"Digital Gold" narrative underestimates the true value of Bitcoin

Reprinted from panewslab

05/13/2025·1M

Original text: Isaiah Austin , Bitcoin Magazine

Compiled by: Yuliya, PANews

Labeling Bitcoin as “digital gold” is a misunderstanding of this revolutionary currency form. This statement simplifies Bitcoin into an asset that only has the function of stored value, covering up its deeper technological advantages and financial potential.

Analogy is a common way for humans to understand new things. Faced with the unprecedented concept of Bitcoin, people naturally tend to find a reference model. Before the general public can understand the underlying mechanisms of Bitcoin in depth, "digital gold" is undoubtedly an intuitive and easy-to-accept analogy. Bitcoin is scarce, universal, and has the function of stored value, so it seems natural to be called "digital gold".

This narrative has driven the adoption at the institutional and sovereign state levels and has even been written into the first paragraph of President Trump’s executive order on the establishment of strategic Bitcoin reserves: “Bitcoin is often called ‘digital gold’ given its scarcity and security.”

This is an undeniable achievement. However, if Bitcoin is to realize its true potential, this narrative must be updated.

Bitcoin is not "digital gold".

Equivalent to gold is to devalue a monetary innovation that completely subverts the traditional financial system. The basic attributes of Bitcoin make the qualities of gold proud appear outdated, and at the same time, it is faster, safer and more decentralized than fiat currency.

Scarcity and finiteness

The key reason why gold has become a tool for storage value for a long time is its scarcity. Over the past century, gold production has increased by only about 1% to 2%. The difficulty of exploration, coupled with the high cost of labor, equipment and environmental protection, makes large-scale production expansion without economic incentives.

This naturally formed supply constraint has enabled gold to gain monetary status since 3000 BC. In ancient Rome, the price of a high-end robe was comparable to the amount of gold required for a tailor-made suit today, which shows that its value was stable.

However, in the Bitcoin era, it seems out of place to use the value scale of volatile assets. Bitcoin is not scarce, but "limited". The total amount is always locked at 21 million and will not grow due to technological breakthroughs or cosmic mining.

Through mathematical and technical means, humans have a fixed total amount of tradable currency for the first time, and its significance is far beyond what "digital gold" can cover.

Differentiability

Although gold can be cut, it is difficult to call it "height differentiation". This feature is barely available only when equipped with saws, laser equipment and precision scales. Therefore, gold is suitable for large-scale transactions, but it is difficult to use for daily payments.

Based on the current market price, 1 gram of gold is worth about $108. If you pay for a sandwich with gold, you have to scrape off one corner, which is obviously not feasible in reality.

Historically, humans have alleviated this problem by issuing gold coins with certain metal content. However, this also opened the door to currency depreciation.

For example, the stater gold coins minted by Lydia in 600 BC, which was issued in Lydia (modern Turkey) and was originally minted from amber gold (a gold-silver alloy) with a gold content of about 55%.

In 546 BC, after being conquered by the Persian Empire, gold coins were gradually doped with basic metals such as copper to reduce the gold content. This practice caused the actual value of the coins to decline, and by the end of the 5th century BC, its gold content was only 30%-40%.

Gold as an asset cannot achieve differentiation, and this flaw has led to its failure to be used for a long time and effectively in history. In order to conduct small transactions, citizens usually hand over gold to the government for 1:1 coins, and this mechanism is often diluted in currency value and collapsed in social trust due to the manipulation of power by the elite.

No gold-based monetary system in history can ultimately avoid depreciation. The actual demand for micro-transactions has forced the public to rely on banknotes and small currencies issued by the state, thus losing control of wealth.

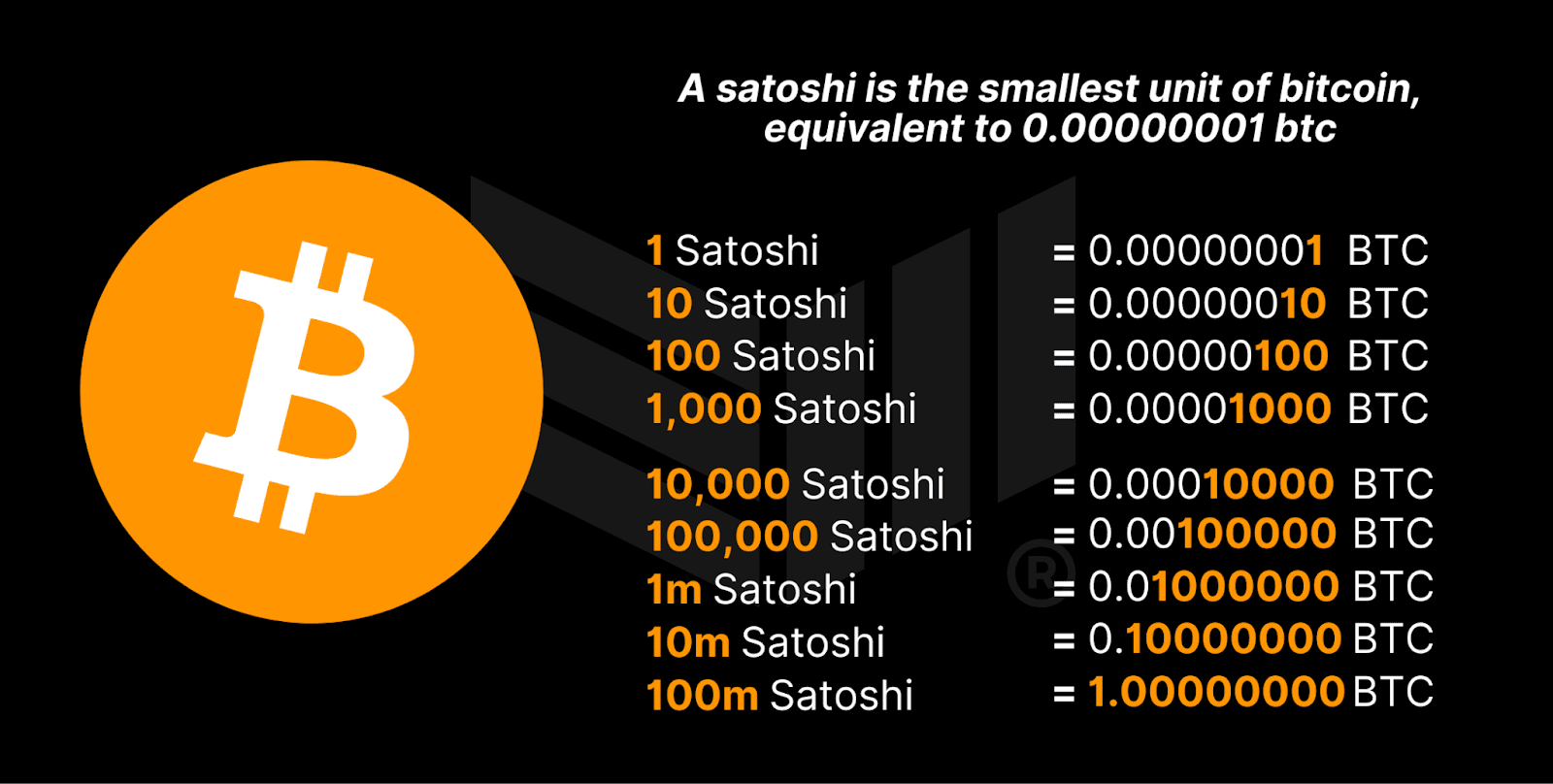

Bitcoin has achieved a fundamental breakthrough in this issue. Its smallest unit is "satoshi", which is equal to 1 part 100 million Bitcoin. Currently, 1Soyo is worth about US$0.001, and its differential ability has surpassed the US$. Bitcoin transactions do not require any institutional or government intermediaries, and users can always directly trade with the minimum valuation unit, making it truly a monetary system that can be used without intermediaries.

Therefore, comparing gold with Bitcoin in terms of separability and valuation units is almost a joke.

Auditability

The last time the U.S. government officially audited its gold reserves was in 1974. At that time, President Ford allowed reporters to enter Fort Knox, Kentucky to view the vault, but there was no abnormality. But this was half a century ago.

To this day, speculation remains as to whether Fort Knox gold is still intact. A few days ago, news came out that Musk would broadcast the audit process live, but this "coming" audit soon ended in vain.

Unlike gold’s rare and low-frequency manual audits, Bitcoin’s verification is performed automatically. Through the proof of work mechanism, new blocks are added every 10 minutes, and the system automatically verifies transaction legality, total supply and consensus rules.

Compared with the third-party trust mechanism that traditional audits rely on, Bitcoin achieves trustless and open and transparent on-chain verification. Anyone can independently verify blockchain data in real time, and "Don't believe it, verify it" has become the consensus principle of Bitcoin.

Portability

There is no need to elaborate on the mobility of Bitcoin. Gold is large in size and high in weight, and requires special ships or aircraft to be transported across borders. Bitcoin is stored in the wallet, and its "weight" is always zero regardless of the amount.

But the real advantage of Bitcoin is not its lightness, but its lack of physical “movement”. In reality, receiving a gold payment means that you must bear the transportation cost and the risk of trust from the middleman. In cross-border transactions, the third parties involved include transaction matchers, export logistics teams, transportation personnel, consignees, and storage agencies. Each link is a link in the trust chain.

Bitcoin does not require any intermediary. Users can directly complete cross-border payments through blockchain, and the transactions can be publicly verified throughout the process, and there is no risk of fraud. This is the first time that humans have truly owned "electronic cash".

Conor Mulcahy of Bitcoin Magazine once pointed out: "Electronic cash is a type of currency that exists only in digital form and is used for peer-to-peer transactions. Unlike electronic currency that relies on banks and payment processors, electronic cash mimics the anonymity of physical cash and direct exchange characteristics with users."

Before Bitcoin was born, peer-to-peer non-face-to-face transactions were still a theoretical assumption. Those critics who believe that "if you cannot see or touch, it is not true" will eventually be eliminated in this era of accelerated digitalization.

Not all Bitcoin “adoption” is worth celebrating

If the goal is just to drive the price of Bitcoin to rise, then the "digital gold" narrative is indeed effective, and governments, institutions and individuals will continue to enter the market and prices will continue to rise.

But if Bitcoin is seen as a technological revolution that changes the liberal order, it must be rethinked. To make Bitcoin a central position in the global financial freedom system, it is necessary to educate people who have not yet been exposed to Bitcoin and convey their uniqueness to them rather than relying on simplified metaphors.

Bitcoin deserves to be recognized as a brand new form of currency, not a digital alternative to gold.

chaincatcher

chaincatcher