Rumors are everywhere. Can Trump’s cancellation of crypto gains tax be implemented?

Reprinted from panewslab

03/05/2025·1M

The market is a huge Christmas tree.

Yesterday, the market was still immersed in the positive news brought by Trump's support for cryptocurrencies. But one day, Bitcoin fell all the way back to its original point, erasing all the gains brought by Trump's speech, and drawing a door that makes the market uncomfortable.

But the market finally grasped a life-saving straw and did not easily give up digging out more possibilities for favorable markets from Trump.

On the morning of March 4, Alpine Fox LP founder Mike Alfred tweeted that the Trump administration may win awards at the crypto summit on Friday to announce the zero capital gains tax policy for cryptocurrency sales.

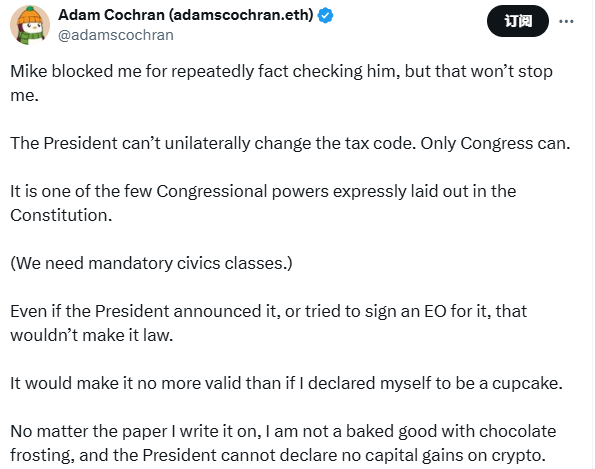

As for Mike Alfred's rumor that "Trump is preparing to announce zero tax rates for cryptocurrencies", Cinneamhain Ventures partner Adam Cochran even directly criticized: "Mike blocked me because I repeatedly checked his facts, but this does not stop me. The president cannot unilaterally modify the tax law. Only Congress can do so. This is one of the few Congress powers clearly stipulated in the Constitution. Even if the president announces the decision, or tries to sign an executive order for it, it will not make it law. This is no more effective than claiming that he is a cupcake."

The abolition of the crypto capital gains tax is a big deal for both the crypto market itself, for market participants, and for the U.S. government.

Social media naturally argued endlessly about the authenticity of such major events.

Putting aside market noise, let’s first look at what impact will it have on the market if the crypto tax exemption is successful? If not, what factors will be restricted?

How do you collect cryptocurrency taxes now?

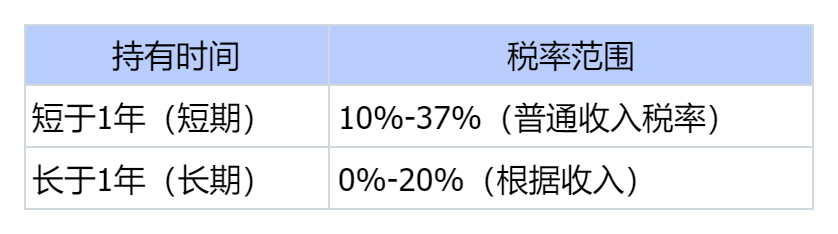

Let’s talk about the current situation first. According to the Coinbase tax system guidelines, in the United States, cryptocurrencies are not "currencies". The IRS (International Revenue Service) defines cryptocurrencies as "property". If you buy Bitcoin and sell it at a higher price, you will have to pay capital gains tax on the money you make. The tax rate also depends on the time you hold the currency:

In other words, if an American citizen bought 10,000 yuan of Bitcoin, it rose to 20,000 yuan in three months, and made 10,000 yuan after selling it. The net profit of 10,000 yuan has to be paid at the ordinary income tax rate (10%-37%), and it may be lost for thousands of yuan. If you sell it after a year of digging in your hands, the tax rate is low, you may just pay one or two thousand, or even if the income is low, you can be tax-free. But no matter what, taxes are indispensable.

Of course, not only transactions, the ordinary income tax of cryptocurrencies is applicable to various activities mediated by cryptocurrencies such as mining, pledge, wage payment, airdrop, etc. Individuals need to declare at the fair market value at the time of receipt and pay tax at the ordinary income tax rate (10%-37%).

What if it was really zero gains tax?

What impact will it have if Trump really abolished the capital gains tax on crypto assets? Let’s put aside the high-level analysis for the time being, and let’s talk about what the market will be like with ordinary people.

For the market, the lifting of tax restrictions will naturally allow more American hot money to enter the market to invest. At the same time, short-term trading behavior has grown due to the lack of tax restrictions, and short-term market fluctuations will amplify. More crypto project teams will also be attracted by the zero-tax policy. If large projects move to the United States, the United States will also become the "crypto assets capital" promised by Trump.

However, concessions to the market are basically equivalent to letting the government cut its losses, reducing the billions of dollars that were originally collected from the crypto tax every year. The government's public budget must be recalculated, and various expenditures such as infrastructure and medical care may have to be squeezed out from elsewhere. If you are an ordinary American who does not come into contact with cryptocurrencies, you will inevitably have psychological imbalance when you learn that the rich people who speculate in currency are exempt from taxes, but you still have to pay income tax honestly.

In short, if the current US crypto capital gains tax has no impact on you, then the impact of the (possible) tax exemption policy on your personal crypto asset returns must be analyzed in detail. It is not appropriate to simply express it with positive or negative factors.

There are constant rumors, but will it be successful in the end?

There have been news about changes to cryptocurrency taxes before. In January, The Street reported that Trump's son Eric Trump, who is keen to participate in crypto activities, confirmed that top crypto projects in the United States, such as XRP and HBAR, will enjoy zero capital gains tax preferential treatment, while non-US projects will face a capital gains tax of more than 30%.

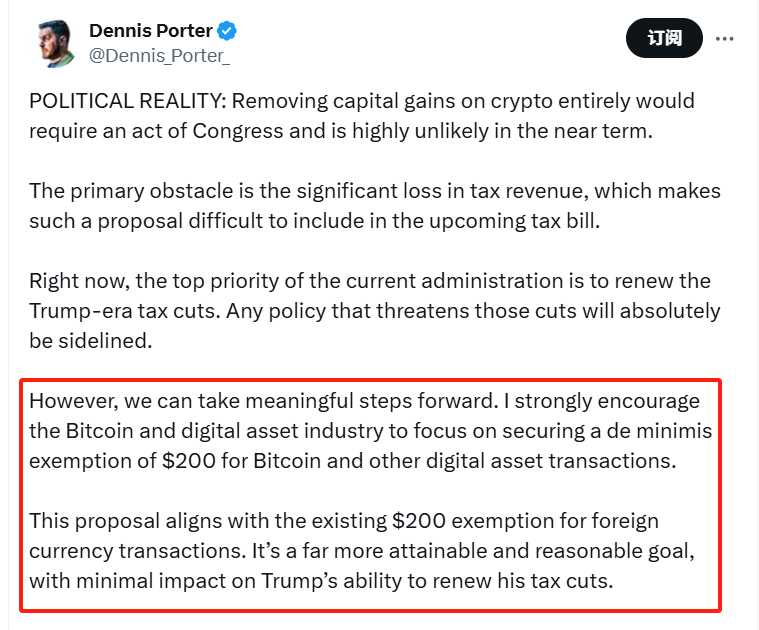

Satoshi Action Fund Dennis Porter said that completely abolishing the crypto tax is unrealistic in the short term, but changes such as "minimum exemption" can be won.

So, even if the slogan is shouted loudly, the tax law is not decided by Trump alone.

The U.S. Constitution stipulates that changes in tax policies must be nodded through Congress. Even if the Republicans support it, the Democrats may not do it.

However, the US local tax law system is complex and the specific policies of each state are different, so how to unify opinions is even more lengthy.

Conclusion: Dreams are good, but maybe you have to wait

Just looking at the abolition of crypto capital gains tax is an extremely beautiful wish for the majority of market participants. If it comes true, it will certainly bring up the current hard-hit market and fight again. But back to reality, the market changes brought about by zero tax rates and a series of social problems are obstacles that policy makers cannot avoid, so this wish may only have expectations in the short term.

In my opinion, this is more like one of the many big cakes drawn for the crypto market. It looks delicious, but whether it can be eaten smoothly in the end depends on the mood of Congress. For retail investors such as me, you can do dreams, but you must also hold your wallet tightly. Don’t just hear the slightest news and make your future happen.

chaincatcher

chaincatcher