Stablecoin Revolution in Progress: The Resonance of Technology Architecture and Business Ecology

Reprinted from panewslab

03/24/2025·1MAuthor: [email protected] , [email protected]

The global financial system is in a profound wave of change. Traditional payment networks are facing all-round challenges from emerging alternatives -stablecoins due to their outdated infrastructure, lengthy settlement cycles and high fees. These digital assets are rapidly revolutionizing the model of cross-border flow of value, paradigms of corporate transactions, and personal access to financial services.

In the past few years, stablecoins have continued to develop and have become an important underlying architecture for global payments. Large fintech companies, payment processors, and sovereign entities are gradually integrating stablecoins into consumer-facing applications and corporate capital flows. At the same time, a series of emerging financial tools, from payment gateways to inbound and outgoing channels, to programmable income products, has greatly improved the convenience of using stablecoins.

This report deeply analyzes the stablecoin ecosystem from the dual perspectives of technology and business. Research on shaping key players in this field, the core infrastructure that supports stablecoin trading, and the dynamic needs that drive their applications. In addition, it is also discussed how stablecoins can spawn new financial application scenarios and the challenges faced in the process of broad integration into the global economy.

1. Why choose stablecoin payment?

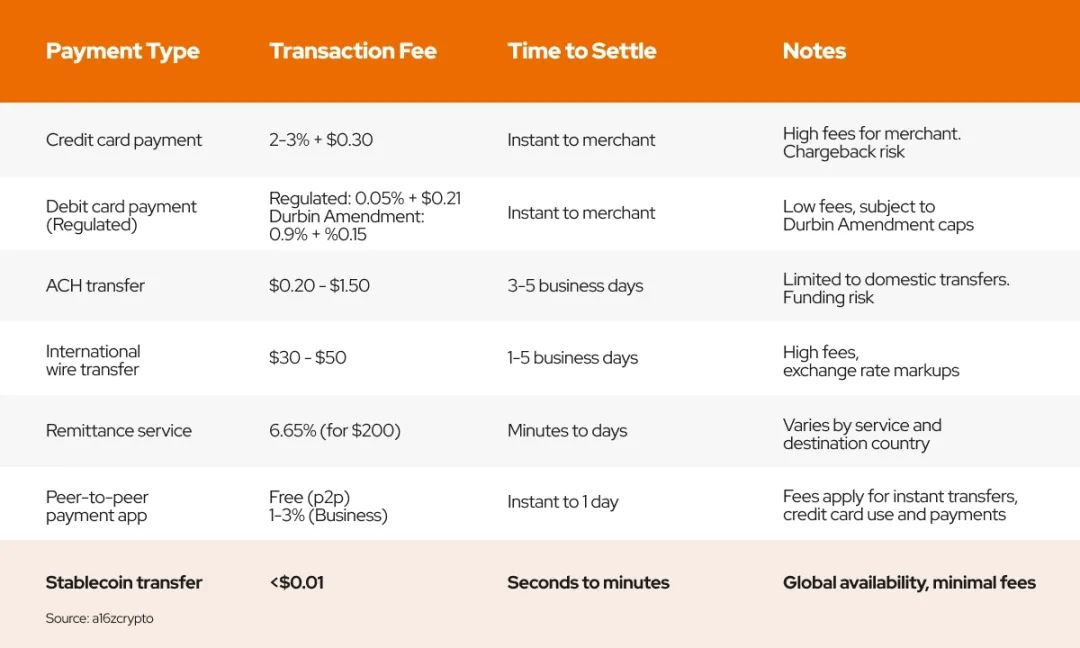

To explore the influence of stablecoins, we must first examine traditional payment solutions. These traditional systems cover cash, checks, debit cards, credit cards, international wire transfers (SWIFT), automatic clearing houses (ACH), and peer-to-peer payments. Although they have been integrated into daily life, the infrastructure of many payment channels, such as ACH, SWIFT, has existed since the 1970s. Despite its groundbreaking significance at the time, most of these global payment infrastructures are outdated and highly fragmented today. Overall, these payment methods are troubled by problems such as high fees, high friction, long processing time, inability to achieve 24/7 settlement, and complex back-end programs. In addition, they often (paid) bundle unnecessary additional services such as identity verification, lending, compliance, fraud protection, and banking integration.

Stablecoin payment is effectively solving these pain points. Compared with traditional payment methods, using blockchain for payment settlement greatly simplifies the payment process, reduces intermediate links, and realizes real-time visibility of capital flows, which not only shortens settlement time, but also reduces costs.

The main advantages of stablecoin payment can be summarized as follows:

- Real-time settlement: Transactions are completed almost instantly, eliminating delays in traditional banking systems.

- Safe and reliable: The tamper-free ledger of blockchain ensures the security and transparency of transactions and provides protection for users.

- Cost reduction: Removing intermediate links significantly reduces transaction costs and saves users' expenses.

- Global coverage: Decentralized platforms can reach markets that are undercover in traditional financial services (including unbanked people) and achieve financial inclusion.

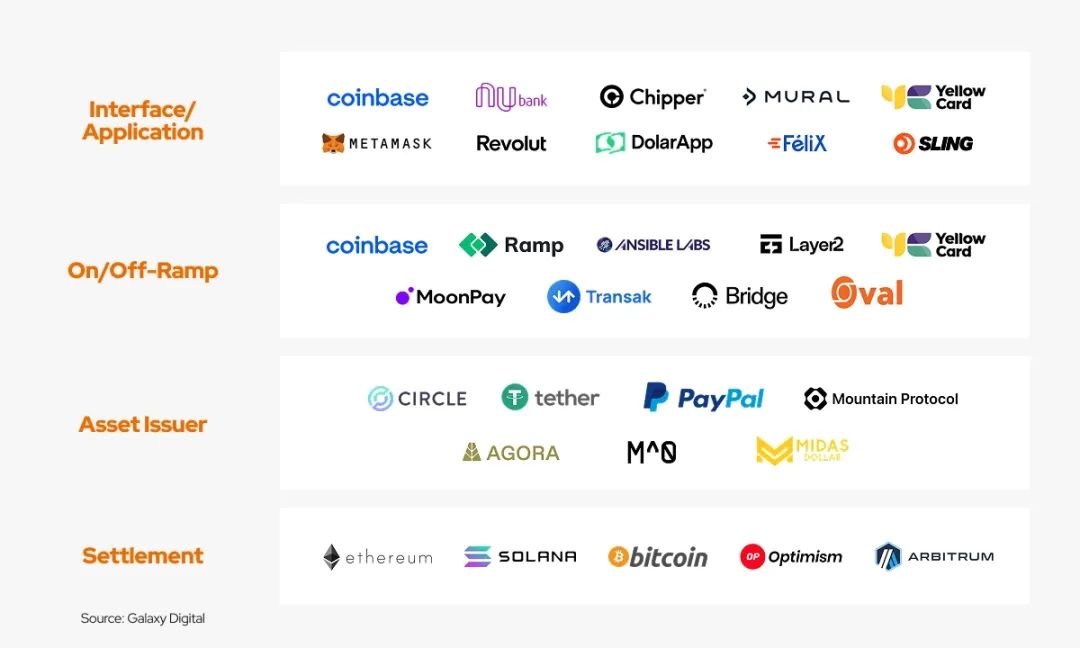

2. Stablecoin payment industry structure

The stablecoin payment industry can be subdivided into four technical stack levels:

1. Layer 1: Application layer

The application layer is mainly composed of various payment service providers (PSPs), which integrate multiple independent deposit and withdrawal payment institutions into a unified aggregation platform. These platforms provide users with convenient access to stablecoin, provide tools for developers developing at the application layer, and provide credit card services for Web3 users.

a. Payment gateway

Payment gateways are services that promote transactions between buyers and sellers through secure processing of payments.

Well-known companies that innovate in this field include:

- Stripe: A traditional payment provider that integrates stablecoins such as USDC for global payments.

- MetaMask: It does not provide direct fiat currency exchange function itself, and users can implement deposit and withdrawal operations by integrating with their third-party services.

- Helio: 450,000 active wallets and 6,000 merchants. With the Solana Pay plug-in, millions of Shopify merchants can settle payments in cryptocurrency and instantly convert USDY to other stablecoins such as USDC, EURC and PYUSD.

- Web2 payment applications such as Apple Pay, PayPal, Cash App, Nubank, and Revolut also allow users to use stablecoins to complete payments, further broadening the application scenarios of stablecoins.

The fields of payment gateway providers can be clearly divided into two categories (there is a certain overlap)

- Payment gateway for developers; 2) Payment gateway for consumers. Most payment gateway providers tend to focus more on one category, thereby shaping their core products, user experience and target markets.

The payment gateway for developers is designed to serve businesses, fintech companies and businesses that need to embed stablecoin infrastructure into their workflows. They usually provide application programming interfaces (APIs), software development toolkits (SDKs), and developer tools for integration into existing payment systems to enable features such as automatic payments, stablecoin wallets, virtual accounts, and real-time settlement. Some emerging projects focused on providing such developer tools include:

- BVNK: Provides enterprise-level payment infrastructure for easy integration of stablecoins. BVNK provides API solutions that enable seamless processes, have a payment platform for cross-border commercial payments, and corporate accounts that allow businesses to hold and trade multiple stablecoins and fiat currencies, as well as merchant services that provide businesses with tools needed to accept customers’ stablecoins payments. It handles annualized transaction volume of more than $10 billion, with an annual growth rate of 200%, and a valuation of 750 million US dollars. Its customers include emerging regions such as Africa, Latin America, Southeast Asia, etc.

- Iron (in beta): Provides API to seamlessly integrate stablecoin transactions into its existing business. It provides businesses with global deposit and withdrawal channels, stablecoin payment infrastructure, wallets and virtual accounts, supporting customized payment workflows (including regular payments, invoices or on-demand payments)

- **Juicyway: **Provides a series of corporate payment, salary payment and bulk payment APIs, and supports currencies including Nigerian Naira (NGN), Canadian Dollar (CAD), USD (USD), Tether (USDT), and USD Coin (USDC). It is mainly facing the African market and has no operational data yet.

The consumer-oriented payment gateway focuses on users and provides a simple and easy-to-use interface to facilitate users to make stablecoin payments, remittances and financial services. They usually include mobile wallets, multi-currency support, fiat currency deposit and exit channels and seamless cross-border transactions. Some well-known projects focused on providing users with this simple payment experience include:

- Decaf: On-chain banking platform, realizes personal consumption, remittance and stablecoin transactions in more than 184 countries; Decaf cooperates with local channels including MoneyGram in Latin America, achieving almost zero withdrawal fees, with more than 10,000 South American users, and is highly rated among solana developers.

- Meso: deposit and withdrawal solution, directly integrated with merchants, enables users and businesses to easily convert between fiat currency and stablecoins with minimal friction. Meso also supports Apple Pay to purchase USDC, simplifying the process for consumers to acquire stablecoins.

- Venmo: Venmo's stablecoin wallet feature leverages stablecoin technology, but its capabilities are integrated into its existing consumer payments applications, allowing users to easily send, receive and use digital dollars without directly interacting with the blockchain infrastructure.

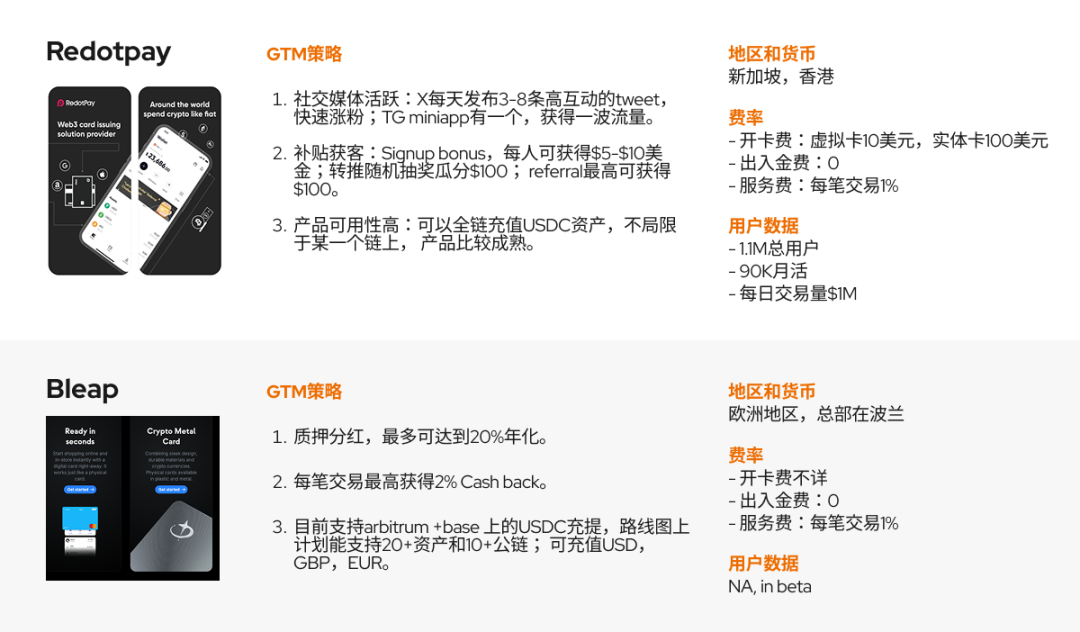

b. U card

Cryptocurrency cards are payment cards that allow users to spend on cryptocurrencies or stablecoins at traditional merchants. These cards are often integrated with traditional credit card networks such as Visa or Mastercard to enable seamless transactions by automatically converting cryptocurrency assets into fiat currencies at the point of sale.

Projects include:

- Reap: Asian card issuers, including more than 40 companies including Infini, Kast, Genosis pay, Redotpay, Ether.fi, etc., sells white label solutions mainly rely on transaction volume commissions (such as Kast 85%-Reap15%) to cooperate with Hong Kong banks, which can cover most areas outside the United States and support multi-chain deposit; the transaction volume in July 2024 will reach $30M.

- Raincards: An American card issuer, supports card issuance by Avalanche, Offramp, takenos and other companies. The biggest feature is that it can serve American and Latin American users. I sent a USDC business card to pay for travel, office supplies and other daily business expenses using on-chain assets (such as USDC).

- Fiat24: European card issuer + web3 banking, the business model is similar to the above two companies, and supports card issuance by ethsign, safepal and other companies; Swiss license, mainly serving European and Asian users, and does not yet support full-chain transactions, only arbitrum recharge. The growth is slower, the total number of users is 20,000 and the monthly income is $100K-150K.

- **Kast: **The fastest growing U card on **Solana has issued more than 10,000 cards, 5-6k monthly active users, trading volume in December 2024 $7m, and revenue of $200k.

- 1Money: Stablecoin ecosystem, recently launched a credit card that supports stablecoins and provides a software development toolkit to facilitate L1 and L2 integration, and there is no data in beta yet.

There are many cryptocurrency card providers, which mainly differ in terms of serving regions and supporting currencies, and usually provide low-cost services to end users to increase users' enthusiasm for using cryptocurrency cards.

2. Level 2: Payment Processor

As a key level of the stablecoin technology stack, payment processors are the pillars of the payment channel, mainly covering two categories: 1. deposit and withdrawal service providers 2. stablecoin issuance service providers. They act as a key middle layer in the payment life cycle, connecting Web3 payments to traditional financial systems.

a. deposit and withdrawal processing provider

- Moonpay: supports more than 80 cryptocurrencies, provides a variety of deposit and withdrawal methods and token swap services, to meet users' diverse cryptocurrency trading needs.

- Ramp Network: Covering more than 150 countries, it provides deposit and withdrawal services for more than 90 crypto assets. The network handles all KYC (identity authentication), AML (anti-money laundering) and compliance requirements, ensuring compliance and security of deposit and withdrawal services.

- Alchemy Pay: A hybrid payment gateway solution that supports two-way exchange and payment between fiat currency and crypto assets, realizing the integration of traditional fiat currency and crypto asset payments.

b. Stablecoin Issuance & Coordinated Processors

- Bridge: Bridge’s core products include coordination APIs and issuance APIs. The former helps enterprises integrate multiple stablecoin payments and exchanges, while the latter supports enterprises to issue stablecoins quickly. The platform is currently licensed in the United States and Europe and has established important partnerships with the U.S. Department of State and the Treasury Department, with strong compliance operations and resource advantages.

- Brale (in beta): Similar to Bridge products, it is a regulated stablecoin issuance platform that provides stablecoin coordination and reserve management API. Compliance licenses are available in all states in the United States. Partners need to pass KYB (enterprise identity verification), and users need to set up an account in Brale to perform KYC. Brale customers are more on-chain OG (such as Etherfuse, Penera, etc.) and Bridge are slightly worse than investors' endorsement and BD.

- Perena (in beta): Perena's Numeraire platform lowers the issuance threshold for niche stablecoins by encouraging users to provide centralized liquidity in a single pool. Numeraire adopts a "central hub-radiation" model, where USD* acts as a central reserve asset and acts as a "hub" for stablecoin issuance and exchange. This mechanism enables a variety of stablecoins pegged to different assets or jurisdictions to be efficiently minted, redeemed and traded, each connected to USD* as a similar “spoke”. Through this system structure, Numeraire ensures deep liquidity and improves capital efficiency, as small stablecoins can be interoperated via USD* without the need to provide a decentralized liquidity pool for each trading pair. The ultimate design goal of the system is not only to enhance price stability and reduce slippage, but also to achieve seamless conversion between stablecoins.

3. The third layer: asset issuer

The asset issuer is responsible for creating, maintaining and redeeming stablecoins. Its business model is usually centered on the balance sheet, similar to bank operations—accepting customer deposits and investing funds in high-yield assets such as U.S. Treasuries to earn interest spreads. At the asset issuer level, stablecoin innovation can be divided into three levels: stablecoins supported by static reserves, interest-generating stablecoins and income-sharing stablecoins.

1. Static Coins Supported by Static Reserves

The first generation of stablecoins introduced the basic model of the digital dollar: centralized issuance of tokens supported by statutory reserves held by traditional financial institutions at a ratio of 1:1. The main players in this category include Tether and Circle.

Tether's USDT and Circle's USDC are the most widely used stablecoins, both supported by USD reserves in Tether and Circle's financial accounts at a 1:1 ratio. These stablecoins are currently integrated with multiple platforms and serve as a large part of the base currency pairs for cryptocurrency trading and settlement. It is worth noting that the value of these stablecoins is owned by the asset issuer itself. USDT and USDC mainly bring benefits to their issuing entities through interest spreads rather than sharing benefits with users.

2. Income-generating stablecoin

The second evolution of stablecoins goes beyond simple fiat-backed tokens, embedding native earnings generation capabilities. Interest-yielding stablecoins provide on-chain returns to holders, usually derived from mechanisms such as short-term treasury bond yields, decentralized finance (DeFi) lending strategies or pledge rewards. Unlike traditional static stablecoins that passively hold reserves, these assets actively generate returns while maintaining prices.

Well-known agreements that provide on-chain earnings for stablecoin holders include:

- Ethena($6B): Stablecoin Protocol Issuance USDe-on-chain synthetic dollar backed by hedged Ethereum (ETH), Bitcoin (BTC) and Solana (SOL). Ethena's unique design enables USDe holders to obtain organic returns derived from the perpetual futures market capital rates (currently annuity of 6.00%) to attract users through unique collateral and earning mechanisms.

- Mountain($152M): Interest-yielding stablecoin with an annualized rate of return of 4.70%. Mountain allows users to earn daily interest by simply depositing USDM into their wallet, which is attractive to users who seek passive gains without additional stakes or participating in complex DeFi, providing users with a simple and convenient way to generate interest.

- Level($25M): A stablecoin composed of liquid re-staked US dollars. Level explores a new method of stablecoin income generation; it uses lvlUSD to provide security for multiple decentralized networks, collecting additional income from these networks, and then passing it to lvlUSD holders, innovating the stablecoin income model.

- CAP Labs(Beta): Built on the highly anticipated megaETH blockchain, CAP is developing the next generation stablecoin engine designed to provide new sources of income for stablecoin holders. CAP Stablecoins create scalable and adaptable returns by leveraging external sources of income such as arbitrage, maximum extractable value (MEV) and real-world assets (RWA) – earnings streams traditionally reserved for complex institutional participants, opening up new directions for stablecoin returns.

3. Income Sharing Stable Coin

Income Sharing Stablecoins integrate a built-in monetization mechanism that directly distributes some transaction fees, interest income or other income streams to users, issuers, terminal apps and ecosystem participants. This model aligns incentives among stablecoin issuers, distributors and end users, further transforming stablecoin from passive payment tools to active financial assets.

- Paxos($72m): As an evolving stablecoin issuer, Paxos announced the launch of USDG in November 2024, which is regulated by the upcoming stablecoin framework by the Monetary Authority of Singapore. Paxos shares stablecoin income and interest income generated from reserve assets with partners who help expand network utility, including Robinhood, Anchorage Digital and Galaxy, etc., to expand revenue sharing models through cooperation.

- M^0($106m): The M^0 team consists of former MakerDAO and former Circle veterans, M^0’s vision is to act as a simple, trusted neutral settlement layer that enables any financial institution to mint and redeem M^0’s earnings-sharing stablecoin “M”. The M^0 Agreement shares most of the interest income with approved distributors known as beneficiaries. However, one of the differences between "M" and other income-sharing stablecoins is that "M" can also be used as a "raw material" for other stablecoins such as Noble's USDN

- Agora($76m): Similar to USDG and “M”, Agora’s AUSD also shares revenue with AUSD-integrated applications and market makers. Agora has received strategic support from some market makers and applications including Wintermute, Galaxy, Consensys and Kraken Ventures. Agora's Rev-sharing ratio is not fixed, but most of it will be returned to partners.

4. Level 4: Settlement layer

The settlement layer of the stablecoin technology stack is the foundation of the stablecoin ecosystem, ensuring the finality and security of transactions. It consists of payment channels (blockchain network) that process and verify stablecoin transactions in real time. Today, many well-known L1L2 networks serve as key settlement layers for stablecoin transactions:

- Solana: High-performance blockchains known for their excellent throughput, fast finality and low fees have become a key settlement layer for stablecoin transactions, especially in consumer payments and remittances. The Solana Foundation is actively encouraging developers to build on Solana Pay and holds PayFi conference/Hacksong strongly supports off-chain PayFi innovation and promotes the application of stablecoins in actual payment scenarios.

- Tron: The first layer of blockchain that occupies an important market share in the stablecoin payment field; USDT on Tron is widely used in cross-border payments and peer-to-peer (P2P) transactions due to its high efficiency and deep liquidity. Tron pays great attention to B2C trading, but the current support for B2B scenarios is insufficient

- Codex (beta): OP L2 for cross-border B2B payments. Codex aggregates deposit and withdrawal service providers, market makers, exchanges and stablecoin issuers to provide enterprises with one-stop stablecoin financial services. Codex has a strong distribution channel, sharing 50% of its sorter fees with Circle to get traffic to its deposits and withdrawals.

- Noble: USDC native asset issuance chain designed for the Cosmos and IBC ecosystems, Cosmos is the fourth largest USDC issuance chain that has been integrated with Coinbase. Projects integrating Noble can store USDC in more than 90 IBC modular chains (dYdX, Osmosis, Celestia, SEI, Injective) in one click to realize the native casting and circulation of USDC in a multi-chain ecosystem.

- 1Money (beta): L1 specially built for stablecoin payments. Transactions are processed in parallel with equal priority and fixed fees, meaning no transactions are reordered and no users can "cut the queue" by paying higher fees. The network also provides gas-free transactions through ecosystem partners to enhance user experience and provide a fair and efficient network environment for stablecoin payments.

3. Expand the application of stablecoins: serving non-cryptographic

native users

1. Current bottleneck

- Regulatory uncertainty: Before banks, enterprises and fintech companies fully adopt stablecoins, regulatory authorities urgently need to provide clearer policy guidance to effectively control risks.

- User side: The lack of stablecoin usage scenarios has restricted its popularity among ordinary consumers. The payment scenarios used by consumers in daily life are relatively fixed, and stablecoins have not yet been deeply integrated into them. Many consumers lack the actual demand and motivation to use stablecoins.

- **Company side: **The acceptance of stablecoin payment by enterprises has greatly affected the promotion process of stablecoin. Currently, when companies accept stablecoin payments, they face the double test of willingness and ability. On the one hand, some companies have limited understanding of the emerging payment method of stablecoins and have doubts about their security and stability, which leads to low willingness to accept them. On the other hand, even if companies have the idea of accepting stablecoin payments, in actual operations, they may face many difficulties such as technical docking, financial accounting, and compliance supervision, which limits their acceptance ability.

Despite many bottlenecks, we believe that as the US regulation gradually becomes clear, more traditional users and enterprises will inevitably encourage adoption of compliant stablecoins. Although both parties may face potential frictions such as KYC (customer identity verification) and KYB (enterprise identity verification), the market potential is huge in the long run.

If the market is segmented into 1. Encrypted native users 2. Non-encrypted native users. Most of the project parties interviewed were targeted at the on-chain market, serving encrypted native users, while the non-encrypted native market was still in an undeveloped state to a large extent. This market gap provides significant opportunities for innovative companies to establish a first-mover advantage in guiding new users into the crypto space.

On-chain, competition in the stablecoin market has become fierce. Many participants are committed to increasing use cases, locking in total value locking (TVL) through higher yields, and incentivizing users to hold stablecoins. As the ecosystem develops, future project success will depend on expanding real-world applications, promoting interoperability between different stablecoins, and reducing frictions faced by businesses and consumers.

**2. Enterprise side: How to improve the adoption rate of stablecoin

payment?**

- Stablecoins are integrated into mainstream payment applications: mainstream payment platforms such as Apple Payment, PayPal, and Stripe have been included in stablecoin transactions. This move not only greatly expands the use scenarios of stablecoin, but also significantly reduces foreign exchange fees in the international payment process, bringing a more cost-effective cross-border payment experience to enterprises and users.

- Incentive to enterprises with Revenue-sharing stablecoin: Revenue-sharing stablecoin prioritizes distribution channels, and builds a strong network effect by cleverly coordinating the incentive mechanism between stablecoins and applications. It is not directly targeted at C-end users, but is aimed at distribution channels such as financial apps. "Revenue Sharing" stablecoins such as Paxos' USDG, M0 Foundation's M and Agoda's AUSD are typical examples.

- Enterprises and organizations can issue their own stablecoins more easily: ordinary companies can issue and manage their own stablecoins more easily, which has become a key trend in promoting the adoption of stablecoins by enterprises. For example, Perena Bridge, Brale is a pioneer in this field. With the continued improvement of the overall infrastructure, the trend of enterprises or countries issuing proprietary stablecoins is expected to further strengthen.

- B2B stablecoin liquidity and fund management solutions: Help companies properly hold and manage stablecoin assets to meet the needs of working capital and income generation. For example, the on-chain income platform of the Mountain protocol provides enterprises with professional fund management solutions, effectively improving the efficiency of corporate fund operation.

- **Payment infrastructure for developers (enterprises): **It is not difficult to find that some of the most successful platforms currently position themselves as crypto-native versions of traditional financial services, committed to providing innovative financial solutions for enterprises. For example, many companies currently have to manually coordinate liquidity providers, exchange partners and local payment channels to make large-scale adoption of stablecoins inefficient, and BVNK solves this problem by automating the entire payment workflow. The protocol also introduces a multi-track solution that combines local banks, crypto liquidity providers and fiat currency downlinks into a single payment engine. Instead of requiring businesses to manage multiple intermediaries, BVNK automatically routes funds through the “fastest, cheapest, and most reliable channel” to optimize every transaction in real time. As stablecoin enterprise adoption continues to accelerate, solutions like BVNK will play a key role in making stablecoin payments frictionless, scalable and fully integrated with global commerce. By addressing the inefficiency problem that hinders the large-scale adoption of stablecoins by enterprises.

- A settlement network designed for cross-border payments: a proprietary L1L2 covering scenarios such as enterprise-to-business cross-border payments or enterprise-to-consumer retail transfers. It has the significant advantages of easy integration and comprehensive supervision, and can effectively meet the payment needs of enterprises in complex business scenarios. For example, Codex, as a L2 specially built for cross-border transactions, provides enterprises with one-stop stablecoin financial services by aggregating deposit and withdrawal service providers, market makers, exchanges and stablecoin issuers. Solana fully supports PayFi. In addition to its own technological stack advantages, it actively promotes products to partners and local companies, and guides Shopify, Paypal companies and offline merchants to use Solana pay to collect and pay (especially in areas with relatively weak banking services such as Latin America and Southeast Asia). A major trend is that the competition between L1L2 settlement networks is not only about technology, but will also involve multi-level competition such as developer ecology, BD merchants, and traditional enterprise cooperation in the future.

3. Consumer side: How to expand non-encrypted native users?

As stablecoins are more accessible and incorporated into traditional financial applications, non-crypto native users will start using them without perception. Just as today's users can use digital payments without understanding the underlying banking system, stablecoins will increasingly become invisible infrastructure, providing industries with faster, lower-cost and efficient transaction support.

Embedded stablecoin payment in e-commerce and remittance

The application of stablecoins to daily transactions is a key driving force for their popularity, especially in the areas of e-commerce and cross-border remittances that are inefficient, costly and rely on outdated banking networks. Embedded stablecoin payments provide the following value for these scenarios:

- Faster and low-cost payment experience: Stablecoins significantly reduce transaction fees and settlement time between merchants and consumers by eliminating intermediate links. When integrated into mainstream e-commerce platforms, it can replace the credit card network, achieve immediate finality of transactions and save payment processing costs.

- Gift economy, cross-border freelancer salary payment, Latin America and Southeast Asia currency preservation demand: These specific scenarios have created the need for barrier-free cross-border payments. Compared with traditional banking and remittance services, stablecoins can enable gig workers and freelancers to receive funds in seconds at a lower cost, which is destined to make them the preferred payment solution for the global labor market.

As the stablecoin payment channel is deeply embedded in mainstream platforms, its application scope will break through the native user circle of cryptocurrencies. In the future, consumers will use blockchain-driven transaction services in their daily financial activities without any sense.

On-chain revenue products for non-encrypted users

Obtaining returns through digital dollars is another core value proposition of stablecoins, and this function has not been fully developed in the traditional financial field. Although native DeFi users have long been exposed to on-chain revenue, emerging products are bringing these opportunities to mainstream consumers through a simplified and compliant interface.

The key is to introduce traditional financial users into the on-chain revenue field in a seamless and intuitive way. In the past, obtaining DeFi revenue required technical knowledge, self-hosting ability and experience in operating complex protocols. Today, compliance platforms provide an intuitive interface by abstracting technical complexity, allowing users to earn money by holding stablecoins without delving into cryptographic knowledge.

As a pioneering agreement in this field, Mountain Protocol deeply understands the inclusive value of on-chain earnings. Unlike traditional stablecoins that serve as a medium of transactions, the USDM, the stablecoin of Mountain, directly distributes income to coin holders every day by default. Its current annualized yield of 4.70% comes from short-term low-risk US Treasury bonds, making it a dual alternative to traditional bank deposits and DeFi pledge mechanisms. Mountain attracts non-encrypted native users through the following methods:

- Friction-free passive income: Users can automatically accumulate income by simply holding USDM, without additional pledge, participation in complex DeFi strategies or active management.

- Compliance Guarantee: USDM accepts a comprehensive audit, fully mortgaged, and through the quarantined bankruptcy quarantine account structure design, ensuring that users receive the same level of transparency and investor protection as off-chain money market tools.

- On-chain earnings risk control: Mountain minimizes the risk of bank bankruptcy and stablecoins decoding by strictly limiting reserve assets to US Treasury bonds and eliminates common concerns about digital assets by Mountain users by strictly limiting reserve assets to USDC.

Mountain brings a paradigm shift to non-encrypted users: for individual users, USDM provides a low-risk digital asset return portal without DeFi knowledge; for institutions and corporate fund management departments, USDM is a compliant, stable and interest-bearing alternative to traditional banking products. Mountain Protocol's long-term strategy includes deepening USDM's integration of DeFi and TradFi ecosystem, expanding multi-chain support, and expanding institutional cooperation (such as existing cooperation with BlackRock). These measures will further simplify the on-chain earnings acquisition path and promote the adoption of stablecoins by non-crypto users.

Optimize the KYC process to achieve seamless user access

To achieve large-scale consumer adoption of stablecoin payments, the KYC (know your customers) process must be extremely simplified under compliance. One of the key pain points that hinder non-encrypted users’ entry is the cumbersome identity verification process. To this end, the leading stablecoin payment service provider is embedding KYC directly into the platform to achieve smooth user access.

Modern platforms no longer require users to complete verification separately, but integrate KYC into the payment process. For example:

- Ramp and MoonPay allow users to complete KYC in real time when purchasing stablecoins through debit cards, reducing manual review delays;

- BVNK provides enterprises with embedded KYC solutions to quickly and securely complete customer certification without interrupting the payment experience.

The fragmentation of cross-jurisdictional regulatory frameworks remains a challenge in simplifying the KYC process. Leading service providers respond to regional compliance differences through modular KYC framework. For example:

- Circle's USDC platform adopts a hierarchical verification mechanism, where users can complete small transactions through basic KYC and unlock higher limits through advanced verification.

In the future, converting KYC into a sensorless link through automation and process optimization will become the key to stablecoin payment service providers breaking the barriers to mainstream users' entry and accelerating on-chain.

4. Stablecoin native economy: Will consumers skip fiat currency?

Although stablecoins have greatly accelerated the global payment process and saved a lot of time and capital costs, real-world transactions currently rely on fiat currency deposits and withdrawal channels. This forms the metaphorical "stablecoin sandwich" framework, where stablecoins act only as bridges between fiat currencies during the transaction life cycle. Many stablecoin payment providers focus on the interoperability of fiat currencies, essentially making stablecoins a temporary transfer layer between fiat currencies. However, a more forward-looking idea is that stablecoin native payment service providers (PSPs) may appear in the future to realize the native operation of stablecoin payment. This means fundamentally rebuilding the payment system, assuming transactions, settlements and fund management functions are entirely on-chain.

Companies like Iron are actively exploring innovation in this field, committed to building a stablecoin that is not only a bridge between the fiat currency system, but also the future of the foundation of the entire chain financial ecosystem. Unlike other payment solutions that usually use stablecoins to copy traditional financial tracks, Iron is focusing on developing an on-chain-first payment and fund management stack, hoping that funds can remain on-chain throughout the entire chain, financial markets can achieve true interoperability, and real-time settlement on shared public ledgers.

As for whether the future of funds staying on the chain is feasible, it depends entirely on the consumer’s choice: whether to convert stablecoins into fiat currency and settle through traditional tracks, or to keep funds on the chain. There are several key factors that may drive this shift:

1. On-chain income and capital efficiency

A very convincing reason for consumers to retain funds in stablecoins is to be able to obtain passive, risk-adjusted returns directly on the chain. In a stablecoin native economy, consumers will have stronger control over the use of funds and can almost instantly obtain returns that are better than traditional savings accounts. But to truly achieve this, users must be able to discover attractive returns opportunities in the future, and agreements that provide such returns must reach a mature level where there is almost no risk to the opponent.

2. Reduce dependence on custodial intermediaries

Holding stablecoins greatly reduces the necessity of traditional bank relationships. Today, users are highly dependent on banks in terms of account custody, payment and access to financial services. Stablecoin realizes self-custodial wallets and programmable finance, and users can hold and manage funds independently without a third-party intermediary. This is of particular importance in areas where the banking system is unstable or the access to financial services is restricted. Despite the increasing appeal of self-hosting models, most non-crypto-native users either lack understanding of it or are cautious about managing funds in this way. To further promote the development of this self-hosting model, consumers may demand more regulatory guarantees and powerful applications.

3. Mature regulation and institutional adoption

As the regulation of stablecoins becomes increasingly clear and its acceptance continues to increase, consumers' confidence in the long-term preservation ability of stablecoins will continue to increase. If large enterprises, wage-paying institutions and financial institutions begin to settle transactions in native stablecoins, the demand for users to convert back to fiat currency will be significantly reduced. This is like the process of consumers gradually transitioning from cash to digital banking. Once new infrastructure is widely adopted, the demand for traditional systems will naturally decline.

It is worth noting that the shift to a stablecoin native economy may ultimately have an impact on many existing payment tracks. If consumers and businesses increasingly tend to store value in stablecoins rather than fiat currencies in traditional bank accounts, this will have a significant impact on existing payment systems. Credit card networks, remittance companies and banks rely mainly on transaction fees and foreign exchange spreads as sources of income, while stablecoins can be settled instantly on blockchain networks with almost zero costs. If stablecoins can circulate freely like fiat currencies in a country's economy, these traditional payment participants are likely to be excluded from the middle.

In addition, the stablecoin native economy will also challenge the banking business model based on fiat currencies. In the traditional model, deposits are the basis for loans and credit creation. If funds remain on the chain, banks may face deposit loss, and their ability to lend and obtain profits from customer funds will also be reduced. This may accelerate changes in the financial system and prompt decentralized and on-chain financial services to gradually replace the traditional role of banks.

Obviously, as long as incentives help funds stay on the chain, the theoretical stablecoin native economy has the possibility of becoming a reality. This shift will be gradual. With the increasing opportunities for on-chain earnings, the continued existence of bank frictions, and the continued maturity of the stablecoin payment network, consumers may increasingly choose stablecoins over fiat currencies, resulting in some traditional financial tracks gradually becoming obsolete.

5. Conclusion: How do we accelerate the adoption of stablecoins?

- Payment application layer: Make every effort to simplify the consumer experience, build a regulatory-first stablecoin solution, providing lower prices, higher asset returns, and faster and more convenient transfer experience than the Web2 payment track.

- Payment processor level: Focus on building enterprise-friendly, out-of-the-box infrastructure middleware. Due to its business characteristics, different licenses and compliance requirements are required to serve different regions, and the competitive landscape of payment processors is still relatively scattered.

- Asset issuer layer: actively passes stablecoin income to non-crypto-native companies and ordinary users to encourage users to hold stablecoins instead of fiat currencies.

- Settlement Network Layer: The competition between L1L2 settlement networks is not only at the technical level, but will also involve multi-level competition such as developer ecology, BD merchants, and traditional enterprise cooperation, accelerating stablecoin payment into real life.

Of course, the large-scale adoption of stablecoins not only depends on emerging startups, but also on the collaborative cooperation of mature financial giants. Four major financial giants have announced their entry into the stablecoin space in recent months: Robinhood and Revolut are launching stablecoins, Stripe recently acquired Bridge for faster and cheaper global payments, and Visa is also helping banks launch stablecoins despite its own interests.

In addition, we observe that Web3 startups are using these mature distribution channels to integrate crypto payment products into existing mature companies through the Software Development Toolkit (SDK), providing users with multiple options such as fiat currencies and cryptocurrency payments. This strategy helps solve cold start issues, building trust with businesses and users from the outset.

Stablecoins have the potential to reshape the global financial transaction landscape, but the key to large-scale adoption is to bridge the gap between the on-chain ecosystem and the wider economy.

chaincatcher

chaincatcher