There is only BTC in BTCFi, no Fi

Reprinted from panewslab

03/12/2025·1MEigenLayer proves the need for Ethereum secure space ≠ monetization of Ethereum secure space.

Babylon’s opponent is actually a BTC Spot ETF, and the promise of security and reward is not as good as off-chain.

After a year of fire cooking oil and the collapse of the middle road, we finally reached a consensus that people's demand for BTC, that is, BTC itself, cannot be expanded to BTC pledged assets, BTC L2 and BTC-based DeFi.

Replica of the success and failure of Ethereum

Babylon is not a new project, but it is unable to complete financing for a long time and stays in the field of academic research.

Solv is not the initial entrepreneurial direction. After adjusting the direction many times, he rose to Binance.

Is Bitlayer/BEVM/Merlin and other BTC L2 considered a new project? I can only say that the probability is 50%. Most of them were established at the same time as WBTC. It turns out that the road that has not been completed has not witnessed miracles in the second attempt.

Even Runes did not have the miracle of reprinting the inscription. In the end, the hearts of people were cold, but they said it was cool and the weather was so cold.

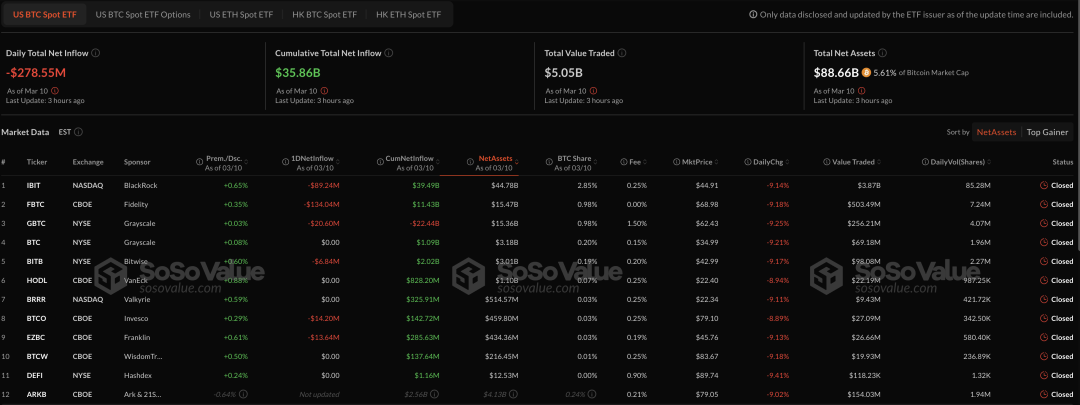

Image description: BTC etf Image source: @sosovalue

In the quarterly report of Q1 2025, only BTC Spot ETF was successful. In addition to Bitcoin itself, ETFs are the most reliable investment tools, which are in sharp contrast with ETH ETFs. The Ethereum chain ecosystem is flourishing, and BTC off-chain trading is booming.

It has to be admitted that BTC does not require repeated wheel creation scenarios such as L2 and pledge. No smart contract is not a market space for Babylon, but an inevitable choice for robustness.

Although people are sarcastic about Vitalik and Ethereum at this stage, most of the innovations of BTC and Solana are imitating and transforming Ethereum. Solana takes away DeFi and Meme, BTC takes away the pledge system and live-for-live scenarios, and plays the RWA of digital gold.

But Solana was successful at least in stages, while BTC itself was strong, with US$80,000 called a decline. SOL 100 started with a pain, and what was even more uncomfortable was BTCFi that was falsified in stages.

ETH L2 does not fail. At least it cultivates successors such as Base. The failure of the price does not mean the lack of practical scenarios, but the BTCFi pledge layer, L2 and DeFi only fail and even more failures.

In short, BTCFi did not replicate Ethereum 's success, but instead followed all of the failures of Ethereum.

The tragedy of the main network security monetization

As mentioned earlier, Eigenlayer hopes to monetize Ethereum's secure space and then split it into partitions and rent it to project parties with security needs. Eigenlayer does not provide security, but is just a porter for security.

Why can't this set be moved to other public chains?

Such as LSD/LRT, Meme, DEX, etc. can be learned by various public chains, and there is no disease of being unacceptable to the local environment. Only BTC cannot be reproduced?

In fact, each chain only tends to one model: asset issuance products, regardless of whether their outer packaging is L2 or pledge/re-pled system.

If you also have a good impression of the SVM L2 track, then we can predict in advance that Solana with a market value of 100 billion cannot support suburban economics. Beijing needs a sub-center of the city, and Tongliao obviously does not.

The same is true for BTC. The trillion-dollar Bitcoin ecosystem has only one product, namely BTC itself. If you rely on BTC to do some edge arbitrage, such as WBTC and ETF, it will enhance the market value of BTC and be recognized and rewarded by the market.

But if you step beyond the line and hope to move the value of BTC to your token, you will face an eternal problem. How can you change the big cake to your token? The difficulty is 100 levels higher than that of Sun Ke and someone who replaces USDT to USDD.

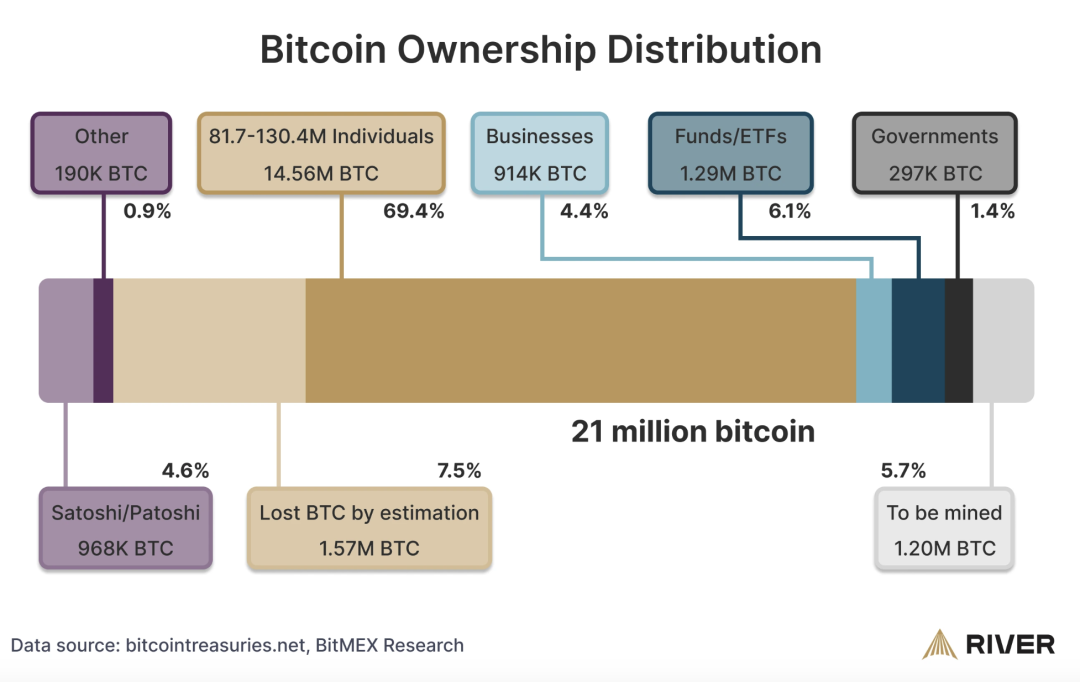

Image description: BTC holder distribution Picture source: River.com

Various BTC pledge agreements are booming, but the world's major BTC is distributed in the hands of exchanges and asset management companies. The BTC on-chain pledge system is just a noun and is difficult to be called an entity.

In the final analysis, the Bitcoin staking system cannot be equivalent to the sense of security caused by holding BTC. If the staking system cannot be established, then BTC L2 and BTC DeFi cannot be established either.

The two dragons don't meet each other

ETH L1 was crowded, and it carried out large-scale L2 infrastructure, and was eventually stolen by Pump Fun. This is the whole story of the currency circle in the past six months.

Recently, if BTC L2 had not started to build momentum before issuing coins, the fast-paced currency circle may have forgotten this ancient memory. According to my personal opinion, the only winner is Merlin Chain's fast issuance + long-term operation.

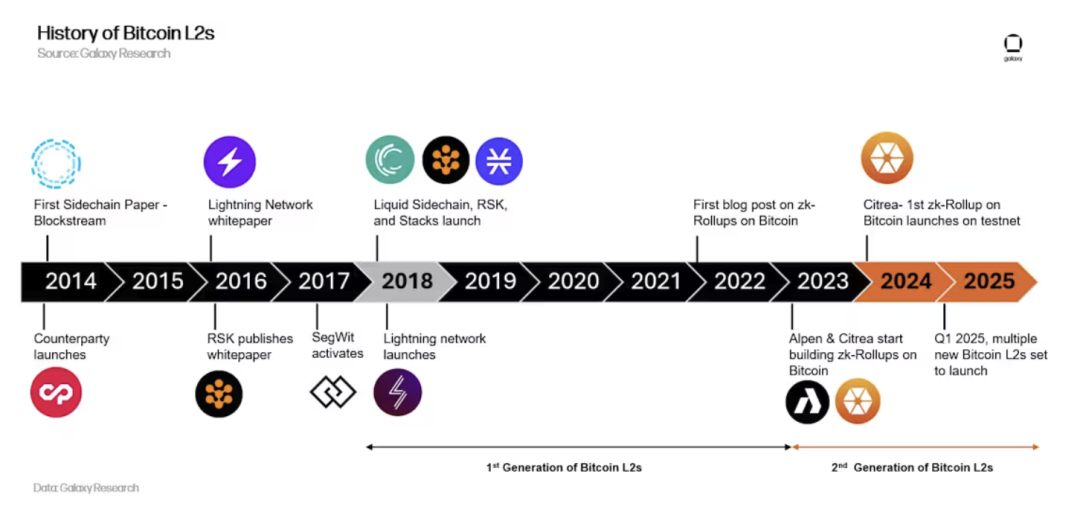

Image description: BTC L2s Development History Picture Source: Galaxy Research

The earlier you issue coins, the worse your character is, the later you issue coins, and it is difficult to control the market. If you are destined to be scolded by retail investors, it is better to choose a way to make more money. This is the whole story of BTC L2 in the past year.

To compare, ETH itself needs L2 to share traffic. The current game is just an adjustment of the fiscal relationship between the central and local relations. The weakness of the EVM ecosystem itself has nothing to do with L2s. Even if Ethereum charges more L2s taxes, retail investors will not return to the EVM ecosystem.

The same is true for SVM L2. Pump Fun has entered the end of the profit curve. The way to extend his life is to grab the cash flow of AMM DEX. If it is in the Ethereum ecosystem, it is likely that Pump Fun Chain will appear.

BTC L2 is the most embarrassing. Compared with the support and guidance of Vitalik and the Ethereum Foundation, BTC L2's technical solutions are chaotic and disorderly. They include imitation monsters that imitate ZK/OP routes, and detailed controls that are focused on patching the operation codes, as well as reformists who want to complete the functions of Bitcoin scripts.

Compared with the decentralization of SVM L2, BTC L2 seems to be a little more important in the "project party + VC" accumulation. After all, the attitudes of the public chain Anatoly and Solana Foundation towards SVM L2 are "not supported, not opposed, not encouraged, and not rejected". Unexpectedly, Solana, which has long been called the computer room chain, is the OG in the currency circle that truly implements the concept of decentralization.

In this way, I lived like this for 365 days until I entered the Listing node of the post-VC and post-market maker era. In the misunderstanding and shock of the onlookers, BTC L2 announced the airdrop plan and token economics mechanism.

It’s just that BTC itself chooses to choose no matter these troubles, whether it’s 80,000 yuan, or 1 yuan, digital gold or US debt saviors, and it’s all external things that I have.

Conclusion

Since the birth of BTC, people have developed large-scale industries such as wallet, mining, and parcel assets, laying the foundation for the Ethereum ecosystem. Vitalik himself is even a seed cultivated by Bitcoin Magazine.

However, BTC is too special. Compared with many competitors that need to face Mass Adaption and externalities, Bitcoin itself does not have the leading personnel, so it does not have to attack the political system like Movement and other juniors.

Just like the internal mechanism of AI, there is no explanatory nature in this absurd world, BTC chooses not to explain, BTCFi hopes to explore new ways, and the result proves that the old ways are more robust.

chaincatcher

chaincatcher