The coin issuing platform has been rolled up, but have you made money?

Reprinted from chaincatcher

05/16/2025·0MAuthor: Jesse, BUBBLE

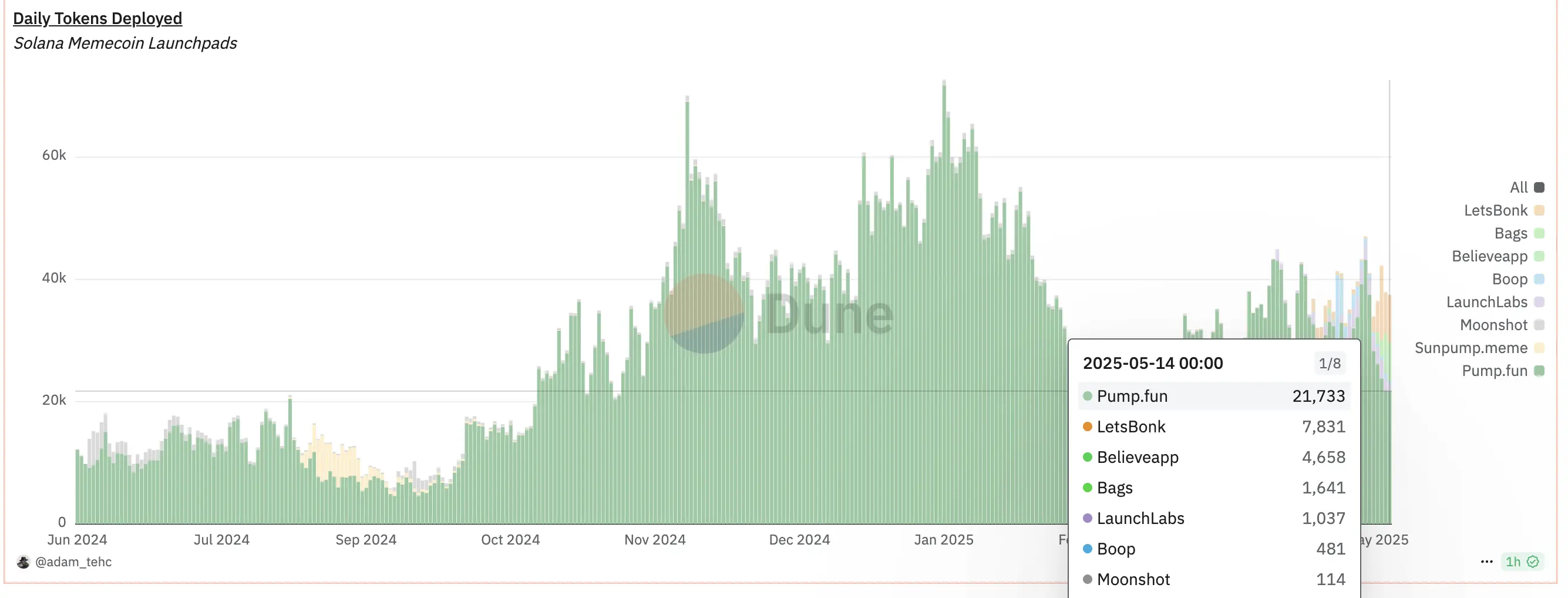

In the past year, the Launchpad market, the Meme coin issuance platform on Solana’s chain, has experienced explosive growth and has rapidly formed a fierce competition. Pump.fun, as the earliest platform to rise, is regarded as a catalyst for the prosperity of Solana's "on-chain casinos". The platform allows any user to issue tokens without threshold, adopts binding curve pricing, creating a fair issuance model without pre-sales and team share.

With the advantages of Solana's low-cost, high-speed transactions, Pump.fun triggered a meme coin frenzy in 2024. In just 13 months, platform users issued more than 8 million tokens. At its peak, on October 24, 2024, more than 36,000 tokens were produced per day, with an average of 25 new tokens per minute. This unprecedented scale of token creation made Pump.fun exclusively the market for a time and also made Solana known as the largest "casino" on the chain. However, Pump.fun's success also brings concerns. On the one hand, a large number of low-quality projects have emerged, with a graduation rate of less than 1%, and most of the tokens have been short-lived. On the other hand, the platform is profitable but users generally suffer losses. Statistics show that nearly 90% of users lose their principal or make less than US$100 in memcoin transactions, while the platform earns about US$98 million in just 6 months.

As of the end of 2024, Pump.fun's official revenue has exceeded US$223 million (about 1.15 million SOLs), and the SOLs have been continuously cashed in. In just one and a half years, the platform's fee account sold about 3.403 million SOLs (about 629 million US dollars), becoming the second largest source of selling pressure after Solana's early investor FTX/Alameda. Such a huge outflow of funds has caused the community to worry about the sustainability and ecological impact of the platform. Faced with the situation where Pump.fun is dominant, market participants acted quickly, and the entire Meme Launchpad track entered a fierce competition. In the Solana ecosystem, the old decentralized trading platform Raydium launched LaunchLab to compete with Pump.fun; the popular meme coin BONK opened the LetsBonk.fun launch platform; the on-chain aggregator Jupiter also tried to launch similar services.

Daily token deployment, data from @adam_tehc's DUNE

The challenge of Pump.fun

As a pioneer in the one-click launch platform of meme coins, Pump.fun has established a basic operating model. Users only need to fill in basic information such as token names and symbols, and automatically deploy token contracts and establish transaction pools without programming skills, which greatly reduces the threshold for issuing coins. The platform adopts a variety of binding curve pricing models to balance initial prices and market demand. The issued tokens can be traded immediately in the platform AMM pool without the need to inject liquidity in advance.

The platform has innovatively introduced an LP share destruction mechanism. When the new currency reaches a specific market value threshold, part of the liquidity will be automatically injected into the Raydium trading pool and destroyed the corresponding LP tokens, ensuring that the project party cannot withdraw the pool and run away, improving liquidity security.

With the experience of "no code issuance and instant transaction", Pump.fun quickly became popular in 2024, giving birth to a large number of creative meme tokens, including hundreds or even thousands of times coins, attracting many speculators. By drawing transaction fees, the platform has become one of the most profitable on-chain applications in 2024.

However, with the development, the problem of Pump.fun has gradually emerged: less than 1% of the more than 8 million tokens issued successfully "graduated" and entered the external liquidity pool; user returns were seriously polarized, forming a zero-sum game; the platform monetized the handling fee and continued to sell SOL, which caused selling pressure on the Solana network; although the completely anonymous and no audit model is in line with the spirit of encryption, it brings regulatory and trust risks. As a result, Pump.fun's growth slowed down at the beginning of 2025, with daily trading volume falling from its January peak of US$544 million to US$270 million in February, a drop of nearly 50%.

Pumpfun's token graduation rate continues to decline weekly

LaunchPad's wheel battle- LaunchLab, Boop, Believe

LaunchLab 's on-chain Degen play

Raydium LaunchLab is one of the most direct competitors of Pump.fun in the Solana ecosystem. Raydium itself is an important AMM protocol on Solana and has benefited from the Pump.fun project that contributed 41% of its Swap fee income. But with Pump.fun's self-established portal, Raydium's traffic and transaction volume were significantly impacted.

In March 2025, Raydium released LaunchLab, which is seen as a direct counterattack against Pump.fun. The overall mechanism of the platform is highly similar to Pump.fun, both supporting one-click issuance and curve pricing, but has targeted optimization in details.

Supports multi-pricing curves, allowing project parties to choose linear, logarithmic or index models based on token positioning; set a lower transaction fee rate of only 1%, which is lower than 2% of Pump.fun, and there is no additional transfer fee; the graduation threshold has also been lowered, and only 85 SOLs (about 11,000 US dollars) can be transferred to the Raydium AMM pool; at the same time, a creator share mechanism is introduced, and the founder of graduation tokens can continue to receive 10% of the handling fee sharing; the platform has also strengthened ecological integration, including handling fee repurchase platform coins RAY, supporting LP locking, and introducing pricing diversity.

On the day of the news, RAY coin rose 14%, and the market has high hopes for Raydium LaunchLab. Although the official stated that LaunchLab is "providing an alternative", it has actually successfully attracted some projects to turn, weakening the dominance of Pump.fun.

In addition, LetsBonk.fun, jointly launched with the BONK community, and many other platforms such as Meteora, Boop, and Genesis Launches, are also striving to break through and push the entire Launchpad market into a comprehensive competition stage.

LaunchLab's daily active users grow rapidly

Believe 's new approach, creative narrative product-based concept approach

As the Meme Launchpad track becomes increasingly crowded, the "rebirth" of the Believe project has attracted widespread attention in the industry.

As the Meme Launchpad track becomes increasingly crowded, the rebirth of the Believe project has attracted widespread attention in the industry. Believe, founded by Australian entrepreneur Ben Pasternak, was formerly the social token platform Clout. Ben has created several popular applications and successfully monetized them, but Clout has quickly become silent due to its over-reliance on the celebrity effect. At the end of April 2025, Ben returned to the market with the upgraded platform Believe, shifting his concept from "Believe in Someone" to "Believe in Something", emphasizing the value belief in creativity and ideas, marking the platform's strategic transformation from social asset trading to creative incubation factories.

Ben himself commented on the change, "This is a change from Influence to Trust. We no longer hype celebrities, but instead look for meaningful projects."

Believe adopts a unique product mechanism and uses social platforms as the entrance to issue coins to achieve seamless connection between Web2 and Web3. Users only need to attach the token name on the X platform @LaunchACoin, and the system will automatically use Meteora's joint curve to create tokens without logging in to the DApp or filling in forms. This interactive model of "discussing coins" allows any valuable ideas to be converted into tokens immediately, greatly reducing the threshold for participation. The platform also established a "Point B" mechanism. When the token fee income reaches the critical value, the founder can withdraw funds to support the project. If the standard is not met, it will be regarded as a market veto. Although point B is not a hard numerical threshold, the logic behind it is similar to the Kickstarter-style crowdfunding mechanism. "Trading popularity is market voting"

Alliance DAO founding partner Imran Khan once commented that "the founder or Scout tag @LaunchACoin is born. The market will assign value to the problem based on the importance of the creativity to solve." In short, market popularity determines the fate of the project.

In terms of revenue structure, Believe has also carried out a series of innovative designs. Each transaction is charged a 2% handling fee. Unlike other LaunchPads, its tokens still have a transaction tax of 2% each in the launch contract, but its distribution structure is highly incentivized: 1% is allocated to the token creator (founder), 0.1% is rewarded to Scout (the first user to discover or promote the token), and the remaining 0.9% is operated by the platform. This mechanism not only provides instant revenue guarantee for creators, but also incorporates "token discoverers" into the income sharing system for the first time, greatly inspiring the community to actively discover and spread high-quality creativity.

Since its launch, Believe has recorded a total transaction volume of US$1.8 billion, bringing creators $9.5 million in direct revenue, of which US$4.7 million belongs to Believe tokens.

According to BelieveScan panel data, Believe's handling fee income in the past 24 hours was about 10 million yuan

While opening up the issuance of coins, Believe also tried to manage the platform order to avoid becoming a place where junk coins are flooded.

In terms of creator incentives, Believe's mechanism is to choose to share with issuers, and 1% of each transaction is directly returned to the creator; there is no reserved position or token ratio control, and the founder can freely define distribution; a Scout incentive mechanism is established to promote "decentralization" of content discovery; the platform actively displays data such as transaction volume, creator income, etc. to enhance transparency. The addition of some Web2 entrepreneurs has also enhanced Believe's Meta temperament. RizzGPT developer Alex Leiman, well-known hacker Ruben Norte, etc. have all issued personal tokens on the platform, and the project's market value has all surged to millions of dollars, pushing Believe's image from a pure Meme player park to a "creative value test site".

This narrative logic is particularly evident in the LaunchCoin incident. The token was formerly PASTERNAK issued by Ben personally. It was later renamed LaunchCoin when the platform was launched and gave it functional significance. LaunchCoin soared 200 times on the day it went online, with a market value exceeding US$200 million, which caused heated discussions in the community for a while.

Some users regard it as a sign that the platform has officially entered the token governance stage; the other part questioned whether Ben used his founder's identity to arbitrage. In the end, Ben sold most of his holdings in batches, making a profit of about $1.3 million. LaunchCoin’s fate has sparked heated debate in the community around the core theme of “trust”. Whether it is supporters or doubters, this storm has successfully brought Believe's brand positioning back to the center of discussion and verified its focus on value.

Trust narrative emphasizes the value behind creativity, no longer simply encourages stupid operations, and attracts more rational Builders and entrepreneurs. The interest bundling mechanism allows creators, Scout, and the platform to have profit mechanisms, allowing participants to bind interests at the economic level and continue to incentivize high-quality content. Under this mechanism, although there are many Web2 talents with product launch tokens at present.

However, the real feedback from the current community after participating is that after the token is launched, the robots get most of the chips, and because there are fewer sell orders at the beginning, high-quality projects will quickly reach a market value of more than 5-10 million US dollars. Subsequently, the transaction tax will decrease, and robots with a large number of chips will sell in large quantities. Therefore, many tokens with a market value of hundreds or even tens of millions have appeared, but the continuity is not very good. Some people in the community believe that it is good for entrepreneurs, Scout, and platforms, but these are all paid by retail investors.

Ben hopes to seek a dynamic balance between "empowering real value projects" and "suppressing blind speculative bubbles" through Believe. Although the market is still controversial about whether it will truly go in the long run, at this stage, Believe has successfully established a differentiated label in the fierce battle of Meme Launchpad with mechanism innovation, topic events and hot product data.

Comparison of key differences on the head platform

After experiencing the follow-up imitation of Pump.fun's first-rate platform, the current Meme Launchpad market has formed multiple leading camps. The following is a horizontal comparison of Pump.fun, Raydium LaunchLab, Boop and Believe in key dimensions.

Issuance method and threshold

Pump.fun, LaunchLab and SunPump both use DApp page-based one-click coins. Users need to log in and fill in the relevant token information to complete the deployment process. Believe completely breaks out of the DApp paradigm and uses Twitter social links to trigger the issuance of coins without entering the platform page.

From the perspective of threshold, Boop, Pump.fun and LaunchLab have almost no requirements for issuers, and any user can issue coins at any time. Believe appears to have zero threshold, but in fact, it has formed a kind of "natural screening" through social relationship networks, focusing on entrepreneurs such as Ben and Alex, and becoming the first creators and participants.

In terms of "graduation threshold", Pump.fun was initially set to a market value of $69,000; LaunchLab was initially set to 85 SOL "about $11,000", but the launch mode of a minimum of 30 SOL can be set, with a lower threshold; while Believe does not set a fixed threshold, and it is judged whether the creativity is accepted by the market based on the "Point B" transaction fee income.

Processing fee structure and allocation mechanism

Pump.fun charges a 2% transaction fee, which is originally owned by the platform, and 50% of the creator will be returned to May 2025; LaunchLab's transaction fee rate is 1%, of which 25% is used to repurchase the platform currency RAY, and the founder can apply for an additional application to obtain up to 10%; Believe charges a 2% transaction fee and is embedded in the token contract, of which 1% is reserved for the creator, 0.1% is reserved for Scout, and 0.9% of the platform. Judging from the data, Believe provides the highest share ratio for creators among all platforms, and at the same time, it pioneered Scout share incentives, so that discoverers can also continue to benefit.

Community participation and governance

Pump.fun follows extreme liberalism, without auditing and governance mechanisms, and the community relies on spontaneous organization to spread hot topics, but it is also easy to be manipulated by dealers, and retail investors "lose more and win less."

Raydium LaunchLab uses its AMM background to bind DeFi community resources and circulate within the ecosystem through platform coins; Boop relies on Dingaling's previous influence in the community.

Believe tries to join community consensus decision-making elements in governance. Through coin-holding governance, Snapshot voting, etc., we will discuss whether tokens will enter the DEX liquidity pool in the future, whether to support and promote, etc., forming a prototype framework from "issuing coins means governance". If it matures in the future, its user community stickiness is expected to exceed that of the current mainstream platforms.

Creator economic model

In terms of creator motivation, Believe and LaunchLab are the most attractive. Based on the 1% fee for issuing coins, Believe combines the Scout reward mechanism to build a flywheel effect of issuing coins → attracting new coins → issuing coins again.

LaunchLab retains creators through low thresholds, high degrees of freedom and RAY repurchase. Pump.fun loses some of its attractiveness in the new environment due to its lack of early incentives.

LaunchPad's Market Outlook

As the Meme Launchpad market enters its maturity from the explosive stage, some key trends are emerging, providing a reference for platform competition and industry evolution.

The data craze has faded, and refined competition has begun

On-chain data shows that the craze for memcoin issuance is falling. Taking Pump.fun as an example, its daily trading volume and daily coin issuance fell significantly at the beginning of 2025, and the "one-night wealth"-style myth is difficult to replicate on a large scale.

This means that the brutal growth phase is about to end, and competition among platforms will shift to refined operations. Whoever can continue to create hot products, improve creators' yields, and improve user trading experience will take the initiative before the next round of craze. The data of Pump.fun users voting with their feet (transaction volume halved) also shows that if the platform cannot improve participants' profit and loss structure and emotional experience, even the first-mover advantage will gradually be eroded.

Business model shifts from "harvest" to "win-win"

Pump.fun's early profit model is simple and crude: the platform charges handling fees, and the user's winning rate is extremely low, forming a unilateral structure of "platform wins, user loses". New platforms represented by Believe and LaunchLab generally take the means of concession to creators and communities to grow.

For example, Believe directly returns 1% of the handling fee to the founder, encouraging creators to continue to produce content; LaunchLab builds an ecological closed loop with more endogenous growth through handling fee sharing and RAY repurchase. In the future, Launchpad will emphasize more on win-win results between the platform, creators and users, forming a true "content incentive network".

Pump.fun recently launched a creator profit sharing mechanism, which can also be seen as a reverse force for old players by this new model.

Multi-chain pattern has become the norm, and each ecology has explored

its own Meme soil

As the competition for Solana-based platforms (Pump.fun, LaunchLab, BONK) becomes fierce, other public chains are also stepping up their deployment of their own Meme Launchpads: Tron's SunPump, Solana's Boop, Base's Genesis Launches, and even projects with ICP and Avalanche ecosystems are beginning to test the waters.

In essence, the Meme coin issuing platform has become a powerful tool for public chains to compete for active users. Because of its low threshold and strong topic attributes, Meme coins are naturally suitable for building on-chain traffic.

In the future, major public chains may spawn one or two top Meme Launchpads, and deeply integrate with wallets, social networking, and NFT tools, becoming an important indicator of ecological activity and user loyalty.

Community culture and narrative construction will become a platform moat

The core of Meme is not technology, but narrative. The platform itself is no exception:

Pump.fun once started with "extreme freedom and absolute openness", but it also fell into the problem of bankers rampant and poor project quality;

Raydium emphasizes "fair launch, technical optimization", shaping the image of "Avenger" and striving for native users to return;

Boop feeds back the ecosystem of personal brands "Dingaling" and $Boop, focusing on the value recycling of core tokens;

Believe took the "trust and value" route, trying to attract the Builder group and use creativity as the source of Meme.

In the future, community culture will directly determine what kind of user population the platform attracts: whether it is Degen (pure speculation), KOL (with single type), Builder (value-oriented), or mass users (mainly entertainment). The platform's differentiated positioning will no longer stop at the product mechanism, but will expand to the level of emotional consensus and cultural atmosphere.

Judging from the daily token deployment ratio, Pumpfun's market share has changed from a significant monopoly to 57%.

From Meme to ICM, a new entrepreneurial incubation path emerges

Although 99% of Meme coins are still short-term speculation, some projects have begun to try to "go from Meme to products". Some founders use handling fees to establish initial fund pools, start building teams, and develop prototypes; some platforms, such as Believe, encourage founders to cash out Roadmap through the mechanism of "releasing start-up funds after reaching point B";

The community has begun to conduct long-term observation and governance of some tokens. For example, LaunchCoin has experimental value in governance, distribution and functional expansion. If a small number of Meme projects are successfully incubated into actual products through Launchpad in the future, its "symbolism" will have a profound impact on the entire industry: it proves that Launchpad can not only incubate speculative coins, but also nurture Web3 projects. By then, Launchpad will no longer be a "issuance tool", but a "project cold start infrastructure".

Summarize

Meme Launchpad is standing at the critical point of moving from a savage outbreak to refined operations. The situation of Pump.fun's dominance has been broken. Platforms such as Raydium LaunchLab and Believe entered the market through differentiated strategies and gradually seized the share of users and creators.

The winners of the future industry may not necessarily be the one with the lowest handling fee, but the one who can build content flywheels, community consensus and platform trust mechanisms. Believe has initially established its own differentiated moat through social distribution models, Scout incentive mechanisms and governance explorations, showing strong iteration and growth potential. Of course, this is still a marathon competition. A platform that can truly stand out must balance it in multiple dimensions of "cultural identity, win-win creators, ecological governance, and safety compliance".

As Ben Pasternak said, "We are not just building a platform, we want to give every good idea a possibility of monetization." This may be the most trustworthy direction for Meme Launchpad's next stage.

panewslab

panewslab