DeFi Income Competition: Pendle and the Rising Star Spectra

Reprinted from panewslab

04/01/2025·29DAuthor: Coinshift , Encryption KOL

Compiled by: Felix, PANews

The DeFi earnings market is growing rapidly – Pendle and Spectra are taking different approaches as key players in promoting growth in the field.

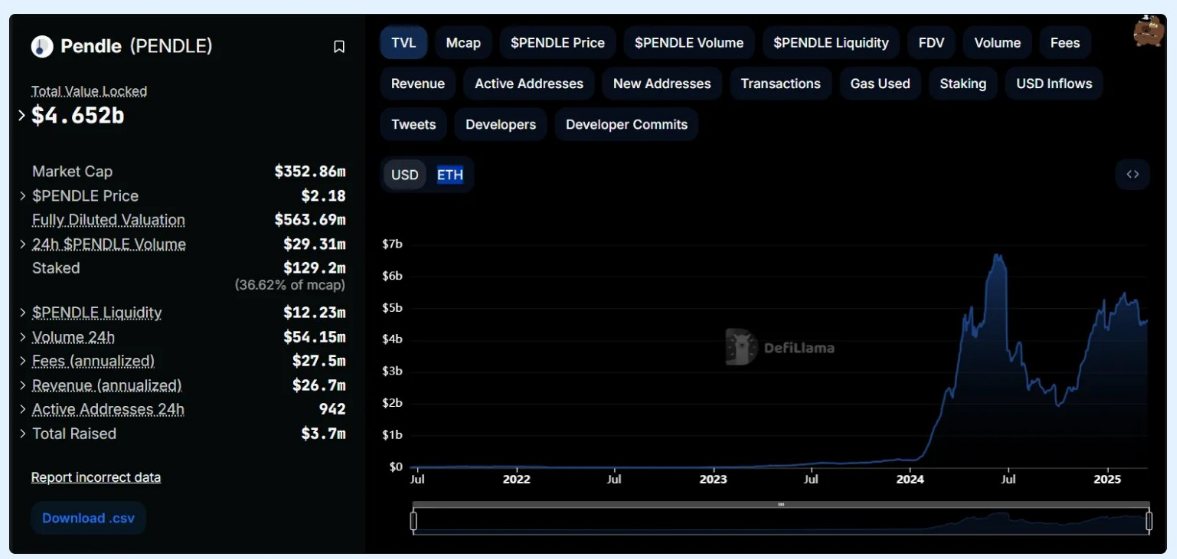

Pendle ushered in a breakthrough year in 2024. Thanks to integration with pledged/re-staking ETH derivatives (LST and LRT), active community and strong airdrop momentum. Pendle TVL rose from $20 million to $4.6 billion.

In June 2024, APWine was renamed Spectra, focusing on permissionless pool creation and integration with stable, real-life income assets such as csUSDL (Coinshift) and USR (Resolv). By the beginning of 2025, its TVL grew from $20 million to around $190 million. Although not as fast as the Pendle, it has a constant appeal in Base and other L2s. Spectra is also developing the MetaVaults feature aimed at improving capital efficiency in the earnings market.

This article aims to review the development history of the two protocols, interpret the differences between the two and the impact of their growth strategies on DeFi's future benefits.

Note: This article is for reference only and does not constitute financial advice. All data related to token price, market capitalization and protocol TVL are based on public sources such as DeFiLlama .

Spectra and Pendle : Development Trajectory

Pendle ' s Explosion: First-mover advantage

Pendle takes the lead in the field of earnings derivatives by converting future earnings into tradable assets. Its TVL soared to $5.2 billion by mid-2024 thanks to liquidity staking boom and early integration with pledged ETH derivatives such as Lido's wstETH and Renzo's ezETH.

The main drivers of Pendle's growth include:

- Early support for popular earnings tokens

- The vePENDLE model will be issued to a high demand pool, encouraging deep liquidity

- Bribery-driven governance system that inspires active participation and improves token utility

As TVL climbs, protocol revenue and user engagement are also increasing, thus forming a flywheel effect. Thanks to a narrative surrounding earnings innovation and increased expense accumulation, Pendle’s native tokens rose 20 times in 2024.

Pendle\'s TVL growth

Spectra ' s low-key restart and breakthrough moment

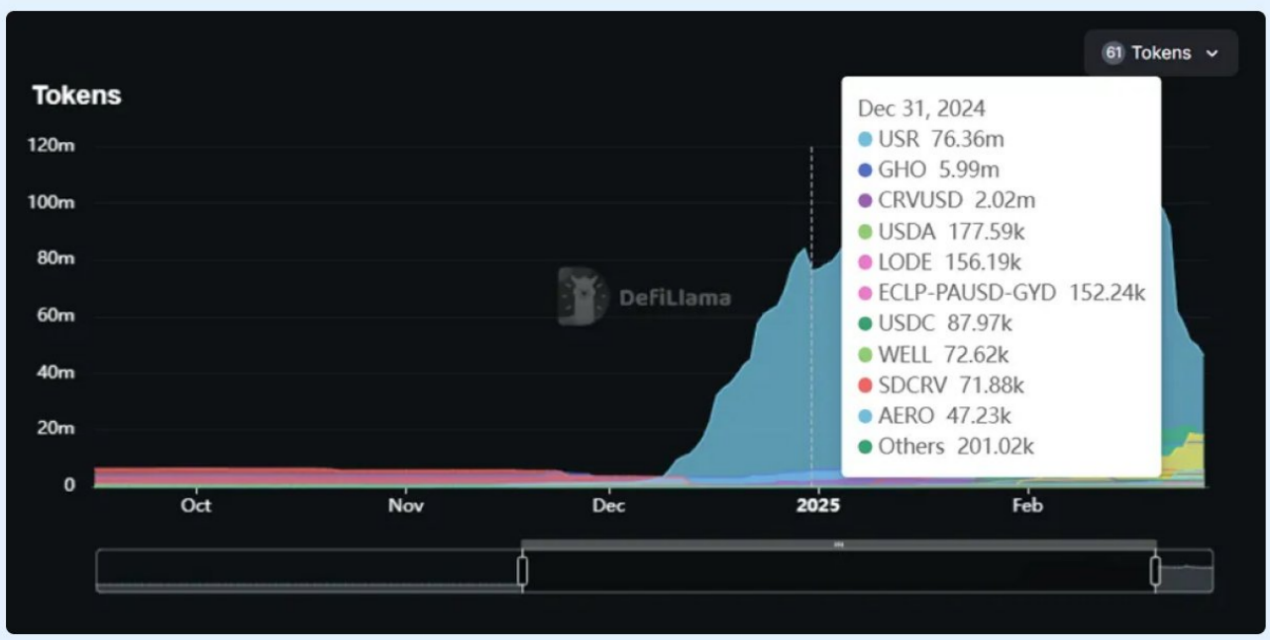

Spectra takes a different approach—strategic, phased launches, rather than high-profile launches. The initial adoption rate was not high after the planned earnings market was relaunched in June 2024. But that changed in December 2024, when Spectra’s TVL jumped from $20 million to over $190 million in just a few weeks.

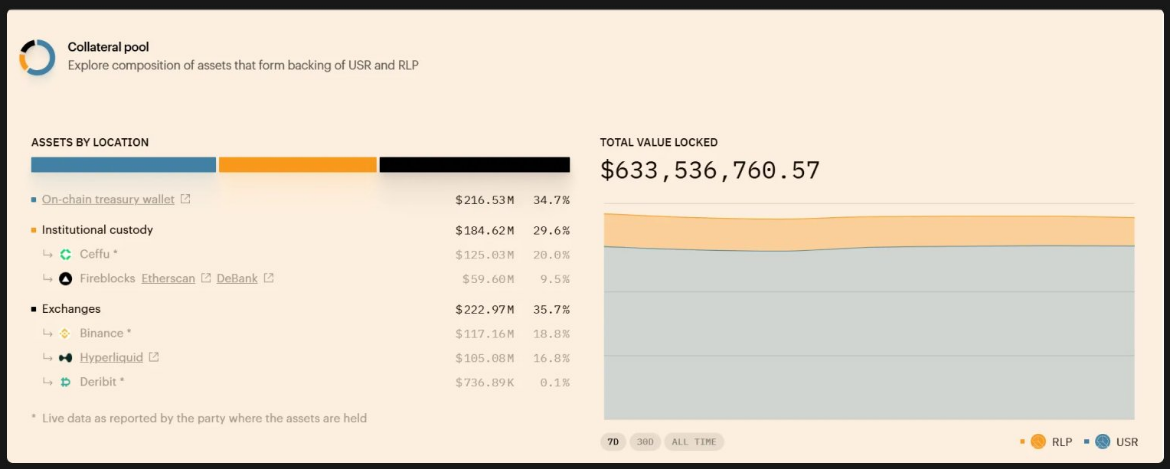

What is a catalyst? Resolv Labs' USR is rapidly rising, a stablecoin that has triggered a wave of demand for fixed income options.

Spectra quickly became the primary place for USR deployment, especially for users seeking predictable fixed interest rate returns. By the end of the year, USR accounted for more than 80% of Spectra TVL.

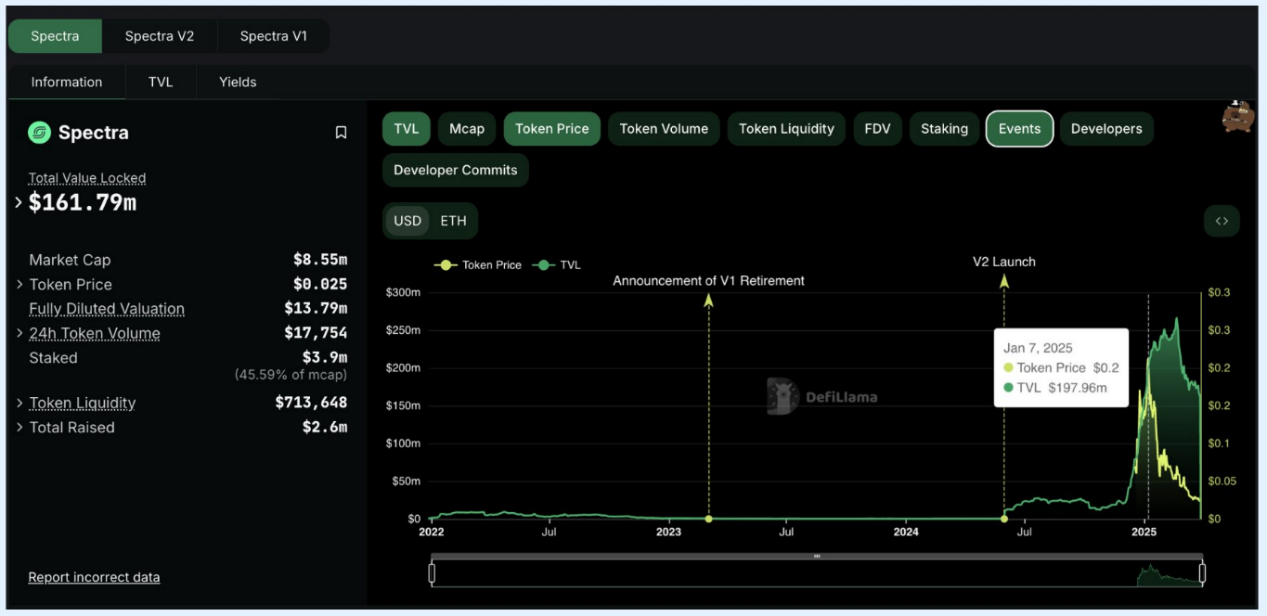

Spectra\'s TVL growth

USR and Spectra : DeFi flywheel

USR ushered in a breakthrough moment at the end of 2024, with TVL jumping from $36 million to nearly $400 million in less than a month. Spectra has become the preferred platform for users to lock in USR fixed income.

Several key factors start the flywheel:

- Spectra is one of the first platforms to provide fixed income for USR holders

- Incentive pools funded by SPECTRA issuance and Resolv income mechanisms quickly attract liquidity

- As liquidity flows in, more and more users are turning to USR-Spectra strategies, chasing competitive fixed income and potential airdrops

Resolv's TVL follows almost the same growth curve as Spectra. Income miners, in particular, were attracted by Spectra’s incentives and Resolv’s stablecoin returns.

Resolv Lab\'s TVL growth track

This forms a growth cycle of self-development. By December 2024, Spectra's TVL climbed from about $20-25 million to $143 million, and the USR pool just exceeded $300 million. Spectra provides one of the first platforms for users to deploy USRs at fixed income, so most of the new USR supply flows directly into their market.

The effect is obvious:

The increase in USR in circulation → The increase in demand for fixed income → More TVL inflows into Spectra → User confidence continues to increase → Repeat.

Spectra's Discord and social channels quickly followed the trend. Some even describe it as a "Pendle-like moment" as Spectra shows signs of catching up on TVL.

As more income assets are added, the composition of Spectra\'s fund pool has also changed.

Morpho Loop : Pendle ' s flywheel, Spectra **' s

opportunity**

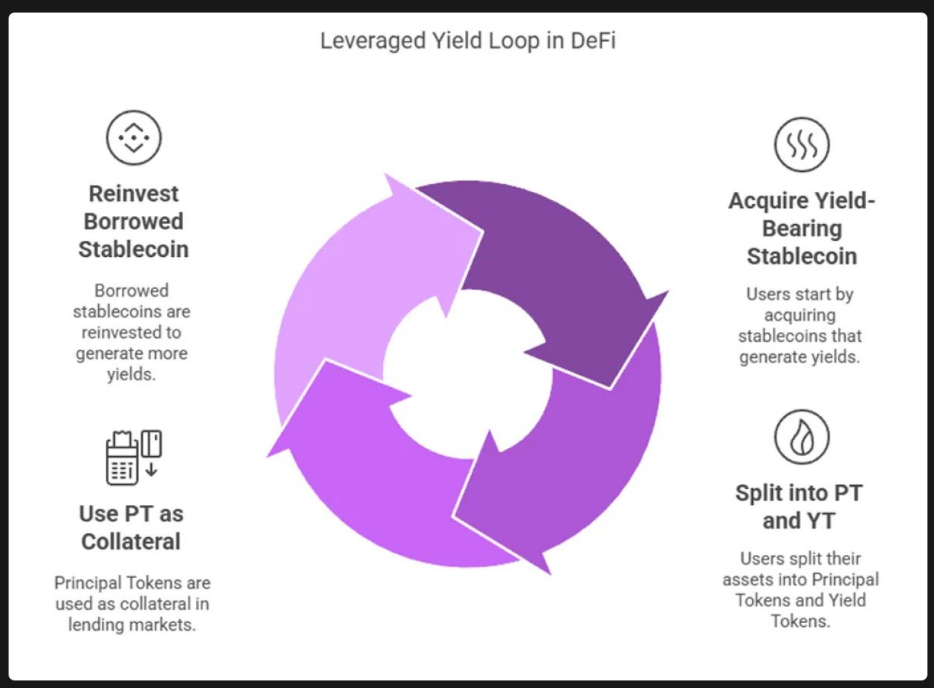

One of the strategies behind Pendle's recent stablecoin TVL growth is the leverage earnings cycle. This is a recursive strategy where users borrow and lend principal tokens (PTs) to expand their fixed income exposure.

This strategy is often called "Morpho Loop" or stablecoin arbitrage trading, reflecting the practical application of DeFi composability. Take PT-USR on Pendle as an example, here is how it works:

(i) Obtain profitable stablecoins

Users start with base stablecoins such as USDC or DAI and convert them into profitable tokens such as wstUSR.

(ii) Split into PT and YT on Spectra

The user deposits wstUSR into Pendle, generating PT (principal token) and YT (yield token).

Most strategies involve holding PT because its value is relatively stable and will accumulate to the full face value upon expiration. Users can sell YT to get instant benefits, or use it elsewhere.

(iii) Use PT as collateral on Morpho

The user takes PT (such as PT-wstUSR) and provides it to Morpho as collateral.

For example, the PT-wstUSR/USR market on Morpho allows users to borrow USR with their PT collateral.

(iv) Reinvest borrowed stablecoins

The borrowed USR is converted back to wstUSR, deposited again into Pendle to cast more PTs and YTs, and the process is repeated.

The result of Morpho loop is a leveraged fixed interest rate position:

Users end up holding more than the amount of PTs they allow for in their original capital, which means that upon maturity, they will receive more stablecoins.

Why is this important?

The PT-USR cycle is a classic example of DeFi composability—combining stablecoin issuers, earnings protocols, and lending markets into a self-reinforced flywheel.

The strategy looks like this:

Mint Stablecoins → Split into PT / YT → Use PT as collateral → Borrow → Repeat.

This stablecoin earnings strategy has become a key factor in Pendle TVL's growth as it allows users to expand their fixed income exposure while putting idle stablecoins into use.

What does this mean for Spectra ?

Currently, this loop exists on Pendle rather than on Spectra. However, Spectra is actively working with Morpho and Ecological Administrators to introduce the Spectra-PT market to Morpho. Once online, the same strategy could open a new round of growth for Spectra, especially given its in-depth focus on stablecoin native earnings markets and license-free mining pool creation.

In other words: Pendle's flywheel is running now. The version of Spectra is still loading – but if its mechanism is copied, the uplink space may be large.

Leveraged income cycle strategy is working

TVL growth and token price correlation

The case of Spectra and Pendle illustrates that protocol TVL growth is often associated with token price performance, especially when tokens acquire value through fees, issuance or governance.

Pendle

Pendle TVL's explosive growth in 2024 directly translates into strong token performance:

- TVL jumped from US$230 million to US$6.7 billion, with a significant increase in market share

- PENDLE rose from around USD 1 to a record high of USD 6.67, up nearly 590%

It's not just speculation. Pendle's vePENDLE model introduces cost sharing and governance weights, so more TVL means more protocol revenues – and more incentives to lock in PENDLE for voting rights and bribery.

At its peak, Pendle's TVL was $4.6 billion and its market capitalization was $644 million, with a TVL-to-market ratio of about 14%. This “undervalued” perception helps drive sustained buying. Finally, after reaching its peak in April, the token price fell from about $7 to the $2-4 range as some TVLs fell as the popularity of the hot earnings pools expired.

Still, the overall trend remains: As Pendle's TVL grows, so does the demand for tokens. Strong fundamentals (TVL, revenue and token utility) drive narratives and investor attention.

Even by early 2025, when Pendle's TVL fluctuated between $3.5 billion and $5 billion, the tokens remained within the range of a few dollars. This shows that the market is still pricing future upside space, not just current TVL.

Comparison of PENDLE token price with TVL

Spectra

Spectra’s token history is recent, but early data shows that there is a clear correlation between TVL growth and token price movements.

In December 2024 alone, TVL grew from $20 million to $143 million, mainly due to demand for USR integration and stablecoin earnings.

In early December, SPECTRA was issued at $0.07 and climbed to an all-time high of $0.23 in a few weeks, up about 310%.

After peaking in early January, SPECTRA prices began to decline, stabilizing around $0.04-0.05 by March, while TVL remained stable above $150 million. This suggests that the initial price surge may have exceeded the rate of usage and expense incurred, and the market will adjust expectations accordingly.

At a peak price of $0.236, Spectra has a circulating market capitalization of about $80 million, accounting for more than 50% of its $143 million TVL – the MC/TVL ratio is much higher than Pendle’s level in a similar growth phase. Once this imbalance becomes apparent, the premium disappears.

By March 2025, Spectra's TVL had a market value of $190 million and a market capitalization of $14 million, which is only about 7% of TVL - arguably undervalued compared to Pendle, which is at a similar point in the growth curve.

If Spectra continues to expand and activate governance mechanisms like veSPECTRA, token demand may arise. Assuming that fees are strong and continued adoption, it jumps to TVL above $1 billion and may reprice the tokens.

Comparison of SPECTRA token price with TVL

Can Spectra catch up with Pendle ?

Pendle has demonstrated a strong demand for tokenized returns, with billions of dollars in liquidity and a clear product market fit. Spectra is building on this – focusing on stablecoin native strategies, comboable lending integration through Morpho, and license-free designs to encourage wider participation.

As the income pattern continues to develop, Spectra's development path seems to be becoming more solid. If growth can be maintained, long-term token incentives are activated through veSPECTRA and continue to attract real users, it is very likely to be the next major player in the field.

Related Reading: Interest-eating stablecoins are booming, how to earn profits from them?

chaincatcher

chaincatcher