The exchange's BTC supply hit its lowest level since 2018, and breaking through a new high is in sight?

Reprinted from panewslab

04/28/2025·16DSource: cryptoslate

Compiled by: Blockchain Knight

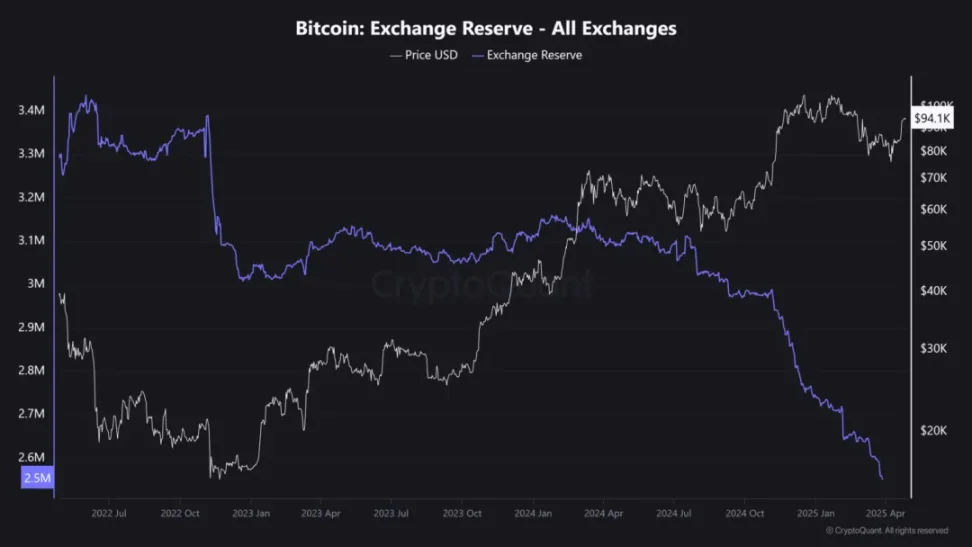

According to CryptoQuant, as of the end of April 2025, the supply of BTC held by centralized exchanges had fallen to its lowest level since 2019, with only about 2.5 million BTC remaining, a decrease of 500,000 from the end of 2024.

Exchange BTC supply shows a trend of transfer to self-custody

The decline in exchange BTC supply is widely interpreted as a signal that investors are transferring BTC from the platform to private self-custodial wallets. This behavior is often associated with a long-term holding (HODLing) strategy, as investors withdraw tokens from exchanges to reduce potential selling risks due to the ease of operation of the platform.

Removing BTC from the exchange has been a growing trend since the beginning of 2023, when the exchange's BTC reserves were about 3.2 million. This trend has accelerated over the past year with the participation of major institutional investors.

Institutional demand may trigger global BTC supply shortage

Institutional demand for BTC could be a key factor driving supply shortages. For example, giant companies such as Fidelity have recently increased their holdings of BTC, and Fidelity alone purchased $253 million worth of BTC, which directly exacerbated the outflow of exchange tokens.

BTC veteran Dennis Porter excitedly said: "We have never seen this before. Global BTC supply shortages have never happened. This is a major positive signal."

Cas Abbe, a well-known Crypto asset trader, also pointed out on social media: "BTC exchange supply has dropped to its lowest level since the third quarter of 2018. So far, only 2.5 million BTC remain on the exchange, a decrease of 500,000 from the fourth quarter of 2024. A few days ago, Fidelity mentioned that institutions are continuing to buy and withdraw BTC from the exchange. Supply + demand = price explosion."

According to a latest Coinbase survey, more than three-quarters of institutional investors plan to increase their digital asset allocation ratio in 2025, many of which have used BTC to diversify their investment portfolios as a hedge against macroeconomic uncertainty.

In addition, listed companies represented by Strategy are also actively hoarding BTC. Since November 2024, these companies have withdrawn more than 425,000 BTC from exchanges, with a cumulative holding of nearly 350,000.

The impact of shrinking supply of exchange BTC on the market

The reduction in exchange BTC supply has several impacts on the market, including the reduction of selling pressure. As the amount of BTC available for immediate sale decreases, the risk of large-scale sell-offs is reduced, which helps stabilize or even drive up prices.

If demand continues to grow and supply continues to be limited, the market may face supply shortages, which have often led to sharp price increases in history.

On-chain analyst Willy Woo commented: "BTC fundamentals have turned bullish and the conditions for breaking through the all-time high are ripe."

The shift to self-custody and long-term holding reflects the maturity of the Crypto asset market, where both retail and institutional investors increasingly view BTC as a strategic asset rather than a speculative tool.

The decline in exchange BTC supply is generally seen as a bullish signal, but it also means that a surge in demand may trigger intensified price volatility. In the coming weeks, the market will verify whether this supply shortage will drive a new round of growth in BTC prices, or whether market sentiment will change with the emergence of new macroeconomic data.

jinse

jinse