2025 Encrypted Bimonthly Special: "Trump 2.0" full moon, the market staged "Song of Ice and Fire"

Reprinted from panewslab

03/05/2025·3MIn January and February 2025, it was the full moon of Trump's 2.0 rule. On the one hand, Trump's 2.0 kicked off, and the warm current of policy dividends surged. On the other hand, under the influence of DeepSeek, the main AI line of US stocks suffered a huge impact, triggering a series of financial avalanches. Especially in February, with the implementation of key economic data, adjustment of regulatory frameworks and acceleration of technological iteration, the crypto market has also continued to experience fluctuations, baptism and reconstruction.

In February 2025, the macroeconomic situation in the United States experienced many changes, and a series of key economic indicators fell. At the same time, after Trump took office, he vigorously promoted the policy of increasing import tariffs. These two factors were intertwined, which had a profound impact on the US and even the global economy and triggered global market shocks.

Although the US GDP correction value in the fourth quarter maintained a steady growth rate of 2.3%, several indicators imply that the US economy has entered a "low-speed growth channel", especially the cooling of the labor market: 187,000 new jobs were created in February, lower than the expected 200,000, and the growth rate of hourly wages slowed to 0.2%, the lowest level since October 2023. In addition, the University of Michigan’s consumer confidence index has deteriorated for the third consecutive month, falling to 98.3, reflecting the accumulation of residents’ anxiety about a decline in actual purchasing power.

In January, the US core CPI rose 0.3% month-on-month and 2.5% year-on-year, a year-on-year increase of 0.1 percentage point lower than the value in December last year, which means that its unoptimistic inflation has slightly "cooled". The U.S. core personal consumption expenditure (PCE) price index in January recorded an annual rate of 2.6%, a new low since June 2024, in line with market expectations and one of the few good news.

But next, the tariff war will become the biggest uncertainty factor in U.S. inflation. The Trump administration announced an additional 10% tariff on imported goods from Mexico and Canada (effective on March 4), directly pushing up the costs of key categories such as automobiles and agricultural products. According to the Cleveland Fed model, this policy may increase the US CPI by an additional 0.3-0.5 percentage points in the second quarter.

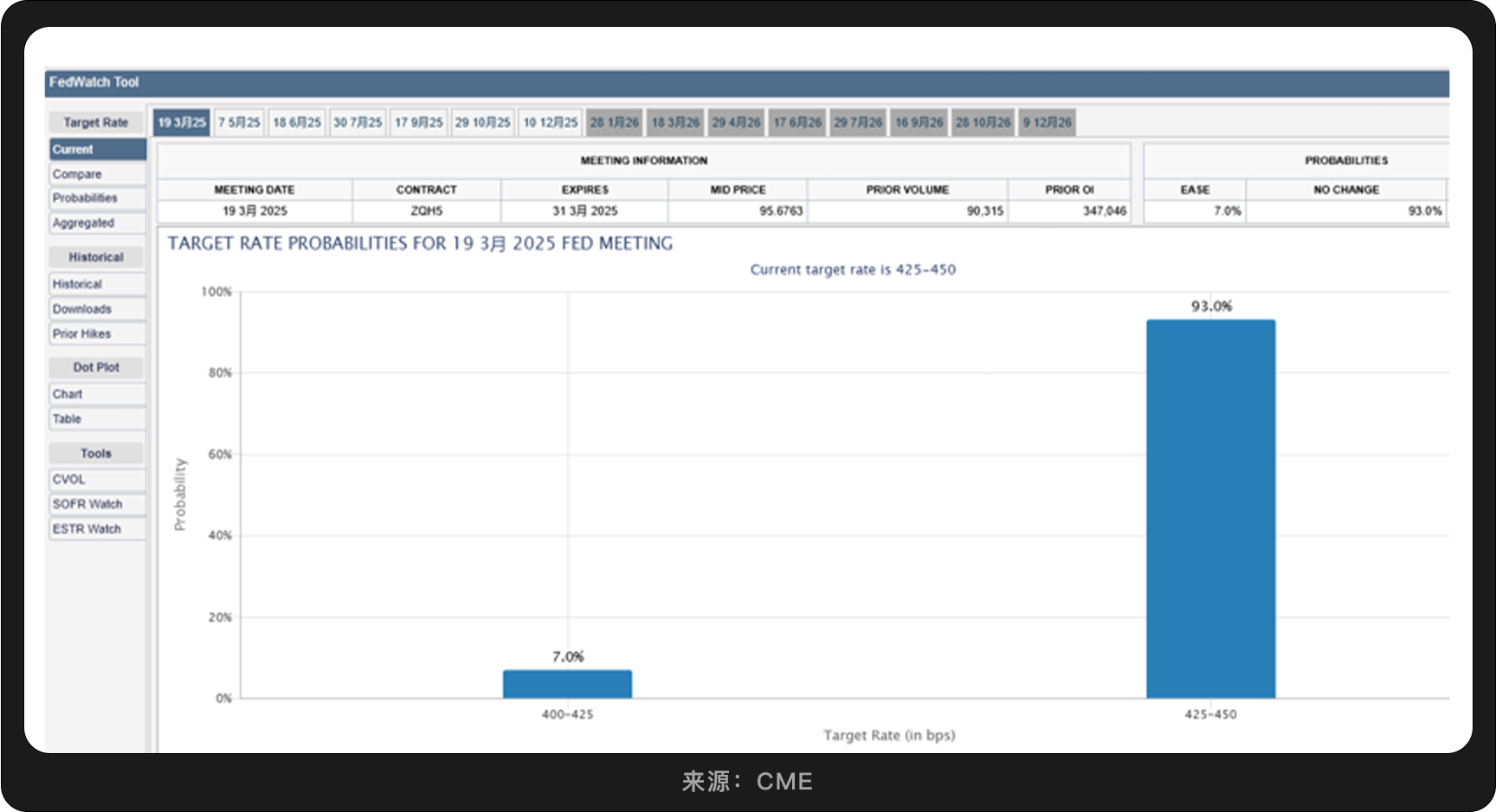

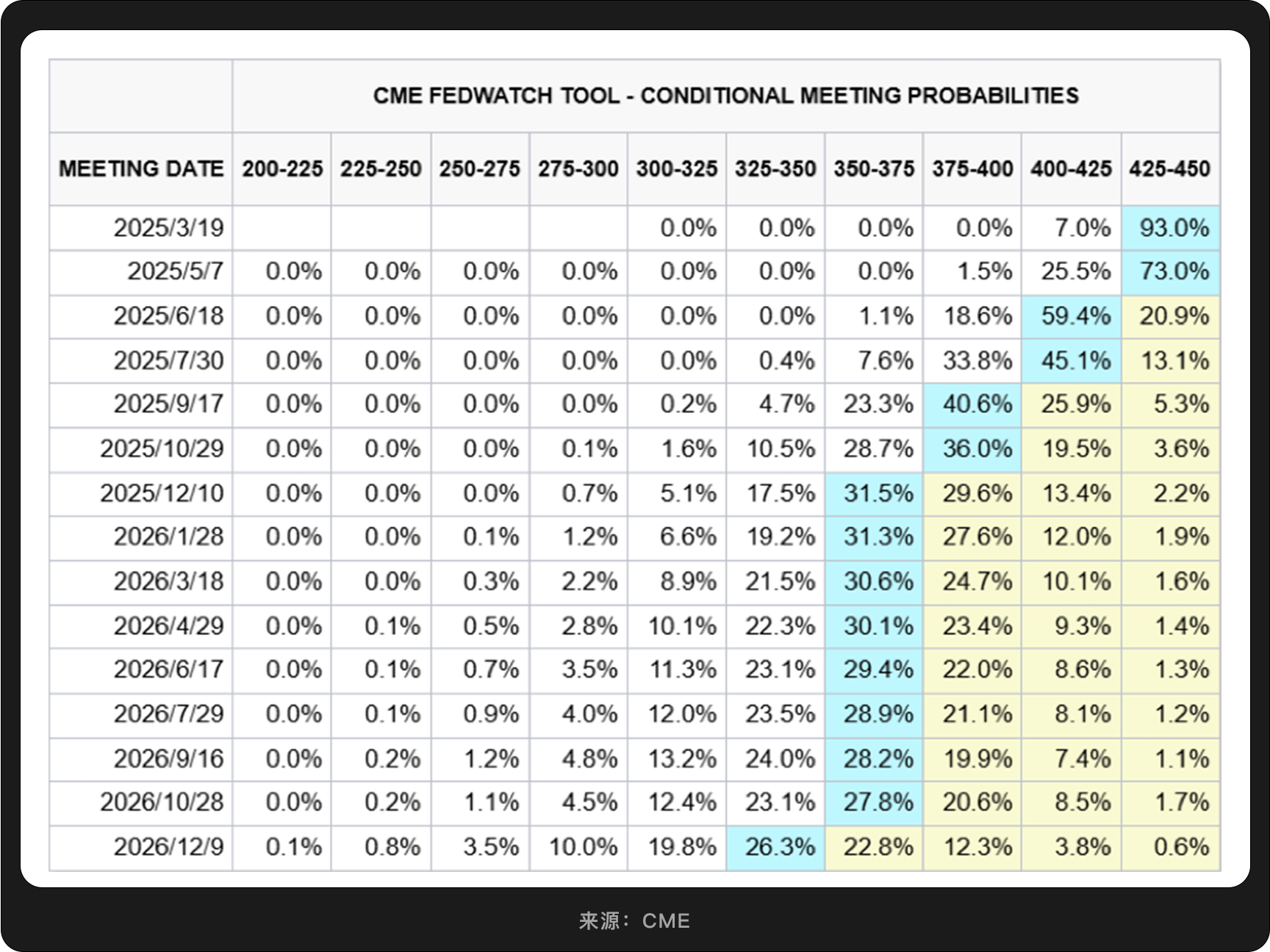

Source: CME

Source: CME

In terms of interest rates, it is currently generally expected that the Federal Reserve's policy interest rate will remain unchanged for the time being. According to CME, the probability of the Federal Reserve keeping interest rates unchanged in March is 95.5%, and the probability of cutting interest rates by 25 basis points is 4.5%. The probability of maintaining the current interest rate unchanged by May is 73.2%, the probability of a cumulative interest rate cut of 25 basis points is 25.8%, and the probability of a cumulative interest rate cut of 50 basis points is 1.1%. But given the uncertainty of inflation and the inflationary pressure that Trump's tariff policy may bring, there are still variables in the Federal Reserve's decision to cut interest rates.

The core contradiction of the US economy in 2025 is the tug-of-war between "slow growth" and "inflation resilience". The Federal Reserve tried to balance risks through prudent monetary policy. After Trump took office, a series of tariffs increased not only aggravated the complexity of this issue, but also continued to impact the global supply chain pricing logic and amplified the turmoil in the global economy. Historical experience shows that trade protectionism often finds difficult to truly solve structural economic problems. How to find certainty in policy games will be the core proposition of the global market in the next six months.

In the two months of the beginning of 2025, the hottest topic in the field of AI was the emergence of DeepSeek, and the biggest impact of DeepSeek on the US stock market was undoubtedly breaking the market 's previous expectations for the future of AI narrative.

As the AI market has developed, bubbles are inevitable. DeepSeek has pierced some of the bubbles of AI. Its open source model has significantly reduced the dependence on computing power through algorithm optimization, promoted the industry to transform from "computing power competition" to "algorithm efficiency", and reshaped the market's demand logic for AI infrastructure . For example, DeepSeek-V3 only uses 2,048 H800 GPUs to complete training, while the traditional model requires tens of thousands of similar chips, which directly shakes the "moat" narrative supported by high capital expenditure by US technology giants.

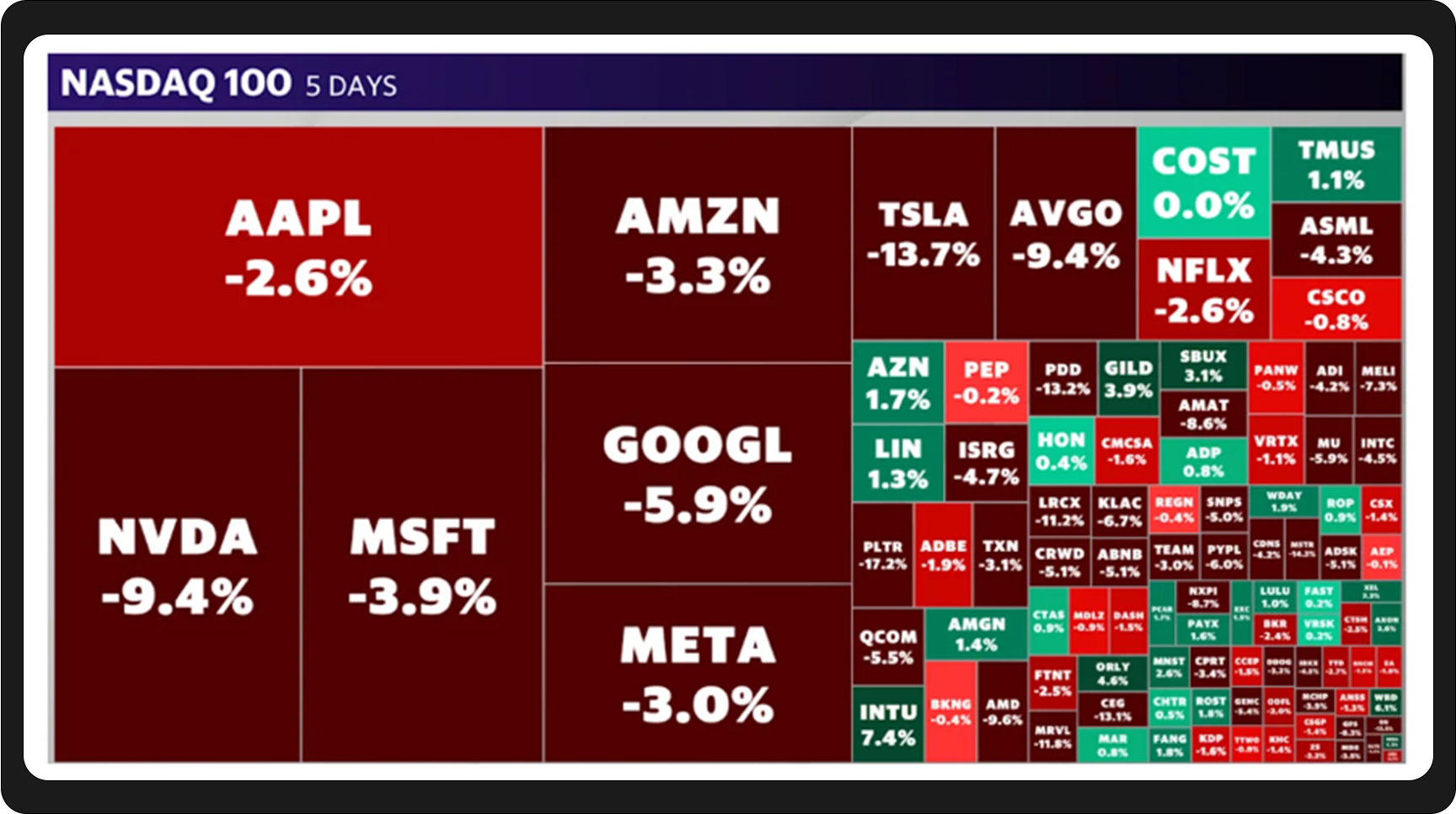

The impact of DeepSeek, coupled with concerns about global supply chain turmoil caused by Trump's tariff policy, technology stocks, as the sector with the highest globalization, were the first to be hit, and the entire US stock market showed a downturn: throughout February, the Nasdaq suffered the deepest hit due to the high weight of technology stocks, falling 4%, erasing the accumulated gains this year, marking the worst monthly performance since April 2024; the Dow Jones Industrial Average, as the proportion of traditional industries is relatively resistant to declines, has a cumulative decline of 1.58%, while the S&P 500 is between the two, down 1.42%.

As of February 28, 2025, Nasdaq 100 five-day chart, source: finance.yahoo.com/

The market 's re-examination of the competitive landscape of the US AI industry has become explicit , which is directly reflected in the performance of the US stock big7. Judging from the financial report, there is nothing particularly worthy of attention to the latest financial report of Big7 in the US stock market. Even Nvidia, which performed the most outstandingly, did not significantly exceed expectations, causing investors to make profits, triggering a sell-off. Overall, as mentioned earlier, there is no clear trading direction in the market at present. Big7's stock price performance is characterized by "the end of the month policy and sentiment dominate the plunge". It is summarized in a sentence from an analyst at Bespoke Investment Group - "Looking at it, fear has become a collective emotion."

In this environment of sluggish market sentiment, crypto assets are inevitably becoming innocent victims. Dow Jones market data shows that the six-month rolling correlation indicator of Bitcoin and Nasdaq has recently risen to 0.5, a new high since 2023, which means that US stocks have intensified and the crypto market is becoming more and more affected by it. Once the stock market fluctuates or even spreads panic due to unexpected variables like DeepSeek, investors' risk appetite decreases, and they withdraw funds from the crypto market from risky assets, it is easy to cause the crypto market to bear down pressure on price downwards. This chain reaction highlights the market's "over-defense" mentality towards DeepSeek's impact and policy uncertainty.

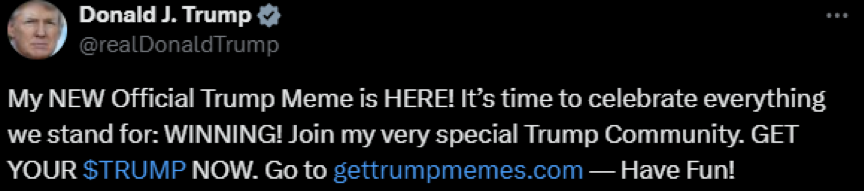

With the emergence of Trump, the "crypto president", the new U.S. administration's crypto policy has shifted from campaign commitments to substantive actions. It is said that "new officials take office for three fires." The most popular fire at present is probably still on January 18. Trump tweeted that he announced the sale of the official Meme token -$TRUMP.

The market value of $TRUMP once exceeded US$14.5 billion, and subsequently plummeted by 60%. This wave of crazy speculation in the market made a group of people rich, and some people suffered a serious shrinkage in their assets. The deeper revelation of this incident is that cryptocurrencies are radiating from the financial world to the political world. If the US SEC's use of Bitcoin spot ETFs is a milestone for cryptocurrencies to enter the traditional financial world, then Trump's issuance of coins is a witness to cryptocurrencies entering the political world. Through operations such as "token swap", it directly transforms political influence into market liquidity , showing the potential of crypto assets as a new political tool. Whether it is the competition of many states in the United States to promote the Bitcoin Reserve Act or the EU MiCA framework accelerates the compliance process, behind the global regulatory game, the important clue of "code is power" is permeated.

In addition to Trump’s issuance of coins, the crypto circle is also continuing to pay attention to the degree of its policy implementation. After the new US government took office, the cryptocurrency field has ushered in many favorable benefits, such as forming a cryptocurrency working group, formulating new digital asset regulatory plans, and exploring the establishment of national cryptocurrency reserves. Meanwhile, the SEC revoked SAB 121, allowing banks to custody digital assets after regulators issue additional guidance. Affected by this, Bitcoin price rose positively, with a month-on-month increase of 9.5% at the end of January. However, Deepseek news and tariff-related news hit the market. By February, the crypto market had a historically poetic adjustment and Bitcoin fell below $100,000, down 17.39% in February, closing at the $85,000 mark, with the monthly decline concentrated in the end of the month. This wave of plunge does not have an independent and single main cause, but is more like the fluctuations in the chaotic market itself. It is not only a chain reaction of the sell-off of risky assets under the impact of Trump 's tariff policy, but also a force of self-purification after excessive leverage in the market.

It is worth noting that Bitcoin still showed some resilience in this wave of fluctuations. Most of the other alternative coins fell even deeper due to negative events within the market. Ethereum was dragged down by the Bybit incident and hit the low point this year. Solana also fluctuated significantly due to the political issuance storm. In mid-to-late February, some institutions regarded the short-term fluctuations as a long-term allocation window. For example, Strategy (formerly MicroStrategy), from February 18 to 23, Strategy spent $1.99 billion at an average price of $97,514 per coin to buy 20,356 bitcoins. Game company Boya Interactive also issued an announcement on February 28 that the group further increased its holdings of Bitcoin and purchased about 100 Bitcoins for about 7.95 million US dollars, with a purchase cost of about 79,495 US dollars each.

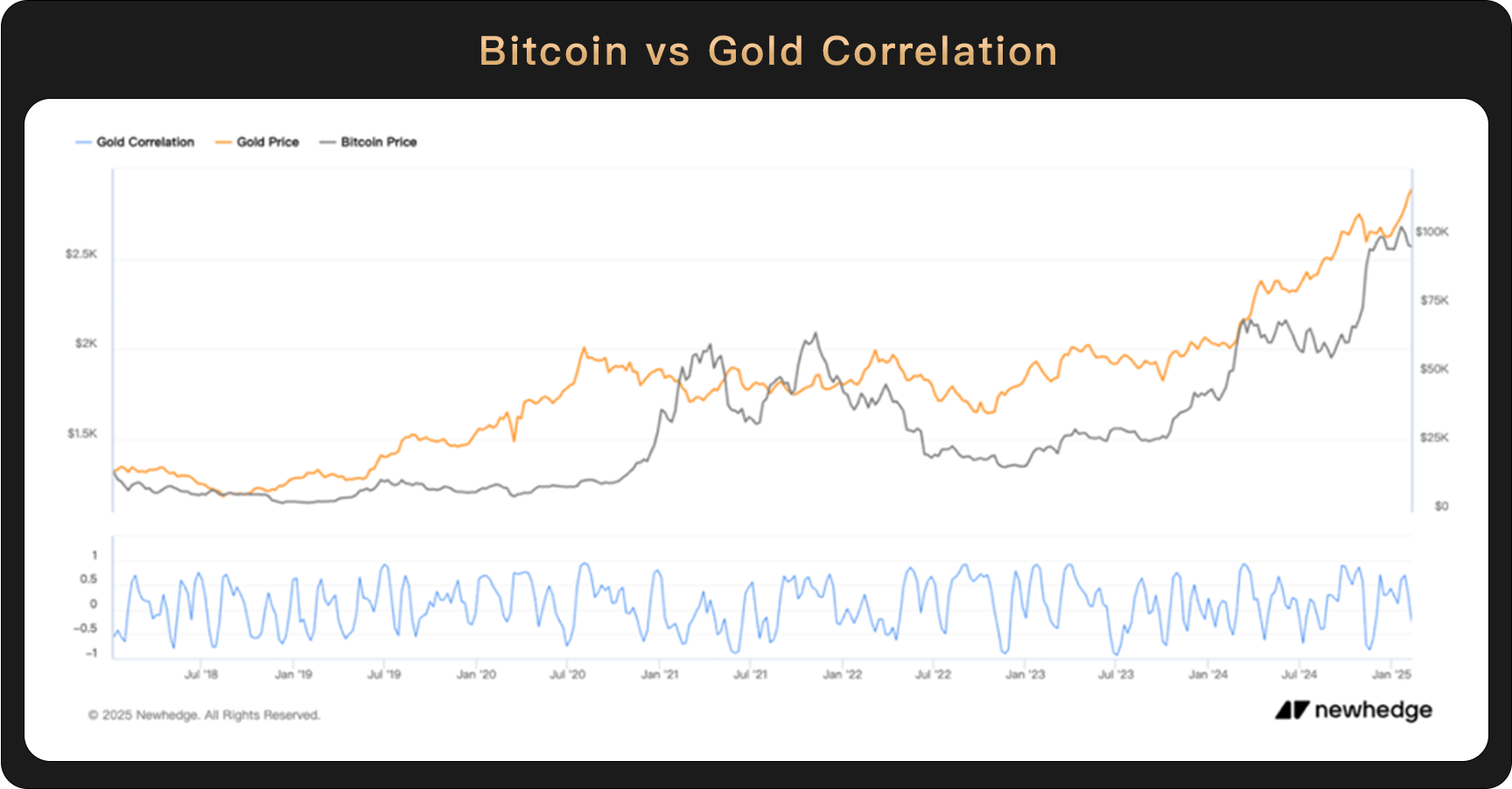

If we extend the timeline again, we will find that since last year, the price trends of gold and Bitcoin have been increasingly converging. In 2024, the overall fluctuations of the two showed a certain same direction. In February this year, gold prices also plummeted by more than $100 in a week after hitting a record high of $2,942 per ounce. Previously, WealthBee analyzed the moderate linear correlation between Bitcoin price and gold price in 2023 (see for details: spanning 10-year cycle, 6 charts to understand the correlation between Bitcoin price and mainstream assets such as US stocks ). At that time, we analyzed that Bitcoin is still positioned as venture capital. The situation has changed now, and the price fluctuations of the two are closely linked, which means that the nature of Bitcoin 's "digital gold" is becoming increasingly obvious . The fundamental reason is that they are both regarded as alternatives to credit currencies. With the further evolution of the global economic situation and geopolitical situation, the prices of the two may continue to maintain a certain degree of linkage.

The current crypto market is in a certain news vacuum period, and the marginal effect of traditional narratives (such as halving cycles and ETF capital inflows) is decreasing . Judging from the signals sent by all parties at the Hong Kong Consensus Conference that ended not long ago, despite the lack of explosive narratives in the short term, the three major trends are quietly reshaping the market: first, the transformation of regulatory paradigm, the pro-crypto-ministered majority in the US Congress promoted the FIT21 Act, the SEC reduced the scale of law enforcement departments, and the shift from suppression to guidance, clearing obstacles for institutional entry. Second, the crypto market in 2025 is at a critical turning point from "policy arbitrage" to "value creation" and from "speculation-driven" to "technology-driven"; finally, the integration of AI and encryption may become the most worthy of attention. If the AI sector begins to rebound and integrates with the crypto market, a new narrative may also come into being. As the market completes the leverage clearance and the coordinated narrative of AI and encryption, a new round of upward breakthrough may be on the string. Historical experience has repeatedly verified that new dawns are often nurtured in the darkest moments of interweaving fanaticism and fear.

Trump took office for a full month, and the market entered a chaotic period, with complexity far exceeding the past. The currency circle is also affected by this uncertainty and encounters rare and frequent fluctuations. Although the inherent weakness of human nature has sown the seeds of risk in the market, Bitcoin’s untampered scarcity has never been shaken and has given it a tenacious vitality to penetrate the cyclical fog. As the Song of Ice and Fire says: "Chaos is not a deep abyss, but a ladder".

chaincatcher

chaincatcher

jinse

jinse