Research on Bitcoin’s value trends: Exploring the evolutionary code of value in four halvings

Reprinted from panewslab

05/08/2025·17DAuthor: SanTiLi, Nasida, Legolas

This article will focus on the four halving events in Bitcoin from 2012 to 2024. It systematically sorts out Bitcoin’s halving mechanism and inflation rate change trends, and combines the market performance before and after the previous halvings to deeply explore its impact on price trends. Through historical data analysis and macro comparison, this article points out that Bitcoin has entered a cycle range with inflation rate lower than gold, and its scarcity is becoming increasingly prominent, and it has gradually gained the long-term value logic to compete with traditional assets. At the same time, judging from the cyclical rhythm of the four rounds of halving, although the halving has increased moderately since 2024, it is still in the stage of accumulation of momentum, and the real window may gradually open between 2025 and 2026. The article finally explores the core value foundation of Bitcoin, including scarcity, decentralization mechanism and deflation model, pointing out that its logic as "digital gold" is becoming increasingly mature.

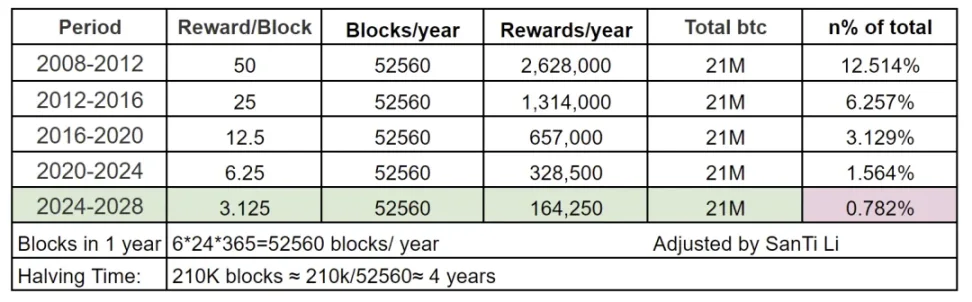

1. Basic rewards and inflation rate of Bitcoin halving cycle

Bitcoin was designed by Satoshi Nakamoto in 2009, and the total issuance is constant at 21 million. For every successful block mining in the early stage, the miner can receive 50 BTC as a reward. This reward will automatically reduce the amount of new issuances for every approximately 210,000 blocks mined (about four years).

The halving cycle of BTC officially began in 2012, with halving every four years and halving in 2024. Each block is rewarded with 3.125 BTC, and the annual inflation is: 52560x3.125=164,250 pieces, accounting for about 0.782%. The inflation rate of about 0.78% is already lower than the annual inflation rate of most developed countries, and the total increase in gold production is about 1.5%-2%. At present, BTC has entered a period range where the expansion rate is lower than the expansion rate of gold.

Fig.1 Bitcoin Half Cycle Rewards and Inflation Chart

As shown in the chart: When there are 50 rewards per block, the annual increase is about: 52560x50=2.628 million pieces, accounting for about 12.5% of the total 21 million pieces. In 2025, when each block has a reward of 6.25, the annual increase is: 52560x6.25=328,500, accounting for about 21 million pieces: 1.564% of the total 21 million pieces: 1.564% of the total 21 million pieces.

As of around 14 o'clock on 2025-5-7, BTC has dug out: about 19,861,268 pieces, accounting for about 94.58%, and the total market value is about 2 trillion US dollars ($2034,300,009,004). Compared with the last halving cycle in 2020, about 18385,031 pieces were dug out at that time, accounting for about 87.5%. At that time, the total market value was about 161.8 billion US dollars. After about 5 years, the total market value increased by about 1236%.

The annual inflation rate in the next four years was only 0.782%.

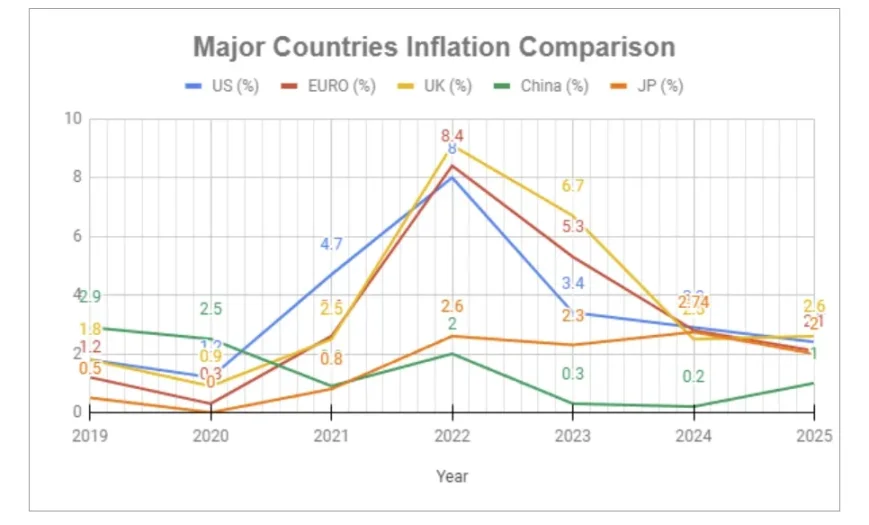

Fig.2 Comparative chart of inflation rates in major countries around the world in 2019-2025

China's inflation rate was about 2.9% in 2019, and the United States' inflation rate was 2.3%. At that time, due to the COVID-19 subsidies in 2020, we predicted that the US dollar's substantial additional subsidies would be estimated to cause a significant increase in inflation rate from 2020 to 2022. The inflation rate in the United States has indeed reached a high of 8%, and then the Fed's interest rate hike policy has declined year by year. It fell to around 2.2% so far in 2024, and China's annual inflation was about 0.2%, making it a good rate of inflation restriction in major countries (2019–2024: The data comes from official statistical agencies of various countries. 2025: The data is the forecast value of the IMF report and actual updates.) The statistics of most developed countries are around 2.5%, but the experience of actual shopping and currency depreciation should be significantly greater than that of the data statistics.

At this time, this time, the #Bitcoin halving will halve BTC's inflation rate again, entering a new historically lower inflation level of 0.782%. In principle, the reduction of inflation is not a bad thing for any asset, because it will further increase scarcity. However, this does not necessarily mean that the value of the asset will increase by 100% in a short period of time, but it is considered a relatively important anti-depreciation factor.

2. Comparative analysis of Bitcoin's market performance after 4 rounds

of halving

Since the advent of Bitcoin, each block reward halving has had a profound impact on the BTC market price. From 2012 to 2024, the four-round halving events showed some relatively consistent periodic characteristics. This article also extracted some rules with reference value for readers by comparing the market price trends before and after each round of halving. History never repeats itself, but there will always be similar rules before reaching its peak or on the verge of destruction.

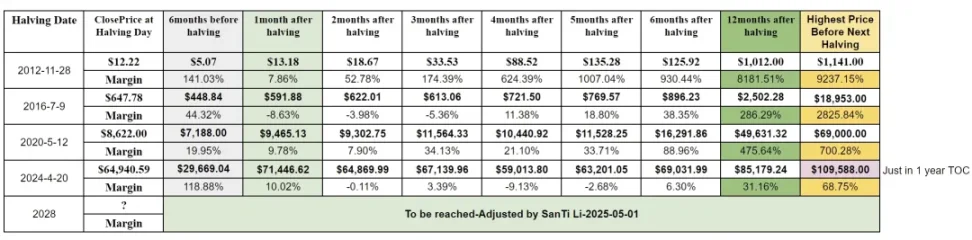

Fig.3 BTC’s value change data chart for four halving cycles

As shown in Fig.3, the trend data of BTC's four halvings, the first half of the year, the first half of the year, and the trend of the highest point in the counterpart cycle. As can be seen from the figure, the price of Bitcoin has risen sharply after each halving. Based on the closing price of the day of the halving, the increase in one year after the halving in 2012 was more than 8,000%, about 286% in 2016, about 475% in 2020, while the increase in one year after the halving in 2024 was only about 31% (the highest so far is 68.75%-$109,588).

1. There have been significant increases in the first 6 months of halving

Looking back at the four rounds of halving events, Bitcoin usually gradually enters an upward channel in the first half of the year. For example:

- When the halving was reduced in 2012, the increase was 141.03% compared with 6 months ago

- The halving in 2024 is, an increase of 118.88% compared to 6 months ago

This stage often corresponds to the market's gradual pricing process of "halving expectations" and has strong prepared signal value.

2. The core outbreak period is 6 to 12 months after halving, but it is not necessarily the highest point.

All three rounds of historical experience show that the 6th to 12th month after the halving is the main upward phase of Bitcoin:

- 2012: The increase reached 8181.51% in one year

- 2016: Increased by 286.29% in one year

- 2020: Increased by 475.64% in one year

- 2024: It has not been a year, temporarily at 31.18%, with a maximum of 68.75% ($100.9k)

Especially in 2012 and 2020, the typical structure of "consolidation within half a year and subsequent outbreaks". One year later, it entered the maximum explosion period and reached a phased historical high. The current halving in 2024 has just been almost one year. If history repeats itself, the real window of explosion may open between 2025 and 2026 Q1.

3. The trend of the first year after the halving has preliminary reference significance for judging the trend

After the halving in 2024, Bitcoin rose 10.02% in one month, but it fluctuated and pulled back in the following two months, and the overall situation was in the accumulation stage. As of October 2024 (that is, half a year), the price rose by only a slight 6.30% relative to the half-day price, far from entering the main upward stage. But this is not uncommon in history. The market officially started in 2016 and 2020 after half a year of halving.

4. The high point of each bull market mainly occurs within 6-12 months after halving.

According to the data of the first three rounds, the highest price of the halving cycle relative to the closing price of the day of halving occurs in the mid-term before the next halving:

- 2012: Highest increase of 9237.15%

- 2016: Increased by 2825.84%

- 2020: Increased by 700.28%

After this round of halving in 2024, it has now reached a stage high of $109,588, up 68.75% compared with the halving day, and has not yet entered the exponential explosion stage. This rule only applies to the end of this round, because after this round, if BTC can reach a value of up to 30-50W or even 100W, then its valuation volume is already very large. The next halving is not allowed to be depreciated by reference anchoring or further expansion of application exploration, such as between interstellar exploration. Otherwise, it will be difficult to see several times more growth.

Chart summary:

Bitcoin’s historical halving cycle shows a highly consistent three-stage rhythm:

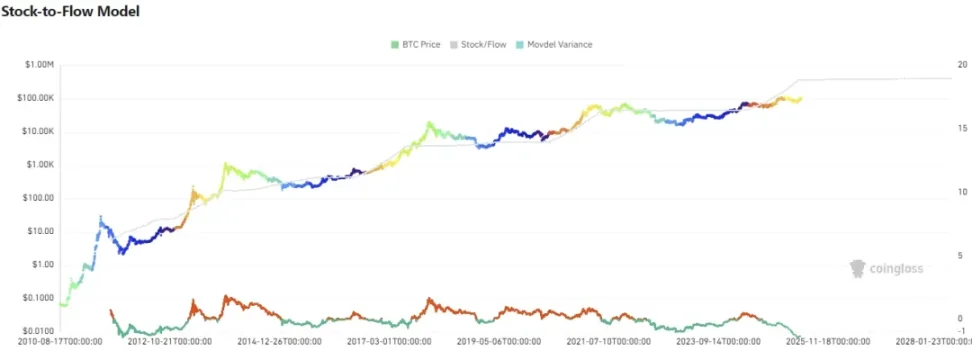

Accumulate momentum to rise (the first 6 months of halving) → Stable oscillation (the first 6 months of halving) → The main upward wave explodes (the first 6 to 18 months after the halving) The current 2024 halving is about to fill one year, which means that the market may still accumulate energy for the later explosion. Similar to the eve of 2017, it is coincidentally also the early days of Trump's coming to power. At the same time, Stock-to-Flow diagram also indirectly assists our reference value view of still accumulating strength: but historical data and laws only have reference value, and we cannot blindly follow the guidance of data, and we must also have enough self-judgment to study DYOR.

Fig.4 Bitcoin Price Stock-to-flow Chart

3. BTC’s own long-term value scientific attributes

The value of an asset comes from consensus and its own value, while long-term consensus must come from its inherent advanced nature and scientific attributes and irreplaceable advances. Bitcoin (BTC) is not only a crypto asset, but also an innovative achievement at the intersection of multiple disciplines such as science and technology, economy, mathematics, and cryptography. Its long-term value is not maintained by market speculation alone, but is based on a complete set of rigorous, verifiable and resistant to manipulation.

1. Scarcity:

As we mentioned earlier, the total amount of Bitcoin is constant at 21 million, and it is written into the protocol by Satoshi Nakamoto in the underlying code and gradually released through the block reward halving mechanism. It was cut by half every four years and was finally released around 2140. Compared with the unlimited issuance mechanism of fiat currency, Bitcoin has natural deflation characteristics, supporting its long-term appreciation logic from the perspective of supply and demand.

Scarcity design is the core pillar of Bitcoin’s anti-inflation, laying the foundation for it to become “digital gold.”

2. Decentralization: Consensus mechanism ensures network neutrality

The Bitcoin network relies on the decentralized PoW (Proof of Work) consensus mechanism provided by computing power. Any node can verify transactions and participate in maintaining the ledger. This structure effectively avoids problems in traditional financial networks such as centralized single point failure, abuse of power, and system accusation. The great globalization is dispersed, and 51% attacks are avoided to the greatest extent.

3. Deflation model fights against depreciation of fiat currency

As shown in Fig2, the built-in deflation issuance model of Bitcoin is in a strong contrast with the inflation structure of fiat currencies in various countries around the world. Especially in the context of large-scale QE and currency proliferation of global central banks since 2020, Bitcoin has gradually proved that it can become a hedge tool to resist the depreciation of fiat currency and the risks of asset bubbles. BTC is gradually becoming a safe haven target for global funds in the "era era of fiat currency distrust".

4. Technology attributes: Advanced cryptography + peer-to-peer network design

Bitcoin has comprehensively applied the following cutting-edge technologies:

- Elliptic Curve Encryption (ECDSA): Ensure account security and private key signature

- SHA-256 hashing algorithm: Ensure data is tamper-free

- Merkle tree structure: efficient verification of in-block transactions

- P2P peer-to-peer network: enabling global value transfer without intermediaries

The combination of these core technologies makes Bitcoin an extremely robust, non-forgery value transmission network, and at the same time it has infinite ductility, laying a solid foundation for subsequent layer two expansions (such as Lightning Network, ecological applications). BTC is not only an asset, but also a masterpiece of cryptotech engineering. Future quantum-resistant updates are also worthy of further expectations.

5. Challengers of the Global Financial Order: Alternative Consensus Assets for Changes in Dollar Trends

The world is currently experiencing a wave of de-dollarization: settlements between countries have begun to turn to local currencies, gold and #decentralized assets. With its non-sovereign objectivity, globalization, scarcity and other characteristics, Bitcoin has become an important channel for asset transfer and storage value in emerging markets and turbulent countries. It constructs a new financial order model that coexists with #U.S. dollar and #gold but is independent - "a neutral system of consensus currency". When "some countries' credit" is difficult to trust, relying on objective algorithmic credit will become a moat between the international community. Of course, regulatory agencies in various countries also need to further intervene to prevent the frequent occurrence of illegal acts.

6. The potential financial infrastructure of interstellar civilization (not yet used, and belongs to personal exploration views)

Bitcoin is currently the only value agreement that does not rely on any country, #bank, or #Internet entity. Its ledger can exist at any node between the planet, and the network can be maintained by just power and computing power. This structure is naturally suitable for future space exploration scenarios, such as Mars or the moon exploration, and is convenient for rapid and direct use and application. However, since humans are still in the rough stage of exploring aliens, there has not been any major breakthrough in stable login and arrival, so this is limited to personal whims. But if you look at the 30-50-year cycle, it seems that initial planetary applications are not entirely impossible. Bitcoin (or credit-like points) can be used as the underlying token of human digital civilization.

So the overall scientific attributes of BTC:

- Supply ceiling (scarcity) + consensus intensity (decentralization);

- Real-world background: fiat currency credit continues to weaken, and the debt bubble expands;

- In the uncertainty of the future, Bitcoin’s “anchoring attribute” is becoming increasingly prominent.

4. Summary of the main long-term trend value of BTC

This paper draws the following conclusions through the analysis of the performance of BTC halving cycle and its long-term scientific attributes:

Bitcoin’s four-round halving cycle shows a highly consistent market rhythm: that is, expectations before halving drive up, short-term consolidation and accumulation of momentum after halving, and then welcoming the main upward trend. From the perspective of inflation rate, Bitcoin's annual inflation rate fell to 0.78% after the halving in 2024, lower than gold for the first time, further consolidating its position as a scarce asset. Against the backdrop of the continued high inflation of the global fiat currency system, credit expansion and increasingly large debt deficits, Bitcoin's deflation model and decentralized characteristics are attracting more and more attention and allocation of traditional capital.

Although short-term market fluctuations still exist and the possibility of the sudden appearance of black swans cannot be ignored, the logic of Bitcoin's long-term value is gradually becoming clear: it is not only a cryptocurrency, but also a new type of asset based on cryptography and consensus. In the future cycle, its long-term value potential, ability to hedge inflation and the irreplaceability of the technological base will continue to empower it, and build a core value barrier that "digital gold" should have.

chaincatcher

chaincatcher