China and the United States shake hands and make peace, why is Bitcoin going to dive on a high platform?

Reprinted from panewslab

05/13/2025·1M1. Agreement implementation: "Seesaw effect" under the transfer of risk

appetite

On May 12, Beijing time, the tariff truce agreement reached by China and the United States in Geneva pressed the "pause button" for the trade friction that has lasted for several years. The agreement includes suspending the 24% mutual tariff for 90 days, retaining the 10% basic tax rate, and establishing a third-country consultation mechanism. This progress directly stimulated the S&P 500 futures to jump 3%, while the Nasdaq closed up 4.35%. However, Bitcoin unexpectedly fell back to a minimum of US$100,700 after hitting US$105,720, forming a rare pattern of "stock and currency divergence". As of press time, BTC has rebounded to US$102,600.

Pivot:

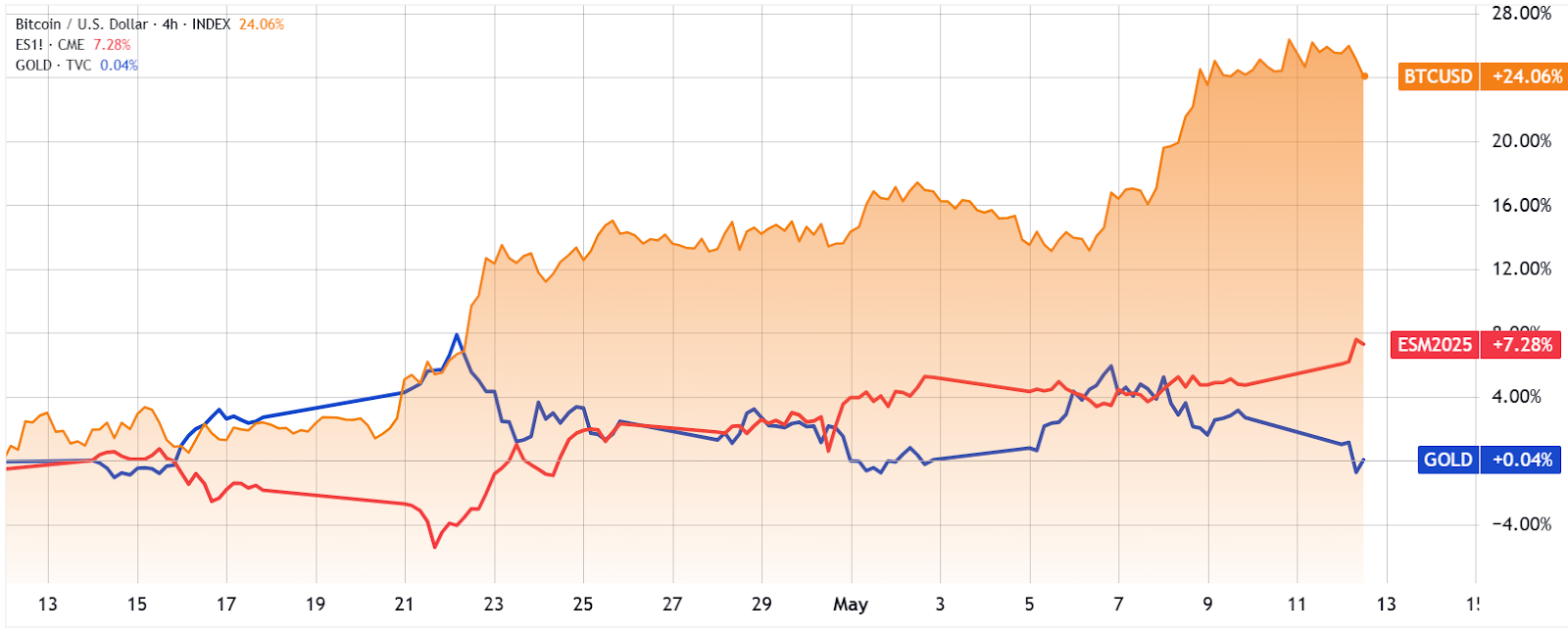

Bitcoin/USD (orange) vs. S&P 500 futures (red) and gold (blue). Source: TradingView

- Short-term capital diversion: In the past 30 days, Bitcoin has risen by 24%, while the S&P 500 has risen by only 7% during the same period, and the gold price remains the same. As the trade agreement reduces market uncertainty, some funds return to traditional stock markets from crypto assets, causing the 30-day correlation between Bitcoin and traditional markets to rise to an all-time high of 83%.

- Institutional holdings "double-edged sword": MicroStrategy and its affiliated institutions have recently increased their holdings by 13,390 BTC, with a total holding of 1.19 million (accounting for 6% of the circulation). Although this is seen as a long-term positive, the market is concerned that its concentrated holdings may form a risk of "price manipulation", especially when the average cost climbs above $100,000, short-term selling pressure is expected to heat up.

2. Technical game: $106,000 becomes a "far-short watershed"

On May 12, Bitcoin briefly broke through $105,800 and quickly fell back to $101,400. The 1-hour K-line chart shows that the price fell below the lower edge of the rising channel.

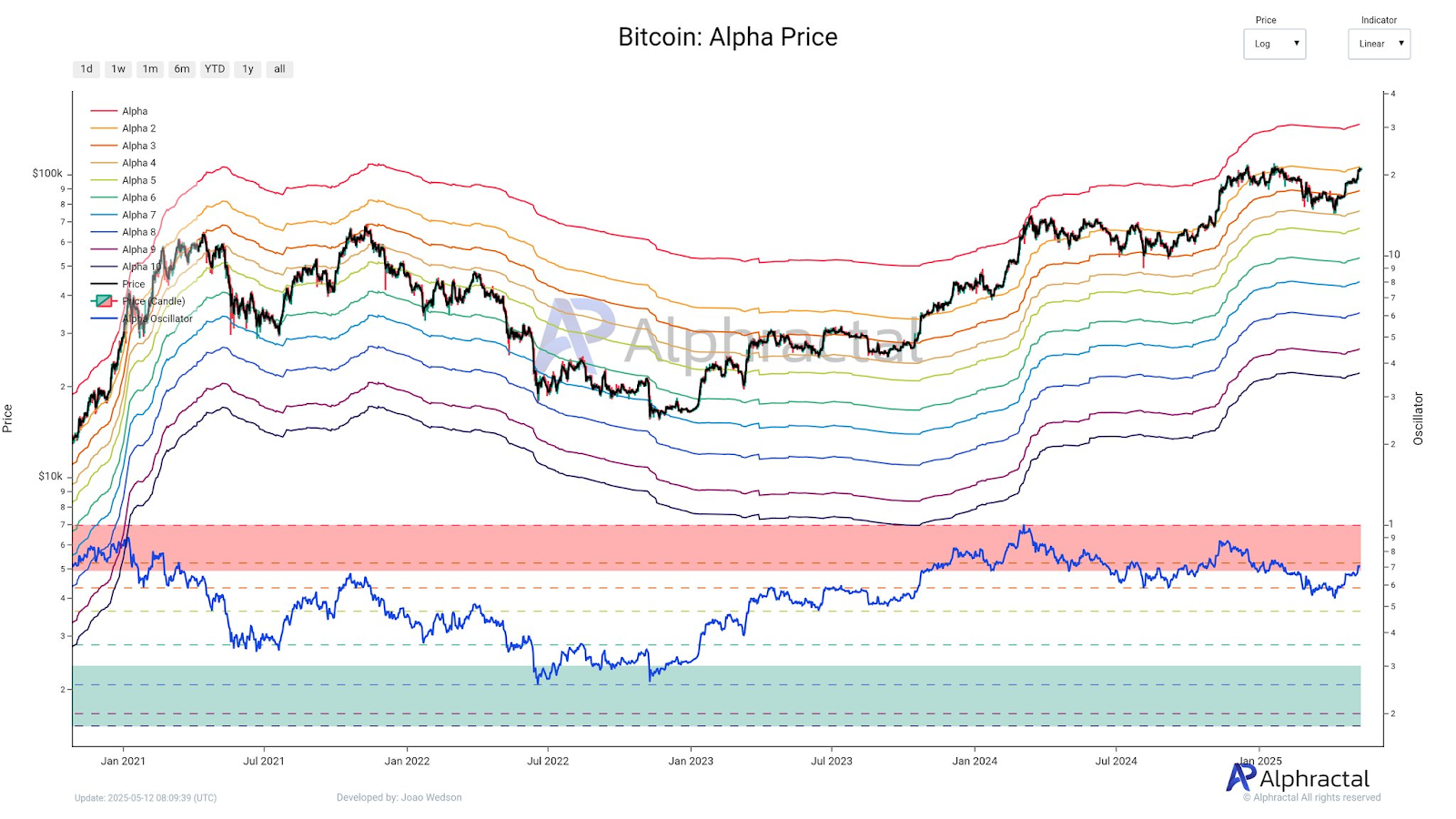

Bitcoin Alpha price level. Source: X.com

Alphractal CEO Joao Wedson pointed out that there is a “alpha price” resistance zone near $106,000, where long-term holders may trigger profit settlement.

Key Risk Indicators:

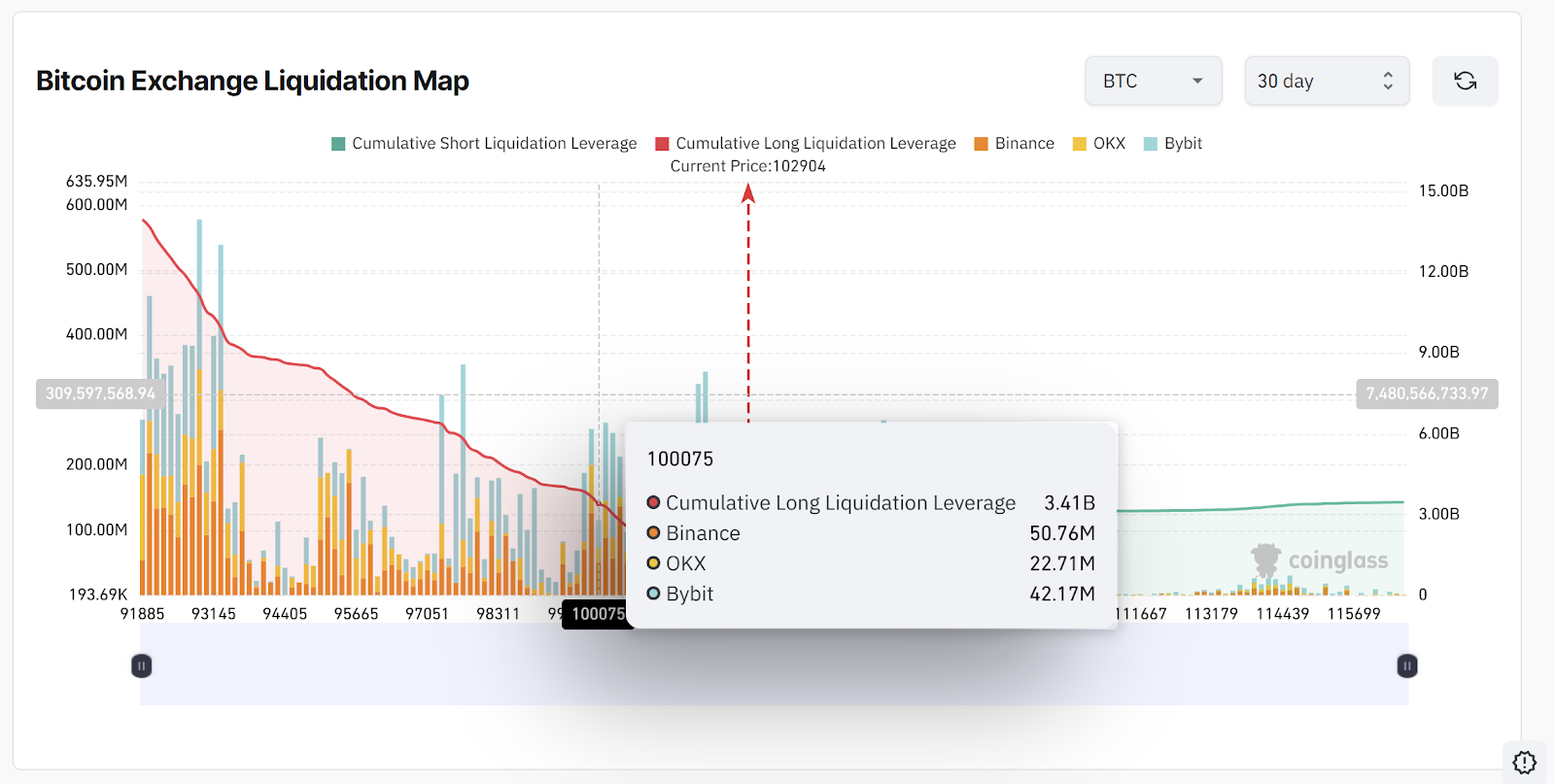

- Liding magnetic absorption effect: CoinGlass data shows that if the price falls to US$100,000, the long leveraged positions of about US$3.4 billion will face the risk of forced flattening, forming short-term downward pressure.

- Support range verification: The four-hour chart shows that US$99,700-100,500 is the recent "fair value gap" (FVG). If it falls below, it may further fall into the US$97,363-98,680 range, with a pullback of 8%.

3. Macro variables: "butterfly effect" between CPI data and the US

dollar index

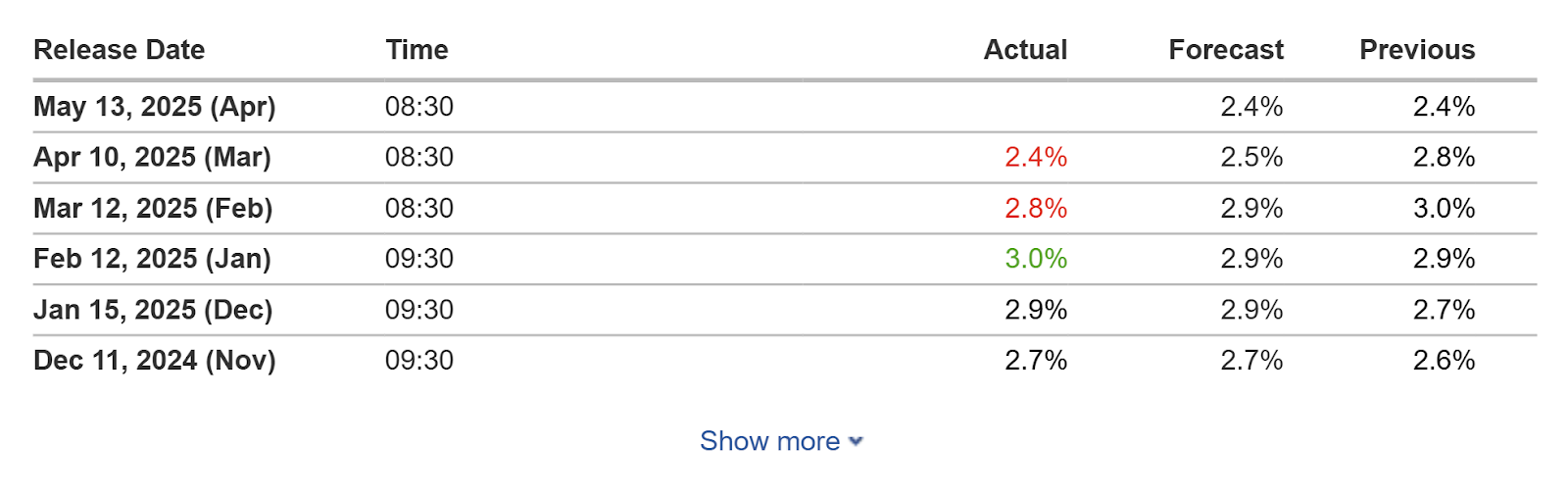

The US April CPI data released on May 13 became the focus of the market. Previously, CPI recorded 2.4% in March (2.5% lower than expected). If the April data continues to decline, it may strengthen the Fed's expectation of interest rate cuts, which will benefit risky assets; on the contrary, if inflation rebounds, the US dollar index (DXY) may break through the 30-day high, which will suppress Bitcoin.

Relevance logic:

Gold/USD (left) vs USD Index (right). Source: TradingView

- “Hell-haven replacement” between gold and BTC: Gold fell 3.4% on May 12, and DXY climbed to a 30-day high, reflecting investors' shift from scarce assets to the US dollar and stock markets. This round verifies the short-term positive correlation between Bitcoin and gold.

- The long-term narrative of the loosening of US dollar hegemony: Despite short-term setbacks, the "local currency settlement pilot" clause in the agreement may weaken the US dollar's trade settlement status. Historical data shows that during the 2018-2020 trade war, Bitcoin eventually exceeded US$20,000 after the initial pullback, and its "decentralized settlement tool" attribute may regain attention in the medium and long term.

4. Market sentiment differentiation: “Difference Signal” between Giant

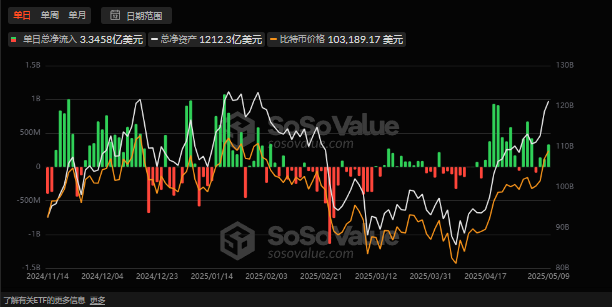

Whale Retreatment and ETF Capital Inflow

On-chain data shows that the number of addresses with positions of more than 10,000 BTC decreased by 12, and the exchange reserves decreased by 1.8%, implying that some large investors chose to take profits.

However, US spot Bitcoin ETFs had a net inflow of US$2 billion from May 1 to 9, and institutional funds were still showing a "buyer the more they rose."

Structural contradiction analysis:

- Retail leverage risk: The current altcoin trading volume surged by 280%, but HTX Research pointed out that its leverage ratio is still in a safe range. In contrast, Bitcoin contract holdings are concentrated at US$98,000-100,000, which is prone to trigger "long and short double kills".

- Institutional "bottom-up" logic: Wall Street giants such as BlackRock have formed liquidity monopoly through ETFs, compressing Bitcoin's daily volatility from 18% to 9%, and gradually tilting pricing power to traditional capital.

5. Future deduction: short-term oscillation and long-term paradigm

migration

Scenario 1 (optimistic):

If the CPI data is lower than expected, coupled with the rising expectations of the Federal Reserve's interest rate cut, Bitcoin may quickly recover to above $105,000 and hit the 120,000 mark. Institutional increase in holdings and ETF inflows will build a "moat", making the probability of falling below $100,000 less than 20%.

Scenario 2 (caution):

If the CPI rebound triggers the dollar to strengthen, BTC may fall to the support level of US$97,000-99,000. However, MicroStrategy's $21 billion capital increase provides it with "ammunition", and long-term holders have limited selling pressure, and after the pullback, it may enter a box fluctuation of $90,000-110,000.

Conclusion: Finding certainty in uncertainty

The short-term fluctuations of Bitcoin are essentially the tug-of-war of pricing power in traditional finance and crypto ecosystems. For investors, they need to be vigilant about leverage risks and policy variables, but they should pay more attention to the evolution of their underlying logic: when tariff barriers collide with blockchain technology, Bitcoin is evolving from "digital gold" to "transnational value transmission protocol."

The real victory of Bitcoin is not about defeating fiat currency, but about proving that humans need diversified value anchors.