Web 3.0 or Fintech 2.0, don't choose the wrong way

Reprinted from panewslab

05/08/2025·17DDon't go to Fintech 2.0

Crypto is doing payments, Fintech is doing stablecoins.

In the past year, the development of the cryptocurrency industry has been in two-way with traditional financial companies, Web 2.0 giants and global politicians. Trump's air coin is the end of crypto liquidity, and peace has just begun.

Pakistan's consultants, Bhutan's crypto mining farms and sky-high financing in the Middle East all turned into the last straw that overwhelmed retail investors. Then they all went to the wishing pool to be the turtle, and maybe they could still gain some infatuation.

The era of crypto stagnation

Humans are very strange creatures. They used to pursue freedom when they were traditional, but now they are free when they are traditional.

The only lesson that humans learn is that they cannot learn anything.

I still remember that when the Bitcoin Spot ETF passed, I thought Bitcoin would change the world. Of course, now everyone thinks that Bitcoin is a mapping asset of M2. It cannot reduce inflation and maintain value and increase value. After being pulled away by the ETF, it cannot be used as a combustion aid for the bull market engine of the currency circle. One tendon becomes a blockage.

The only lesson that humans learn is that they cannot learn anything +1.

When Trump came to his loyal currency circle with air coins in his arms, it was not surprising that the silence after the surge was not surprising. PumpFun's self-rescue, Binance Wallet's attack, or whether Boop was Binance CXO, all turned into farce itself, or the kind that could not make money.

Image description: Encrypt the existing pattern Image source: @zuoyeweb3

There is nothing new under the sun, and cryptocurrencies only have a big stagnation.

First, the "innovation at the level of human civilization" Ethereum cannot resist the decline of 4,000 to 1,500. We must use Risc-V to return to the L1 war. If EVM can be changed, it is better to be in place in one step and change PoS to PoW. Can Ethereum bets on L1 and the newly added Risc-V really save itself?

Being commanded by the enemy is the stupidest behavior, but unfortunately Solana is the commander this time, and Solana bets on L1 before and after FTX.

In essence, SVM L2 or expansion layer is also a blood-sucking behavior for Solana. It is a cattle on the whale, not intentionally doing it, but ETH L2 is a barnacle on Ethereum, or it is brought by Ethereum itself.

Gone are the market paradigms we were familiar with before, ETH is not Money, Stablecoin is Money.

Secondly, invalid information is infecting the entire market. KOL Summer will quickly become a KOL Agency Summer, and then CEX Summer. If you don’t believe it, look at the grand occasion of this Dubai Music Festival. The project parties, KOLs and exchanges are ultimately trading-oriented. The exchange itself is the receiving point of trading behavior, which is an unsolvable situation.

This is not a criticism of KOL, but a recognition of market laws. From the earliest community AMA at three o'clock, community-based currency, to the past of the Thousand Media War, KOL's hot peak is also the end, and oriented transactions are the moment of clearing trust and influence.

However, there are new differentiation trends in this cycle. Although they are all invalid information, they are generally divided into two categories:

1. Screaming orders to sink into the market

2. Lao Qian stands up and promotes existence

Again, it is the destruction and persistence of VCs. Relying on US dollar capital, Silicon Valley, the Middle East and Europe VCs are all planning for the next stage, while the lonely Chinese VCs are constantly tortured by LP and ROI. It has nothing to do with innovation and are all rapidly making markets. Anyway, they have to be directed to trading, so it is better to save steps and do it yourself.

True innovation was in the past, and in the future, it would be in Shenzhen Science and Technology Park. Chinese Founders would look for money in Silicon Valley and Wall Street, but projects that truly meet the next stage of the market will not be recognized by investors according to the existing framework.

The currency circle does not require FA, and Meme cannot short.

The reason is that the trading path is too short. The exchange is eyeing any traffic. It would rather waste casting a net than miss the opportunity. The only beneficiary has become a former big manufacturer that fled from the Internet to CEX. It is not only bytes, but also the food trough of cows and horses.

Toutiao in 2018 had only 4 months of working hours, while in 2024, the ByteSystem has risen to 7-8 months, but more people are still sent to society. They only have to pay attention to the top CEX.

Today’s storm: VC beneficiaries are top school students, and CEX beneficiaries are eliminated by large factories. They not only bring professional and beautiful resumes, but also have more advanced operating standards, as well as the decline in capital efficiency after the increase in intermediary costs.

Gone are the eras and people who are full of vitality in the currency circle, and who are determined to make money.

The continuous institutionalization has become a tight curse in the currency circle. The currency circle is more like the Internet, and the Internet is more like XXX.

Invention is the mother of demand

I don’t have FUD cryptocurrency, and my more accurate mentality is “confidence in the crypto industry and worry about my future.” This is no longer a niche industry full of opportunities for getting rich. Practitioners are being replaced by the Internet and financial industries. Encryption OG and ground-based push are either going to the jail, or becoming a brother, or becoming a boss after going to the jail, Baby will fight the tiger tonight.

The complaints are too strong to prevent heartbreak. We should not continue to discuss VCs and exchanges. Ethereum has either started from scratch or explored a new ecosystem. In every crisis in the crypto industry, new asset issuance methods will be born, such as ERC-20 supporting DeFi, NFT supporting BAYC, and now we have reached the stablecoin stage.

Please note that the core of the activity on the previous round of chain was Ethereum and lending, and the "Lego-style" amplification of capital efficiency. However, this round of Ethereum and staking model did not replicate miracles. In our timeline, Tencent did not invent WeChat, but the rise of Xiaomi Mijie.

Interest-yielding stablecoins (YBS) have become new inventions. They will create new demands. It is not because everyone's demand for stablecoins cannot be met. USDT is alive, but because it can do YBS in this way. Ethena was invented. Referring to the end of US dollar seigniorage, stablecoin super cycle.

YBS will become a new form of asset issuance. This is an expectation. According to the history of the mind, I have three predictions for the future, which point to different futures:

1.YBS has become a new asset issuance method, and Ethereum has successfully replaced its "core". ETH replaces BTC as the new crypto engine, and Restaking ETH becomes the real Money;

2.YBS has become a new way of asset issuance, and Ethereum has entered a silence. YBS will be swallowed up by US dollar assets such as treasury bonds, Fintech 2.0 will come true, and Web 3.0 will become a dream;

3.YBS will not become a new asset issuance method, and Ethereum will die silently. Then the blockchain will "de-coin storage chain", Fintech 1.0 is Paypal's replacement for banks, Stripe is an electronic innovation in the acquisition of bills, and then the currency-free blockchain is at most Fintech 1.5.

To sum up, Fintech 2.0 is a financial blockchain, and Fintech 1.5 is a currency-free blockchain technology.

Stablecoins are becoming a new asset issuance model, which is something that no VC research report has ever predicted, and even Ethena himself has never thought so. If we think that the market itself is the optimal solution, the biggest problem for VCs and exchanges is not to learn Vitalik's addiction to technical narratives, but to disrespect market laws.

Under the existing currency circle pattern, exchanges, stablecoins and public chains are actually the only ones. Binance, USDT and Ethereum form the protagonist group. The others are suppliers and distribution channels around the three. Exchanges and public chains are relatively stable. Now the war is concentrated on stablecoins. Not only USDC, BlackRock, etc. are entering, but the answer given on the chain is YBS, which is related to the overall situation and has no choice.

PS, exchange stability refers to Binance as the dominant player, public chain stability refers to the revitalization of Ethereum, and Solana is still on the way to replace it.

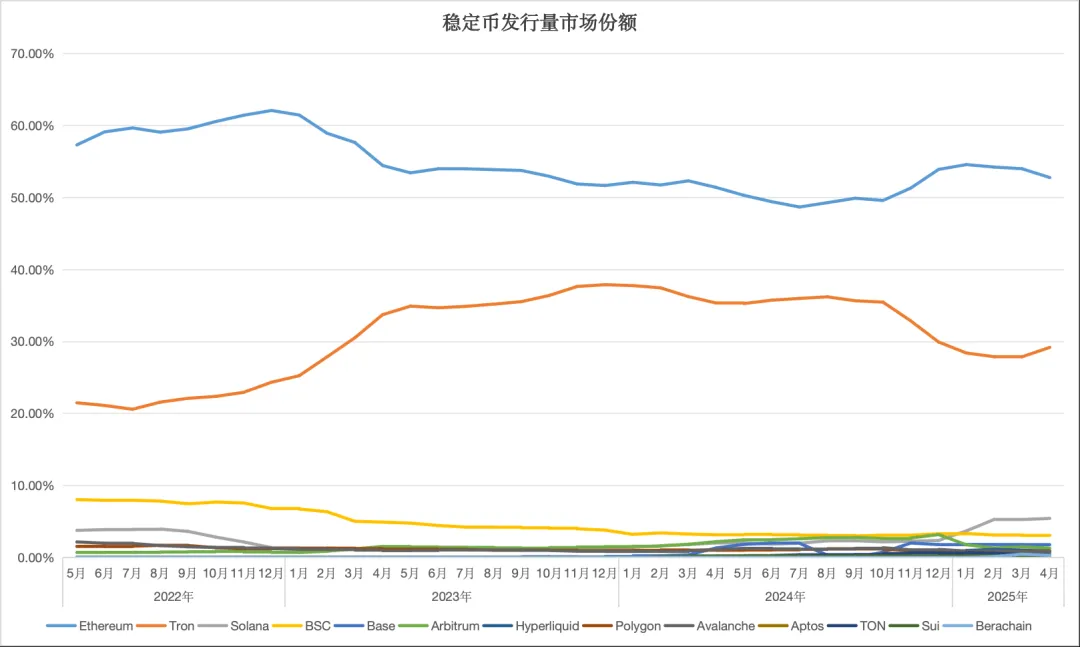

Image description: Stablecoin market issuance image source: @zuoyeweb3

In today's market structure, Ethereum and Tron are the only ones, but Solana has not given up catching up, especially Ethereum has not been completely defeated. You can always hear the news that Solana DEX trading volume exceeds the Ethereum ecosystem. However, in terms of real asset issuance, ETH+ERC-20 USDT is still the leader.

This is also the main reason why I think there is no problem with Ethereum's fundamentals. Everyone's expectation for ETH is 10,000, and SOL is 1,000, which is completely different.

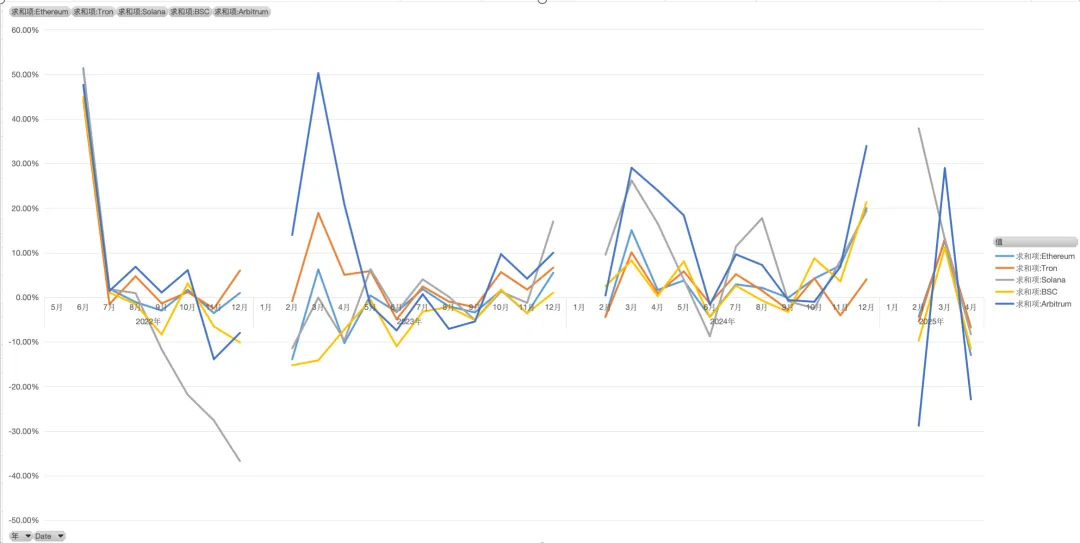

Image description: Stablecoin growth rate Image source: @zuoyeweb3

Especially compared with the growth rates of each chain, we can find that the frequency is basically the same. Except for Solana's death in 2022, everyone is consistent with Ethereum in the rest of the time. We can believe that in terms of correlation, the stablecoins of each chain have not gone out of the independent market, and are still a spillover of Ethereum.

Based on this, the importance of Ethereum and stablecoins pairing is explained, and the importance of YBS lies in the change of anchors. The market value of stablecoins of 230 billion is, and YBS such as USDe are still just others.

In the same sentence, YBS must become a new asset issuance method in order to transmit the asset attributes of ETH to the monetary level. Otherwise, the spring of RWA will be the cold winter of the currency circle.

Conclusion

Ethereum only has technical narratives, and users only embrace stablecoins.

We hope that users will embrace YBS, not USDT. This is the current situation and the differences between us and the market.

It is a big deal to pursue niches. Look at the through-type taillights and the LABUBU that spreads all over the world. Let’s briefly mention blockchain payments. There is no problem with payment. However, before the mainstreaming of YBS supported by crypto-native assets, the strong promotion of blockchain payments was "the result was earlier than the reason", that is, payments should be the direction of YBS.

Cryptocurrencies should not become Fintech 2.0, and the road should not be narrower and narrower.

jinse

jinse

chaincatcher

chaincatcher