Super Public Chain Three Kingdoms Kill: Comparison of Ethereum, Solana and BNB Chain

Reprinted from panewslab

03/17/2025·3MEthereum has no dreams, and Vitalik refuses to be a lifelong merciful dictator;

Solana has no bottom line, the only active cabal in the blockchain world;

BNB Chain has no future, and only Binance traffic diversion is left outside the ultimate marketing.

Why study public chains?

When you have connections with all retail investors in the cryptocurrency industry, you will inevitably become the infrastructure of this industry. So far, only BTC/ETH, as a public chain, Binance, and Coinbase, as an exchange, have done this. One is decentralized and the other is centralized, and can it connect with everyone if it continues to develop?

In 2025, there will be no more L1, non-EVM and public chains with market influence. L2, Move VM and Sonic/Bear Chain are just making a dojo around tokens. The struggle between Solana and Base is more like a dispute between business consortiums and has little to do with the dispute over technical standards and routes.

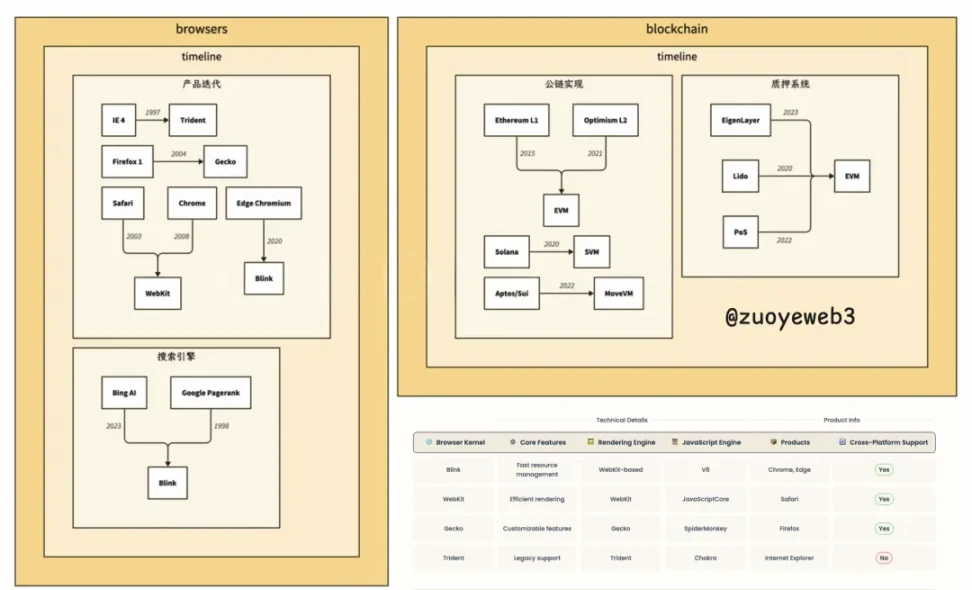

Image description: Public chains compare the history of browser development, image source: @zuoyeweb3

Based on this, I summarized three tones of this article, which is also a summary of public chains from a historical perspective. Just like the new Edge chose to be compatible with Chromium and set off again, a rushing era is over.

- The background of the birth of finance is to hedge business risks, but since its birth, finance has become the main source of risk, from the road protection movement that buried the Qing Empire to the Bitcoin that eroded the legal currency system, it is impossible.

- The development of the Internet is a brief history of browser kernels, products and search engines. Convert to the public chain system, EVM/SVM-->ETH/L2, EVM compatible L1-->PoS node system + super dApp.

- The public chain is still built on the lowest level of the Internet. After the wild west and the great voyage, the journey of human civilization is the migration from rural areas to cities. The death and life of the super-large public chain reflect the developers' desire.

You have to go through these before becoming Bitcoin

Send away Bitcoin’s successor and welcome the new life of Base?

The Ethereum system is an era of anarchism and individual free will, an era of decentralization, counter-attacking fiat currency systems and world computers, and is also dedicated to this era.

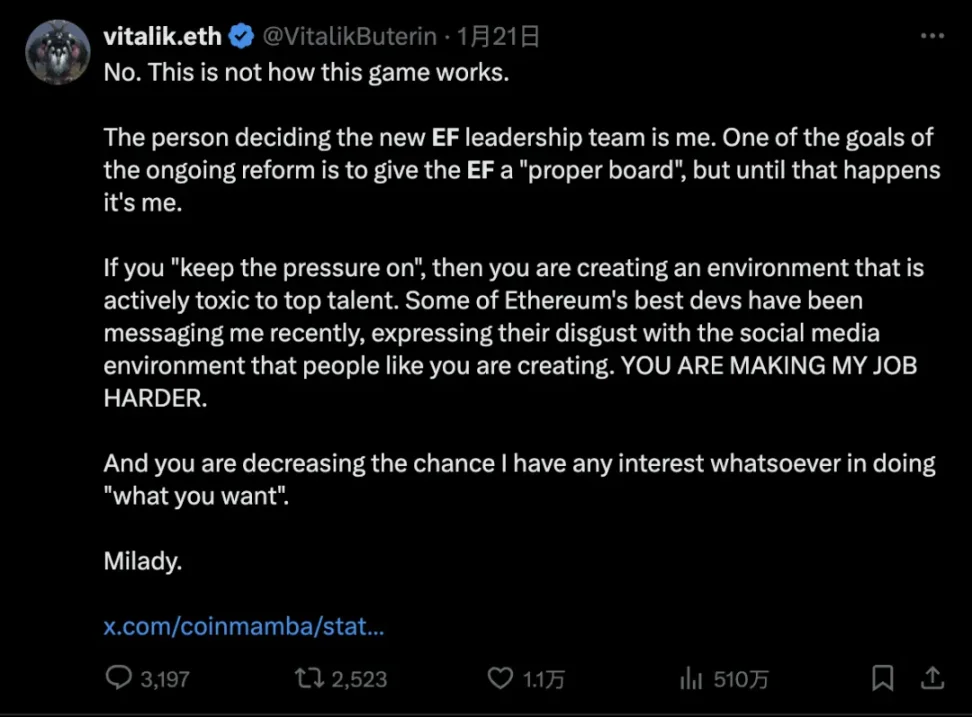

After a year of sarcasm, Vitalik chose to promote Aya to the position of chairman of the Ethereum Foundation. After all, Vitalik himself said he could decide everything about EF.

But there is no need to have more expectations for Vitalik. Vitalik is an extremely nostalgic person. Aya is the "drift mother" he met in Kraken's floor shop. The hero's last era is the softest part deep in his heart.

I don't want to list various data and charts to prove the problem of Ethereum, because Ethereum itself and EF and EVM ecosystems are actually fine, and BNB Chain and Base will not switch to SVM for the time being.

Referring to the history of browser development, the most "halal", orthodox and free FireFox did not continue the glory of Netscape, but was incorporated under the combination of Google's open source Chromium and Google search commercialization. 90% of Firefox's revenue comes from setting Google as the default search engine, becoming Google's de facto "monetary opposition".

The same is true for today's ETH/EVM system. Every dApp, each L2, each Dev, each VC, and each KOL that make up the EVM circle are evolved on a unique historical trajectory and in a unique ecological environment.

ETH, L2 and EVM are linked together to form the most "network effect" public chain system at present. The inherent continuity positive feedback mechanism of the network effect will double the ecological connection, which is also the fundamental reason why everyone is scolding but cannot leave.

For the time being, peace will not last forever, Trident IE will also be replaced by Chromium Edge. The bottom layer of Ethereum is precisely Vitalik’s personal problems, and the collapse of the governance system has led to the current dilemma.

Vitalik's parents are both Soviet Union's. Vitalik himself is extremely opposed to centralization, autocracy and authoritarian systems. The seeds of the DAO system are buried here, but as mentioned earlier, he also said in person that he can decide everything about the Ethereum Foundation. The rollback after the DAO incident has proved that if it is absolutely not decentralized, it will move towards absolute centralization.

Image description: I am the one who decided to lead the new EF (Ethereum Foundation) team, Image source: @VitalikButerin

Referring to Satoshi Nakamoto's work, he hid his merits and fame, Vitalik was obviously in a state of chaos and neutrality, that is, he did not want to lead everything in EF, and he also wanted to retain the final decision-making power over EF. Unfortunately, in the governance system, this is the worst.

Since Machiavelli's "The Prince" and Max Weber's summary of bureaucracy and Taylor's, companies are the most efficient existence in the organizational model of human society. The technological right of Silicon Valley, such as Musk, Peter Thiel, etc., believe that companies should take over the country, rather than bureaucrats in managing the society, and DOGE is its direct product.

However, for organizations that are not so "capital efficiency" oriented, such as the technical geek group, how to govern and collaborate on global programmers who do not receive salaries, becomes the social demand of foundations or DAOs. Linux and RISC-V foundations are both examples, but it is not enough. There will always be conflicts in the community and people's hearts are not always in line.

For Linux and Python, its founders will also assume the benevolent dictator for life (BDFL, Benevolent Dictator For Life), but it is not enough. Linux founder Linus did a bad job of banning Russian administrators on October 24 last year. After the 2018 PEP 572 dispute, Python announced that it would no longer play the role of BDFL. This move has the beauty of Aptos Mo Shaikh resigning and AVAX directors ran away.

However, one thing must be admitted that in the early stages of the development of technical organizations, it is inseparable from the hard-working nurturing of founders, but the complexity of EF is not here. The capital efficiency-oriented corporate system only needs to be responsible to shareholders, and the social effect-oriented technology foundation only needs to be responsible to the project itself. Programmers are always free, and they can choose and fork freely among different organizations.

But EF is not the same as the two. EF can ignore profits. There is enough ETH in the vault, but the EVM ecosystem needs to consider profits. This is the awkward thing about Vitalik--EF-EVM. Vitalik does BDFL jobs, but refuses to take on the corresponding positions. The downstream of EF is the hungry ETH Hodler and a huge economic system, but they have to operate under Vitalik's personal will.

Only by understanding this can we understand that the route of Aya’s Infinite Garden is extremely correct. This is the only choice to ensure that everyone in EF can follow Vitalik’s will, the master of the EVM Empire, and the first sister of Duanshui of the Central Military Machine.

Vitalik is like a child holding gold. Famous young heroes cannot maintain balance in a complex world, so they introduce external helpers, but they go out layer by layer, and the external group is more concerned about profit. Vitalik can neither manage EF/Ethereum/EVM like a company, nor refuse to actually assume the nominal role of BDFL like a technical organization. After DAO was falsified in stages, Ethereum is now in a strict low-speed out-of-control state, either slowly silence or being taken over.

The Ethereum community is now talking about Pectra upgrade, but its attention has been reduced to a terrible situation where no one cares about it. This is a precursor to silence. Please believe that this cannot be solved by pulling the disk or making a few Memes. What Ethereum wants to answer now is whether it is Vitalik's decentralized test site for non-financialization, Aya's infinite garden, or a real "world computer".

Vitalik personally has the dream of adhering to decentralization, non-financial and non-sovereignty, but EF does not, and it is hard to say that the entire EVM ecosystem has it. Equalities of scale are both an advantage and a curse.

Public chains such as Base have proved that ETH L2 can indeed balance between efficiency and inexpensiveness. There is absolutely nothing wrong with the parallel route of OP/ZK L2, but Base can run without tokens, and it is more like an advanced version of the alliance chain. If this is the bouquet dedicated to the real world by the EVM system, it would be a bit hilarious.

Family members, let’s look at Solana and BNB Chain in the distance, at least they are serious about the currency price.

The only remaining cabal in the blockchain camp

The yellow willows are covered with flowers.

Why choose Ethereum, Solana and BNB Chain as the comparison of super public chains?

BTC does not need to be compared. Ethereum's EVM is the de facto industry standard. Just like Chrome accounts for the highest proportion, Solana is more like Safari. Behind its extreme fluency is centralization. BNB Chain is the only orphan among the old coins such as ADA and XRP that really have on-chain activities.

If there is a palace fight in the currency circle, then Solana is Huanhuan. After Ling (F) Yun (T) Peak (X) was robbed, she can still perform the heroine drama of Xi (coin price) Concubine (rise) back to the (ecological) palace (recovery). To give only two examples, as of February, Solana DEX trading volume has surpassed Ethereum for four consecutive months. In March, Solayer's market value exceeded EgenLayer. As Meme's decline, Solana still proves herself.

Especially for the latter, the staking/re-staking system is the originality of Ethereum and the most important content of the PoS system. Here we will also explain that the corresponding search engines are PoS nodes and Super DApps. Google is essentially an advertising company, and its source of profit is to sell Google search traffic to advertisers. The revenue of the PoS chain is node pledge for the public chain Gas Fee. Super DApps are also the generator of public chain fees, which is the root cause of the two.

Therefore, the prosperity orientation of public chains actually refers to the transactions of public chains. SOL coin price and cheap Gas Fee can balance stimulating nodes and encouraging user transactions. Of course, the price is to become a "computer room chain". Responsibly, Ethereum is still decentralized enough, even if Lido accounts for about 30% of the pledge share.

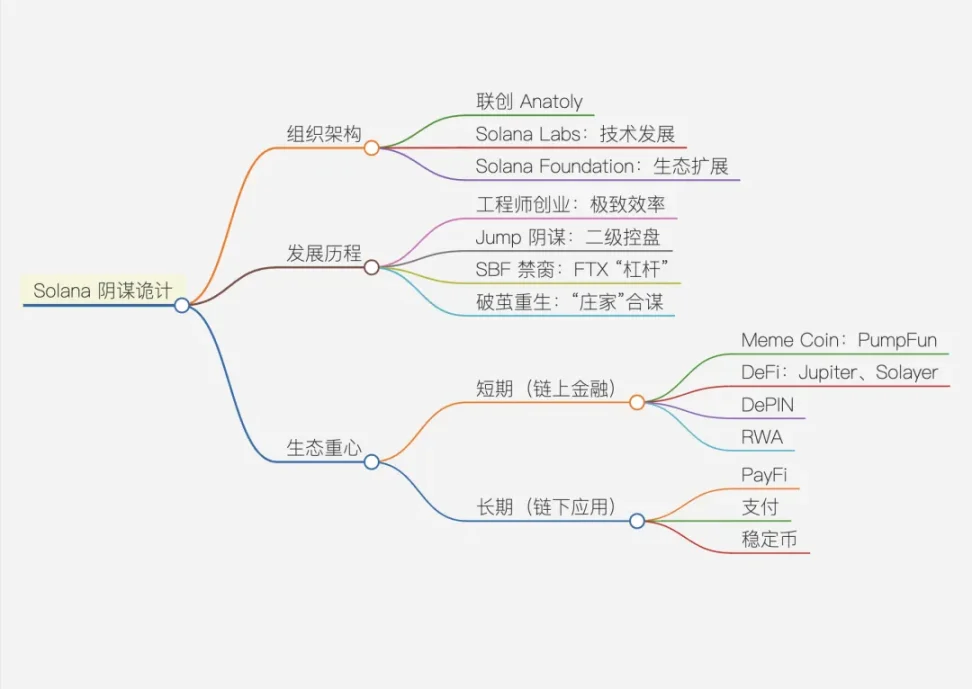

So I like the title of Coin Group very much. Solana has been closely linked to conspiracy since she was a child. From the high control of Jump and SBF to the Jupiter DeFi small group in the Meme era, it is closer to the PayPal gangster color than the words "Community and DAO" - the pursuit of ultimate capital efficiency.

Image description: Solana\'s indomitable life, source: @zuoyeweb3

In terms of the absolute scale of the ecosystem, Solana/SVM is much smaller than ETH/EVM, but Solana has found the best way to play: embrace any cabal, if you think the coin issuing group will destroy Solana's image, please flash back to Jump, SBF and the current Trump family. I can't say they are not good people, but there is absolutely no good guy.

Labs and Foundation are divided into two parts. Labs considers more technological progress. The foundation actively markets under the leadership of Lily Liu, which contrasts with Ethereum's personal dominance and EVM's attracting ecosystem. This does not mean that EF should be transformed into SF. It emphasizes that Vitalik's name and reality are consistent. Either go on it yourself or completely delegate power and concentrate on being a spiritual leader. It is both and obviously not getting anything.

Since its birth, Solana has grown on the dark side, embracing the ultimate capital efficiency, and in the name of decentralization, the original number of the coin group is returned and the retail investor group is open.

From this perspective, Solana is the opposite of the scale effect, the relationship between the net income of public chains and total assets relative to its number of people: the more Web2 and industrial companies, the larger the company's assets are, but the same is true for Web3 under the coin price. Strictly speaking, BTC has no employees, while the huge personnel of EF and Linux have caused bloat. Solana has amplified its economic value to the extreme under a relatively small controller system.

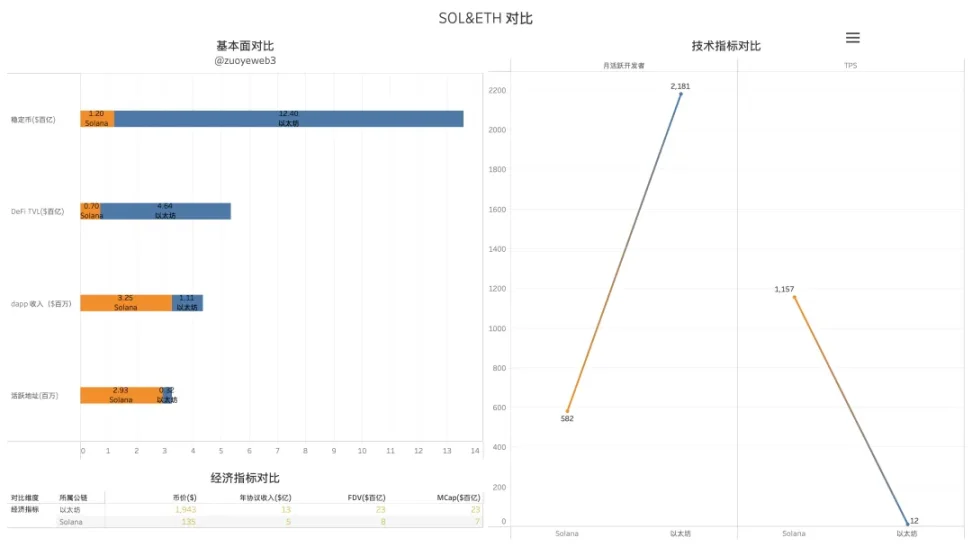

Image description: SOL ETH comparison, data source: CMC/Defilama/Token Terminal/Chain spect

If you want to evaluate the human-effect ratio, then Solana deserves the first place and rewards a little red flower. With 1/4 of Ethereum's developer scale, Solana surpassed Ethereum in active addresses and dApp revenue, and it is even more rare that DeFi TVL and stablecoins are significantly behind.

In fact, this is mainly achieved when PumpFun accounts for most of the issuance of memecoin. It cannot be considered that Solana DeFi has completely surpassed Ethereum as a whole, because the huge scale of Ethereum is also reflected in the L2 and EVM ecosystems, which we will explain with BNB Chain.

Tu Dog Paradise transforms into cousin Miaomiao House

The key to the problem is not the size of our brain, but the right idea.

EVM is Chromium, and BNB Chain's best way out is to become Edge. Binance is the role of Microsoft, and it is definitely the industry's top traffic entrance. We just said that Solana has the highest human-effect ratio, so BNB Chain's active address crushes everything. BNB Chain has a total of 4.4 million, far exceeding Solana's 3 million and Ethereum's 300,000.

Perhaps it is Binance's past glory that crushes everything. Most people will call BNB Chain BSC. They know the details. All the highlights of BNB Chain are in the past. How to make progress in the future is not something Meme can afford, because BNB coins are the essence, not the ecology, which is also the wonder of BNB Chain.

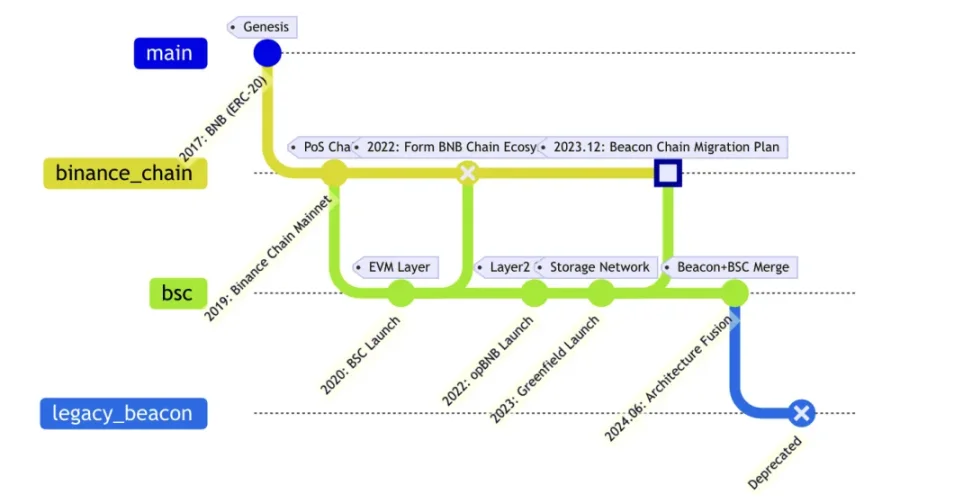

Image description: BNB Chain Change, data comes from Binance Academy, Image source: @zuoyeweb3

As a complaint, the changes in BNB Chain's name highlight the illness of a large company. He has definitely experienced more than one person in charge. It is obvious that BNB Chain's focus during the industry hotspot cycle is completely different.

The confusion of the name is the manifestation of the increase in entropy. Entropy can kill people. Whether it is genius, technology and money, everything will move towards disorder and disorder.

Especially the weird name of BNB Chain, which is as strange as ETH Chain or SOL Chain. It focuses too much on the price of the currency rather than the ecology. Judging from the experience of Solana and Ethereum, moderation is the true gentleman.

If we summarize the development ideas of BNB Chain, then following the strategy is the best evaluation. From imitating Ethereum in the early days to "plagiarizing" Solana, please note that this is not a criticism. Everyone likes useful things. AMM DEX swept everything. It can't be said that everyone plagiarized Uniswap. In fact, Bancor is the first one.

However, the biggest problem of BNB Chain is to follow the idea of using the exchange, which is actually very different from the idea of building a public chain, and the more serious thing is to confuse the two.

We can sort out the mixture of today's BNB Chain ecosystem:

- Ethereum thinking: DeFi/Staking/RWA/DePIN/DeFAI/Meme

- CZ Thinking: AI First/DeSci/Meme

- Solana Thinking: Payment/Stablecoin/Meme

In fact, Meme is not the focus of BNB Chain's current development because of its "latest", but is more of a tripartite consensus zone after the game. Although CZ/Binance has stated that they do not own or manage BNB Chain, their influence is still huge.

Especially after CZ was banned from managing Binance, BNB Chain became its main battlefield. We can understand the value of BNB and BNB Chain according to the split Binance ecosystem.

BNB's dual identity is that it is also a Binance platform coin, and it empowers the Binance main site ecosystem. Then BNB serves as the value support of BNB Chain, and meets the income of "old" large-scale nodes and the needs of new users to make high-speed and low-cost Meme.

If Binance's own shares are CZ/He Yi 19:1, then the price increase of BNB and the node returns are the only way to give back to node users. In this way, the willingness of large investors to hold BNB is guaranteed, so retail investors' Gas Fee must be consumed through hot products.

As long as the market pull-up (ecological construction fee) is lower than the handling fee contributed by users, then BNB is a cash bull, especially at the moment when CZ actually begins to sell its own shares, BNB's stability is crucial. After all, when Binance went online, it sold BNB instead of Binance shares, maintaining BNB's value and price.

Only in this way can we understand the significance behind BNB Chain's frequent use of liquidity subsidy moves. BNB Chain should become a barrier to cash flow on Binance's main site, rather than a blood loss flood discharge.

However, now there is no flower red, and Sichuan has 103 palms. It is completely close to the existing political system of the United States. Only God knows whether Binance can maintain the status quo in the midterm elections and four years later.

Because Base and Solana are more American, Ethereum and BTC are more world-wide, there are only two development paths for public chains, 99% belong to the United States, 1% belong to all mankind, and there is no middle ground.

Conclusion

FireFox, the sequel to Netscape Spirit, nurtured the Rust language, and Rust became the forerunner of Solana and Move VMs, which is also a bond between Web3 and Web2.

Vitalik once wanted to intern at Ripple and almost became Sun Chu's colleague. I don't know if it was luck or misfortune. Sun Chu failed to inject Eastern philosophy into Vitalik, which also made Tron bear the reputation of plagiarizing Ethereum.

Compared with this, Solana's story is not that legendary, and BNB's story is more like a commercial company, but now everyone's focus is on Vitalik, who "beats" Ethereum's 7-bit Lianchuang and becomes the main spokesperson of Ethereum. This is a historical opportunity and a heavy responsibility.

Milady!

chaincatcher

chaincatcher

jinse

jinse