Rising demand for hedging, brief analysis of tokenized gold and yield opportunities

Reprinted from panewslab

04/03/2025·1MAuthor: 0xEdwardyw

Why gold still matters

In 2025, gold made headlines again, hitting record highs driven by surge in safe-haven demand. Gold prices broke through $3,000 per ounce for the first time, marking the strong return of this "king of precious metals". Investors are re-susciting their fears about devaluation of fiat currencies and global instability.

Bitcoin is often called "digital gold", and many people have begun to question whether physical gold still has significance. However, the latest data has said it all: gold remains crucial in asset diversification and stability. As of March 2025, gold's annual return rate reached 36%, surpassing the performance of major stock indexes and Bitcoin.

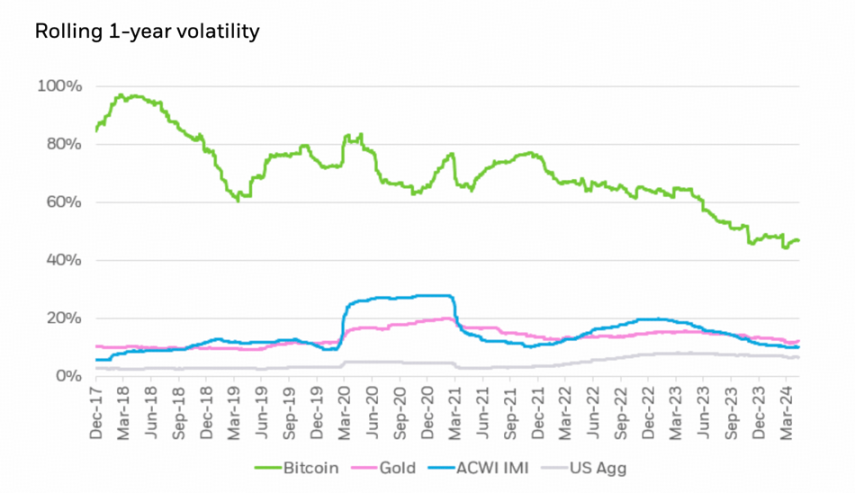

Lower volatility than Bitcoin

Compared with Bitcoin’s drastic price fluctuations, gold’s price movements are much milder. For example, as of 2024, Bitcoin had an annual volatility of about 47%, while gold was only 12%. This means that Bitcoin’s price fluctuations can average nearly four times that of gold. This difference is crucial for investors who focus on risk control.

We have witnessed this in early 2025: With tech stocks (Nasdaq) down nearly 15% in a few weeks, gold remained largely flat (up about 1%), while Bitcoin fell about 20%, and the trend was almost synchronized with the stock market. Gold's low volatility makes it a valuable asset for capital preservation during market turmoil, while Bitcoin is more like a high beta risk asset.

Source: https://www.ishares.com/us/insights/bitcoin-volatile-trends#:~:text=,deviation%20of%20annualized%20daily%20returns

Low correlation with Bitcoin

In the recent market cycle, the trends of gold and Bitcoin have differentiated. In the past year, gold has risen steadily under inflation concerns and war tensions, setting new highs repeatedly; while Bitcoin has fluctuated in a wide range, and its trend is more affected by investors' risk appetite. It is worth noting that gold has a low correlation with traditional assets, or even negative, which is very ideal for decentralization in asset allocation. In fact, gold and Bitcoin also show negative correlation, which means that holding both can further enhance the diversification of the portfolio.

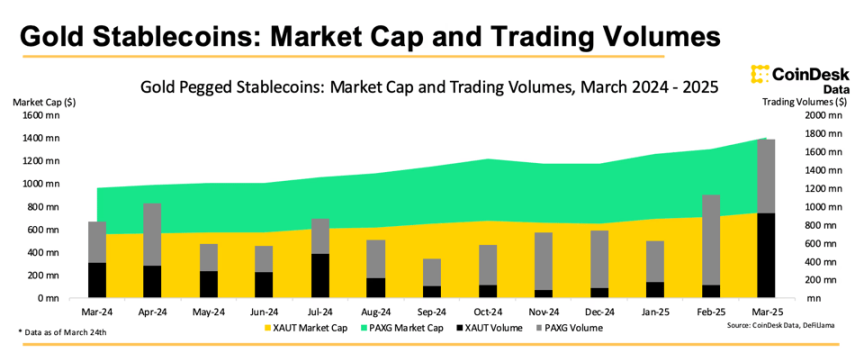

Tokenized gold in 2025

One of the most exciting developments is that gold itself has joined the wave of the blockchain revolution. The so-called "tokenized gold" means that digital tokens with 100% of physical gold as reserves are experiencing rapid growth. In March 2025, gold-backed crypto tokens hit a record high of $1.4 billion. This track is dominated by two tokens: PAX Gold (PAXG) and Tether Gold (XAUt). These tokens allow investors to hold gold in digital form, combining the stability of gold with the flexibility of crypto assets.

Source: https://www.coindesk.com/markets/2025/03/27/tokenized-gold-hits-new-record-market-cap-as-trading-volumes-soar-in-march

PAXG (Paxos Gold)

PAX Gold (PAXG) is issued by Paxos Trust Company, a regulated financial institution headquartered in New York. Each PAXG token represents one ounce of refined gold stored in a certified vault in the London Gold and Silver Market Association (LBMA). Importantly, Paxos operates under strict supervision – the token is fully supported by physical gold at a 1:1 ratio and is subject to a monthly audit by third parties to verify its reserves. Paxos is authorized by the New York State Department of Financial Services (NYDFS), so it is highly compliant and provides full confidence for holders.

In 2025, PAXG's popularity has steadily increased. Its market capitalization is currently about US$680 million, accounting for about half of the tokenized gold market. PAXG often reaches tens of millions of dollars in daily trading volume. It benefits from regulatory trust, and even after the intensification of US scrutiny of stablecoins, Paxos Gold is still operating steadily.

PAXG's new trading products are also emerging: for example, at the end of 2024, derivatives exchange Deribit launched PAXG's futures and options contracts, marking the rising interest of institutional investors in tokenized gold as a trading asset.

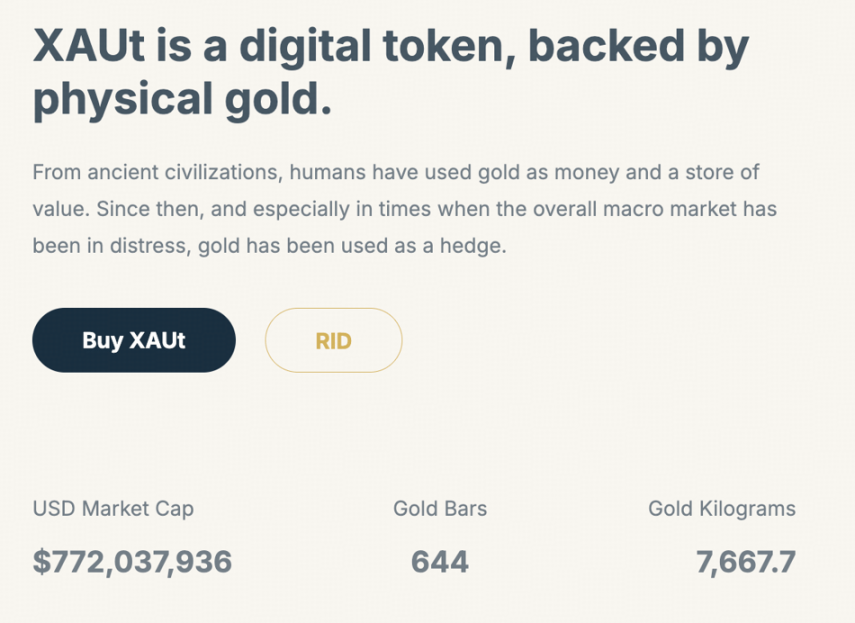

XAUt (Tether Gold)

Tether Gold (XAUt) is another major gold-backed token issued by TG Commodities, a company affiliated with Tether. Each XAUt represents one ounce of gold stored in Swiss vaults that meet London Good Delivery. As of 2025, XAUt has a market capitalization of approximately US$770 million.

However, XAUt's regulatory architecture is different from PAXG. In 2023, Tether moved its gold token business to El Salvador’s supervision, and TG Commodities obtained a stablecoin issuance license in El Salvador, thus operating within the country’s regulatory framework. Tether Gold regularly publishes gold reserve reports and claims its tokens are fully backed by physical gold, but unlike Paxos, it has not yet received a full independent audit of the reserves. This has also caused some markets to worry about its transparency.

Tether's management has said that taking into account the new regulatory rules in the stablecoin space, conducting a comprehensive audit completed by the Big Four accounting firms has become its top priority. The market also generally hopes that XAUt's gold reserves will achieve audit standards and transparency at the same level as PAXG in the near future.

Profit Opportunities in DeFi

In addition to simply buying and holding, tokenized gold has also opened up new use cases in decentralized finance (DeFi). Crypto investors can deploy gold-backed tokens into various profit-generating strategies, making gold an asset that generates passive returns. Historically, gold usually just lie quietly in the vault, generating almost no returns; but now, without moving physical gold, gold can also create returns with the DeFi protocol.

Liquidity Pools and Automatic Market Makers (AMMs)

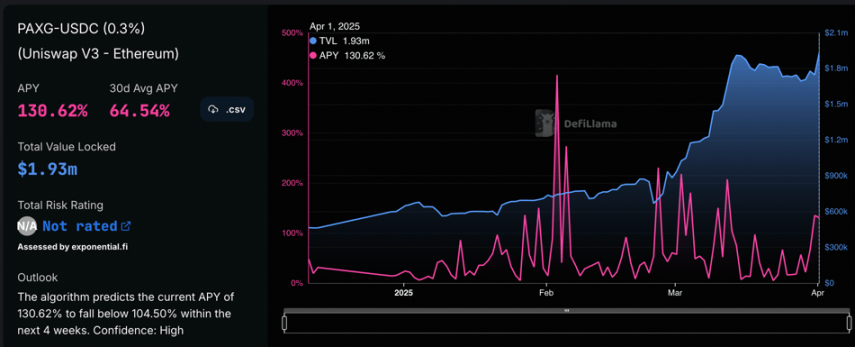

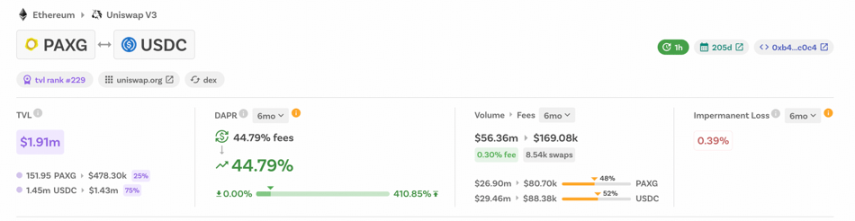

For example, the PAXG/USDC pool on Uniswap allows users to trade between tokenized gold and USD. The liquidity provider (LP) of this pool can make a profit by earning transaction fees.

This mechanism allows LPs to obtain passive income while maintaining gold exposure, especially during periods of high gold popularity and active trading. This approach seems particularly attractive.

Source: https://defilama.com/yields/pool/459e731e-60a0-45fa-8b49-092468ab14f5

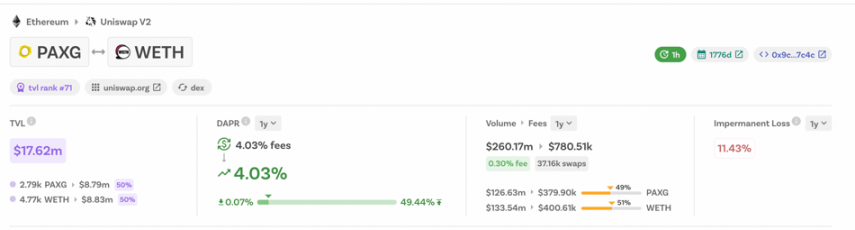

Another option is the PAXG/WETH liquidity pool, which supports redemption between gold and Ethereum. This pool is usually more liquid, but it is also more prone to "Impermanent Loss" because PAXG (tracking gold price) is relatively stable, while WETH (tracking ETH) is extremely volatile. When the ETH price fluctuates violently, the relative values of the two assets will quickly diverge, causing a greater risk of impermanence loss.

Both pools provide earnings opportunities, but their risk-reward characteristics vary by volatility of paired assets.

Source: https://defilama.com/yields/pool/40ac1aaf-26f1-4a04-b908-539f37672ef2

Impermanent Loss

Impermanent Loss (IL) is a core concept in DeFi, especially for users who provide liquidity in automated market makers (AMMs) such as Uniswap. When the prices of the two tokens in the liquidity pool change compared to those held separately, the value of the assets borne by the LP may decrease, and this loss is called "impermanent loss." It is called "impermanence" because if the price returns to the original ratio, the loss may decrease or disappear; but if liquidity is extracted in a state of price deviation, this part of the loss will be turned into "permanent loss".

The size of an IL depends mainly on two factors: the volatility and correlation of the paired asset.

In the PAXG/USDC pool, on one side is the stablecoin PAX Gold (PAXG), which anchors the gold price, and on the other side is the stablecoin USDC, which anchors the USD. Since gold price volatility is much lower than crypto assets and USDC has always maintained at $1, the price ratio between this asset is relatively stable, which significantly reduces the risk of impermanent losses.

In contrast, PAXG in the PAXG/WETH pool pairs WETH. PAXG trends are less volatile, while the ETH market fluctuates violently, sometimes rising or falling 20–50% in a short period of time. This violent fluctuation triggers AMM's "constant product" algorithm, causing the pool to rebalance, reduce the holding ratio of good-performing assets (such as PAXG when rising), and increase the proportion of poor-performing assets (such as ETH). Ultimately, the high-value assets left by the LP will be far less than the result of simple holdings, resulting in larger impermanence losses.

Yield Samurai 's impermanent loss estimate chart

Source: Samurai

chaincatcher

chaincatcher