The four-year cycle has expired. What happened to the crypto market in the past two years?

Reprinted from panewslab

03/24/2025·1MArticle author: Duo Nine YCC

Article Compilation: Block unicorn

Has the four-year cycle died?

In this article, I will answer this question, explain why the past two years have changed everything, and then make a very important suggestion. Let's start.

What is a four-year cycle?

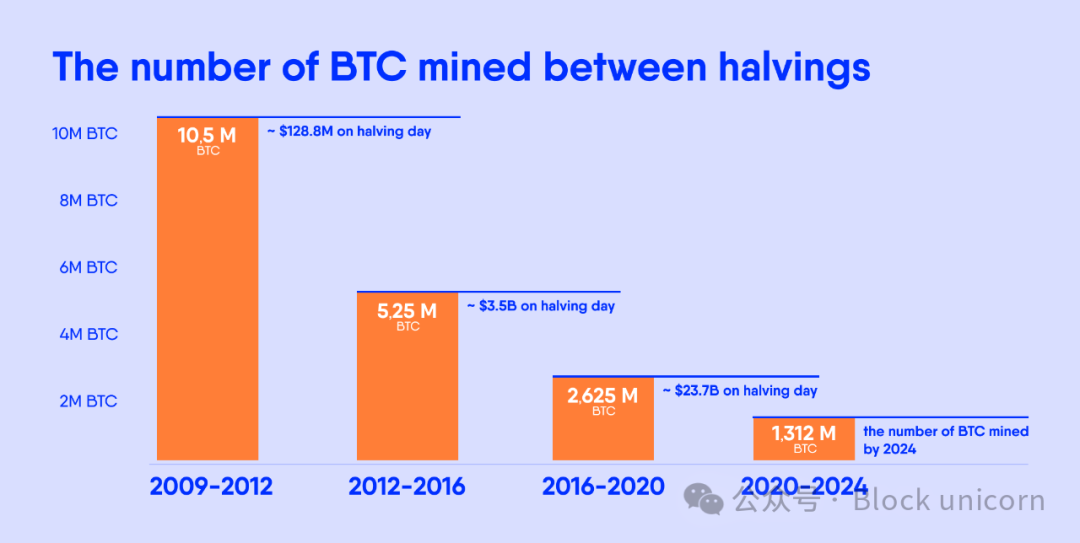

This four-year cycle originates from the basic principles of Bitcoin. Every four years, Bitcoin’s inflation rate drops in half. Back in 2012, the first halving event reduced the issuance of new Bitcoin by 50%, from 50 BTC per block to 25 BTC.

This has had a huge impact on Bitcoin’s supply and demand balance, especially during the first two halving events in 2012 and 2016. At that time, Bitcoin price soared as supply could not keep up with demand. Other cryptocurrencies (altcoins) also rose.

However, the impact of each new halving event on price is weakening. The latest Bitcoin halving in 2024 only reduced the issuance of new Bitcoins from 6.25 BTC to 3.12 BTC.

Given that almost 95% of Bitcoin is already in circulation (nearly 20 million of 21 million BTC), the impact of future halving events on prices is quickly becoming trivial.

The effective method that was implemented a few years ago is no longer applicable today. You can't "print free money" by buying any cryptocurrency like you did in the past. Now, we have new factors that have a more fundamental impact on the crypto cycle than Bitcoin’s halving plan.

It's time to improve your thinking! This will be explained in detail next.

Why has everything changed in the past two years?

Two things that have changed the cryptocurrency space in the past two years are:

- Cryptocurrency ETF (exchange-traded funds) are launched

- Altcoin inflation

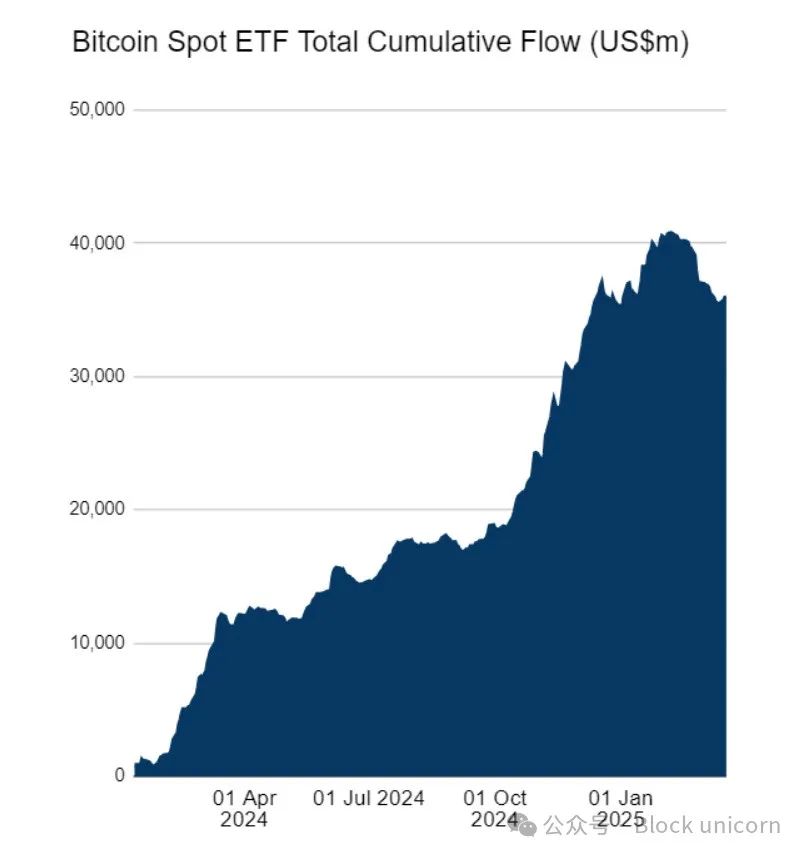

In early 2024, Bitcoin received ETF approval for the first time. This suddenly opened up the global market for Bitcoin. Now, anyone can add Bitcoin to their retirement portfolio, which was impossible in the past.

This represents a large amount of new funds flowing into Bitcoin that did not exist before. But there is a problem here.

As funds flow into Bitcoin ETFs, this creates buying pressure on the Bitcoin spot price. However, these liquidity never really leaves Bitcoin ETFs and flows to altcoins because there are no altcoin ETFs besides Ethereum. The demand for Ethereum ETFs has been disappointing so far, with a total of only US$2.5 billion.

As of the beginning of 2025, almost all ETF liquidity flowed to Bitcoin, with a total of US$40 billion, as shown in the chart. No wonder Ethereum has been falling against Bitcoin for many years. The same goes for most altcoins.

That's why everyone has been waiting for the "real" altcoin season for the past two years, and this season may never actually come. The altcoin rebound in November 2024 pale compared to the previous cycle.

While SOL, XRP, BNB and TRX hit new all-time highs, these prices are not far from past highs, and most altcoins, such as Ethereum or ADA, fail to hit new all-time highs. This clearly shows that altcoins are lagging behind compared to Bitcoin.

What is the reason?

Dilution of altcoins.

Compared to previous cycles, there are so many altcoins today (in millions). I have discussed this issue in detail in a past article. In short, the altcoin season is hijacked by Solana and its Meme coins. This basically sucks out all liquidity of the altcoin.

Not long after, when Solana's music was the loudest, Trump entered the stage in January 2025, breaking the party. This also ended the Meme currency season, with most Meme coins plummeting 80% to 90% since then.

Funds or liquidity in cryptocurrencies are limited and are now divided up by millions of altcoins. Moreover, Bitcoin is taking up an increasingly large share. Just look at BTC’s market dominance, which has been the highest since 2021, over 60%!

The altcoins are in a difficult situation. They only account for 40% of the market, and with millions of coins, there is not much money left for the altcoin season. If you are planning to play altcoin game, you really need to choose carefully.

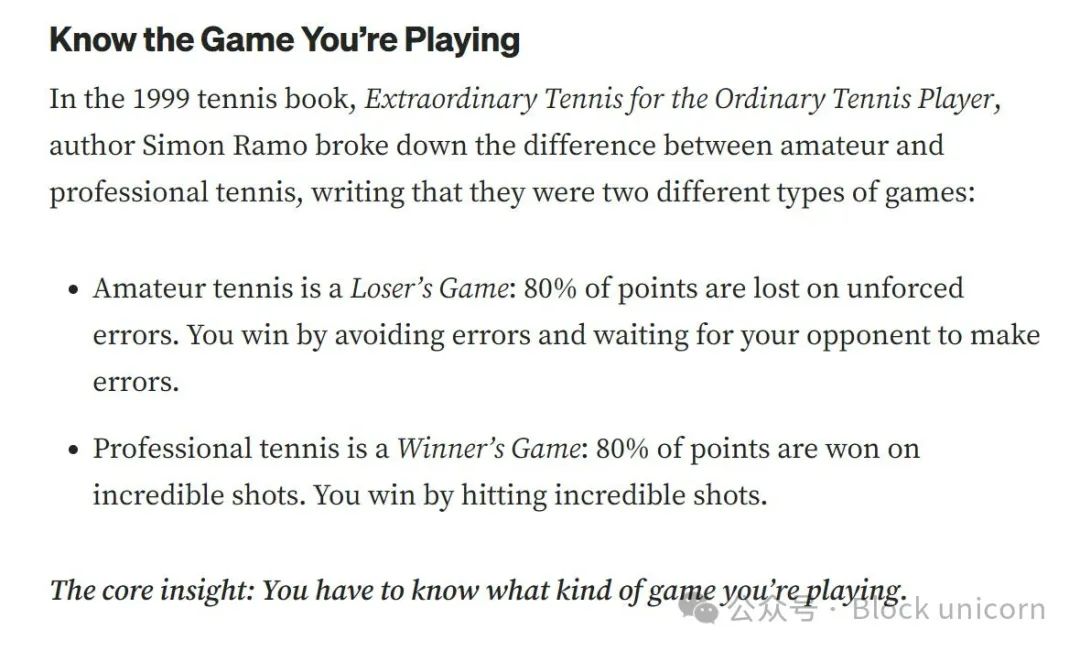

This reminds me of an interesting analogy. In tennis, there are two types of games players participate in:

- The loser game (altcoin)

- The person who plays the winner game (Bitcoin)

In the first case, tennis players must try their best to minimize their mistakes, because by doing this they can beat most opponents who make more mistakes. This is a loser game because losing less than most people can make you a winner.

In the second case, tennis players are the top of the top. Their game is no longer about reducing points, but about skill and becoming a winner. This is the winner game (top player) played by the winner.

In cryptocurrency, if you play the altcoin game, you are playing the loser game. To win, you need to pick altcoins that lose less than other coins. However, you can completely ignore this and choose to play the winner game by buying Bitcoin!

It's time to look at Bitcoin, and why it will continue to win regardless of the four-year cycle statement, which is no longer relevant based on the past two years.

Why is Bitcoin still the king?

I promised to give you a suggestion at the beginning of the article.

The goal is to play the winner game and focus on Bitcoin. This is your way to win for a long time. Limit your contact with losers’ games (altcoins) to a controllable range. Otherwise, things can get bad soon.

With this premise, here are 10 reasons why betting on Bitcoin makes you a winner:

- Fiat currency (USD) dilution - Central banks cannot stop printing fiat currency. Look at gold, it keeps hitting new highs. The same is true for Bitcoin in 2024, and the resistance of $100,000 will eventually break through. Be patient.

- Inflation - It's easy to print new dollars from the air, but you can't print bitcoin out of thin air. This makes Bitcoin the hardest currency on the planet. That's where you store your wealth.

- Quantitative tightening is coming - this means quantitative easing is coming, which will make fiat currency dilution and inflation inevitable.

- Global money supply hits record highs - it's not just the United States that is diluting the wealth of its citizens, every country is doing it, just at a different speed. Check out the price of Bitcoin in the Turkish Lira.

- Gold - Its record-breaking price movements seem to have no end since the end of 2023. What is better than gold? Bitcoin. Why do everyone buy gold? Because points 1 to 4. It's only a matter of time before people accept Bitcoin.

- Crypto ETFs - Calling them crypto ETFs is somewhat misleading because 95% of funds flows into Bitcoin ETFs. This ratio is even more biased towards BTC than Bitcoin's 60% market dominance.

- Altcoin Dilution - You can't dilute Bitcoin. You can't copy and paste it because you can't copy its multibillion-dollar security and mining equipment.

- The country is buying bitcoin - look at El Salvador. More and more countries are adding Bitcoin to their sovereign wealth funds.

- US cryptocurrency strategic reserves - what this basically means. No need to say much.

- You don't have a better choice - the only reliable currencies today are Bitcoin and gold, and the former has obvious advantages.

Although Bitcoin’s four-year cycle will continue, its impact on price is at best insignificant. In this sense, this statement no longer exists. However, the reason to continue buying Bitcoin is stronger than ever.

I can't say the same thing to the altcoin.

The game is getting harder and over time, picking the winner becomes the loser’s game. This is the exact opposite of betting on Bitcoin, more like betting on a Turkish lira to protect your wealth. We also know how the ending is.

chaincatcher

chaincatcher