"Bear Market Light" Pendle's 2025 plan: V2 upgrade, multi-chain expansion, perpetual contract income products

Reprinted from panewslab

04/01/2025·29DThis article comes from: 0xDíaz

Compiled by Odaily Planet Daily

Translator|Azuma

Pendle (PENDLE) has become a dominant fixed income protocol in DeFi, enabling users to trade future gains and lock in predictable on-chain returns.

In 2024, Pendle promoted the development of major narratives such as LST (liquid staking tokens), re-staking, and income stablecoins, and itself became the preferred launch platform for asset issuers.

In 2025, Pendle will expand beyond the EVM ecosystem and evolve into a comprehensive fixed income layer of DeFi, targeting new markets, products and user groups, covering native cryptocurrency markets and institutional capital markets.

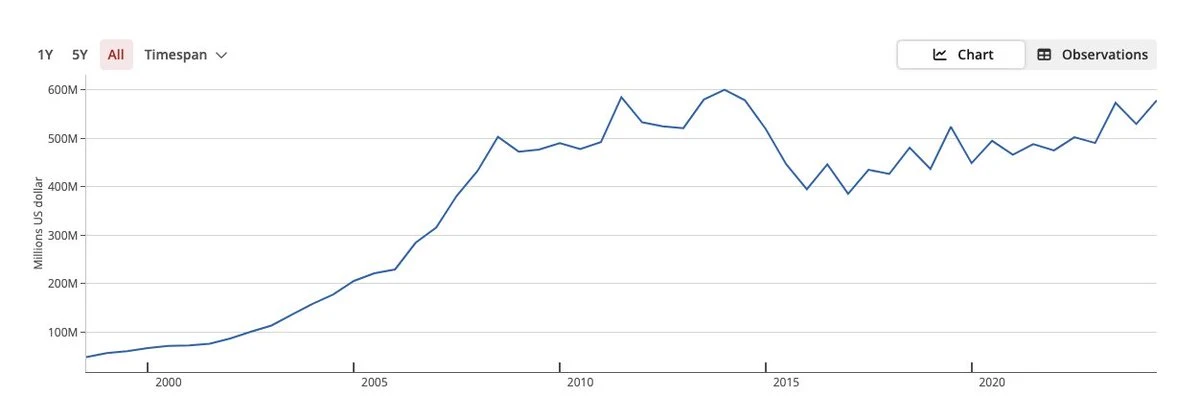

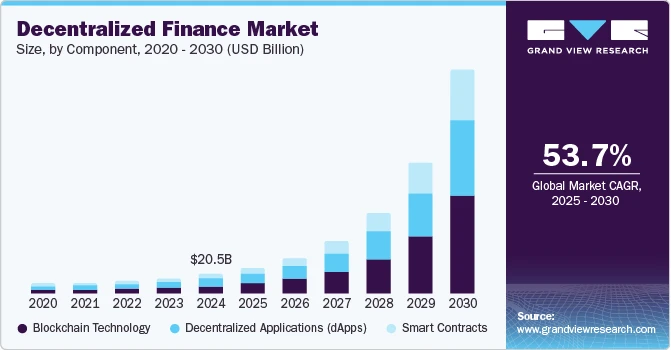

The yield derivatives market in the DeFi world can be compared to one of the largest market segments in the traditional finance (TradFi) world - interest rate derivatives. This is a market of over $500 trillion, and even a small proportion of that market represents a multi-billion dollar opportunity.

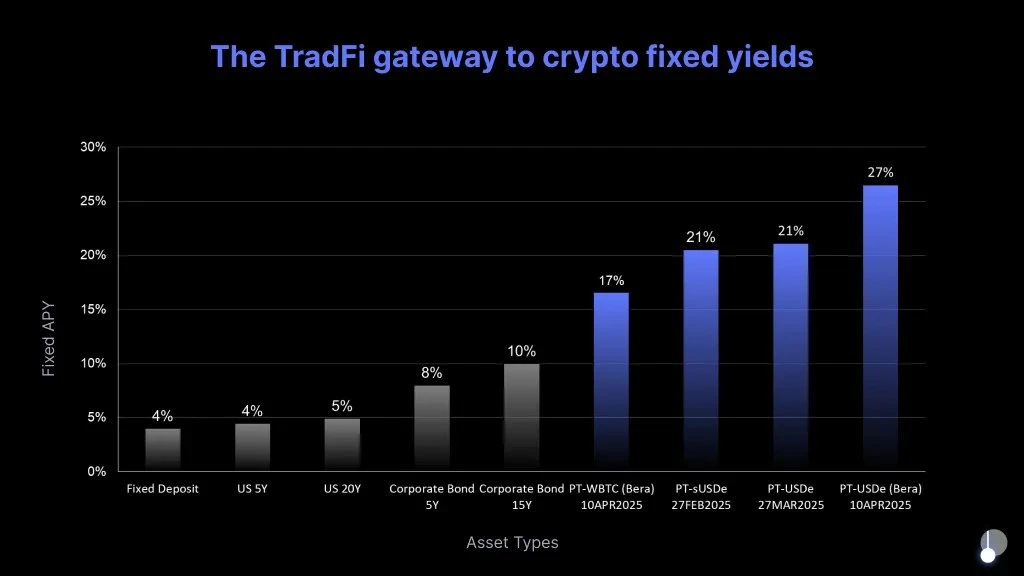

Most DeFi platforms only offer floating returns, which inevitably exposes users to market volatility, but Pendle introduces fixed-rate products through transparent and composable systems.

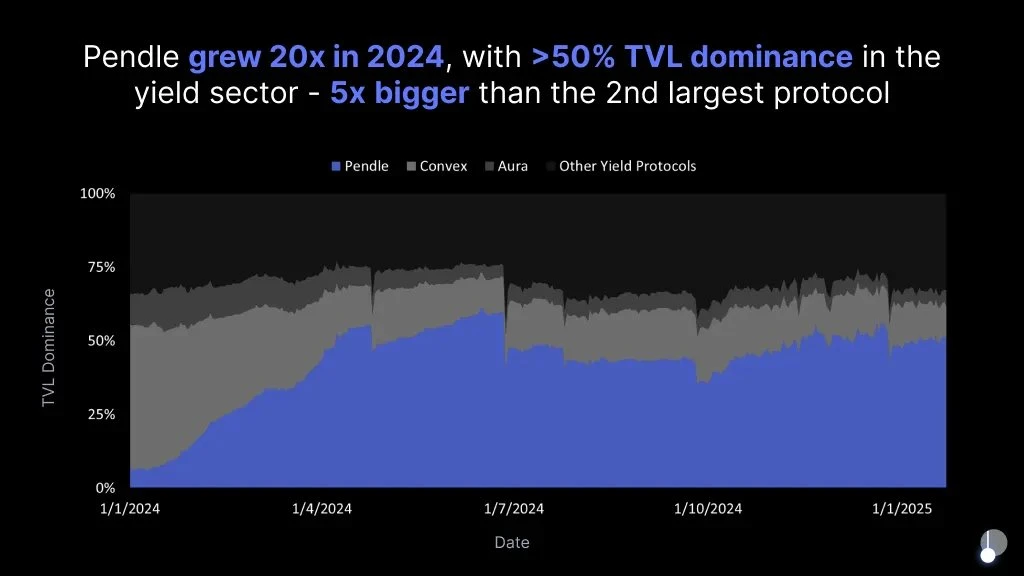

This innovation reshapes the $120 billion DeFi market landscape, making Pendle a dominant earnings deal. In 2024, Pendle's TVL grew by more than 20 times, and its TVL currently accounts for more than half of the yield market, 5 times the second largest competitor.

Pendle is more than just a revenue protocol, it has evolved into the core infrastructure of DeFi, driving the liquidity growth of those top protocols.

Finding fit: From LST to Restaking

Pendle gained early market attention by solving a core issue in DeFi – the volatility and unpredictability of returns. Unlike Aave or Compound, Pendle allows users to lock in fixed returns by separating principal from earnings.

With the rise of liquid staking tokens (LST), Pendle adoption has surged to help users release liquidity from staking assets. In 2024, Pendle successfully captured the restaking narrative - its eETH fund pool became the largest pool on the platform in just a few days after it was launched.

Today, Pendle has played a key role in the entire chain revenue ecosystem. Whether it is providing hedging tools for volatile capital rates or as a liquidity engine for interest-generating assets, Pendle has unique advantages in growth areas such as liquidity re-staked tokens (LRT), real-world assets (RWA), and on-chain money markets.

Pendle V2: Infrastructure Upgrade

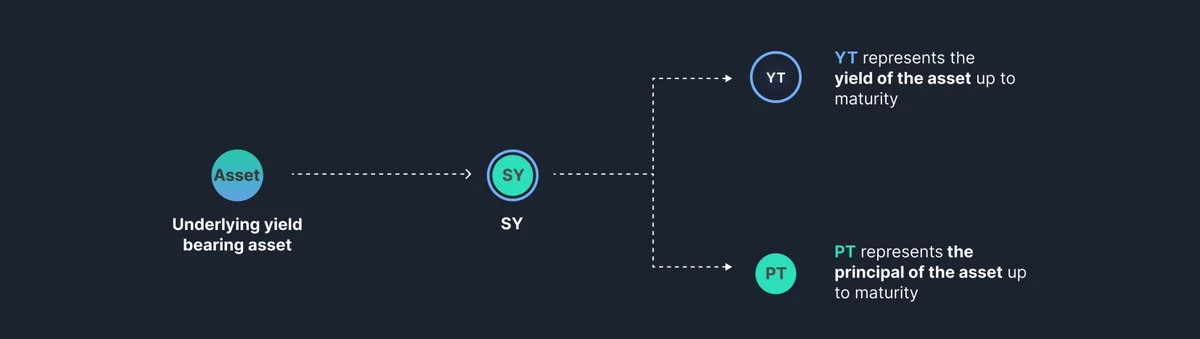

Pendle V2 introduces standardized income tokens (SYs) to unify the packaging of interest-bearing assets. This replaces the V1 scattered, customized integration solution, enabling seamless minting of "principal tokens" (PT) and "earnings tokens" (YT).

Pendle V2's AMM is designed for PT-YT transactions, providing higher capital efficiency and better price mechanisms. V1 adopts a general AMM model, while V2 introduces dynamic parameters such as rateScalar and rateAnchor, which adjusts liquidity over time, thereby narrowing spreads, optimizing earnings discovery and reducing slippage.

Pendle V2 also upgraded its pricing infrastructure, integrating native TWAP oracles in AMM, replacing the V1's mode of relying on external oracles. These on-chain data sources reduce manipulation risks and improve accuracy. In addition, Pendle V2 adds order book functionality, providing an alternative price discovery mechanism when the AMM price range exceeds.

For liquidity providers (LPs), Pendle V2 provides a stronger protection mechanism. The fund pool is now composed of highly relevant assets, and the AMM design minimizes impermanent losses, especially for LPs held to maturity – in V1, the LP’s earnings outcome is more difficult to predict due to the inexpensive mechanism.

Breakthrough of EVM boundaries: Enter Solana, Hyperliquid and TON

Pendle’s planned expansion to Solana, Hyperliquid and TON marks a key turning point in its 2025 roadmap. To date, Pendle has always been limited to the EVM ecosystem - even so, Pendle still accounts for more than 50% of the market share in the fixed income track.

However, multi-chainization of cryptocurrencies has become a trend. Through the Citadel strategy, Pendle will reach a new fund pool and user base.

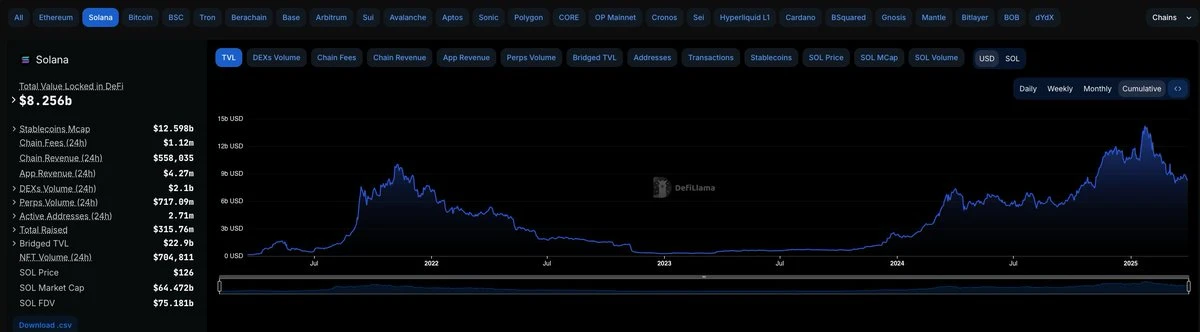

Solana has become a major hub for DeFi and trading activity – TVL hit a historical peak of $14 billion in January, with a strong retail base and a fast-growing LST market.

Hyperliquid relies on the vertically integrated perpetual contract infrastructure, while TON relies on Telegram native user funnel. The two major ecosystems are growing rapidly, but both lack mature revenue infrastructure. Pendle is expected to fill this gap.

If deployed successfully, these measures will significantly expand Pendle's reachable market volume. Capturing fixed income funding flows on non-EVM chains can lead to hundreds of millions of dollars in incremental TVL. More importantly, this move will consolidate Pendle's industry position not only as an Ethereum native protocol, but also as a DeFi fixed income infrastructure across major public chains.

Embrace traditional finance: Building a compliant income access system

Another key move in Pendle’s 2025 roadmap is the launch of a KYC compliant version of Citadel designed for institutional funding. The solution aims to connect on-chain earnings opportunities with traditional regulated capital markets by providing structured, compliant, encrypted native fixed income products access channels.

The program will work with agreements such as Ethena to manage the standalone SPV architecture by licensed investment managers. This setup eliminates key friction points such as custody, compliance and on-chain execution, allowing institutional investors to participate in Pendle earnings products through a familiar legal framework.

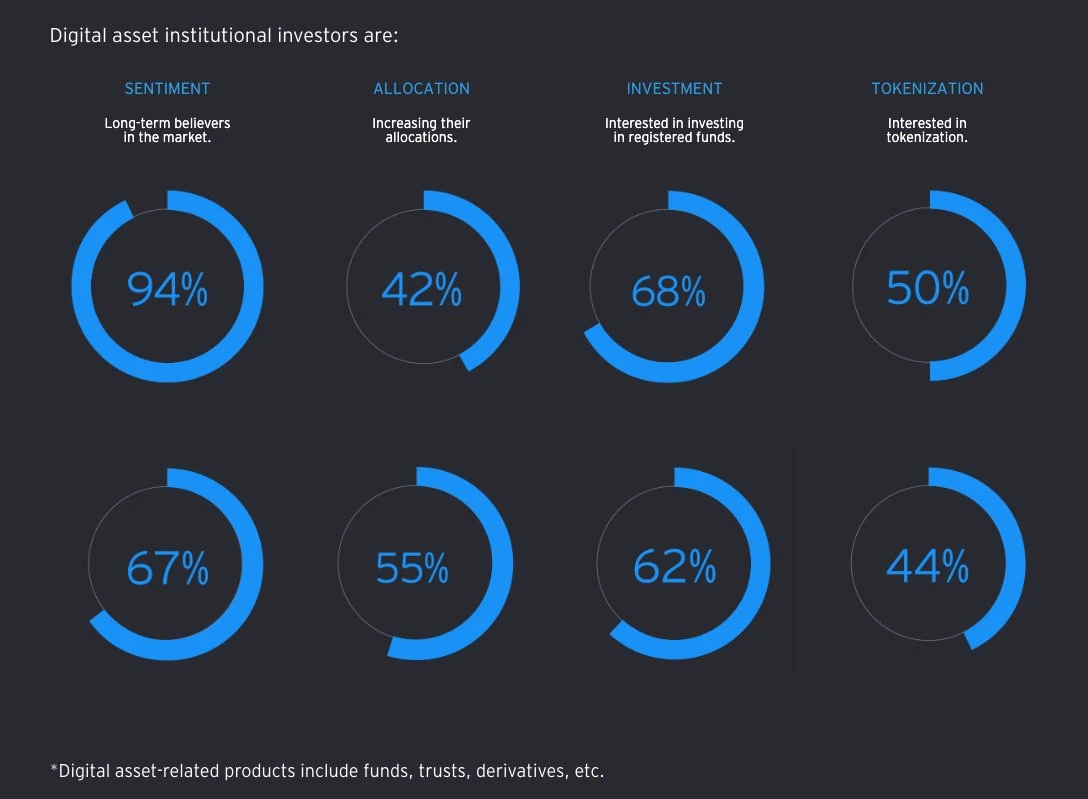

The global fixed income market size exceeds US$100 trillion, and even if institutional funds only allocate a very small proportion to the chain, it may bring in billions of dollars of capital inflows. Ernst & Young Paton's 2024 survey showed that 94% of institutional investors recognized the long-term value of digital assets, and more than half are increasing allocation.

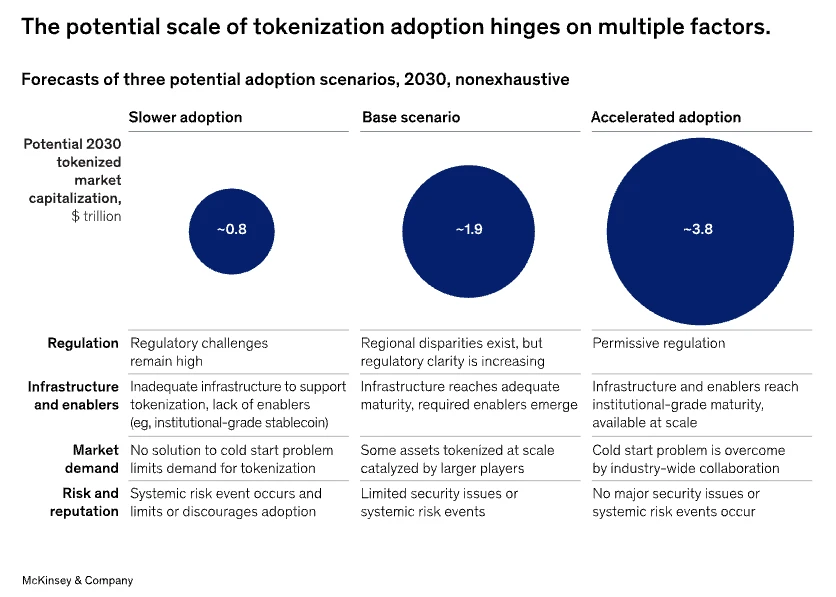

McKinsey predicts that the tokenized market size may reach US$2-4 trillion in the 2030s. Although Pendle is not a tokenized platform, it plays a key role in the ecosystem by providing pricing discovery, hedging and secondary trading functions for tokenized income products - whether it is tokenized treasury bonds or interest-generating stablecoins, Pendle can serve as the fixed income infrastructure layer of institutional-level strategies.

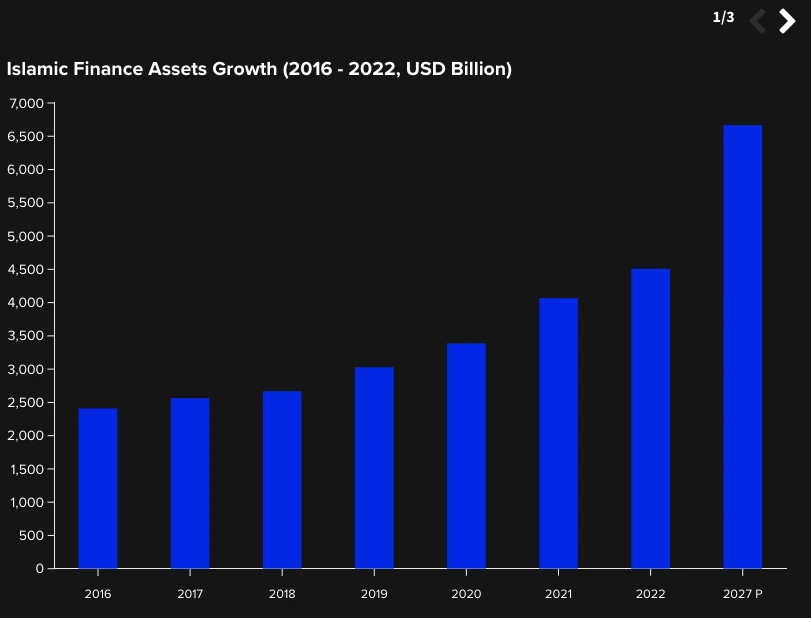

Islamic Finance: New Opportunities of $4.5 trillion

Pendle also plans to launch a Sharia law-compliant Citadel solution, serving a global Islamic financial market with a scale of US$4.5 trillion - the industry covers more than 80 countries and maintains an average annual compound growth rate of 10% over the past decade, especially in Southeast Asia, the Middle East and Africa.

Strict religious restrictions have long prevented Muslim investors from participating in DeFi, but Pendle's PT/YT architecture can flexibly design Sharia-compliant earnings products, which may be similar to Islamic bonds (Sukuk).

If successfully implemented, the Citadel will not only expand Pendle's geographical coverage, but will also verify DeFi's ability to adapt to a diversified financial system - thus consolidating Pendle's position as a global fixed income infrastructure in the on-chain market.

Entering the capital rate market

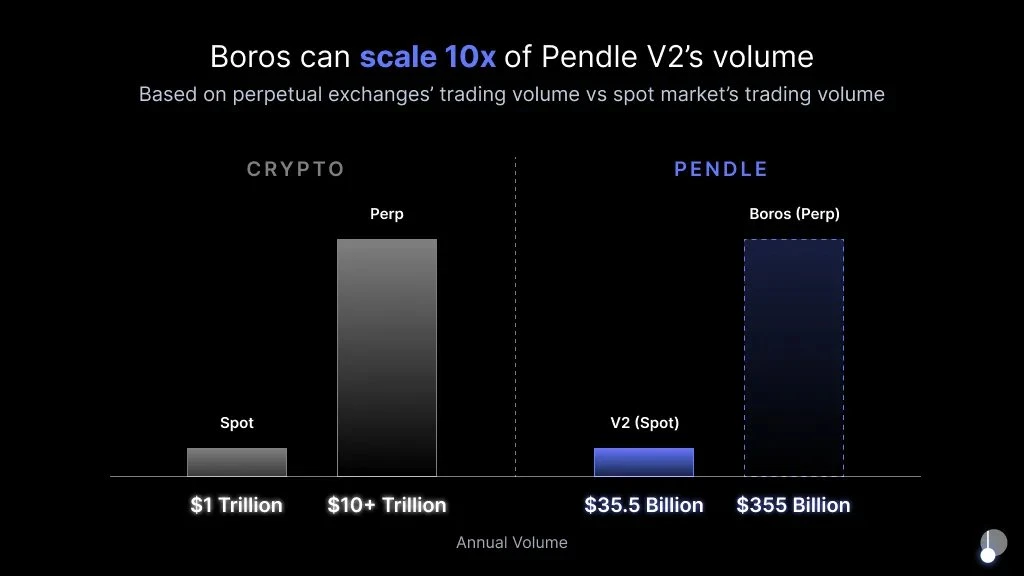

Boros, as one of the most important catalysts in the Pendle 2025 roadmap, aims to introduce fixed-rate transactions into the perpetual contract funding rate market. Although Pendle V2 has established its dominance in the spot income tokenization market, Boros plans to expand its business landscape to the largest and most volatile source of income in the crypto space - perpetual contract funding rates.

The current open contract market has exceeded US$150 billion, and the average daily trading volume reaches US$200 billion. This is a huge market but seriously insufficient hedging tools.

Boros plans to provide more stable returns for agreements like Ethena by achieving fixed funding rates – which is crucial for institutions that manage large-scale strategies.

For Pendle, this layout contains great value. Boros is not only expected to open up a new market with a scale of billions of dollars, but also achieves an upgrade in its protocol positioning - transforming from a DeFi income application to an on-chain interest rate trading platform, and its functional positioning is comparable to the interest rate trading stations of CME or JPMorgan Chase in traditional finance.

Boros also strengthens Pendle's long-term competitive advantage. Unlike chasing market hotspots, Pendle is laying the foundation for future earnings infrastructure: Whether it is capital rate arbitrage or spot holding strategies, it provides practical tools for traders and fund management departments.

Given the lack of scalable funding rate hedging solutions in both DeFi and CeFi fields, Pendle is expected to gain a significant first-mover advantage. If implemented successfully, Boros will significantly increase Pendle's market share, attract new user base, and consolidate its core position as a DeFi fixed income infrastructure.

Core team and strategic layout

Pendle Finance was founded by anonymous developers TN, GT, YK and Vu in mid-2020 and has received top institutions such as Bitscale Capital, Crypto.com Capital, Binance Labs and The Spartan Group.

Financing milestones:

- Private equity round (April 2021): Raise US$3.7 million, and the participating investors include HashKey Capital, Mechanism Capital, etc.;

- IDO (April 2021): Financing $11.83 million at USD 0.797/token price;

- Binance Launchpool (July 2023): Distribute 5.02 million PENDLEs (accounting for 1.94% of the total supply);

- Binance Labs Strategic Investment (August 2023): Accelerate ecological development and cross-chain expansion (amount not disclosed);

- Arbitrum Foundation Funding (October 2023): Received US$1.61 million for the construction of Arbitrum ecologically;

- The Spartan Group Strategic Investment (November 2023): Drives Long-term Growth and Institutional Adoption (Amount Not Disclosed).

The ecological cooperation matrix is as follows:

- Base (Coinbase L2): Deploy to the Base network, access native assets and expand fixed income infrastructure;

- Anzen (sUSDz): Launch the RWA stablecoin sUSDz to realize fixed income transactions linked to real-world returns;

- Ethena (USDe/sUSDe): Integrate high APY stablecoins, access to crypto-native returns and strengthen DeFi collaboration;

- Ether.fi (eBTC): launches the first BTC native income pool to break through the boundaries of ETH assets;

- Berachain (iBGT/iBERA): As the first batch of infrastructure to settle in, a fixed income framework is built through native LST.

Token Economic Model

PENDLE tokens are the core of the Pendle ecosystem, with governance functions and protocol interaction permissions. By splitting interest-bearing assets into principal tokens and income tokens, Pendle has created a new paradigm for income management—and PENDLE is the key tool to participate in and shape this ecosystem.

The key data are as follows (as of March 31, 2025):

- Price: $2.57

- Market value: US$410.6 million

- Fully Dilution Valuation (FDV): $725.2 million

- Circulation volume: 161.31 million pieces (accounting for 57.3% of the maximum supply)

- Maximum supply: 281, 527, 448 pieces

- Deflation mechanism: Since September 2024, PENDLE weekly emissions have decreased at a rate of 1.1% (initial weekly emissions are 216,076). After 29 weeks of adjustment, the current weekly emissions have dropped to about 156,783. The deflation program will continue until April 2026, after which the agreement will switch to an annualized inflation rate of 2% to maintain long-term incentives.

vePENDLE Governance Model

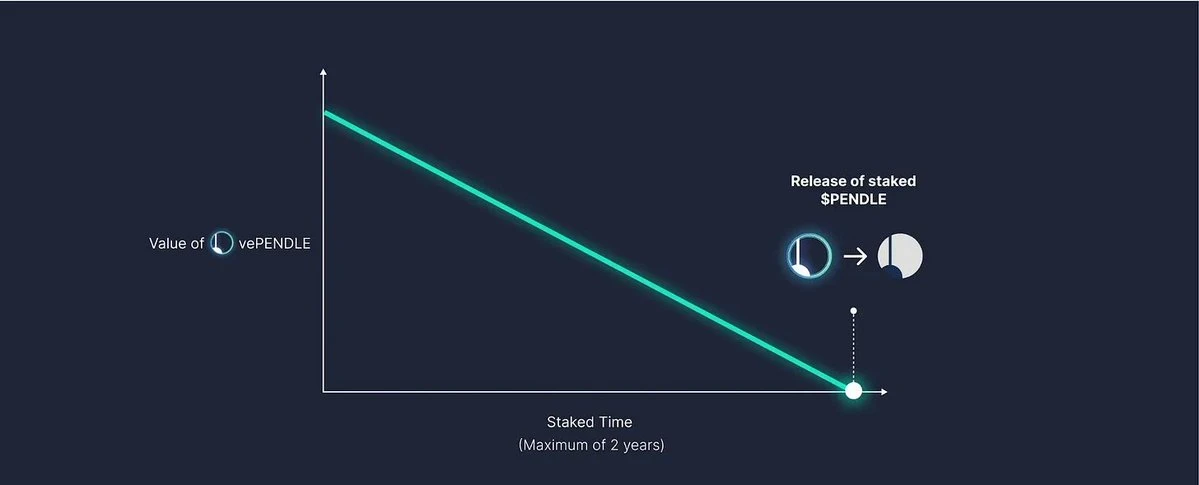

Pendle improves governance and decentralization through vePENDLE. Users can obtain vePENDLE by locking PENDLE. The longer the locking period (up to two years) and the more locking numbers, the more vePENDLE they will obtain. Over time, vePENDLE will decay linearly to zero, and the locked PENDLE will be unlocked.

This locking mechanism reduces circulation supply, helps price stability, and is aligned with long-term incentives for the ecosystem.

Benefits of vePENDLE holders include:

- Voting rights to participate in agreement decision-making

- Profit fee allocation

- Exclusive incentives and airdrops

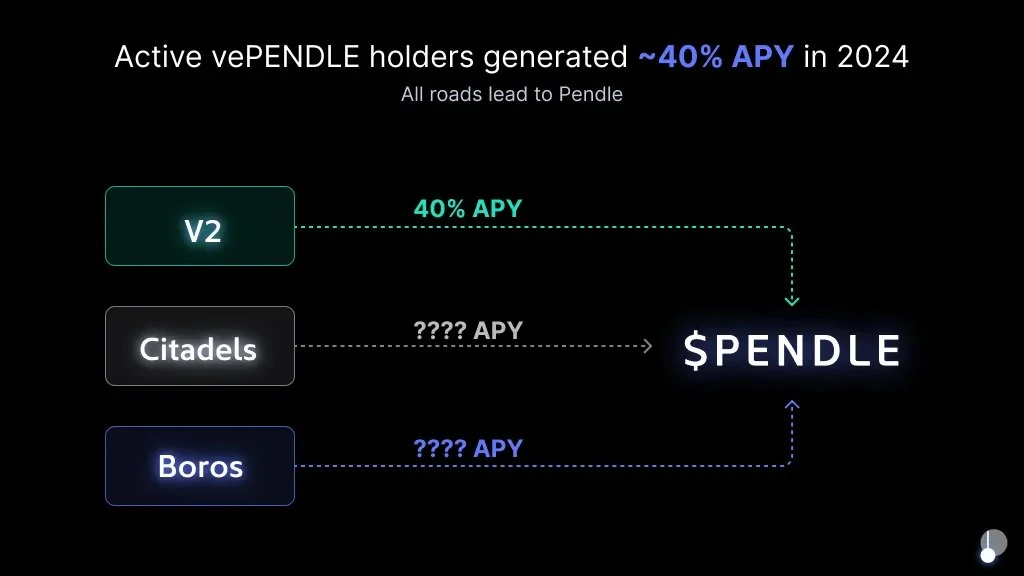

In 2024, active vePENDLE holders received an average of about 40% annualized yield (APY), which is not counted as the $6.1 million airdrop distributed separately in December.

Pendle's earnings flywheel

Pendle absorbs value through the following triple channels:

- Agreement fee: 3% of interest-bearing token income is injected into the treasury;

- Transaction fee: 0.35% is charged for each transaction (0.3% is to LP, 0.05% is to treasury);

- Earnings Sharing: YT Part of the income is distributed directly to vePENDLE holders;

With the advancement of V2, Citadel and Boros, more value will flow to vePENDLE holders, further consolidating their ecological core position.

Key risks and challenges

Although Pendle already has an advantage in the DeFi ecosystem, it still faces several risks. The complexity of the platform remains a barrier to its widespread adoption, especially for users who are not familiar with the earnings trading mechanism. To achieve a new round of growth, Pendle needs to continue to simplify user experience and reduce the learning curve for PT, YT and fixed income strategies.

Pendle's total locked value (TVL) is highly concentrated on USDe, which makes the protocol more dependent on a single asset and its capital dynamics. In bull market conditions, USDe provides attractive returns. But if the capital rate drops or the incentives turn to other areas, capital may flow out, which in turn affects Pendle's overall TVL and usage rate.

Other factors to consider include smart contract risk, oracle reliability, and market volatility in underlying assets. The low liquidity of some fund pools can also lead to slippage or reduced capital efficiency when users exit.

In addition, Pendle's recent growth is partially driven by airdrops and points incentives. As these plans gradually withdraw, the continued momentum will depend more on the core practicality of the agreement, diversified sources of income, and the continuous launch of products such as Boros and multi-chain Citadels.

Conclusion

Although market cycles often cause fluctuations in investor sentiment and attention, Pendle has always adhered to its long-term vision to continue to build. Pendle’s customizable fixed income strategy is at the forefront of DeFi innovation, which can help users effectively manage volatility, hedge risks and obtain stable returns - making Pendle a naturally bridge between traditional finance and on-chain market composability.

Looking ahead, Pendle’s 2025 roadmap paves a clear path for wider adoption and deeper liquidity. The key to subsequent development is the simplification of user experience and the ability to transcend short-term narratives.

With the growth of stablecoin market and the surge in tokenized assets, Pendle is expected to be the fixed income layer that drives the next wave of asset issuance, and its recent strong performance reflects market demand and market confidence. If the execution goes smoothly, Pendle may become the core pillar of the future of DeFi fixed income.

chaincatcher

chaincatcher