The BRC20 ecosystem is recovering, and we are about to usher in the third wave of inscriptions?

Reprinted from panewslab

02/25/2025·2MAuthor: ChandlerZ, Foresight News

On February 24, the on-chain Gas fee on Bitcoin chain increased significantly after experiencing a long low run, from an average of 1-2 Satoshi/bytes that climbed to more than 12 Satoshi/bytes. A few weeks ago, the Bitcoin memory pool was completely cleared for the first time in nearly two years, but the number of unconfirmed transactions has climbed back to more than 100,000.

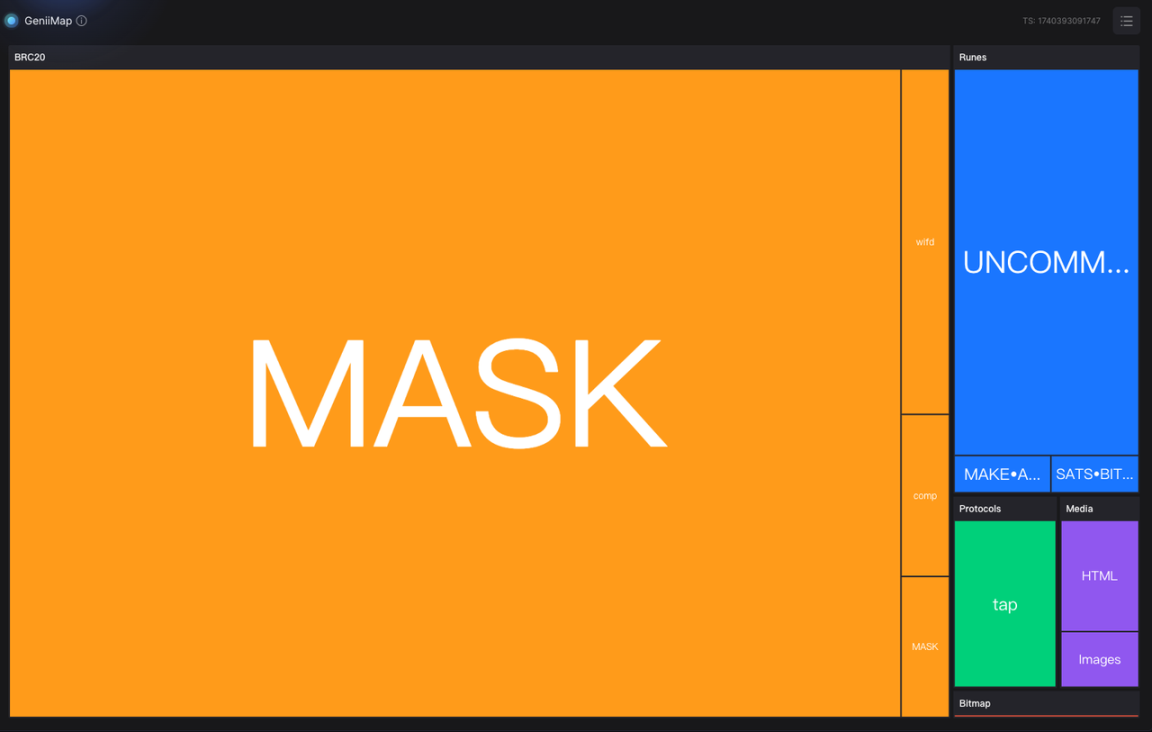

According to Geniidata data monitoring, on-chain casting activities have shown a highly concentrated feature over the past 24 hours, focusing mainly on the MASK project.

The total number of MASK minted is 2.1 million pieces, each containing 10 tokens. The current market price remains around US$0.18 and the total market value is approximately US$3.06 million. As of the latest data, the project's casting progress has reached 82.69%, and this increase in activity has triggered extensive discussions in the market that the BRC-20 ecosystem may usher in a new round of recovery.

From the perspective of deep market logic, the current crypto market is at a special time node. At a time when the cabal theory of Solana Ecology and BSC Ecology is widely questioned, the BRC20, which to some extent symbolizes "fairness", seems to have regained market attention. However, the market's memory has not faded with time, and the previous violent fluctuations in the Bitcoin ecosystem still left a shadow on the market.

Seeing him building a tall building, he saw his building collapse

According to The Block data, since April 20, 2023, driven by the BRC-20 ecosystem, the number of transactions on the BTC network has begun to rise sharply, and the transaction volume has increased by nearly 1 times in less than a month. . The rise in transaction fees was even steeper, up nearly 10 times in less than half a month. During the most active stage of the BRC-20 ecosystem, more than 70% of transactions on the Bitcoin chain are related to the BRC-20 project.

Behind this appearance of prosperity, there is a fragile ecological foundation. After entering 2024, the Bitcoin ecosystem gradually fell into a downturn. This transformation actually reflects the deep dilemma of the market for the Bitcoin application layer. Although the market had high hopes for the Bitcoin ecosystem and believed that innovation based on the inscription protocol could inject new vitality into the Bitcoin network, the actual development trajectory has deviated greatly from expectations.

Looking back at the development of the BRC20 ecosystem, we have to face a cruel reality. Most of the early popular projects experienced extremely significant price retracement, ORDI fell from a high of US$87 to US$11, Sats fell from 0.00000086 to 0.00000012, others The projects and even the NFTs of the Bitcoin ecosystem can even be said to have fallen by as much as 90%, and have long since returned to zero, and only projects with serious ground-based cultural heritage remain.

This phenomenon is not accidental, but an external manifestation of deep-seated market structural problems. The BRC20 protocol has taken "real fairness" as its core concept at the beginning of its design, and has eliminated reservations and scientist mechanisms through a completely transparent on-chain mechanism, trying to provide truly equal opportunities for participation for all market participants. This design does achieve maximum decentralization in theory, but it reveals significant limitations in practice.

The paradox of fairness and disk control

From the perspective of market structure, the scientist mechanism and initial chip allocation system in traditional encryption projects are essentially a market regulation tool. Although these mechanisms are often criticized as manifestations of centralization, they play an indispensable role in maintaining market stability. Through these mechanisms, the project party can regulate market fluctuations to a certain extent and provide necessary price support for the long-term development of the project.

However, the fully open casting mechanism of the BRC20 ecosystem, although maximizing the fairness of participation, also leads to a high degree of dispersion of the bargaining chip structure. In the absence of an effective price support mechanism, market volatility often manifests more severely. In this case, when market sentiment changes, it is easy to have a chain reaction, resulting in a rapid decline in prices.

The deeper problem lies in the motivation for large funds to participate. In traditional crypto projects, large funds can influence market trends through various mechanisms to obtain profits. However, under the inscription mechanism of BRC20, this operating space is greatly compressed. When these so-called "bankers" or "institutions" find it difficult to establish effective chip control, they will naturally choose to turn to other markets that are easier to manage funds. This creates a paradox: the pursuit of absolute fairness may instead lead to market instability, which will in turn harm the interests of all participants. In this case, the market needs to find a balance between complete fairness and necessary market stability.

The re-popularity of the MASK project shows to some extent that the market's yearning for fair mechanisms has not completely faded, regardless of whether this project still becomes a "meteor". However, how to establish an effective market stability mechanism while maintaining basic fairness is still the core challenge facing the entire crypto ecosystem. This requires innovation at the protocol design level and may require the introduction of new mechanisms to balance the two seemingly contradictory goals of decentralization and market stability.

chaincatcher

chaincatcher