Supporting Bybit reached US$320 million, who do you think of as white horse knights?

Reprinted from panewslab

02/24/2025·2MAuthor: flowie, ChainCatcher

Within 12 hours after nearly $1.5 billion was stolen, Bybit CEO Ben Zhou said the withdrawal system had completely returned to normal.

Faced with the largest theft case in cryptocurrency history, in addition to the crisis and public relations handling of the Bybit team's textbook version, all parties supporting Bybit are also reducing huge pressure on the cryptocurrency ecosystem.

Supporting US$320 million, who do you think of as white horse knights?

As of press time, according to Ember Monitoring, five institutions and individuals have provided loan support to Bybit, totaling approximately 120,000 ETH, worth approximately US$321 million. Specifically including:

Bitget: Support and support 40,000 ETH loans to alleviate withdrawal pressure

This morning, Bitget supported 40,000 ETH (US$105.9 million) loans to Bybit to survive the withdrawal wave after ETH was stolen. These ETHs were transferred directly from Bitget to Bybit cold wallet address.

Bitget CEO Gracy later tweeted that Bybit is a respected competitor and partner. Although the loss this time is huge, it is their profit for a year. I believe that the customer funds are 100% safe, and there is no need to panic or run. . It then added that the assets lent to Bybit are Bitget's own and the user's assets will not move.

MEXC: Provide 12,652 stETHs

This morning, Ember Monitoring, MEXC Hot Wallet transferred 12,652 stETH (approximately $33.75 million) to Bybit Cold Wallet.

Other giant whale investors: support over $200 million

11,800 ETH (approximately $31.02 million) from Binance, or another agency/whale withdrawing from Binance, provide 36,000 ETH (approximately $96.54 million) from Binance, and address 0x327 ...45b provides 20,000 ETH (approximately $53.7 million).

In addition to the above institutions or giant whale investors that provide real money, many CEX peers or institutions have also continued to support Bybit, including:

OKX: Blacklisting of Bybit hackers can provide security and liquidity support for Bybit

OKX President Hong Fang said Bybit's stolen hacker addresses have been added to OKX's blacklist, and engineers will keep an eye on these addresses and will take immediate action if there is any capital flow.

OKX’s team also stays in touch with the Bybit team to provide any IT security and liquidity support that can be provided to them at the moment.

HashKey: Support Bybit, saying he believes security incidents will be properly resolved

HashKey condemned the hacker's illegal behavior in the official bid and expressed his belief that Bybit's security incidents will be properly handled and overcome.

BitMart: Freeze the hacker address, founder Sheldon said Bybit will provide support if necessary

BitMart founder Sheldon posted a statement on the X platform that the relevant addresses have been frozen and that once stolen assets flow into BitMart, the relevant assets will be frozen immediately to support the recovery work.

He pointed out that "the cryptocurrency industry is a community of shared future, and the most important thing about this industry is its credibility. We hope to work together to help Bybit recover losses and assets. This industry needs everyone to protect it."

Justin Sun supports Bybit and promises to assist in tracking funds

Justin Sun, global consultant for Huobi HTX and founder of Tron TRON, said, "We have been paying close attention to the Bybit incident and will do our best to assist our partners in tracking relevant funds and providing all support within our capabilities."

JuCoin: Provides 1,000 BTC industry co-construction funds and technical support for Bybit security incidents

In response to the recent security incident of Bybit, JuCoin announced that it will provide 1,000 BTC as an industry co-construction fund and open up advanced security technology services for free, including threat detection, smart contract audit, hot and cold wallet management and multi-signature technology implementation, to fully ensure the security of user assets and The platform operates stably.

At present, Bitget is the institution that has given out real money and helped Bybit the most. (Welcome to contact ChainCatcher to add more supporters.)

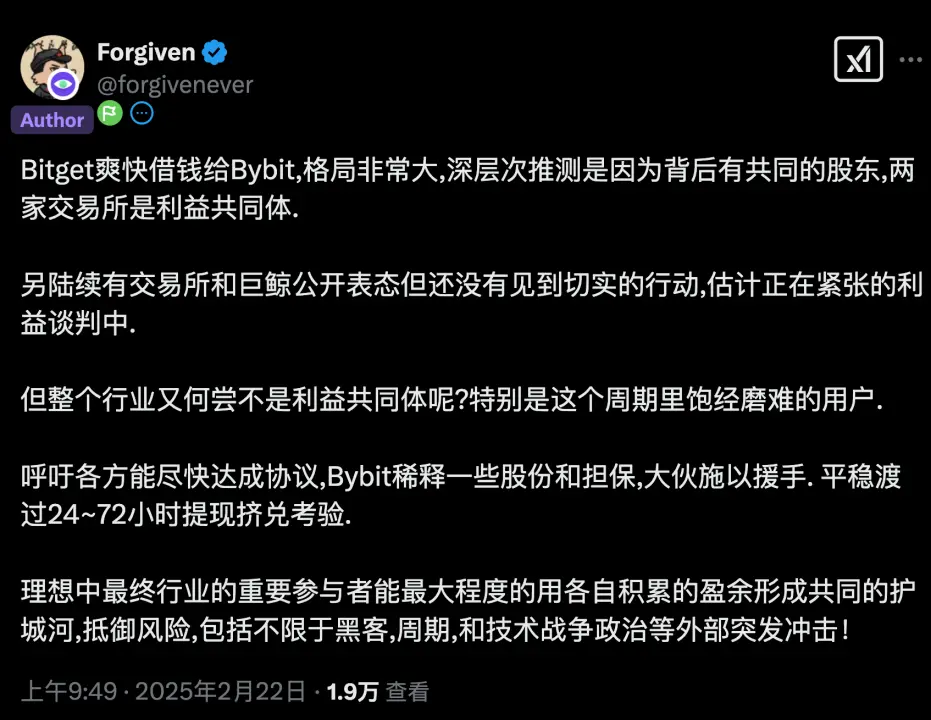

In response to this, Conflux Lianchuang Yuanjie tweeted and praised Bitget for having a pattern. At the same time, he speculated that the reason behind it may also be that Bitget and Bybit have common shareholders.

He is expected to be in tense interest negotiations for other exchanges or giant whales to support but fail to take action. He called on all parties to reach an agreement as soon as possible, and Bybit can dilute some shares and guarantees to help Bybit and users overcome difficulties.

Yuanjie believes that "the important participants in the ideal industry can use their accumulated surplus to form a common moat to the greatest extent and resist risks, including, not limited to hackers, cycles, and technological wars and politics! "

The interview with Ben is close to you. What exactly drives Bybit to

handle the crisis in an orderly manner?

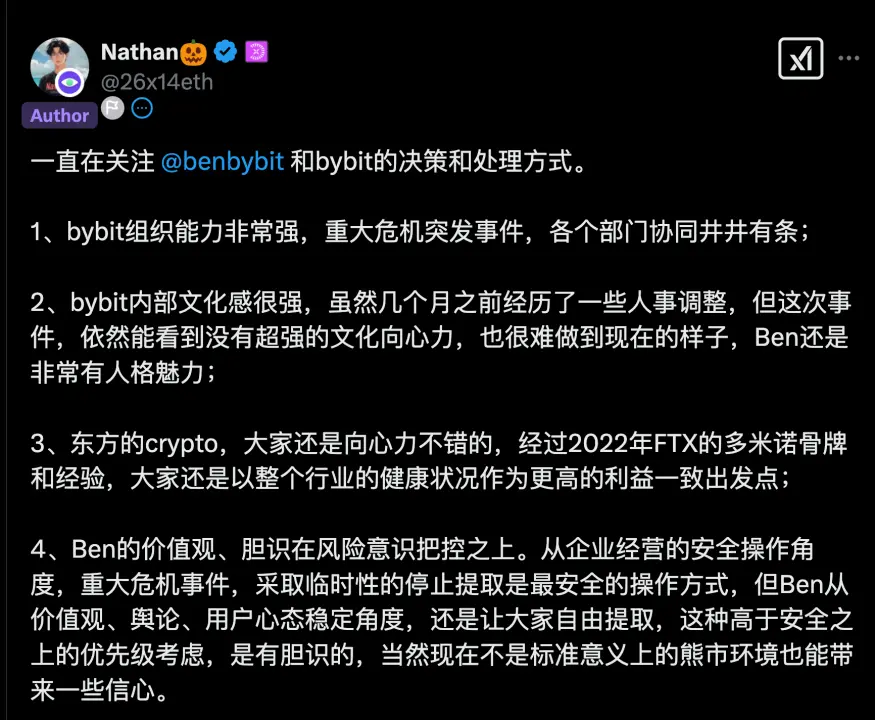

Regarding the theft crisis, crypto investor @26x14eth posted a message saying that he felt that Bybit has good organizational capabilities and cultural centripetal force.

ChainCatcher also felt this during the interview.

During the Hong Kong Consensus Conference a few days ago, we briefly had a conversation with Bybit CEO Ben Zhou.

When we asked questions about how CEX should transform and build the Onchain ecosystem, Ben Zhou was very frankly speaking, they were a little confused at the moment. They are not very sure about Web3 wallets that burn money and have difficulty in making revenue in a short period of time, and are still exploring the direction of other chains. They may form an active team of children playing on the chain for young people to try it out.

No special official.

He also joked in a public interview before, "He should be the only founder of a large exchange that can still speak out for the outside world."

Looking back now, Bybit's ability to handle this major crisis in an orderly manner may be related to this style of being able to face yourself and others sincerely.

In December last year, in the face of KOL's doubts about Bybit's rat warehouse and best friend group, before public opinion could ferment on a large scale, Ben directly opened an AMA to respond one by one. This stolen incident occurred, and it was also a live broadcast overnight. Ben Zhou first shared the cause of the accident, saying that "there was a problem when signing, but he didn't pay attention to it, and the delivery address was not displayed when signing." In addition, he also synchronized the Bybit run that everyone is most concerned about. and the treasury situation.

In fact, no matter how strong the support is, the result is, at least such positive things have not happened in the market for a long time. Especially in the past six months, many investors have complained that the industry is in garbage time, helpless and powerless.

And after this Bybit stolen incident, we seem to see from the crisis that Crypto's centripetal force is returning.