312 fifth anniversary: Bitcoin has survived the halving of its single day. What are the difficulties in front of us?

Reprinted from panewslab

03/12/2025·1MIt's another year of 312, and this number once made countless investors in the currency circle still feel scared.

Thursday, March 12, 2020. After get off work, the editor curled up in the rental house and surfed the Internet. After 6:30, the phone kept sending alarms, and the ghost story began:

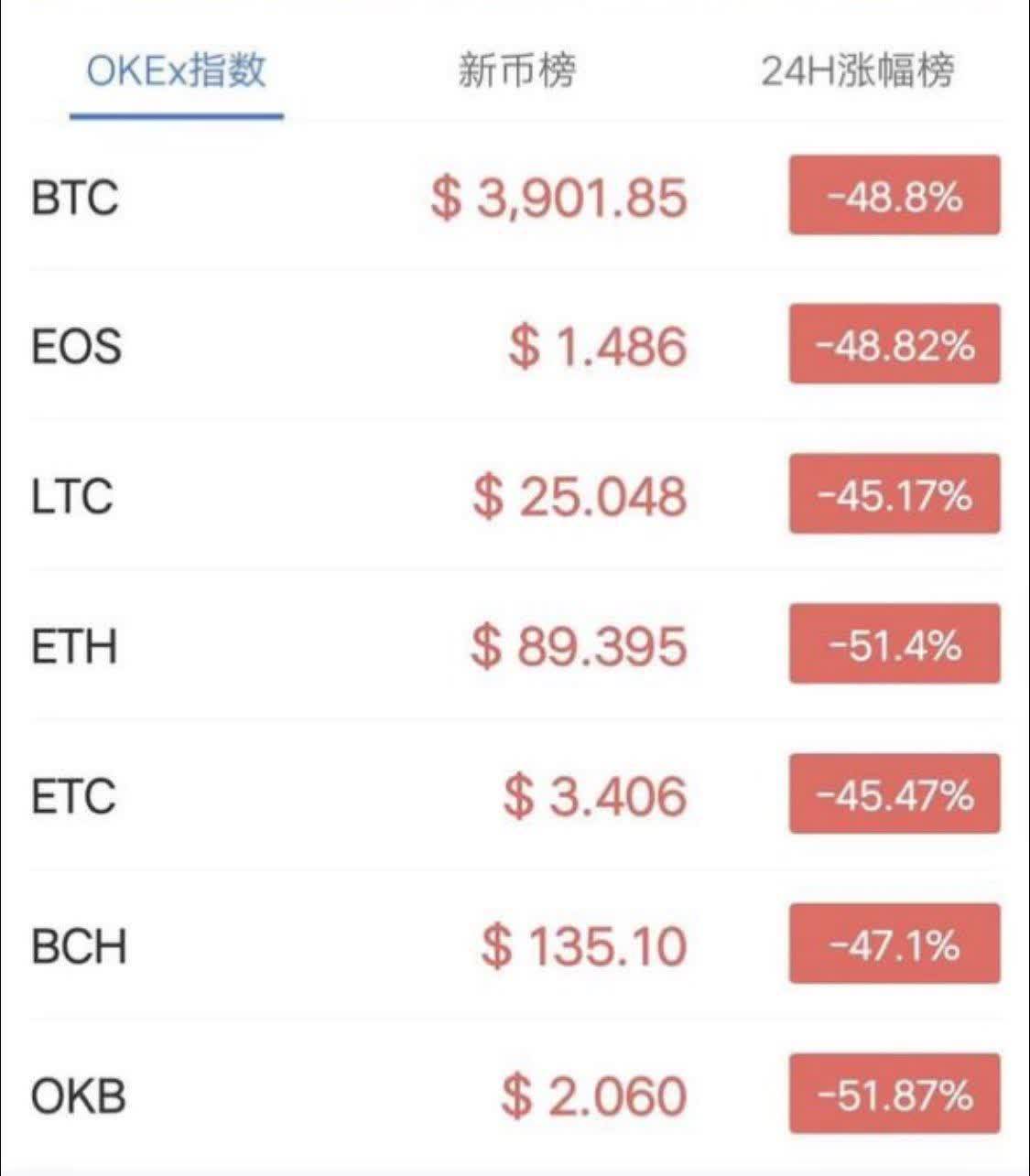

The price of Bitcoin fell from 7,000 at that time, without any resistance, and fell to $3,800, the largest single-day drop in Bitcoin history.

Ethereum even plummeted from around $200 to $90, a drop of more than 50%.

Cryptocurrency ushered in the darkest day in history. Various cryptocurrency communities were wailing. The editor was shocked and felt sad: Is the industry going to disappear? Should I change my line?

This is not because the editor is overly pessimistic. On that day, panic spread like a plague. PayPal co-founder Wang Li also told his colleagues that night: This industry is gone.

Bitcoin fell one after another, from $7,000 to $6,000 to $5,000. Each decline triggered a series of leverage liquidation, and 100,000 people lost their positions. Even if it was 2-3 times the leverage, many people were not spared; Ethereum continued to fall, and the DeFi protocol MakerDAO also experienced leverage liquidation and faced a bad debt crisis...

The exchange is overloaded, and many platforms are paralyzed, making a doomsday scene.

At the time of crisis, BitMEX, the largest derivatives platform at that time, went down. Later, the industry widely believed that BitMEX downtime (disconnection of network cables) saved the industry. If the network cables were not removed, Bitcoin would face a bigger price crisis.

The 312 crash is not an isolated event, but a storm caused by the interweaving of multiple factors:

Global outbreak: COVID-19 spreads rapidly around the world, causing market panic;

Traditional financial markets plummeted: US stocks rarely ushered in a historic situation of circuit breakers in a single week, with the Nasdaq falling 8.4% in a single day, and the Dow Jones Index also hit its largest single-day decline since 1987;

Oil price crisis: Oil price war between Saudi Arabia and Russia further exacerbated market panic, oil prices plummeted, and later fell to negative

This is an external macro factor, and within the crypto market, the excessive leverage accumulated over a long period of time was detonated, and panic selling led to liquidity exhaustion, exacerbating price declines.

In summary, the collapse of the global financial market caused by the new crown epidemic, coupled with the structural defects of "high leverage + low liquidity" in the early stage of the crypto market, has jointly caused this crisis.

However, it is this crisis that has become a turning point in the maturity of the crypto market.

After 312, Bitcoin began a long and firm road to recovery.

From a low of $3,800 in March 2020 to a record high of nearly $69,000 in November 2021 to a record high of January 20, 2025, Bitcoin once exceeded $108,000, with a maximum increase of more than 28 times.

Ethereum has climbed from its $90 low to its $4,800 high, up more than 53 times.

SOL fell to $0.5 at its lowest point, reaching its highest point of $293, an increase of more than 580 times.

More importantly, the 312 crisis has spawned several innovations in the crypto industry:

DeFi explosive growth: After 312, DeFi (decentralized finance) ushered in DeFi Summer, opening the most magnificent era of wealth creation in cryptocurrency history.

Institutional entry accelerates: Large institutions such as MicroStrategy and Tesla have begun to include Bitcoin in the balance sheet, and El Salvador uses Bitcoin as a fiat currency.

Market structure optimization: The crypto derivatives market is more mature and the liquidity provision mechanism is more sound.

Every veteran of the currency circle who has experienced 312 may look back at the past, and may even regret it, fearing that the market will encounter such turmoil again, and regret not buying at the bottom at that time. The cruelty and opportunities of the market often coexist.

All the projects and investors who survived 312 have experienced the ultimate test.

No matter how the market changes in the future, we have witnessed the most extreme situation. We can say frankly: We have survived 312, what else can we fear?

Since its birth, Bitcoin has been declared "death" more than 400 times. From the first major collapse in 2011, to the Mt.Gox incident in 2014, to the bear market trough in 2018, to the 3.12 plunge in 2020, Bitcoin has experienced countless tragic declines of up to 80% or even 90%.

However, after each crash, Bitcoin can be reborn from the ashes and create new all-time highs. This extraordinary vitality is exactly what Nietzsche said: "If you can't kill me, you will make me stronger."

The history of Bitcoin tells us that in this highly uncertain market, the most important thing is not short-term gains and losses, but long-term survival. As long as you survive, you will have the opportunity to create new miracles.

As Buffett said, "The first rule of investment is not to lose money, and the second rule is not to forget the first rule." In the crypto market, this wisdom can be transformed into: "The first rule is to live, and the second rule is not to forget the first rule."

Finally, let’s repeat the sentence: We have survived 312, what else can we fear?

chaincatcher

chaincatcher