Stablecoin Predictions for 2025: What’s Next for the $200 Billion Market?

Reprinted from jinse

12/25/2024·4MAuthor: Helen Partz, CoinTelegraph; Compiler: Bai Shui, Golden Finance

Crypto stablecoins have enjoyed great success in 2024, with circulation reaching an all-time high of over $200 billion in December.

Stablecoins – cryptocurrencies designed to mimic the value of a currency, most commonly the U.S. dollar – are an integral part of the crypto ecosystem, accounting for 5% of its market capitalization.

As 2025 approaches, this article summarizes the industry’s predictions and forecasts for the main stablecoin trends next year.

The Next Stop Is $300 Billion: USDT and USDC Will Remain Dominant

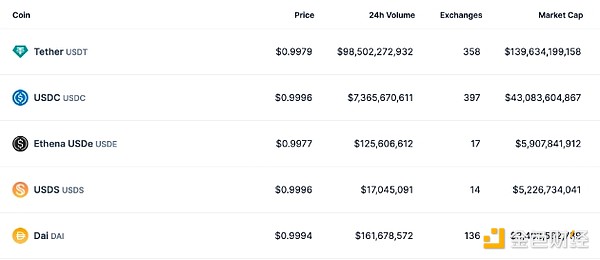

Tether’s USDT and Circle’s USD Coin, the two largest stablecoins by market capitalization, are likely to remain dominant through 2025, multiple industry executives and founders have said.

Guy Young, founder of the decentralized stablecoin protocol Ethena, predicts that USDT will continue to become the largest stablecoin next year, and the total market value of stablecoins will rise to $300 billion.

“I expect we will have over $300 billion in circulation, with Tether continuing to dominate with its existing moat, and the rest of the market being challenged by new fintech and Web2 entrants and their own products,” Young noted.

The top five stablecoins by market capitalization as of December 24. Source: CoinGecko

Ailona Tsik, chief marketing officer at Alchemy Pay, said stablecoins such as USDT and USDC “have become important tools for global transactions, and their adoption in emerging markets and decentralized applications is likely to accelerate.”

“Fiat-backed stablecoins such as USDT and USDC are likely to maintain their dominance because of their established credibility, liquidity, and broad ecosystem of users and businesses that rely on them.”

USDC partner Coinbase said in its 2025 outlook that stablecoins are "just getting started," and some analysts predict these tokens could grow to a $3 trillion market within the next five years.

Stablecoin payments: Visa expects surge in demand for stablecoin cards

Cuy Sheffield, head of cryptocurrency at Visa, pointed out that the adoption of stablecoins can modernize and simplify global payments, but existing stablecoin consumption opportunities are still limited.

“If 2024 is the year stablecoin demand picks up, 2025 will bring the next key opportunity: the rise of stablecoin-pegged cards,” Sheffield said.

“This demand will only increase through 2025 as wallets look to capitalize on stablecoin adoption and issue stablecoin-pegged cards.”

He said Visa will expand its capabilities to enable issuers to use stablecoins to settle stablecoin-linked cards directly with the payments giant.

Simon McLoughlin, CEO of crypto platform Uphold, is also optimistic about increased payment adoption in the coming year.

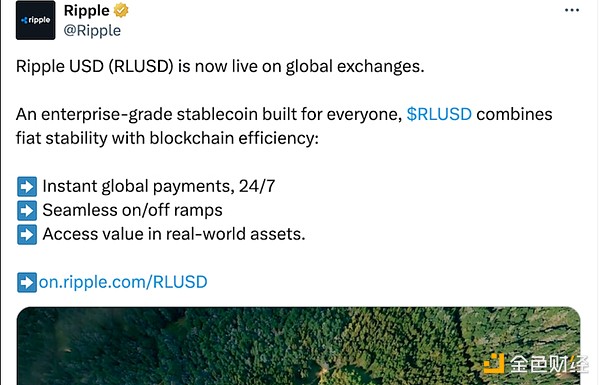

“2025 will be the year stablecoins enter the mainstream as international payment instruments,” McLoughlin said. He highlighted new stablecoins aimed at cross-border settlements, such as Ripple Labs’ Ripple USD (RLUSD), which began trading on December 17.

Ripple began transferring RLUSD out of exchanges on December 17. Source: Ripple

BitPay Chief Marketing Officer Bill Zielke said that although stablecoins only account for 5% of all transactions, by 2024, they will account for at least a quarter of the crypto payment platform’s transaction volume.

“While the average BTC transaction value on BitPay is just over $1,000, USDC transactions average over $5,000,” he said.

“We expect this trend to continue into 2025 as stablecoins further solidify their role in global commerce and business-to-business payments,” Zielke added.

Regulatory disagreements and the need for consistent systems will persist

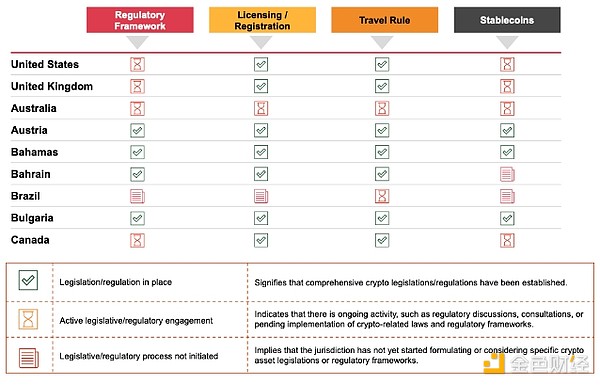

While many are optimistic about the growth of stablecoins in 2025, regulation of stablecoins remains inconsistent globally.

“One of the key challenges we foresee for stablecoins in 2025 is dealing with the changing regulatory environment,” said Alchemy Pay’s Tsik.

Ben Reynolds, head of stablecoins at BitGo, said regulatory uncertainty and the need for greater transparency will remain significant challenges in 2025 until lawmakers provide clear guidance.

“Crypto Regulation at a Glance” from PwC’s 2023 Crypto Regulation Report. Source: PwC

Vishal Gupta, founder of True Markets, noted that the legal environment for stablecoins “will continue to suffer from inefficiencies and fragmentation due to inconsistent regulatory regimes.”

He cited the global regulatory divergence caused by the EU’s introduction of specific stablecoin rules, specifically the Market Regulation in Crypto-Assets (MiCA).

“Regulatory divergence may present opportunities in areas where rules are clear and balanced, but also challenges in areas where regulations are overly complex or restrictive,” Gupta said.

As U.S. President-elect Donald Trump prepares to take office in January, companies such as BitPay are hoping for greater clarity and consistency in the way stablecoin and crypto markets are regulated.

Stablecoin Trends in 2025: L2, Yields, and Interoperability

Many industry executives predict that stablecoins will further develop in the next year in areas such as layer 2 (L2), yield and interoperability.

BitPay’s Zielke said the adoption of L2 stablecoins on networks such as Arbitrum, Optimism and Base will be one of the biggest development areas for coins in 2025.

Tether CEO Paolo Ardoino said that stablecoins "will become the most important currency technology in the next few decades, and blockchain and L2 will be integrated."

BitGo’s Reynolds predicts that next year will see a push for greater interoperability between blockchains to enable stablecoins to be transferred seamlessly across the cryptocurrency space, with True Markets’ Gupta noting that this will unlock “new capabilities in retail and institutional markets. Use Cases".

Ethereum, Tron and Avalanche are the three major networks of USDT. Source: Tether

The stablecoin industry is also likely to see more revenue-generating stablecoin solutions in 2025 as L2 and interoperability adoption becomes more widespread.

Azeem Khan, chief operating officer of Ethereum L2 platform Morph, emphasized that stablecoins such as PayPal USD can provide income rewards simply by holding the stablecoin. Companies such as BitGo are also launching revenue- generating stablecoins in 2024.

“There will be other yield-generating stablecoins entering the market looking to gain more holders and find ways to add them as payment options,” Khan said.

The Risks of “Exotic” Stablecoins

True Markets' Gupta said that as demand for stablecoin yields increases, there will be an increase in "exotic" stablecoins - those designed to provide higher returns.

“The pursuit of higher yields may lead to the creation of ‘exotic’ stablecoins, which effectively act as structured financial products, hiding risks that retail users may not fully understand,” he added.

Gupta warned that retail investors could be lured by promises of higher returns without fully grasping the associated risks, which could lead to significant losses.

"Industry players must prioritize transparency, detailed risk disclosures and education for retail users. Regulators should set clear standards to protect consumers while maintaining room for innovation."

chaincatcher

chaincatcher

panewslab

panewslab