The Rule of Encryption Scale - Where is the hard top of DeFi

Reprinted from jinse

06/03/2025·15DSource: Zuo Ye Waibo Mountain

DeepSeek R2 did not come out like the rumored May, but was updated in the R1

version on 5.28. Musk's Grok 3.5 has also frequently dropped tickets, which is

not as good as the Starship.

Driven by the fanatical amount of capital, scaling law in the field of big models has gone through its life cycle faster than Moore 's Law of chips.

If software, hardware, and even human lifespan, cities and countries have upper limits of their scale effects, then the blockchain field must have its own rules. At the moment when SVM L2 enters the issuance cycle and Ethereum returns to the L1 battlefield, I try to imitate the scale law and give an encrypted version.

Ethereum soft scale, Solana's hard top

We start with the full node data scale.

The full node represents a complete "backup" of the public chain. Our own BTC/ETH/SOL does not mean that we have the corresponding blockchain. Only when we download the full node data and participate in the block generation process can we say "I own the Bitcoin ledger". Correspondingly, Bitcoin has also added a decentralized node.

Solana's 1500 node scale is difficult to maintain a balance between decentralization and consensus efficiency. Correspondingly, the 400T full-node data scale leads the public chain/L2.

Picture description: Data scale of full nodes of public chain Image source: @zuoyeweb3

If compared with Bitcoin, Ethereum is already very good at controlling the data volume. Since the birth of the Genesis Block on July 30, 2015, Ethereum's full node data volume is only about 13 TB, far less than the 400 TB of its "killer" Solana, and Bitcoin's 643.2 GB is a work of art.

In the initial design, Satoshi Nakamoto strictly considered the growth curve of Moore's Law, which strictly limited the growth of Bitcoin's data to the expansion curve of hardware. It has to be said that later, the party supporting the large block of Bitcoin was untenable because Moore's Law had already stepped on the edge of marginal effect.

Image description: Comparison of Bitcoin node growth and Moore's law Image source: Bitcoin White Paper

In the CPU field, Intel 14 nm++ can be called a heirloom. In the GPU field, Nvidia's 50 series has not "significantly exceeded" the 40 series. In the storage field, under the Xtacking architecture of Yangtze Memory, the 3D NAND stacking scale has gradually reached its peak, and Samsung's 400 layer is the expected high point of engineering.

In a word, the rule of scale will not make any huge progress in the underlying hardware of the public chain. It can even be said that this is not a short-term technical limitation, but will maintain the status quo for a considerable period of time.

Faced with difficulties, Ethereum is obsessed with ecological optimization and reconstruction. trillions of RWA assets are a must-fight place. Whether it is imitating Sony's self-built L2 or comprehensively accelerating the Risc-V architecture, it is not "finding more extreme software and hardware collaboration", but sticking to its own advantages.

Solana chose to go to the extreme of the speed of light. In addition to the current Firedancer and AlpenGlow, the super-large node scale has actually excluded individual participants. 13 TB of hard drives can be saved, 400 TB is already a dream, and 600 GB of Bitcoin can be theoretically satisfied when Samsung, LG and Hynix factories are putting out fires every day.

The only question is, where are the lower and upper limits of on-chain size?

The limits of the token economic system

AI did not embrace Crypto as scheduled, which did not hinder Virtuals' currency price surge. Even blockchain in the left hand and AI in the right hand have become a fellow traveler of this US government MAGA. 5G and the meta-universe are old. For celebrities, they also look at Sun Cuo and Stable Coins.

Let’s briefly discuss the various limit indicators of the token economic system. Bitcoin, under the premise of lack of practical uses, has a market value of US$2 trillion, Ethereum is US$300 billion, and Solana is US$80 billion. We take Ethereum as the standard value, and the limit of the public chain economic system is US$300 billion.

This does not mean that Bitcoin's valuation is too high, nor does it mean that the new public chain cannot surpass this value, but it is highly likely that the market performance of a public chain is the current optimal solution , that is, "we believe that the current market performance is the most reasonable existence", so directly selecting this value is more effective than complex calculations. If it is not necessary, do not add entities.

We introduce two concepts from the book "Scale":

- 1. Superlinear scaling. When the system scales, its output or benefits do not increase proportionally, but grow at a faster rate.

- 2. Sublinear scaling, when the system scale is expanded, the growth rate of some indicators (such as cost, resource consumption, maintenance demand, etc.) is lower than the linear proportion .

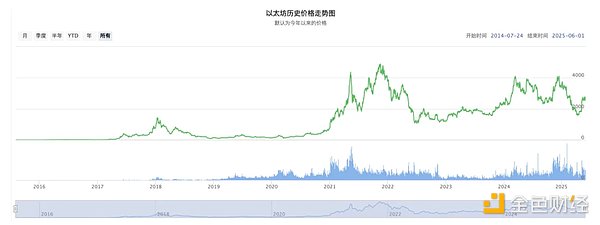

Image description: Ethereum price trend Image source: BTC123

Image description: Ethereum price trend Image source: BTC123

Understanding the two is not complicated. For example, Ethereum's growth from USD 1 (2015) to USD 200 (2017) is a hyper-linear scale scaling, which takes about half the time to grow from 200 to ATH (2021), which is a classic sublinear scale scaling.

Everything has its limits, otherwise blue whales, elephants, and North American sequoia will surpass themselves, but the gravity of the earth is hard to overcome.

Continue to drill, has DeFi reached its limit?

The scale limit of DeFi can be included in Ethereum, and instead examines the rate of return. This is also the core proposition of DeFi. The driving force behind the increase in entropy lies in the extreme pursuit of returns. We give three standards: UST's 20% APY, DAI's 150% over-staking ratio, and Ethena's sUSDe's 90D MA APY 5.51% calculation.

We can assume that DeFi's revenue capture capability has dropped from 1.5 times to 5%, and even at 20% of UST, DeFi has reached its upper limit.

It should be noted that the trillion-dollar RWA assets will only reduce the average rate of return of DeFi and will not increase. This is in line with the law of sublinear scale scaling. The extreme expansion of system scale will not lead to the extreme increase in capital efficiency.

Please also note that there is a market motivation for DAI's 150% over-staking ratio: I can make additional profits at 150% pledge ratio, so assuming it is my personal opinion and it is not necessarily correct.

We can be more blunt. The current on-chain economic system, based on the token economy, has an actual upper limit of US$300 billion and a yield of around 5%. In the same sentence, this does not mean that the total market value, the upper limit or lower limit of a single token, but that the overall tradable scale is so large.

In fact, you can't sell 2 trillion Bitcoins, and U.S. bonds cannot handle such a large selling scale.

Conclusion

Looking at the history of blockchain development since Bitcoin, the discrete trend between public chains has not been bridged. Bitcoin is increasingly decoupled from the on-chain ecosystem, and the failure of on-chain reputation system and identity system has led to the over-collateralization model becoming the mainstream.

Whether it is stablecoins or RWA, they are all leveraged-winding off-chain assets, that is, off-chain assets naturally have higher credibility. Under the current on-chain scale law, we may also touch the upper limit of scaling law or Moore's law. It took only 5 years since DeFi Summer, and only 10 years since the birth of Ethereum.

chaincatcher

chaincatcher