The crypto industry under "Trump Manufacturing": Challenges and Turning Points in the Tariff Era?

Reprinted from panewslab

04/02/2025·1MText/Hedy Bi, OKG Research

The United States, which has returned to the "salary to the strong and competitive advantage", will fire the first shot of the trade war tomorrow morning (East Time on April 2), and it is already a clear sign to put "America First" above multilateralism. The global economy has been partially realized in the first-tier market, and gold has risen 18% since the beginning of the year, setting new highs again and again. However, there are still opportunities under the crisis. We can seem to smell a glimmer of opportunity from the latest crypto business layout of the Trump family. Although with the high mining costs and meager profit margins, from recent stablecoins to mining machines, the crypto industry seems to accelerate "Made in the United States" and "Made in Trump". In the words of Donald Trump Jr., “There is no upper limit in the future.”

This article is the seventh chapter of OKG Research's special planning of "Trump Economics" in 2025, looking for vitality from the crisis and deeply analyzing the impact of tariffs on the entire industrial chain of the crypto industry.

Tariffs have been known as the "Tax of the Customs and City" since ancient times, and taxes are imposed on transit goods to manage Silk Road trade. As a macroeconomic tool, tariffs directly affect the market price and circulation efficiency of commodities. In other words, for the crypto industry, it is not only necessary to pay attention to the prices of goods and technologies directly related to the chain, but the more profound impact is its reshaping of the overall efficiency of the industry, supply chain liquidity and market structure.

Tariffs will cause Bitcoin mining costs to rise directly by 17%

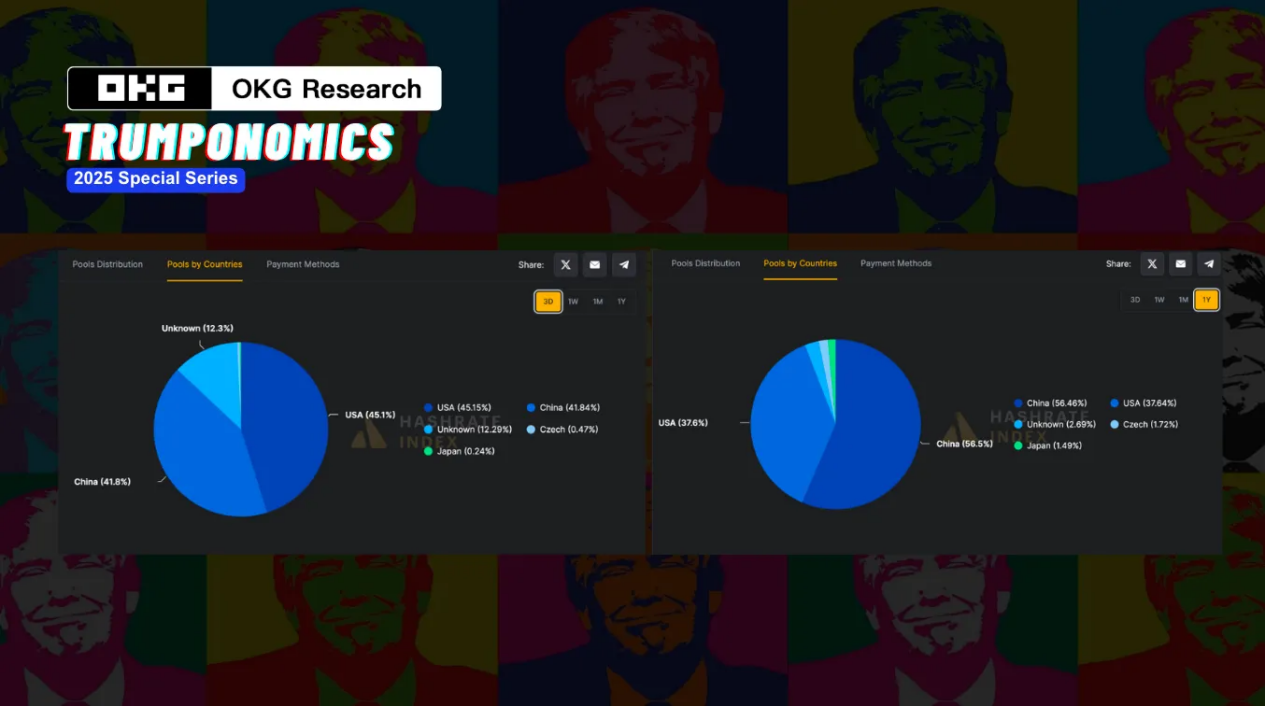

In the cryptocurrency industry, Bitcoin has always been the most representative digital asset and dominates the market structure. According to CoinMarketCap data (April 2, 2025), Bitcoin's market value accounts for 59% of the entire crypto market, far exceeding other digital assets. Bitcoin relies on the Proof of Work (PoW) consensus mechanism, which makes mining machine prices and supply chains a key factor in the market direction. However, although the computing power share of US mining pools has increased from 37.64% to 45.15%, the mining machine supply chain is still dominated by Chinese manufacturers, especially Bitmain, MicroBT and Canaan Technology, which account for more than 70% of the global mining machine market share. Therefore, the Trump administration’s goal of “bringing Bitcoin mining back to the United States” faces huge challenges.

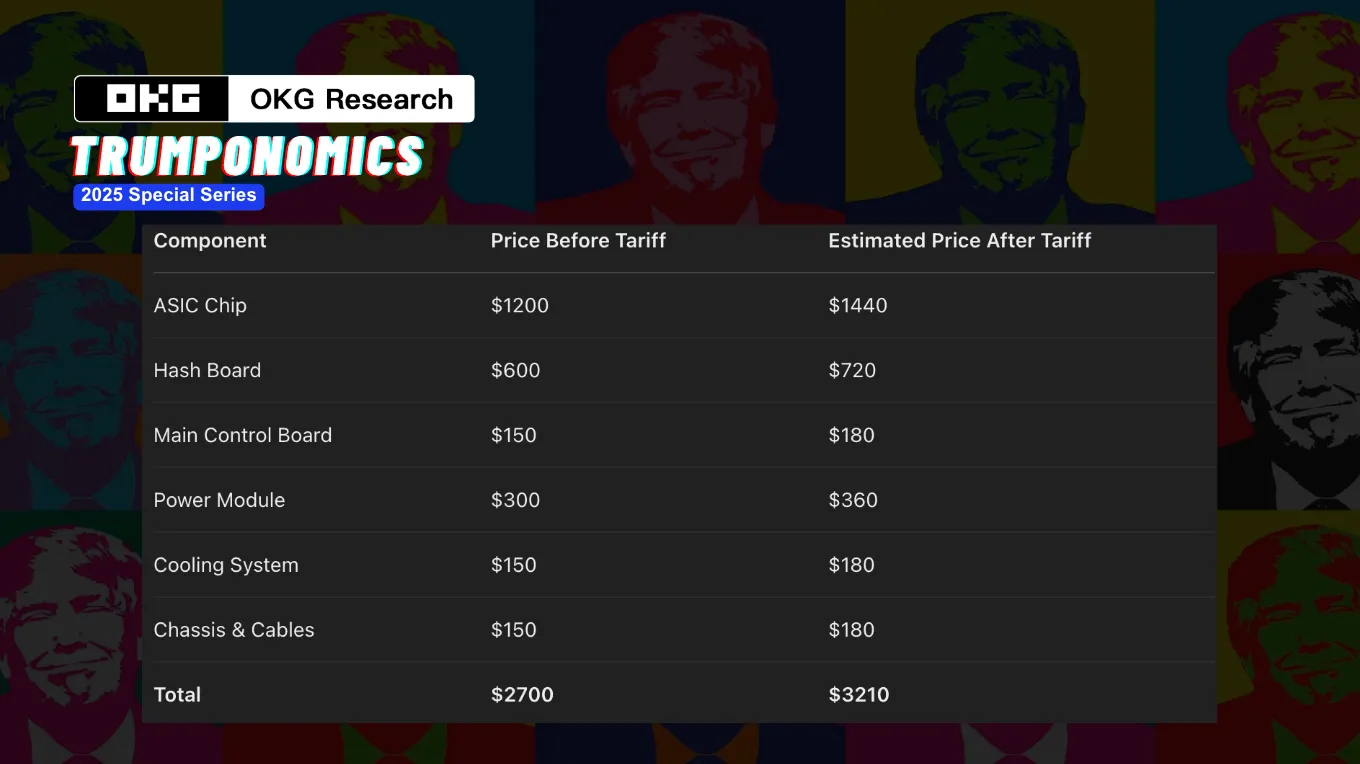

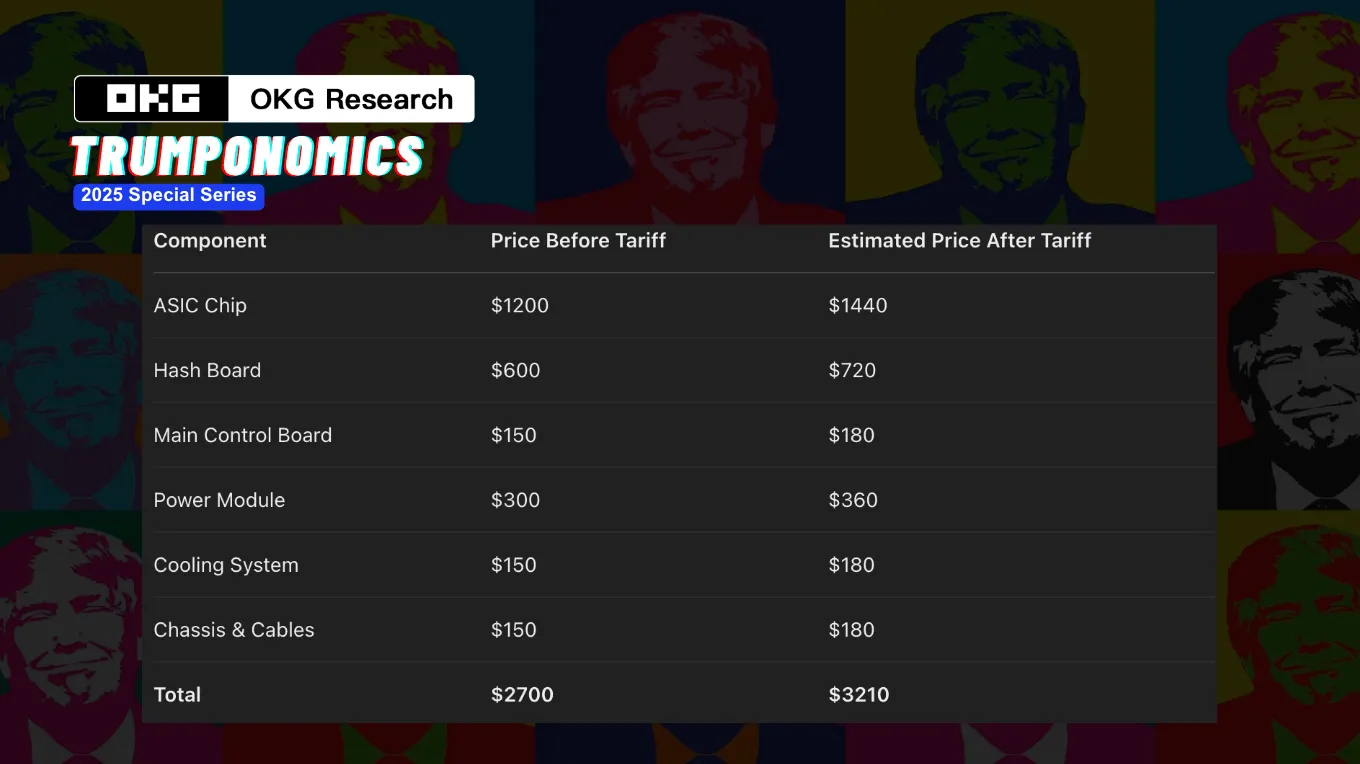

The U.S. tariffs on Chinese electronic products have exacerbated this supply-demand mismatch. It is expected that if China Electronics imposes a 20% tariff, the cost of mining machines will rise by about 17%, which directly affects the return on investment cycle (ROI) of the mine. This change is particularly critical for new mine operators who may need to reevaluate the profit model. In addition, although MicroBT and Bitmain have announced the establishment of manufacturing centers in the United States and Malaysia to promote the de-Sinicization of mining machine production, this transformation has also brought delivery delays, and customers may have to wait 1 to 3 months to receive equipment, posing a considerable challenge to mine operations that rely on timely delivery.

Global semiconductor shortages and U.S. technology export restrictions on China have forced mining machine manufacturers to establish production bases in multiple countries to reduce risks. This change has led to instability in the supply of mining machines, and supply bottlenecks may occur in the short term, which will affect the expansion and operational capabilities of the mine. With the rise in mining machine prices and the intensification of delivery delays, the mining industry may gradually develop towards centralization. Large mining companies will occupy more market share with their financial advantages, while small mining farms may face greater survival pressure, and the extension of the return on investment prompts them to exit the market.

Overall, tariff policies and supply chain volatility are profoundly affecting the Bitcoin mining industry. Increased costs, delayed delivery and instability in the supply chain have extended the return on investment of mines, and also accelerated the process of centralization in the industry. Large mining companies may dominate the market, while small mining farms will face more severe survival challenges. In addition to Bitcoin, other blockchain projects (such as AI) that rely on importing electronic hardware in non-US regions will also face similar cost-increasing pressure.

Off-chain blockade and on-chain opening

The US tariff policy not only directly affects commodity costs, but its far-reaching impact lies in the reshaping of the global financial order. In recent years, the rapid rise of US dollar stablecoins is becoming part of the US financial strategy - building barriers off-chain and accelerating opening on-chain.

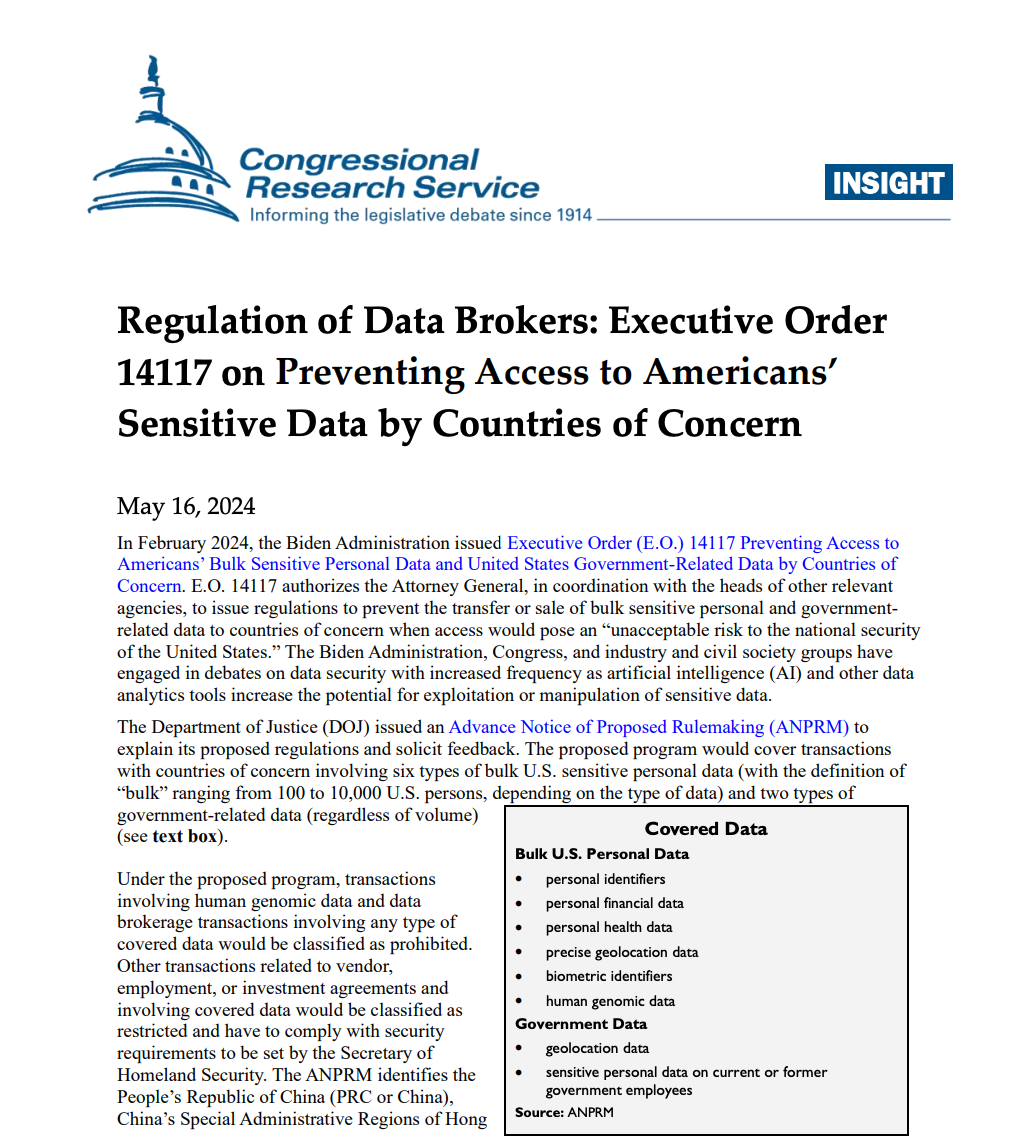

For a long time, the settlement system of global trade has relied on banking networks, and clearing systems such as SWIFT and CHIPS have dominated international capital flows. However, as geopolitical conflict intensifies, the United States not only imposes tariffs, but also deeply reshapes global trade through data decoupling and financial regulation. The most typical example is Executive Order No. 14117 (hereinafter referred to as the "Executive Order 14117") signed by US President Biden in 24, aiming to restrict the acquisition of US data by "countries of concern". The "14117 Executive Order" will officially come into effect on April 8. For example, companies such as Paypal also need to adjust companies within mainland China. The policy is on the surface to target the cloud computing and chip industries, but in fact it also cut off the supply chain data sharing of multinational companies, and has had a chain reaction to trade financing and payment settlement.

Against this backdrop, the US dollar stablecoin has become a new channel for global capital flows. This means that when traditional banking networks are subject to regulatory restrictions, stablecoin networks can still provide US dollar liquidity to global markets. For example, Argentina's financial companies, Southeast Asian exporters, and even some Middle East traders have begun to bypass the banking system and directly use USDC or USDT for supply chain payments. The low cost and instant settlement characteristics of stablecoins make them an ideal tool for cross-border trade. Traditional bank transfers can take 2-5 days and have high fees (the average SWIFT transfer fee is $20-40). Taking USDC as an example, transfers through stablecoins are usually less than 1 cent and can be completed in seconds.

More symbolic is that in countries such as Argentina and Nigeria, the demand for stablecoins is becoming increasingly urgent. In 2024, Argentina will pay a 30% premium when purchasing stablecoins, while Nigeria will pay 22%. Behind these premiums is precisely because of the blockage of traditional financial channels and the depreciation of domestic currencies that stablecoins have become a key tool for residents and enterprises to bypass banking networks and protect wealth.

Post-Tariff Scheme: Liquidity Expansion Beyond the Federal Reserve

After the tariffs, the market demand for US dollar stablecoins will increase. To be more precise, a "shadow dollar market" that bypasses Federal Reserve regulation is expanding rapidly around the world.

In addition to their "debanking" circulation paths, in terms of issuance, the issuance of USDT and USDC relies on US bonds as collateral. This model is still superficially affected by the Fed's policy - after all, the yield on US bonds determines the cost of issuing stablecoins. However, the liquidity creation mechanism of stablecoins is not directly controlled by the Federal Reserve. When market demand for the US dollar rises, stablecoin issuers can quickly issue additional issuances without Fed approval. This means that even if the Fed hopes to tighten liquidity through tightening policies, the stablecoin market can still "release money in disguise" and continue to expand the supply of US dollar around the world.

In the past, the Federal Reserve could adjust the supply speed of the US dollar through the banking system, but now, these "on-chain dollars" are completely free from the banking network, and the Federal Reserve's traditional regulatory methods are almost ineffective in the stablecoin market.

The liquidity of stablecoins is mainly concentrated within the crypto market. The DeFi platform, centralized exchange (CEX) and on-chain payment system form an "internal cycle" of stablecoins. A large amount of capital has not flowed back to the Fed-regulated financial system, but has remained in this emerging on-chain dollar economy. What's more, many DeFi platforms provide US dollar deposit interest rates far higher than traditional banks, which further weakens the Fed's interest rate transmission mechanism. Even if the Federal Reserve adjusts the benchmark interest rate, the flow of funds in the stablecoin market still operates according to its own logic, becoming a relatively independent dollar financial system.

Demand from the stablecoin market has also pushed up the market demand for US bonds and lowered the yield on US bonds. It is worth noting that with the introduction of RWA, the liquidity of stablecoins has also begun to enter a wider asset pool, further exacerbating this trend. This means that the interaction between the stablecoin market and the US bond market will be more complex, and may even affect the capital pricing logic of the global capital market in the future.

The date of the tariff announcement, known as the "Liberation Day", will more or less restrict both in terms of cost and circulation, but the United States is quietly reshaping the global financial structure by strengthening off-chain blockade and expanding the liquidity of the US dollar on the chain. From decoupling of supply chain data, to restricted bank clearing, to the rapid rise of stablecoins, we seem to be witnessing a financial change.

Do you still remember the original intention of Bitcoin written in the white paper? A fully peer-to-peer electronic currency should allow online payments to be sent directly from one party to the other without the need to go through a financial institution. Perhaps, we are already standing on the threshold of this vision.

chaincatcher

chaincatcher