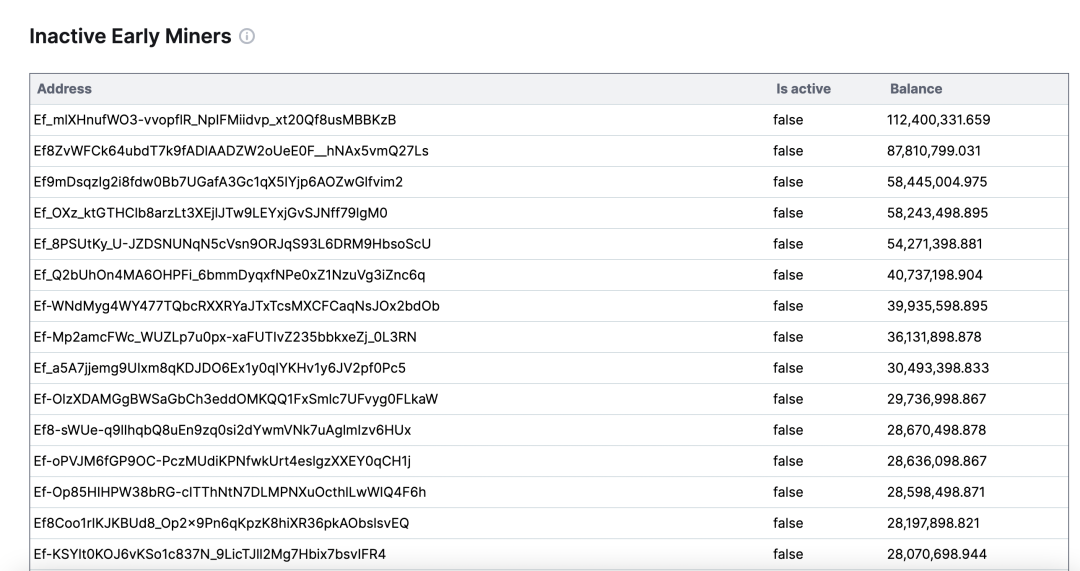

Due to the suspension and being taken over by the development team, TON, which accounted for 98.55% of the total supply, was available for mining in June 2020 until the end of mining on June 28, 2022, that is, most of the tokens were in the hands of early miners. TON project party launches a service that purchases tokens from early miners in batches at discounts. At the same time, if the giant whale locks in tokens for a long time (4 years), it can obtain 6-7% APY;

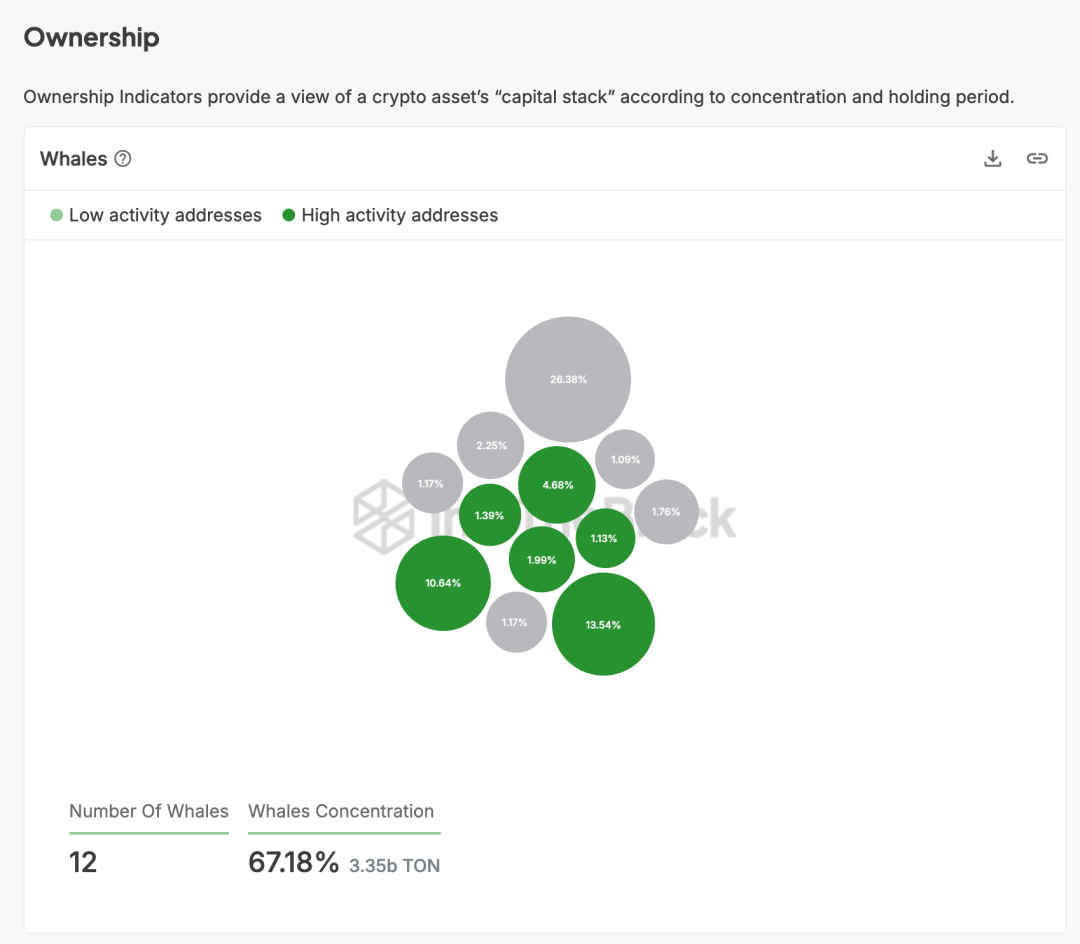

TON The giant whales are frozen/inactive miners: According to the data from the block, there are 12 giant whales with a total supply of more than 1%, and 6 of them are low-active addresses (referring to addresses with less than 300 transactions during their lifetime). According to the community TON voting, the whale address marked as "frozen" refers to the inactive early miner address. It can be seen in https://tontech.io/stats/#/early-miners that there are 171 addresses with a locked 1081m TON;

The assets marked "TON Believers Fund" were confirmed to be frozen until October 12, 2025. The data showed that a total of 1317 mTON was locked (about 52%). In order to stabilize the selling pressure, the APY given to these frozen assets was as high as 7.176%;

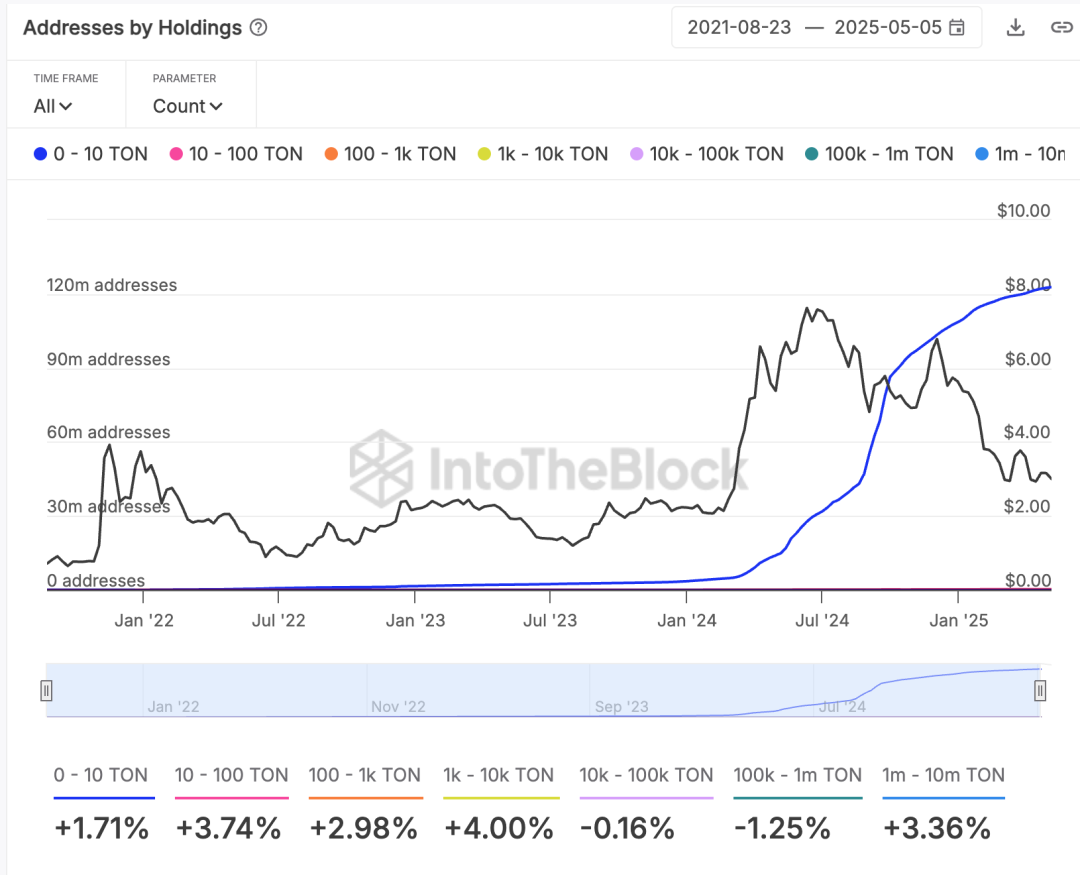

TON The chip distribution is severely uneven

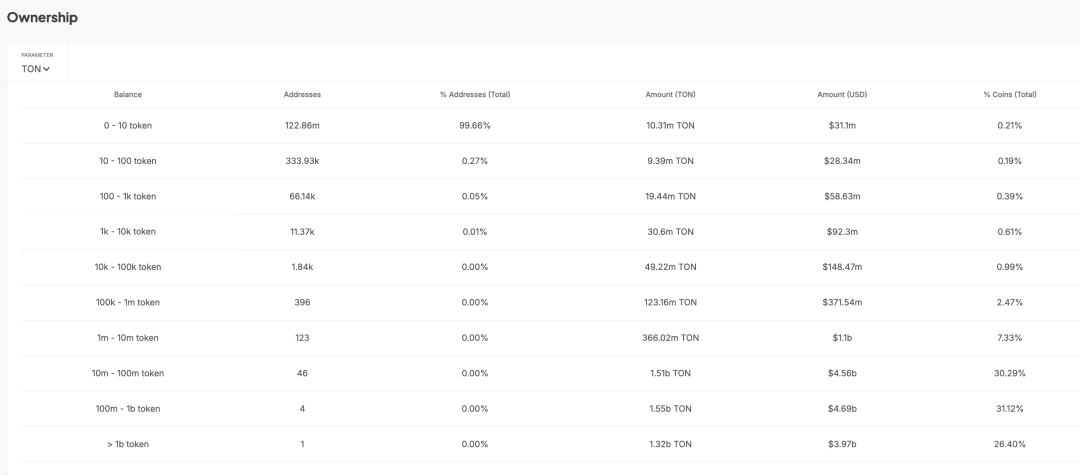

TON is very polarized, with nearly 99.9% of users holding less than 100TON. Retail investors have poured in since March 2014: According to Addresses by Holdings data, there are currently about 123m addresses holding TON, and most of them (122.54m) still only hold less than 10 TONs. Among them, those holding more than 100K TONs were 500+ before March 2014, and slowly climbed after March, reaching a peak in August 2014, at 1.3K. However, the latest data shows that the number of large-scale holders has decreased as the popularity of TON declines, and is currently about 600.

According to the data from into the block: Although there are many addresses with TONs below 1K, they only account for more than one-point percentage of the overall token.

The situation of TON is different from other public chains. They need to build a development path that suits them under the constraints of history.

TON valuation fell, but the upside still exists

TON Coin Price, Market Value and Liquidity

According to CMC data, TON coin price ATL September 21, $0.5194; ATH: June 15, 24, $8.25.

1⃣️, 2⃣️Shopping + Official Support: In November 2019, TON launched a centralized exchange and received public support from the founder of Telegram;

3⃣️: At the end of February and early March 2019, the overall trading volume rose sharply, and there was a large inflow of funds. On the one hand, Mirana Ventures invested US$8 million in March to support TON, on the other hand, TG users exceeded 900 million, and news of IPOs were leaked;

4⃣️: From June to late July 24. Then there was the arrest of CEO Durov on August 25, causing a decline (about 20%).

There are several major upward nodes in the currency price:

In the past year, TON tokens have fallen by more than 50% at a high point, and their market value has also shrunk significantly. At the same time, the total locked value of TON ecosystem (TVL) also suffered a sharp decline, falling from a high of more than US$770 million to the current US$140 million, a drop of nearly 80%.

Although the currency price has been halved at a high point, from the perspective of market value scale, TON still has room for a new rise. The key is whether it can convert the ecological popularity into long-term value: as of May 11, 2025, Ethereum's market value was US$306.36B. If ETH wants to achieve another 10% annual growth, it also needs to add about US$30B of capital inflows. In comparison, SOL's current market value is US$91.93B, and to achieve the same proportion of growth, it will take US$9 billion. TON's current market value is 8.64B, which is 65.65% lower than the highest market value of 25.17B in 24 years, but it shows that it still has a lot of room for growth.

TON's market value has increased for several stages, including from the market value of $4B in mid-July 2023 to the market value of $7B in early 2024, and then to the peak of around $13B (FDV$27B) in August 2024, the market value almost doubled every six months. However, the market value has fallen back to around $8B (FDV$17B).

From November 2019 to June 2019, the construction of the TON ecosystem brought about an increase in market value, which was almost stable at around $3B;

From June to August 23, TG bot became popular, and from July to August TON integrated the built-in wallet+ to launch the TAPP application center, so the enthusiastic attention to the bot ecology and ecological development brought about an increase in TON's own ecological narrative;

Since March 24, due to the continued construction of financing and ecosystems, the market value has soared;

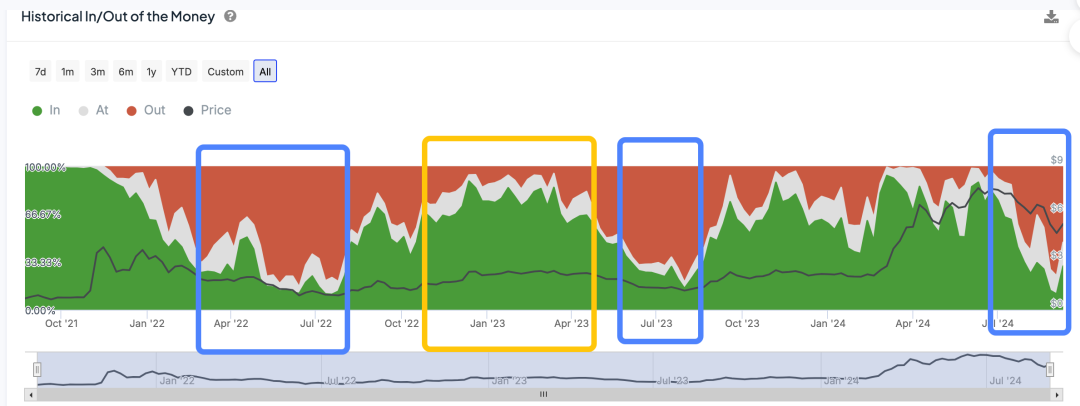

Liquidity inflow/exit history: According to data from the block, from the entire time range, the current time nodes of large shipments are April-June 22, June 23, July 24, and April-May 25. In addition, the end of 22 and early 23 is the time for a large amount of funds to flow into TON;

On May 29, 2024, Durov OTC sold 2,564,103 TON, but it did not affect the price of TON. Prior to this, Durov had been selling TON intermittently since mid-March;

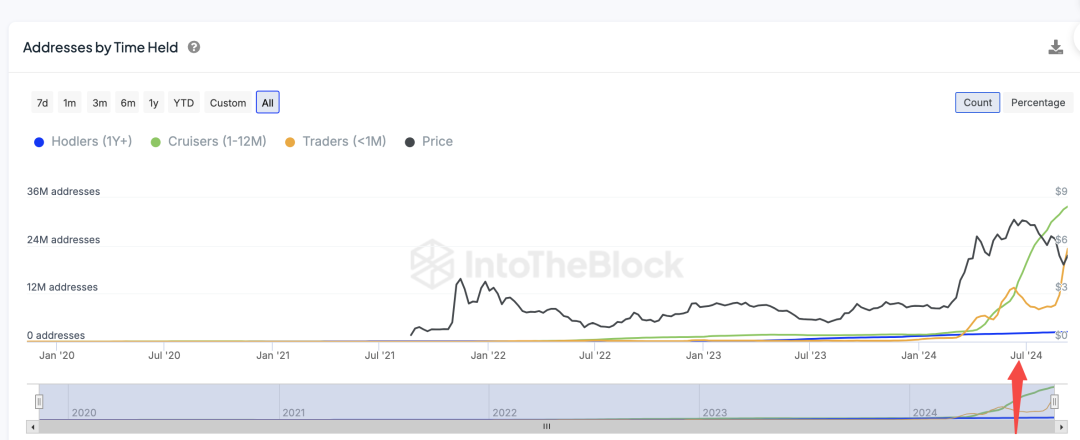

Starting from June 10, 2024, the price of currency and short-term traders continued to fall, and the number of people who held it within one year increased. It can be seen that most of them entered the market in June 2023 (TON purchased and shipped), and continued to hold positions (being trapped) when the price of currency fell;

**TON Inflation is controllable, application scenarios need to be

expanded**

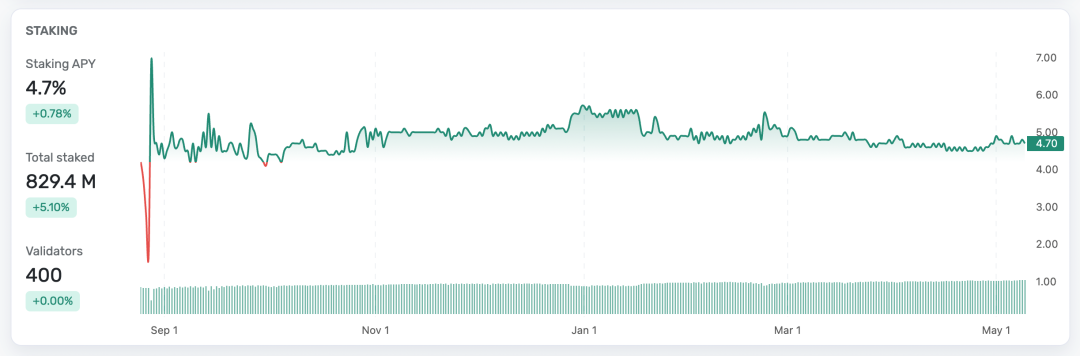

Token supply: The initial supply of TON token is 5 billion pieces, with no upper limit, growing at a rate of about 0.6% per year (about 30 million pieces). The token is used to reward verifiers. If the verifier acts improperly, the tokens they pledged will be slashed. Currently, about 4.7% of APY can be obtained by pledging TON.

Token Utility: smart contract transaction processing fees, payment platform application services, staking, cross-chain transactions, TON governance and storage services, and TON can be paid for in the future. Currently, you can directly purchase TON by credit card, and then purchase virtual products such as anonymous accounts;

TG stars is a solution for TON to enter crypto by incrementally redirecting web2 users, and can directly recharge credit cards:

The app store will support it in the future, and the official description will be the only payment channel for digital products. And the official statement is that Telegram Stars is just the beginning. Future updates will bring more features and features to Stars, such as providing gifts to content creators, small payments, etc.

But TG officially links the two most important parts of MKT - traffic and withdrawals with TON links: 1) You must recharge Ton to serve ads 2) Developers need to go through TON, which means that the "start" and "end" of the product are surrounded by TON.

For users: Simple to use, just use a credit card to purchase, no encryption involved;

For merchants: TON must be used for withdrawal (some people say it is crypto grift, only cashing is useful);

For TG: Use stars instead of real currency and follow Google Play/App Store rules, on the one hand, it can be converted into TON;

Currently, TG has launched Telegram Stars transit solution to adapt to Apple and Google's supervision and improve user usage. The official links the core (advertising, funds transfer) of its future ecosystem to TON ecosystem: In order to support the payment of digital goods and services in the entire Telegram ecosystem, Telegram Stars has been launched. Users can get Stars through in-app purchases or PremiumBot from Apple and Google, and then use them to purchase digital products provided by the robot, such as e-books, online courses and items in Telegram games.

**TON The reality after the traffic ebbs: the pain of ecological

transformation**

TON is currently concentrated and crowded. The official no longer focuses on the game ecosystem, but focuses on the payment side: 1000+ projects have only 20 small categories, but in fact there are only 5 major categories, such as NFT related (120+), 700+ game related (including gamble), transactions (CEX, wallets, bridge), social (channels, chats, etc.) and tools (explorers, dev tools, VPN, launchpad). It can also be seen that TON has not focused on the previously popular game ecosystem, and the game category is even the second-last category on the official website classification page.

However, there are products for other categories: except for games and memes, other tracks are basically low in popularity. Even in the shopping category, there are problems such as single user (only supporting Russian-speaking areas), basic functional areas (mostly helping TON payments);

The continued decline in activity on the TON chain is clearly revealing the recession of economic vitality within its ecosystem. Both user participation and transaction frequency declined, reflecting a significant weakening of the momentum of ecological growth.

This dilemma stems from the interweaving of multiple factors. On the one hand, TON relied on Telegram's traffic dividend in the early days to quickly attract users with mini programs and "Tap to Earn" mini games, but failed to establish an effective user retention and value precipitation mechanism. After the wealth-making effect subsides, user interest has dropped sharply and traffic dividends have quickly dried up.

On the other hand, TON's ecological narrative is relatively single, mainly focusing on social interaction and games, and lacks in-depth layout of diversified tracks such as DeFi, AI, and DePIN. DeFiLlama data shows that there are currently only more than ten projects on TVL with over 10 million US dollars, among which Tonstakers stand out, with high concentration of ecological projects and prominent development imbalances.

In addition, TON's unique development architecture and programming language are not friendly to developers, limiting project incubation and innovation efficiency, and further weakening the ecological vitality. Although Mini Apps has seamless licensing and payment integration functions, which can theoretically reach 950 million Telegram users, the ecosystem is actually highly concentrated in games and NFTs, and general applications such as tools, payments, and infrastructure are still scarce.

If TON cannot get out of its path dependence on short-term popularity and expands into implementable application scenarios based on TON tokens, it will be difficult to accumulate into sustainable on-chain value. Once the traffic dividend fades, what can truly support the ecology must be the structural health and diversified capabilities of the project. Judging from the current ecological composition of TON, the pressure of transformation is gradually emerging.

Where are TON's users and developers?

TON users skyrocketed, but their activity is declining

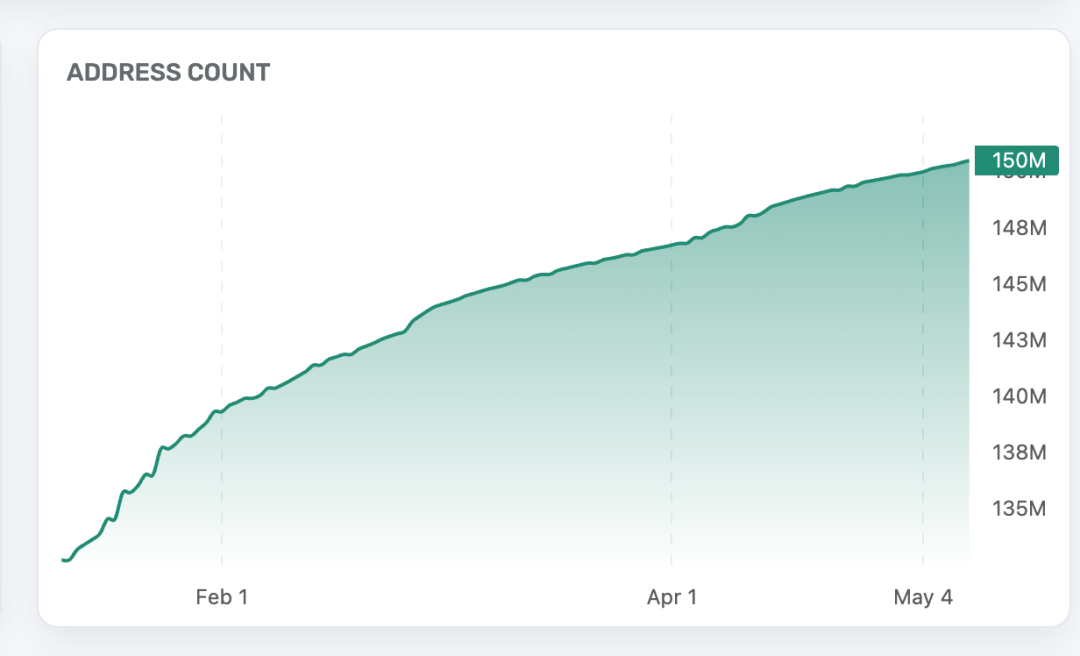

TON users have grown rapidly: According to tonscan data, from mid-May to early September 2024, TON's address has doubled from 20m to 70m users, of which it doubled in August (45m-70m). From September 2024 to the present, TON's address has doubled again. Currently, there are 150m users, and the increase is very rapid;

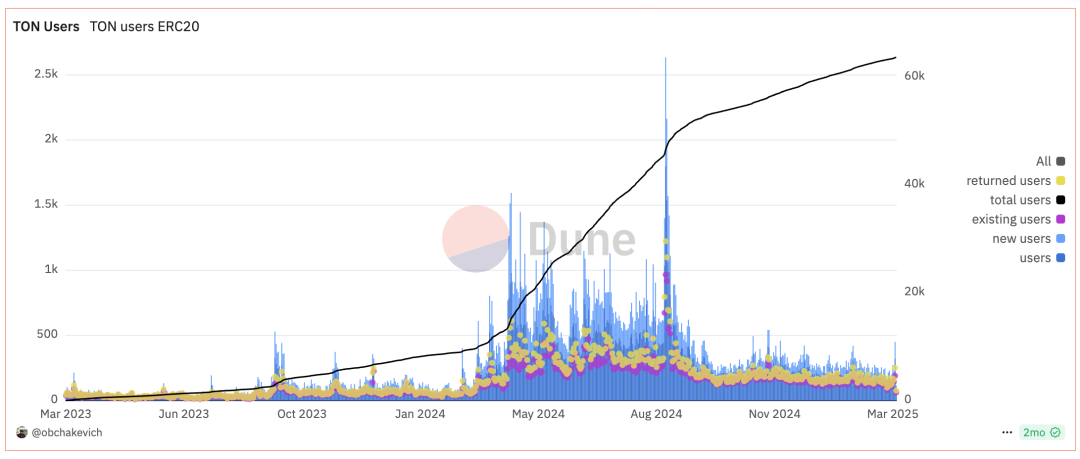

According to Dune data, new users have increased at an average daily rate of 200-300 since the beginning of 24, and returned users can cover the churn of users;

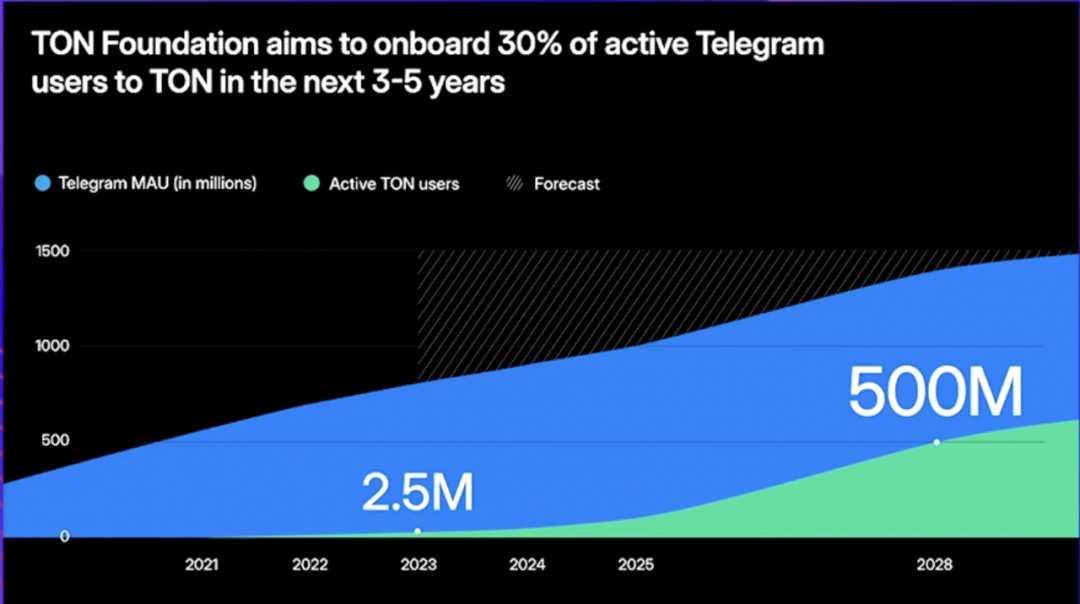

TON is expected to cover 30% of Tg users, Target 2028 500M users;

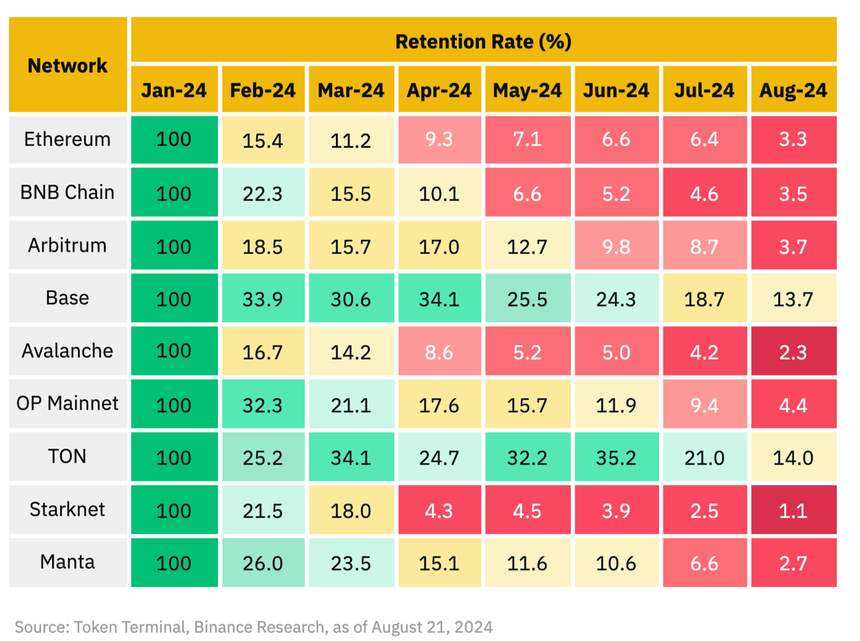

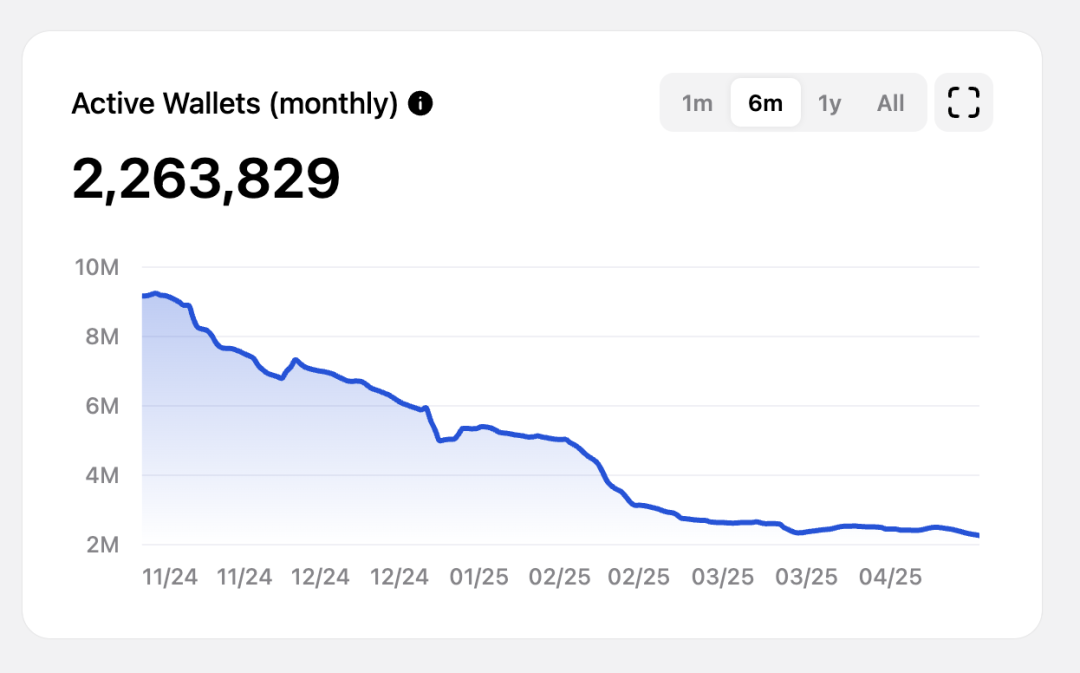

TON has a high user stickiness, but the number of active addresses has decreased significantly with the ecological neglect: According to Binance's 24-year report "Web3: The Household Name in the Making", the average retention rate of each chain is 5.4%, while TON has the highest retention rate among all well-known public chains. The reason is simple: it focuses more on building a strong consumer ecosystem and has a solid product market fit. Currently, TON's active address last month was 200w (3w daily active users), compared with the monthly active users that exceeded 10 million at the end of 2024, the data is now significantly reduced, considering that the market's attention and funds are shifting to other ecosystems.

The trading volume of TON has dropped significantly compared to before, but overall stability: According to tonscan data, the trading volume of TON has been 4m per day at the end of 2024, and the current trading volume has dropped to 2.5. In comparison, the number of daily trading transactions on the BTC chain is between 30-40w, and the ETH is between 110-130w, which has been very stable.

**TON Developer ecosystem is under pressure, infrastructure needs to be

strengthened**

The number of TON validators is small, resulting in a certain degree of centralization: the number of TON validators is currently 400, an increase from 361 at the end of 24, distributed in 26 countries, with the number of pledged close to 700 million TONs, accounting for 12% of the total tokens and 28% of the circulating tokens;

This difference in the number of validators leads to more transaction requests (centralization) each validator needs to process. And when the transaction volume increases sharply, the validator may be unable to process all transactions in time, resulting in delays in block production or even interruptions (this may be the reason why the TON block was suspended after Durov's arrest incident): On August 28, the TON blockchain experienced two interruptions in one day, with a cumulative time of 10 hours.

The problems with TON network are: 1) TON has high requirements for the hardware and network of verifiers, and to become verifiers, you need to pledge at least 300,000 TON; 2) There are insufficient number of verifiers. Compared with other PoS public chains, the number of TON's validators is significantly smaller. Currently, the TON network has only 400 validator nodes, while the number of validators in Ethereum has exceeded 1 million, and the number of validators in Solana is far exceeding that of TON.

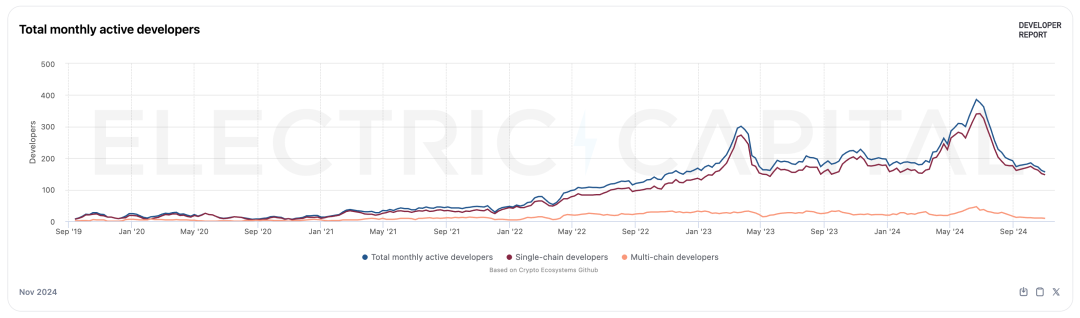

The number of developers is stable, but there is a decline: many developers come from telegram, and the core devs are mostly from South Korea and Russia, with strong technical capabilities but average product experience. According to develop report, as of May 2025, there were 30 full-time developers on Ton (10+ daily code increase or decrease) and 150+ monthly active developers, a decrease of 100 compared with the end of 24. Compared with other ecological quantities, the number of ETH is average (ETH is up to 2000+, other such as polygon, arbi, and Solana are between 500-600);

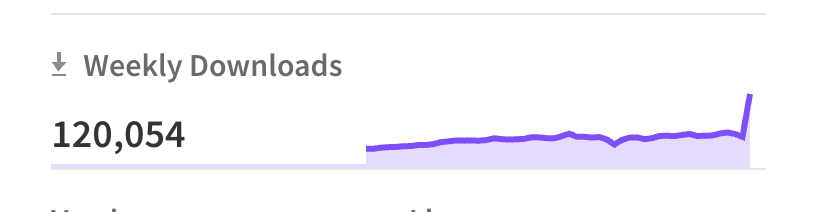

TON Connect SDK is a must-have SDK for developers linking the TON ecosystem. The download volume has ranged from 10,000 per week at the beginning of 2024 to more than 25,000 per week in the hot ecosystem in August 2024, and up to 12,000 per week;

TON's growth shows a typical "user first" feature, but this also conceals the problem of unstable ecological foundation and insufficient developer support. If TON does not continue to find a sustainable development direction that can be adapted to TG applications, it will be difficult to compete with other public chains.

The Future of TON: Going to Compatibility and Connectivity

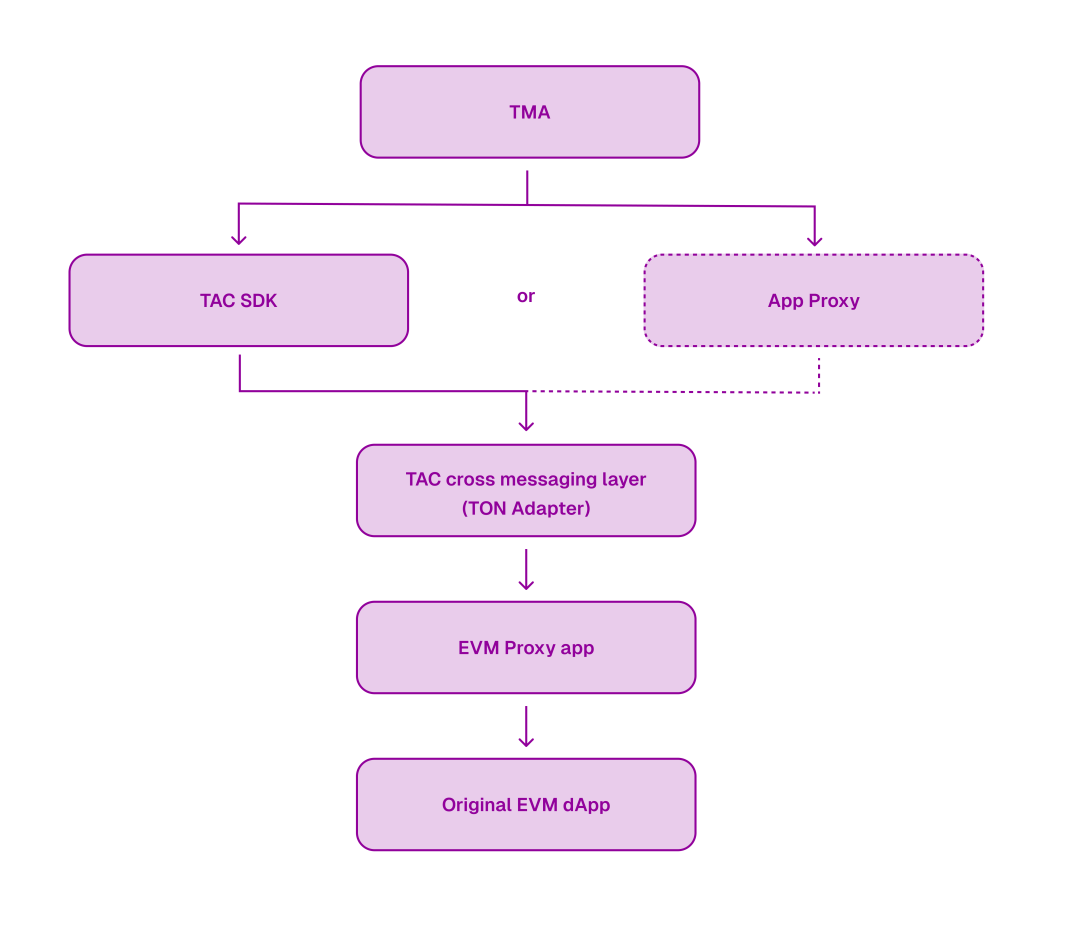

Although TON has a large potential user base, its ecosystem is facing a significant obstacle: incompatibility with mainstream Ethereum Virtual Machine (EVM) applications. Therefore, in the face of the strong Ethereum ecosystem and the trend of inter-chain interoperability, TON is also making key adjustments - launching the TAC architecture to open up the boundaries with the EVM world.

TAC is a TON network extension that connects TON with EVM-compatible applications to create a unified experience for users and developers. With TAC, users can use the TON wallet to interact with any EVM application, and developers can migrate EVM applications to TON without rewriting code or learning a new framework.

Its core is not a compatibility layer, but an independent EVM public chain, built by Cosmos SDK + Ethermint, adopts dPoS consensus and implements BTC staking security through Babylon. This chain supports complete EVM smart contract execution and is the "EVM native area" on TON.

Cross-chain communication is the responsibility of the TAC's sorter network. Each cross-chain transaction needs to first reach a 66% consensus in the sorter group, and then conduct cross-group verification to ensure that the message is delivered safely and the process is not tampered with.

The entire process is supported by the Proxy smart contract system: the Proxy contract on TON is responsible for initiating messages and locking assets, and the Proxy contract on the EVM side (written in Solidity) receives messages and completes interaction. For users, the entire cross-chain process is transparent, and the experience is like using a native DApp.

TAC also enhances economic security through pledge mechanisms. Sorters and verifiers need to collateralize assets to participate in verification, and they will receive rewards for good behavior, and face punishment for doing evil, thereby ensuring stable and efficient network operation.

In general, TAC is not a bridge, but more like TON's native high-speed channel to EVM, expanding the ecological boundaries of TON and allowing Web3 users to truly "bring only one wallet and travel all the world" between multiple chains.

The practical application logic of TAC is not complicated. The following is a real scenario that shows how a user completes a token exchange operation on EVM DEX through a TON wallet - TON users exchange coins on EVM DEX: 1) The user uses a TON wallet to connect to the DEX front-end and selects to exchange tokens; 2) The TON Proxy contract locks assets and generates cross-chain messages; 3) Sequencer network for verification and consensus; 4) The EVM Proxy contract receives the verification message and completes the redemption logic; 5) The transaction result is returned to the user wallet through the reverse path.

TON's story is not simply a "surge" or "collapse". Its past has accumulated decentralized restarts after the SEC ban, with complex bargaining structures and ecological narratives rely mostly on Telegram's platform capabilities. Its current number of users has exploded, but also faces bottlenecks in activity and development support. And its future is betting on the compatibility path opened by the TAC architecture, that is, whether it can access the mainstream world of EVM, build a stable developer ecosystem, and break through the bottlenecks of payment and scenario implementation will determine whether TON truly walks out of its own paradigm from the platform dividends.

After the traffic fades, what can really stay is the chain's self-hematopoiesis ability. TON, still at the intersection.

jinse

jinse

chaincatcher

chaincatcher