This article takes stock of the seven major DeFi staking platforms in 2025: How to maximize returns?

Reprinted from panewslab

12/25/2024·4MAuthor: Siddhant Kejriwal

Compiled by: Glendon, Techub News

Since the development of the cryptocurrency industry, staking has become an indispensable cornerstone, playing an important role in network security and investor participation. By participating in staking, individuals can not only contribute to the stable operation of the blockchain network, but also unlock opportunities for passive income. Specifically, the benefits of participating in staking include:

1. Strengthen cryptoeconomic security: In essence, staking involves locking a certain amount of cryptocurrency to support the operation of the blockchain network. This process is especially critical for proof-of-stake (PoS) blockchains, where validators confirm transactions based on the amount of cryptocurrency they stake. This mechanism ensures the security of the network and closely connects the interests of participants with the healthy development of the blockchain.

2. Earn passive income: In addition to enhancing network security, staking provides attractive financial incentives. By staking their assets, investors can earn rewards, usually in the form of additional cryptocurrency tokens. This method of income generation meets the needs of both novice and experienced investors looking to maximize returns without active trading. In some projects, staking may also involve airdrop activities, providing pledgers with additional opportunities for asset appreciation.

3. Launch new projects through re-pledge: One of the latest innovations in the staking field is “Restaking”, which allows pledged assets to be reused across multiple protocols. This approach allows new projects to leverage the security and capital of existing networks, effectively bootstrapping their growth. For example, platforms such as EigenLayer facilitate re-staking by allowing users to stake their ETH or liquid staking tokens and extend cryptoeconomic security to other applications on the network, bringing further benefits to investors.

It should be noted that although re-staking provides investors with opportunities to increase returns and enhance network support, it is also accompanied by some complexities and risks that cannot be ignored. As 2025 approaches, the DeFi staking space will continue to flourish, providing investors with more options, and this article will take you through the top DeFi staking platforms worth paying close attention to.

What is DeFi staking?

DeFi staking involves locking cryptocurrency assets into smart contracts to support the operation of blockchain networks, particularly those that employ proof-of-stake (PoS) consensus mechanisms. In a PoS network, validators confirm transactions and create new blocks based on the amount of cryptocurrency they stake. Staking typically requires deploying a full node and meeting the network's minimum staking requirements, allowing participants to validate transactions and participate in network consensus to earn rewards.

Key concepts in DeFi staking

-

Smart Contracts and Pledge Contracts: Smart contracts are self-executing protocols encoded on the blockchain, ensuring that the staking process is automated, transparent, and secure. When you stake your tokens, you actually become a validator (or delegator) of the network, jointly maintaining the security and stability of the network. In return, you will be rewarded in the form of new tokens or a share of transaction fees.

-

Staking rewards: Staking rewards typically include newly minted tokens and a share of transaction fees as an incentive for participants to contribute to network security and operations.

-

Penalty mechanism: In order to maintain the integrity of the network, the PoS network implements a penalty mechanism "Slashing". If a validator engages in malicious activities or fails to perform its duties, its pledged funds will be reduced. This mechanism is intended to deter inappropriate behavior from occurring.

DeFi staking vs. centralized staking

When comparing DeFi staking and centralized staking services, the following key factors stand out:

-

Ownership: DeFi staking allows users to retain actual ownership of their assets because they control their private keys. In contrast, centralized staking requires users to entrust their assets to a third party, thereby giving up direct control.

-

Transparency: The DeFi platform runs on open source smart contracts, providing a transparent staking process and reward distribution. Centralized platforms may lack this transparency, making it difficult for users to verify how rewards are calculated and distributed.

-

Security and Control: DeFi staking gives users greater control over their assets, reduces reliance on intermediaries, and reduces counterparty risk. Centralized staking involves entrusting assets to the platform, which can pose security risks if the platform is attacked.

-

Mechanism: In DeFi staking, users entrust their pledge to a network of permissionless validators and directly participate in the network’s consensus mechanism. Centralized staking platforms pool user funds and stake them using validators selected by the platform, often without disclosing the specific details of the process.

-

Learning Curve: DeFi staking can be complex and requires users to navigate various platforms and manage private keys, which can be challenging for beginners. The centralized platform provides a more user-friendly, Web2-like experience, simplifying the staking process at the expense of decentralization.

in conclusion

Choosing between DeFi and centralized staking platforms comes down to personal preference, especially regarding control, transparency, and ease of use. Next, this article will explore the top DeFi staking platforms expected to make an impact in 2025 and provide some insights.

DeFi staking platform

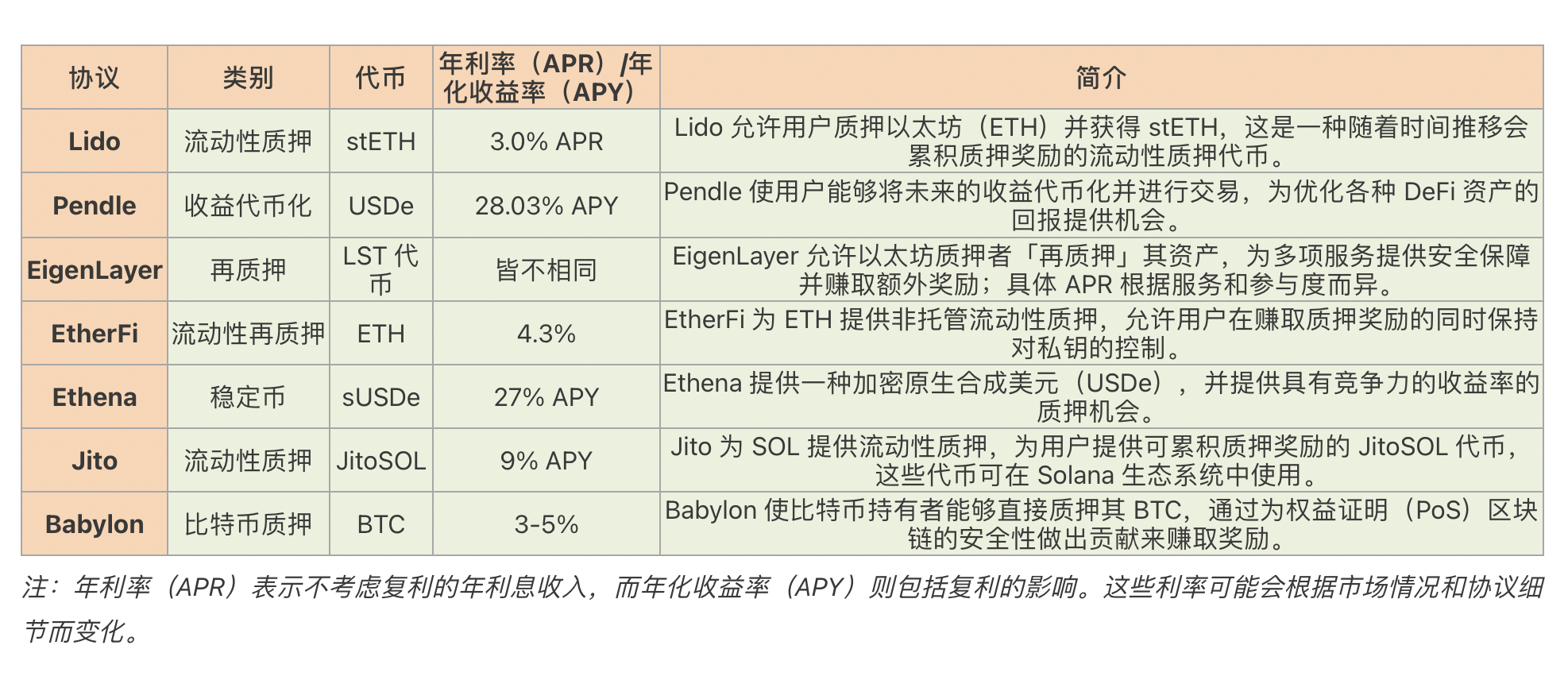

Below is a comprehensive overview of the DeFi staking protocols we are about to discuss, focusing on their main features, related tokens, and current Annual Percentage Rate (APR) or Annual Percentage Yield (APY).

Lido Finance

Lido Finance is a DeFi protocol focusing on liquidity staking services. It enables users to stake their digital assets on multiple blockchain networks while maintaining liquidity, effectively solving the limitations of traditional staking such as asset locking and high entry barriers. By issuing liquid staking tokens (LSTs) such as stETH for Ethereum, Lido allows users to earn staking rewards while using their assets within the broader DeFi ecosystem.

Main features of Lido Finance

-

Liquidity Staking: Lido’s core service allows users to stake assets without locking them up. It offers collateralized token derivatives (such as stETH) that can be freely transferred, traded, or used in other DeFi protocols.

-

Decentralized Governance: Governed by the Lido Decentralized Autonomous Organization (DAO), Lido ensures that decisions regarding protocol parameters, node operator selection, and fee structures are made jointly by LDO token holders.

-

Security Measures: Lido employs experienced node operators and conducts regular audits to maintain the integrity and security of the staking process and minimize risks such as penalty cuts.

-

DeFi Integration: Lido’s liquid staking tokens are widely accepted across various DeFi platforms, allowing users to participate in activities such as lending and yield farming while earning staking rewards.

Supported staking tokens

Lido supports staking of multiple cryptocurrencies across different networks, including:

-

Ethereum (ETH): Stake ETH and receive stETH.

-

Polygon (MATIC): Stake MATIC and receive stMATIC.

-

Solana (SOL): Stake SOL and receive stSOL.

-

Polkadot (DOT): Stake DOT and receive stDOT.

-

Kusama (KSM): Stake KSM and receive stKSM.

LDO Token and Its Utility

Lido’s native token, LDO, plays several key roles in the ecosystem:

-

Governance: LDO holders participate in the Lido DAO and vote on key decisions such as protocol upgrades, fee structure, and node operator selection.

-

Incentives: LDO tokens can be used to incentivize liquidity providers and users who contribute to the growth and stability of the Lido protocol.

Summarize

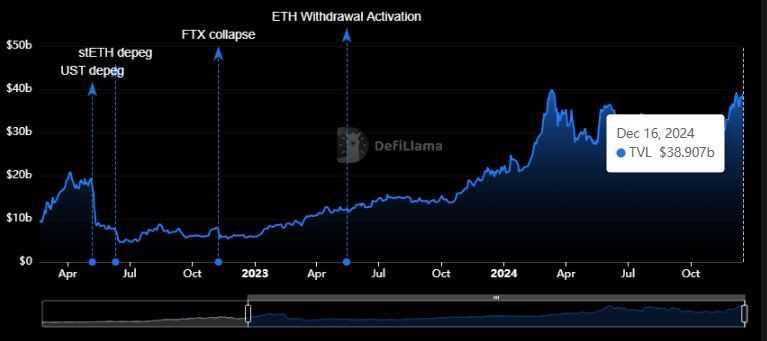

Lido Finance has now consolidated its leading position in the DeFi field. As of December 2024, its total value locked (TVL) is close to an all-time high of $40 billion.

Lido’s growing dominance as leading LST platform | Chart via [DefiLlama](https://defillama.com/protocol/lido?tvl=true)

This growth reflects growing user confidence in Lido’s liquidity staking solution and its integration within the DeFi ecosystem. Additionally, Lido’s recently launched community staking module enhances decentralization by allowing permissionless node operators to participate, further strengthening the network’s security and resiliency.

Pendle Finance

Pendle Finance is a DeFi protocol that allows users to tokenize and trade the future earnings of yielding assets. By separating the principal and income components of an asset, Pendle employs more advanced income management strategies, including fixed income, speculation on future income changes, and unlocking liquidity from pledged assets. This innovative approach brings traditional financial concepts, such as interest rate derivatives, into the DeFi space, providing users with greater control and flexibility over their investments.

Main features of Pendle Finance

-

Yield Tokenization: Pendle allows users to wrap income tokens into Standardized Yield (SY) tokens and then split them into Principal Tokens (PT) and Yield Tokens (YT). This separation allows the principal and future return components to be traded independently, thereby facilitating the implementation of strategies such as locking in fixed income or speculating on return fluctuations.

-

Pendle Automated Market Maker (AMM): Pendle's AMM is designed for assets that decay over time, such as YT, providing optimized pricing and minimal slippage. It supports centralized liquidity and a dynamic fee structure that improves capital efficiency and reduces impermanent losses for liquidity providers.

-

vePENDLE governance: Pendle adopts a voting escrow token model, and users can lock PENDLE tokens to receive vePENDLE. This mechanism grants governance rights, allowing holders to participate in protocol decisions, provide direct incentives to specific liquidity pools, and earn a share of protocol revenue.

Supported pledge assets

Pendle supports a variety of income-generating assets across multiple blockchain networks, including:

-

Ethereum (ETH): Pendle allows for the tokenization and trading of assets such as stETH (Lido’s liquidity staking token).

-

Stablecoins: Tokens from lending protocols such as Aave or Compound (such as USDC and DAI) can be used in Pendle's ecosystem.

-

Other income tokens: Assets generated by various DeFi protocols can also be integrated into Pendle’s platform.

PENDLE Token and Its Utility

The PENDLE token is the native utility and governance token in the Pendle ecosystem. Its main functions include:

-

Governance: PENDLE holders can lock their tokens to receive vePENDLE, granting them voting rights to participate in protocol governance decisions such as proposal and voting upgrades, fee structure, and other key parameters.

-

Incentives: PENDLE tokens incentivize liquidity providers and users, promoting the growth and stability of the platform. Additionally, vePENDLE holders can direct incentives to specific liquidity pools, thereby increasing their returns.

-

Revenue Sharing: vePENDLE holders are entitled to a share of the protocol’s revenue, aligning the interests of the community with the success of the platform.

Summarize

Pendle Finance has gradually become an important force in the DeFi field by introducing revenue tokenization and an AMM dedicated to revenue trading. As of December 2024, Pendle’s total value locked (TVL) has exceeded $5 billion (data from DefiLlama ).

Pendle’s integration with multiple DeFi protocols and expansion into various blockchain networks such as Ethereum and Arbitrum further solidifies its position as a versatile and valuable tool for yield management in the DeFi ecosystem.

EigenLayer

EigenLayer is an innovative protocol based on Ethereum that introduces the concept of "re-staking", allowing users to reallocate their pledged Ethereum (ETH) or Liquid Staking Tokens (LSTs) to enhance the capabilities built on Ethereum The security and functionality of other services on the network. By enabling the reuse of staked assets, EigenLayer facilitates the development of shared security models, application chains and rollup technologies that do not require an independent set of validators.

Main features of EigenLayer

-

Re-staking mechanism: EigenLayer allows ETH stakers and LST holders to choose to verify new software modules by re-staking their assets. These modules are called Active Verification Services (AVSs). This process extends Ethereum’s security to a wider range of applications, including data availability layers, oracle networks, and consensus protocols.

-

Permissionless Token Support: EigenLayer introduces permissionless token support, allowing any ERC-20 token to be added as a re-pledgeable asset. This expansion allows multiple tokens to contribute to the security of the decentralized network, promoting cross-ecosystem collaboration while enhancing the utility of various tokens.

-

EigenDA (Data Availability Layer): EigenLayer offers EigenDA, a low-cost data availability solution for Rollup and other Layer 2 solutions. EigenDA increases the scalability and efficiency of Ethereum-based applications by ensuring that data is easily accessible and secure.

-

Governance and Flexibility: EigenLayer’s architecture allows AVSs to customize their security parameters, including selecting specific tokens for re-staking and defining slashing conditions. This flexibility enables services to tailor security measures to their unique needs, promoting a more resilient and adaptable ecosystem.

Supported rehypothecated assets

EigenLayer supports re-hypothecation of multiple assets, including:

-

Ethereum (ETH): Users can participate in ensuring the security of other services by re-staking their native pledged ETH.

-

Liquid Staking Tokens (LSTs): Tokens such as stETH and rETH can be re-pledged through EigenLayer, allowing holders to obtain additional rewards.

-

ERC-20 Tokens: With permissionless token support, any ERC-20 token can now be added as a re-pledgeable asset.

EIGEN Token and Its Utility

EigenLayer has launched the EIGEN token, a universal inter-subject working token designed to enhance the security of the AVS fork protocol supported by EigenLayer. The EIGEN token protects these protocols in the face of extreme situations, such as active attacks or security breaches, ensuring that the integrity of the blockchain modular stack is not compromised. By combining EIGEN tokens with re-pledged ETH, EigenLayer provides users with a higher level of cryptoeconomic security.

Summarize

According to DefiLlama data, as of December 2024, EigenLayer's TVL has reached approximately US$20.1 billion. As EigenLayer continues to evolve, it remains at the forefront of enhancing Ethereum’s security and scalability with its groundbreaking restaking protocol, providing new opportunities for users and developers to participate in and build on the Ethereum network.

Ether.fi

Ether.fi is a decentralized, non-custodial liquidity staking protocol that empowers Ethereum holders by allowing them to stake their assets while retaining control of their private keys. Ether.fi has issued eETH, a liquid staking token that enables users to earn staking rewards and participate in the broader DeFi ecosystem without the limitations imposed by traditional staking. This approach enhances the security, decentralization, and user autonomy of the Ethereum network.

Key features of Ether.fi

-

Non-custodial staking: Unlike many staking services, Ether.fi ensures users maintain control of their private keys throughout the staking process, significantly reducing custodial risk.

-

Liquidity Staking with eETH: When users stake ETH, they receive eETH, a liquidity token that represents their staked assets. This token can be used for lending and yield farming on various DeFi platforms while accumulating staking rewards.

-

Integration with EigenLayer: Ether.fi has partnered with EigenLayer to provide a re-staking feature that allows users to earn additional rewards by simultaneously securing multiple decentralized applications (DApps).

-

Operation Solo Staker: Ether.fi promotes decentralization by allowing individuals to operate their own validator nodes through the Operation Solo Staker program.

ETHFI Token and Its Utility

Ether.fi’s native token ETHFI has multiple functions within the platform:

-

Governance: ETHFI holders have the right to participate in the governance of the protocol and influence decisions related to treasury management, token utility, and ecosystem development.

-

Revenue Sharing: A portion of the protocol’s monthly revenue is used to buy back ETHFI tokens, which may enhance its value and benefit token holders.

-

Staking Incentives: Users can stake their ETHFI tokens to receive additional rewards, further incentivizing participation and keeping in line with the development of the platform.

Summarize

Ether.fi has become a major player in the DeFi space, with its TVL exceeding $9.54 billion in December 2024, making it one of the leading re-staking protocols in the Ethereum ecosystem.

Ethena Finance

Ethena Finance is an Ethereum-based DeFi protocol that provides a crypto-native synthetic U.S. dollar called "USDe". Unlike traditional stablecoins that rely on fiat reserves, USDe maintains its peg through a delta hedging strategy and cryptocurrency collateral (primarily Ethereum), a design that provides a censorship-resistant and scalable solution.

Key features of Ethena Finance

-

Synthetic USD (USDe): USDe is a fully backed synthetic USD collateralized by crypto assets and managed via delta hedging. This approach ensures stability without relying on the traditional banking system, providing a resilient alternative to the DeFi space.

-

Internet Bonds (sUSDe): By staking USDe, users can earn sUSDe, a yield asset that the protocol generates over time. This mechanism allows users to earn passive income while maintaining exposure to stable assets.

-

Delta hedging mechanism: Ethena uses delta hedging, using short positions in the derivatives market to offset price fluctuations in mortgage assets. This strategy maintains USDe's peg to the U.S. dollar, ensuring stability even if the market fluctuates.

-

Non-custodial and decentralized: Ethena operates without relying on traditional financial infrastructure, providing users with complete control over their assets.

Supported pledge assets

Ethena primarily supports Ethereum as collateral for minting USDe. Users can deposit ETH into the protocol to generate USDe and then stake to receive sUSDe, thereby participating in the protocol's revenue generation mechanism.

ENA Token and Its Utility

Ethena’s native governance token, ENA, plays several key roles in the ecosystem:

-

Governance: ENA holders can participate in protocol governance and influence decisions related to system upgrades, parameter adjustments, and overall strategic direction through voting.

-

Staking Rewards: By staking ENA, users can earn sENA, which may accumulate additional rewards and provide higher reward multipliers in the incentive mechanism within the protocol.

Summarize

DefiLlama data shows that as of December 2024, Ethena Finance’s TVL exceeds $5.9 billion.

Jito

Jito is a liquid staking protocol running on the Solana blockchain that focuses on Maximize Extractable Value (MEV) strategies. By allowing users to stake their SOL tokens in exchange for JitoSOL, a liquid staking token, Jito enables participants to earn staking rewards augmented by MEV revenue.

Jito’s main features

-

MEV-driven staking rewards: Jito integrates MEV strategies to increase staking rewards. By capturing and redistributing MEV profits, JitoSOL holders can earn higher returns than traditional staking methods.

-

Use JitoSOL for liquidity staking: After staking SOL, users will receive JitoSOL tokens representing their pledged assets. These tokens remain liquid, allowing users to participate in various DeFi activities while still receiving staking rewards.

-

Non-custodial platform: Jito operates as a non-custodial platform, ensuring users retain control over their assets.

-

Enhanced network performance: Jito helps improve network performance and reduce spam on the Solana blockchain by staking exclusively with validators running optimized software.

Supported pledge assets

Jito mainly supports the pledge of Solana token SOL. Users can stake any amount of SOL and receive JitoSOL in return.

JTO tokens and their uses

Jito launched its native token JTO, which serves multiple functions in the ecosystem:

-

Governance: JTO holders can participate in protocol governance.

-

Staking rewards: By staking JTO, users can receive additional rewards.

Summarize

Jito has achieved significant growth within the Solana ecosystem. According to its website data, as of December 2024, more than 14.5 million SOL tokens have been pledged through Jito, with approximately 204 Solana validators participating. The platform provides a staking annualized yield (APY) of over 8%, reflecting its competitive advantage in the liquid staking market.

One of Jito’s signature features is the integration of the MEV strategy to increase staking rewards. Additionally, Jito's commitment to open source development is demonstrated through the release of Jito-Solana, the first third-party, MEV-enhanced validator client for Solana.

Babylon

Babylon is a groundbreaking protocol that brings Bitcoin staking to the DeFi ecosystem. By allowing Bitcoin holders to stake their assets directly, Babylon allows users to earn while also contributing to the security of the proof-of-stake blockchain. This innovative approach eliminates the need to bridge, wrap, or transfer BTC to a third-party escrow, thereby maintaining Bitcoin’s inherent security and decentralization.

Main features of Babylon

-

Self-custodial staking: Babylon’s protocol allows BTC holders to stake assets without handing over control to an external entity. Users lock their Bitcoins in a self-custody manner, ensuring full ownership and security throughout the staking process.

-

Integration with PoS chains: By staking BTC, users can participate in protecting various PoS blockchains, including application chains and decentralized applications (DApps). This integration enhances the security of these networks and rewards stakers in return.

-

Quick unbundling: Babylon adopts the Bitcoin timestamp protocol to enable the pledged BTC to be quickly unbundled. This feature ensures that users can quickly withdraw their assets without relying on social consensus, thus maintaining liquidity and flexibility.

-

Scalable re-staking: The protocol’s modular design supports scalable re-staking, allowing a single BTC stake to simultaneously secure multiple PoS chains. This feature maximizes earning potential.

Supported pledge assets

Babylon focuses on using Bitcoin for staking purposes.

Summarize

Babylon has achieved significant results, including the successful launch of its mainnet and the launch of multiple staking caps. Notably, the protocol’s TVL exceeded $5.7 billion in December 2024.

Pros and Cons of DeFi Staking

Benefits of DeFi Staking

1. Potential for high returns through yield farming: DeFi staking often offers significant rewards, especially when combined with a yield farming strategy.

2. Enhance control over funds: Users retain full ownership of funds through decentralized wallets without relying on third-party custodians.

3. Participate in governance: Staking governance tokens enables users to vote on protocol decisions and influence the future development of the platform.

4. Contribution to network security and operations: By staking, users can help protect the blockchain network and maintain decentralized operations.

5. Liquidity Staking Tokens: Liquidity Staking Tokens enable users to access staked capital while continuing to earn rewards.

6. Flexibility of income strategies: DeFi staking provides opportunities for multiple innovative strategies, such as achieving compound interest by re-staking or using pledged tokens to participate in other DeFi activities.

7. Access emerging ecosystems: Staking supports innovation by helping bootstrap new protocols and ecosystems.

Risks of DeFi Staking

1. Smart contract vulnerabilities: Malicious attacks or vulnerabilities in smart contracts may lead to the loss of pledged assets.

2. Impermanent losses in liquidity pools: Changes in token prices may reduce the value of assets in the liquidity pool, thereby affecting overall returns.

3. Fluctuation in Token Prices: The volatility of cryptocurrencies may affect the value of staking rewards.

4. Penalty reduction: In some networks, inappropriate validator behavior may result in penalties that reduce the amount of staked funds.

5. Protocol-specific risks: Emerging platforms may lack sufficient auditing or experience, thereby increasing the risk of operational failure.

6. Lack of liquidity: Pledged assets may be locked for a period of time, limiting the immediate availability of funds.

Strategies to Reduce DeFi Staking Risks

1. Decentralize staking across multiple platforms: Spread your pledged assets across different protocols to reduce the impact of a single platform failure.

2. Research platform audit and security history: Choose platforms that have good security records and are regularly audited by third parties to ensure the safety of your funds.

3. Pay attention to token economics and protocol changes: Closely monitor token supply changes, reward mechanisms, and governance decisions that may affect your staking strategy.

4. Leverage Liquidity Staking Options: Maintain liquidity and flexibility while earning rewards using protocols that offer liquid staking tokens.

5. Set risk limits: To manage risk exposure, determine the maximum percentage of your portfolio allocated to staking and stick to it.

6. Use reputable wallets and hardware security devices: Store your staked assets in a secure wallet to protect against potential hacking or phishing attacks.

How to Start Staking in DeFi: A Step-by-Step Guide

DeFi staking allows you to earn rewards by supporting blockchain networks, and while the exact steps may vary by protocol, the following provides a general guide:

Step 1: Choose a pledge agreement

-

Research different staking platforms and choose one that aligns with your goals, such as liquidity staking (like Lido Finance or Jito) or yield tokenization (like Pendle Finance).

-

Consider factors such as supported assets, security measures and potential returns.

Step 2: Set up wallet

-

Choose a protocol-compatible non-custodial wallet that you plan to use, such as Ethereum-based platform MetaMask or Solana’s Phantom.

-

Keep your wallet secure by backing up your mnemonic phrase and enabling two-factor authentication.

Step 3: Get tokens

-

Purchase the tokens required for staking (e.g. ETH for Lido, SOL for Jito) through a cryptocurrency exchange.

-

Transfer coins to your wallet.

Part 4: Connecting to the Staking Agreement

-

Visit the official website of the protocol (e.g., lido.fi , jito.network ).

-

Follow the prompts to authorize the connection and connect your wallet to the platform.

Step 5: Pledge assets

-

Select the token you want to stake and determine the amount.

-

Confirm the staking transaction and make sure you have enough funds to cover the transaction fees.

-

In a liquid staking protocol, you will receive a derivative token (such as stETH or JitoSOL) that you can use in the DeFi ecosystem.

Step 6: Monitor and manage your rights

-

Track your staking rewards and portfolio performance regularly via the dashboard or protocol’s interface.

-

Consider leveraging the revenue tokenization capabilities of protocols like Pendle for additional strategies.

How to maximize DeFi staking returns

1. Diversify your staking portfolio: Spread your investments across multiple protocols to minimize risk and optimize returns.

2. Reinvest rewards: Use earned rewards to increase returns by re-staking or participating in yield farming opportunities.

3. Stay informed: Stay aware of updates to protocol governance, token economics, and network upgrades that may impact staking rewards or security.

4. Optimize Gas fees: Arrange transaction times when there is less network activity to reduce transaction costs.

5. Explore advanced strategies: Consider using protocols like Pendle Finance to lock in fixed returns or use tokenized assets to speculate on future returns.

7. Use Liquid Staking Tokens in DeFi: To accumulate additional returns on top of staking rewards, deploy derivative tokens (e.g. stETH, JitoSOL, etc.) in lending or yield farming.

The above steps and tips will help you get started on your DeFi staking journey and unlock your full potential to generate passive income in the DeFi ecosystem.

Summarize

This article explores some of the top platforms that may be gaining attention in 2025, including Lido Finance, Pendle Finance, EigenLayer, Ether.fi, Ethena, Jito, and Babylon. While each protocol provides basic staking services, it also has some unique features, such as revenue tokenization, re-staking or Bitcoin staking, etc. Mastering and effectively utilizing these capabilities will be the key to unlocking real benefits. As the cryptocurrency market enters a new bull market, the DeFi field in 2025 is showing unlimited possibilities. Driven by continued innovation and widespread adoption, DeFi staking is expected to become an important way for us to obtain generous returns.

jinse

jinse

chaincatcher

chaincatcher