A zombie or a salvation? Can the EOS transformation be successful?

Reprinted from panewslab

04/03/2025·1MAuthor: Luke, Mars Finance

On April 1, 2025, the crypto market was filled with sorrow. ACT token plummeted 55% in 36 minutes, its market value evaporated like smoke, and a number of altcoins plunged one after another, with a drop ranging from 20% to 50%. The bear market with exhausted liquidity is like a meat grinder, and retail investors lost all their money. Just as everyone lamented that the "Era of Zeroing the Copyright" was approaching, an old face staged a "dramatic plot" - EOS, with the new label of "Web3 Bank" Vaulta, soared by more than 30% in 24 hours, and the price exceeded US$0.8. This wave of lap disk is like a signal flare, dazzling the ruins of liquidity collapse.

Looking back on 2017, the currency circle was still a gold rush. The cheers of Bitcoin just exceeded 10,000 have not yet dissipated, and EOS entered the field of vision with the bold words of "Millions of TPS". A year-long ICO swept away $4.2 billion, which is the most exaggerated "money-making show" in blockchain history. Founder Dan Larimer is regarded as a "technical prophet", CEO Brendan Blumer becomes a "capital conductor", and EOS becomes the "son of God" who wants to revolutionize Ethereum's life. Seven years later, the market value has dropped from 18 billion to less than 800 million, and the community is as deserted as no man's land. Block.one is being criticized by regulation. However, this "old horse" once again ignited the controversy with the Vault transformation and 30% counter-trend pull-up.

Is EOS "resurrect" or "last fight" before liquidity drying up? Let’s look back on the ups and downs of these seven years, dismantle Vault’s trends, and explore the end of this 4.2 billion marathon - is it the rebirth of the “Web3 Bank” or another tombstone in the currency circle?

From ICO fanaticism to technical Waterloo, EOS's "flash-and-date"

USD 4.2 billion "Dream Making Machine"

In the crypto world in 2017, the speculation boom is in full swing. EOS seized the opportunity and shouted the slogan of "the ultimate solution to blockchain": handle millions of transactions per second, free handling fees, and developer paradise. This set of rhetoric attracts global capital like a magnet. After a full year of ICO, EOS attracted 4.2 billion US dollars, and ETH poured in like flowing water, setting a record that no one could defeat. That year, the air in the currency circle was full of "Shuha's wealth", and EOS became the brightest "dream-making machine".

In the spring of 2018, the price of EOS soared from US$5 to US$23, with a monthly increase of more than three times, and its market value once ranked among the top five. The 21 super node elections have become a global event, with exchanges, mining pools, and retail investors scrambling to grab the spots, and the community is full of enthusiasm, as if EOS is the future "blockchain United Nations". At that time, no one suspected that EOS would become the "Ethereum Terminator", and even the V god had to look at it.

DPoS 's "Game of Thrones" and technical shortcomings

EOS's killer weapon is the DPoS (Delegated Proof of Stake) mechanism, with 21 nodes responsible for block production, and in theory, efficiency crushing Bitcoin and Ethereum. But what about the actual operation? This system has become a "power concentration camp": the big exchange controls the nodes, and the voting rights of retail investors are like waste paper; the on-chain arbitration institutions are manipulated, and the farce of freezing accounts has collapsed trust. Some research also pointed out that most EOS on-chain transactions are "idling", and their activity is as low as a "digital desert".

Technically, "Million TPS" has become the biggest joke. After the main network was launched, the actual peak was only more than 4,000, which was several orders of magnitude away from the publicity target. BM explained that "it has to be achieved by side chains", but after a few years, the side chain ecosystem is very small. At the same time, Ethereum broke through with layered technology, new public chains such as Solana and BNB chains sprung up like mushrooms after a rain, and EOS's "technical halo" completely faded. Someone joked: "EOS's TPS is probably counting "Millions of Dreams per Second"."

" Self-destruct mode" for user experience

EOS focuses on "zero handling fees", but requires users to exchange tokens for CPU and RAM resources. It sounds tempting, but it makes people crazy when used: when the Internet is busy, resource prices soar, and transfer costs increase instead of falling; RAM is hyped outrageously, and developers complain. During a peak period, thousands of EOS can only be replaced with a few seconds of calculation time, and the operation is as complicated as solving math problems. Compared with Ethereum's "simple and crude", the EOS's DApp ecosystem has rapidly withered. By 2022, developers will run faster than rabbits, and even their wallet and browser projects will be closed.

Block.one's "retirement technique" and community's "self-rescue road"

The "mysterious flow" of 4.2 billion funds

When EOS ecological collapsed, all eyes turned to Block.one: What about US$4.2 billion? The company's answer was to show off a "capital magic" with actions. The funds invested in US Treasury bonds, Bitcoin, and even resort hotels have nothing to do with the EOS main network. Now, they have 160,000 BTC and their net worth soared to 16 billion, but they ignore the community's request for help. The community was angry: "We are investing in public chains, not asking you to use them to speculate in coins!" Someone joked: "Block.one is not a blockchain company, but Buffett from the crypto industry."

Regulatory thwarting and internal chaos

In 2019, the SEC took action, accusing Block.one of illegal financing and fined 24 million - just a drizzle for 4.2 billion. The company paid the money and continued to "make a fortune in silence." Internal management is even more outrageous: BB operates family-based, relatives are in charge of marketing and investment, and there are a lot of money-burning projects, but few results are achieved. BM has been marginalized and has become a technical facade of "name but not real". Talking about the Bible and the end of the world on Twitter is more time than blockchain.

**Community takeover and the rise of foundation: Why does EOS "dead

without being stiff"?**

Just when EOS seemed to be about to be cool, the community stood up. In 2021, the EOS Foundation (ENF) launched an "uprising" under the leadership of Yves La Rose, joining 17 nodes to kick Block.one out and take over the control of the project. In the following years, the foundation fought a tug-of-war with Block.one. Although it did not get back the control of the 4.2 billion yuan, it relied on its own, and pulled EOS from "half-dead" back to "staying alive".

Why is EOS not dead? To put it bluntly, Block.one did not do anything, but the foundation was unwilling to accept it. They fought a lawsuit with the original project party for several years and took over the lifeblood of EOS. After years of hard work, the foundation has launched many new concepts: RAM resource optimization, exSat Bitcoin expansion, 1DEX decentralized exchange, and finally rebranded it into Vaulta. The reason why EOS can last until now depends entirely on the spirit of ENF, the people who are "to fight to the death".

Vaulta's debut and new concept "self-rescue experiment"

From public chain to "Web3 Bank": Vaulta's transformation drama

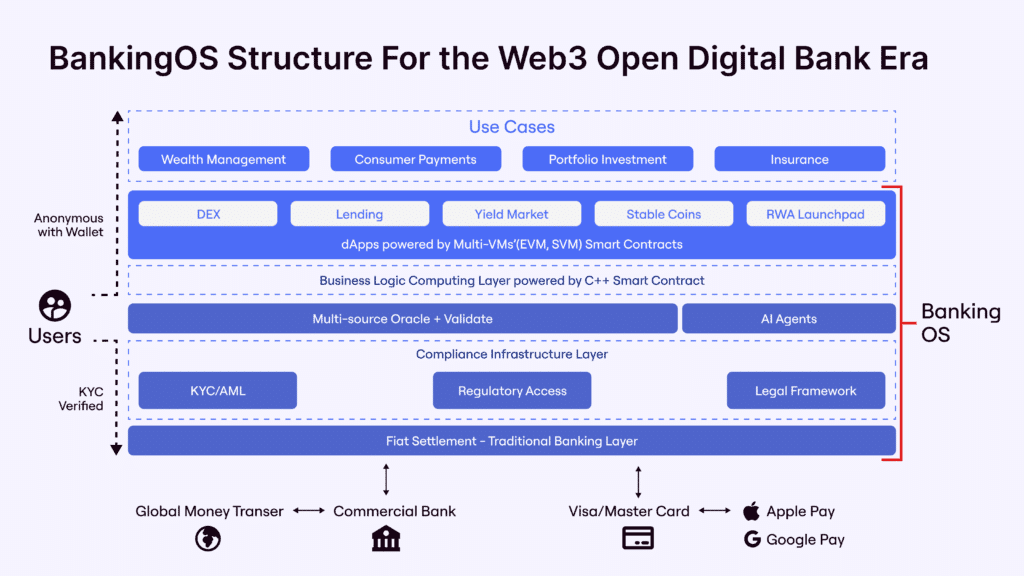

In March 2025, EOS announced the rename of Vaulta, positioning the "Web3 banking operating system" to reshape finance with blockchain. The plan includes wealth management, consumer payments, investment portfolios, insurance, and a "bank advisory group" has also been launched to support the scene. The tokens are exchanged for new coins at 1:1, and the exchange is started at the end of May, with a pledge reward of 17% annualized income -this combination of punches looks quite frightening. Someone on X joked: "EOS has gone from "Ethereum Killer" to "Bitcoin Brother", and now I want to be a bank teller, it's such a versatile chain."

But if you look closely, you may be suspected of "changing soup but not changing medicine". The foundation of Vaulta is still the old architecture of EOS, with the core selling point relying on new projects to support the scene. Other functions have been played on Ethereum and Solana. The community response was polarized: Optimists felt that this was a "bottom-back", while pessimists scoffed: "Just change the name and just cut the leeks."

RAM, exSat, 1DEX, RWA: The Foundation 's new "life-saving straw"

After the foundation took over, EOS's "self-rescue" relies on these four axes, and we will disassemble them one by one:

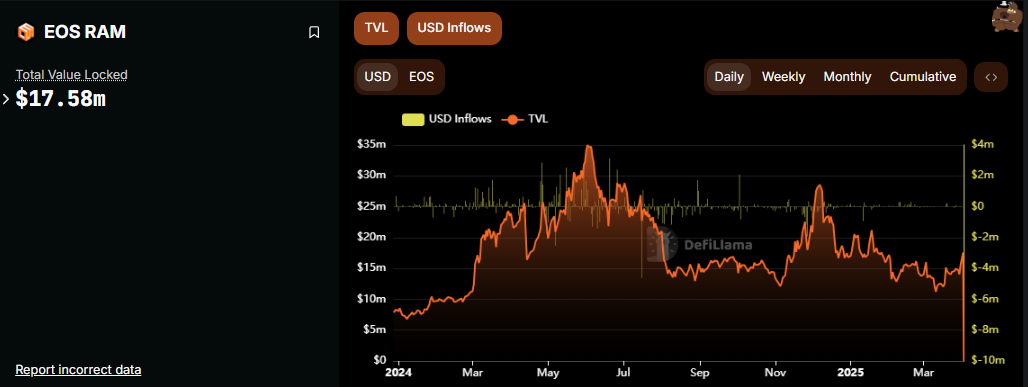

EOS RAM: Hidden Easter Egg in the memory market: EOS's RAM (memory resource) is a unique design, and it depends on it on the chain, with limited supply, but the usage is increasing with the growth of DApp. The foundation has optimized the RAM mechanism and launched XRAM (extended RAM), allowing users to stake tokens to exchange resources and can also share Gas fees - and this Gas fee is directly given to Bitcoin. This operation is very creative, binding EOS to BTC, and it has forced a bit of the popularity of "digital gold". For example, users who pledge hundreds of MB of XRAM can receive Gas fee sharing in BTC, indicating that there is still demand in the RAM market, especially new projects push up its value. Some people joked: "RAM is more like an asset than EOS coins."

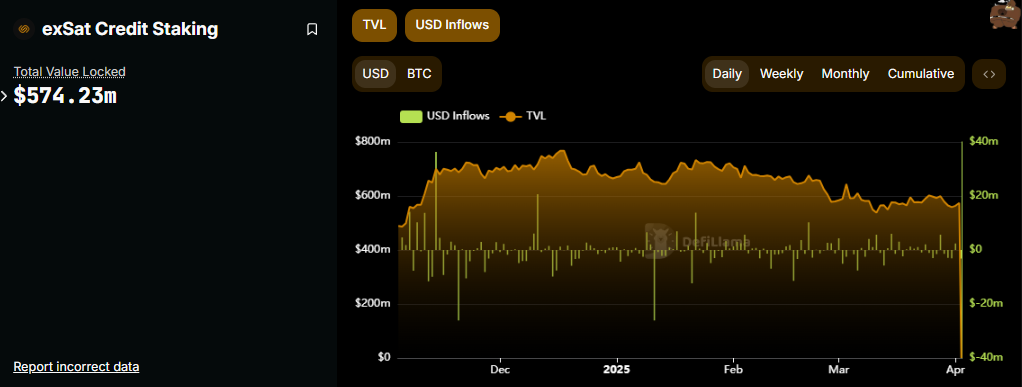

exSat: Bitcoin "EOS plug-in: exSat is a new attempt in 2024. It uses EOS RAM to store BTC UTXO data, and wants to solve the problem of slow Bitcoin transactions and high cost. It sounds cool: BTC can run smart contracts and develop DeFi, and EOS has transformed into "Bitcoin Layer 2". In March 2025, exSat locked 5,413 BTC, with a total value of 587 million knives, far exceeding the 174 million knives on the EOS main network, and has become the "new leader" of the ecosystem. But there are many problems: the Bitcoin mechanism does not support pledge, and the RAM capacity cannot support the big scene. The community questioned: "Isn't this just a big pie for BTC?"

1DEX: Late attempts for decentralized exchanges: 1DEX is a newly launched DEX by EOS, with the goal of filling the shortcomings of DeFi. The EOS main network is fast (1 second block is produced), low cost, and theoretically suitable for transactions. Unfortunately, the resource model in the early years was too complicated and the developers ran away. Now 1DEX makes a comeback 1DEX supports unique asset trading and cross-chain operations, but EVM compatibility is not done, and the documents are scattered, like a "semi-finished product". Some users on X complained: "If 1DEX was released five years ago, EOS could still grab some market, but it's a bit late now."

RWA: Vaulta holders will soon have the opportunity to acquire exclusive investment options for tokenized real-world assets (RWA), including diversified ownership in traditionally poorly liquid markets such as real estate, commodities and stocks. Establishing strategic partnerships with leading tokenization platforms will unlock these complex financial products, significantly enhancing portfolio diversification and promoting dynamic, liquid markets.

Market boom: "Recovery Moment" of 30% Continuous Increase

On the day of Vaulta's release (March 18), EOS soared 30%, from $0.65 to $0.84. Today (April 1), it rose by another 30%, breaking through $0.8021. The technical chart shows that it has broken through key resistance levels and trading volume has surged, and some people shouted "Return to $1.4". What's even more exaggerated is that someone on X raised a question: "Is EOS going to save the currency circle again in April 2020?" Many novices may be confused, but old leeks remember: In April 2018, EOS soared from US$5 to US$23, with a monthly increase of more than 360%. It led the entire bear market to rebound for a month and became the "hero of market rescue" that year.

Now Vault has risen by 60%, and the technical cooperation is seamless, which inevitably makes people think a lot - can this old horse really play "Dog-headed salvation" again? However, the old player sneered: "It's just a trick to pull the market." OKX and Binance launched trading pairs in advance, and the quantitative robot "increased both volume and price", and FOMO's sentiment was ignited - this continuous rise is like the "dance of the dungeon" of the foundation's self-rescue and new concept hype, or a preview of the miracle in 2018? It depends on the subsequent momentum.

The three "behind the scenes" that surged

- Concept speculation: Vaulta's "Web3 Bank" story is novel enough, and Bitcoin linkage and DeFi layout are both hot topics of speculation. As soon as the news came out on March 18, the trading volume soared by 631%, and the short-term buying pressure was very strong. On April 1, it took advantage of the trend to rise by 30%.

- Technical signal: The daily line breaks through the box, and the short-term trend is bullish, attracting a large number of traders to enter the market. Some analysis even said that the descending triangle was pointed at $1.4.

- The foundation is fighting against the slump: ENF has been holding its breath in recent years, and the lawsuit has been very exciting. ExSat and 1DEX have accumulated some popularity, and rebrand has released it in a concentrated manner, which has forced EOS to continue its life.

**BTC pledged by XRAM is divided into: "Strange Highlights" of the

Ecology**

In the EOS ecosystem, users who pledge XRAM can receive Gas fee sharing in BTC, which is quite intriguing. As a scarce resource, even if the main network is half dead, there is still a market, especially after the exSat is launched, demand has surged. The Gas fee is directly given to BTC instead of EOS coins, which means that the foundation no longer expects the EOS token itself. After Vault is replaced, the governance function may be further weakened. This "weird mechanism" has become a microcosm of EOS transformation.

Can EOS still be chased?

In the short term, if EOS holds $0.8, $1.4 will have a chance, and may even be hyped into double-digit numbers. XRAM's BTC share can continue for a while, and it is a good strategy to keep a flexible adjustment as you keep an eye on exSat progress. But the long-term prospects have three major weaknesses:

- Competitive pressure: The Web3 banking track is not new, Ethereum has MakerDAO, Solana has Serum, and EOS technology foundation is not advantageous.

- Implementation problems: exSat and 1DEX sound fancy, but compliance and technical stability are both questionable. Whether Vaulta's blueprint can be implemented is a big unknown.

- The crisis of trust: Block.one has too much "historical burden", and no matter how hard the foundation works, it will be difficult to completely whitewash it.

Conclusion

The seven years of EOS are the epitome of the currency circle from fanaticism to calmness. $4.2 billion created a "technical utopia", but it declined due to experience collapse and management chaos. After the foundation took over, RAM, exSat, 1DEX, and Vaulta became new moves to "self-rescue", making EOS "dead without being stiff". This 30% increase is a blessing from a new concept and a carnival of market sentiment, but how far it can go depends on whether Vault can tell the story.

The old saying in the currency circle: "The biggest risk of EOS is that you dare not take it." Facing this "old horse", whether you dare to place bets, you may have to ask whether your heart is big enough. Because on the blockchain track, what is more difficult to measure than code is the ups and downs of people's hearts. The XRAM you have in your hand is still there, and the EOS marathon has not stopped yet - this 4.2 billion journey, whether the end is the "bank" or "tombstone", time will give the answer.

chaincatcher

chaincatcher