Trading Moment: Trump's 100-day approval rating hits a 80-year low, Bitcoin's $94,000 to $99,000 whale selling pressure became the focus of breakthrough

Reprinted from panewslab

04/28/2025·16D

1. Market Observation

Keywords: BONK, ETH, BTC

Trump will usher in a 100-day ruling node for his second term on April 29, but his approval rating continues to decline to 39%, setting the lowest 100-day rating for presidents in the past 80 years. Polls show that 72% of Americans believe that their economic policies may trigger a short-term recession, 53% of respondents believe that the country's economic situation has deteriorated, and 41% feel pressure on their personal financial situation. The Trump administration's trade protectionist policies and tariff measures have exacerbated market volatility. The S&P 500 index has fallen by about 8% since its inauguration, the worst 100-day performance since 1974; the US dollar index plummeted 9% during the same period, the weakest start since the Nixon era, and funds accelerated to gold and non-US assets. At the same time, the Federal Reserve is in a policy dilemma due to the coexistence of inflationary pressure and recession risks, and the room for interest rate cuts is limited. The combined comments on Trump's intervention in the independence of the central bank have further weakened market confidence. Wall Street strategists generally recommend reducing their holdings of US stocks and US dollar assets when highs are highs. Bank of America emphasizes that global capital allocation is shifting from "American exceptionalism" to diversified layout, and gold and emerging markets have become safe-haven choices.

Bitcoin recently broke through the key resistance level of $95,000, and ran steadily above the 21-week moving average. It also stood firm at the 23.6% Fibonacci retracement level of $87,045, providing a clear stop loss reference for bulls. Although Bitcoin only recorded a 43.4% increase after the halving in April 2024, significantly weaker than the historical cycle performance, the strengthening of gold and the diversification trend of US dollar assets still give it long-term allocation value. Crypto analyst Willy Woo believes that the acceleration of on-chain capital inflows lays the foundation for breaking through historical highs, with the medium-term target pointing to the range of $103,000 to $108,000. Citibank predicts that if the stablecoin market size grows to $1.6 trillion based on the benchmark scenario, the price of Bitcoin may reach $285,000 in 2030, and in optimistic cases, it may even look at $475,000. Even under conservative assumptions, the price may double to more than $190,000. But analyst Ali warned that Bitcoin faces selling pressure of 1.76 million BTC in the range of 2.61 million wallet addresses in the $94,125-99,150 range, and still need to be wary of fluctuations during periods of weak market liquidity.

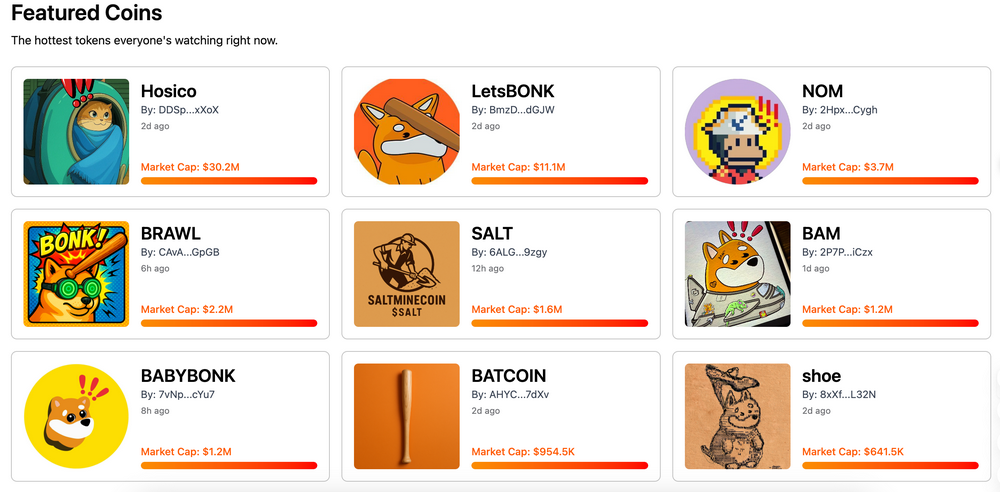

Sui's ecological popularity continues to remain unabated. Its token SUI will unlock 74 million pieces (accounting for 2.28% of the circulation) on May 1, worth about US$267 million. Its ecological projects DeepBook, MemeFi, and Walrus have also seen significant increases recently, and Binance Alpha will also launch its ecological project Haedal Protocol on April 29. Currently, SOL is still hovering around US$150. The ecological project PENGU has increased rapidly in the past week, pulling up more than twice. The new MEME token HOUSE has temporarily exceeded US$78 million in market value recently and has fallen back to around US$67 million. In addition, the leading Meme project BONK announced yesterday that it would launch Letsbonk.Fun, a Meme coin issuance platform jointly developed with Raydium. Currently, multiple million-cap projects such as Hosico, LetsBONK, and NOM have emerged.

2. Key data (as of 12:00 HKT on April 28)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars, GMGN, Letsbonk.Fun)

-

Bitcoin: $94,179.39 (+0.5% year-to-date), daily spot trading volume $17.72 billion

-

Ethereum: $1,794.82 (Year-Date--46.15%), daily spot trading volume is $9.749 billion

-

Corruption Index: 54 (neutral)

-

Average GAS: BTC 1 sat/vB, ETH 0.4 Gwei

-

Market share: BTC 63.3%, ETH 7.3%

-

Upbit 24-hour trading volume ranking: XRP, DEEP, TRUMP, JST, WAL

-

24-hour BTC long-short ratio: 1.0153

-

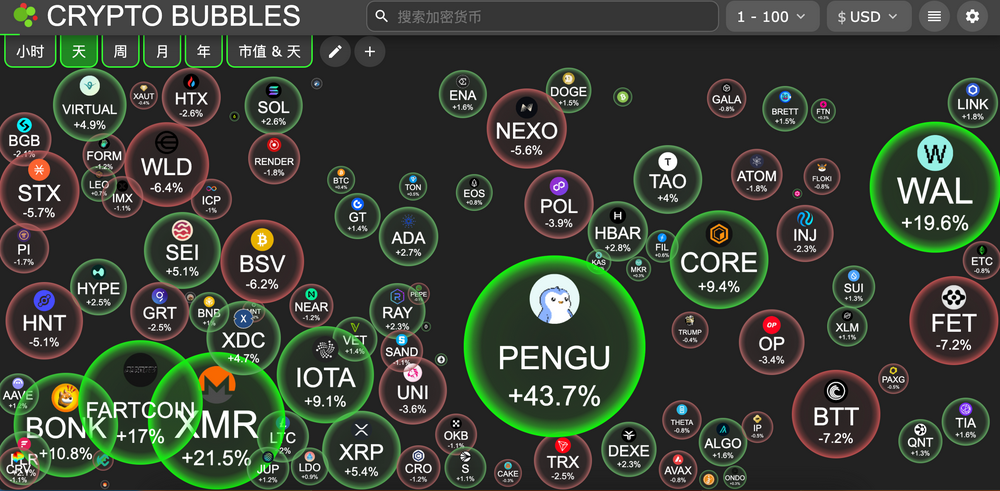

Sector rises and falls: NFT sector rises 7.2%, PayFI sector rises 5.78%

-

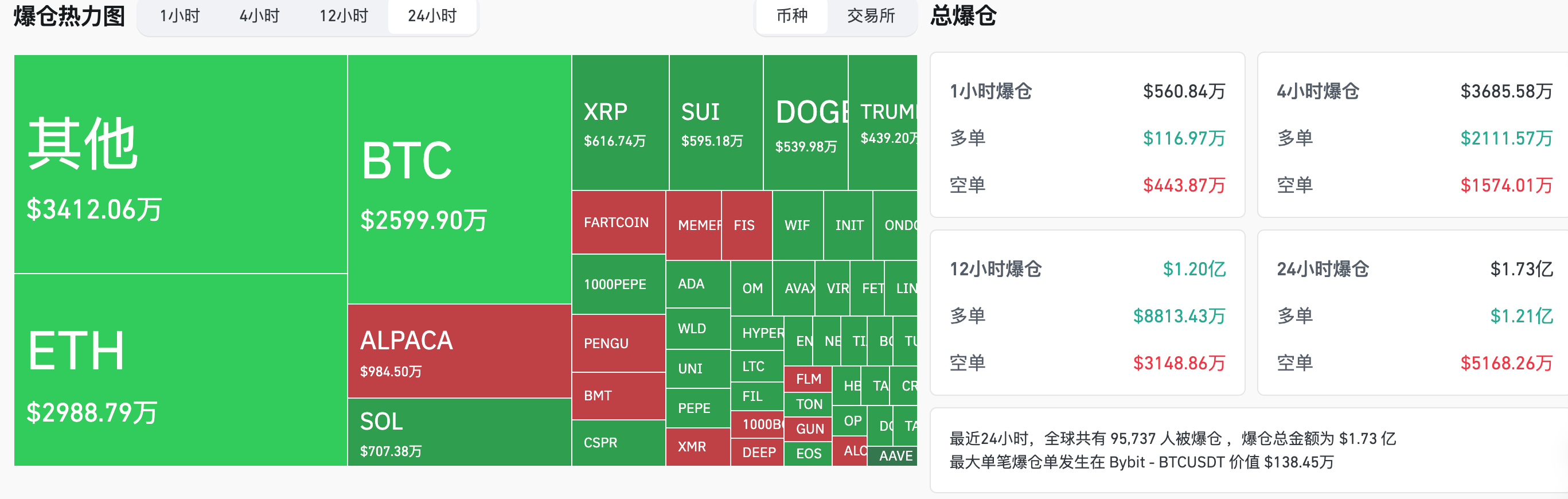

24-hour liquidation data: 95,737 people worldwide were liquidated, with a total liquidation amount of US$173 million, with BTC liquidation of US$25.99 million, ETH liquidation of US$29.88 million, and ALPACA liquidation of US$9.84 million

-

BTC medium and long-term trend channel: upper line ($90816.14), lower line ($89017.80)

-

ETH medium and long-term trend channel: upper line ($1733.27), lower line ($1698.95)

*Note: When the price is higher than the upper and lower edges, it is a medium- and long-term bullish trend, and vice versa is a bearish trend. When the price passes through the cost range repeatedly in the range or in the short term, it is a bottom or top state.

3. ETF flow (April 21 to April 25)

-

Bitcoin ETF: $3.06 billion (the second highest inflow in history)

-

Ethereum ETF: $157 million (ends 8-week net outflow)

4. Looking forward today

-

Two Arizona Bitcoin reserve legislation to be read on Monday with a final vote likely

-

Binance Alpha will be launched on April 29th Haedal Protocol (HAEDAL)

-

Ouyi will launch spot trading pairs of five currencies including KISHU and MAX on April 29

The biggest increase in the top 500 market value today : CSPR rose 63.43%, UNP rose 52.19%, PENGU rose 44.23%, XMR rose 22.61%, and FWOG rose 18.87%.

5. Hot News

-

Ethereum Foundation researchers propose to increase Ethereum gas cap by 100 times within 4 years

-

Binance Alpha will be launched on April 29th Haedal Protocol (HAEDAL)

-

Market News: IMF says El Salvador has stopped using public funds to invest in Bitcoin

-

Analysis: If Citi predicts a surge in stablecoin supply, BTC may rise to $285,000 in 2030

-

Cryptocurrency advocates call on Swiss National Bank to include Bitcoin in reserve assets

jinse

jinse

chaincatcher

chaincatcher