Devouring the World: The True Connection of Cryptocurrencies and the World

Reprinted from panewslab

03/03/2025·2M

With David Sacks pushing, the White House crypto conference is on the string.

However, Dongda University's crypto industry is not happy, believing that Trump simply regards the currency circle as an ATM, which will continue to absorb internal liquidity and lead to further price declines. Against this background, voices of calling for the crypto industry to be independent and reject external users on the surface, but actually calling for staying away from the political vortex one after another.

There is no doubt that cryptocurrencies are already part of the real world;

It is impossible to avoid, the economic returns and purity of blockchain have declined.

Judging from the current situation of cryptocurrencies, PVP is an absolute no return, and innovations such as DeFi and NFT in the 2021 cycle are unavailable. If you do not participate in PVP, Trump and ETF will pump, and Pump Fun and Four Meme will also take away the USDT in your hand. Then just PVP together, and it seems that you can be happy for a while.

Of course, I'm talking about the crypto field.

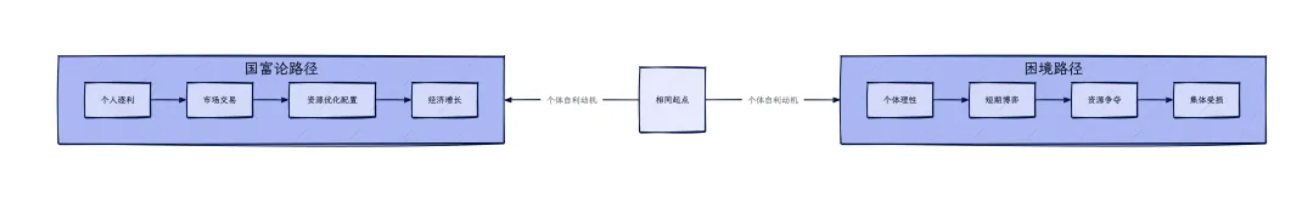

Regarding this matter, Western great scholars have long recorded the dilemma of prisoners through the theory of wealth of the country and the dilemma of prisoners:

Starting from the motivation for personal self-interest, the paths of both parties are:

- Wealth of the People: Personal Profit-> Market Trading-> Resource Optimization-> Economic Growth

- Game Theory: Individual Rationality -> Short-term Game -> Resource Competition -> Collection

Translated, all the problems now are that the crypto industry does not produce and retain products of value, which eventually becomes U-based, and no one is willing to hold all kinds of cryptocurrencies.

In fact, Trump's FOMO and FUD targeting cryptocurrencies were both emotionally cleared, from $TRUMP to metaverse and NFT, which obviously exceeded Trump's personal trading ability. Otherwise, while confronting Zelensky, the layout of the crypto career would be too abstract.

The only question is who the matchmaker is, they replaced the K Street lobbyist, proving that the lobbying power of the crypto industry can already match the traditional military-industrial complex.

Nothing is real; Bitcoin is value.

At the critical moment of the industry, when looking back at the process of Bitcoin, you will find that Bitcoin is not an exclusive private product, but a gift for all mankind. It is precisely because of its extreme inclusiveness that it has finally evolved from money laundering tools and toys for geek groups to become synonyms of value for global competition.

If you believe in compound interest in time, you will get rewards in life.

Looking inside and outside the snow line, encryption continues to evolve

High temperature corresponds to disorganized, and low temperature corresponds to high tissue degree.

The temperature of the encryption market is very high now, and the corresponding disorderly entropy value is also extra high. After the Hong Kong Consensus Conference, the short composition that has been popular for several years disappeared together with Meme, which means that people in the circle cannot find a consensus, and only KOL Agents are left looking at each other and treating each other as offline.

The subculture of the crypto market is forming, and the group consciousness of our crypto world is surging undercurrents. He Yi's boss direct recruitment maps the self-organization of the industry, and the outside world is silent about this. The accumulation of power always represents the accumulation of energy before leaving the circle.

In this cycle, BTC/ETH/SOL has weak continuity. BTC with 100,000 yuan has become a goalkeeper with ETH sleepwalking throughout the game. At the beginning, SOL is the most normal thing, and it is nothing more than Coin Group replacing FTX and Jump Cabal.

The real future is obviously not about the competition between public chains and L2, but about the swallowing of cash by stablecoins. The only question is to what extent can the stablecoin + SOL/Tron/EVM public chain replace small systems in various countries.

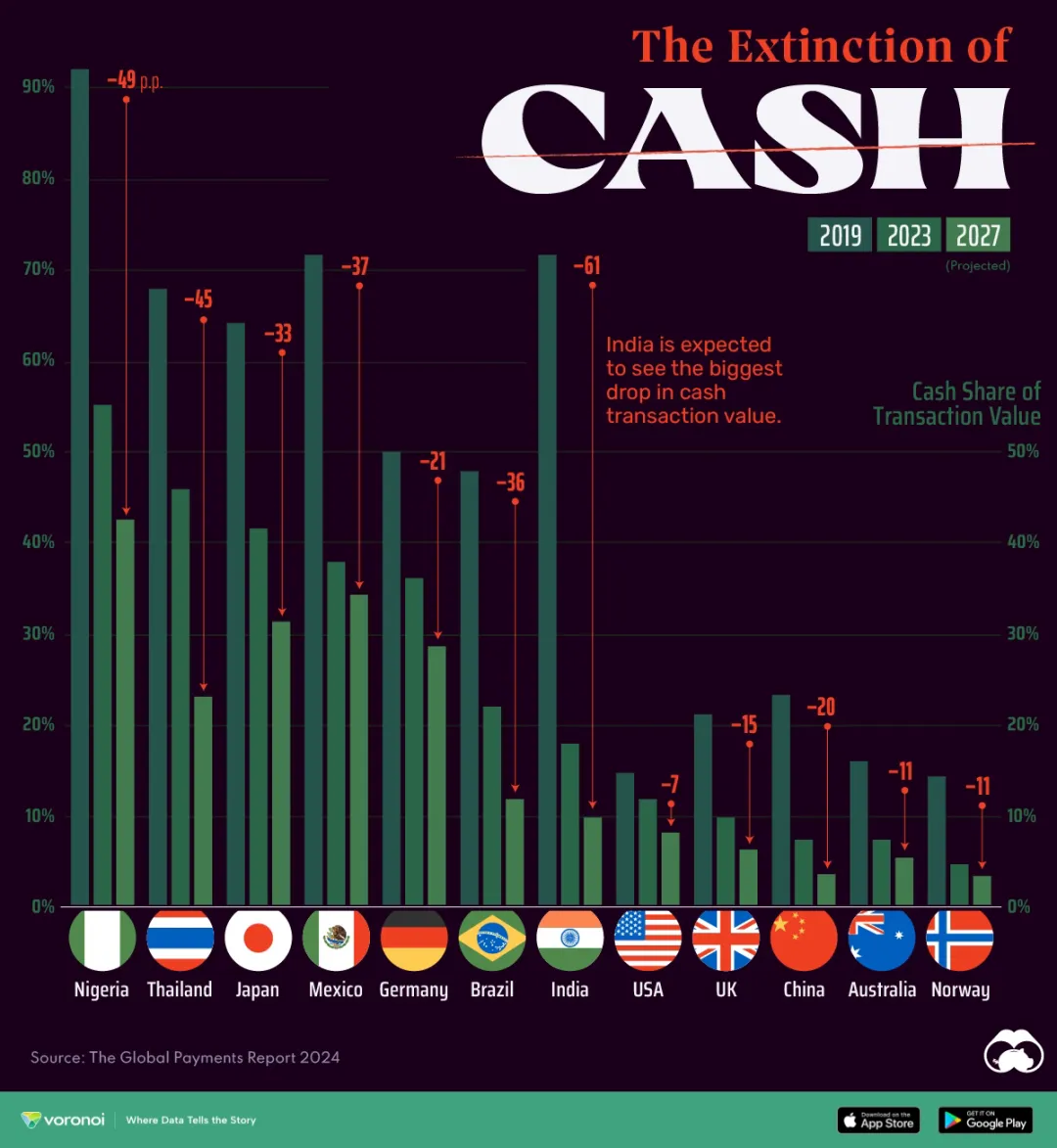

Image description: Predictions on the demise of cash in various countries

Image source: Voronoi

China's cash has disappeared, but WeChat and Alipay are the mainstream players. No U cards such as Infini cannot obtain the qualification for issuance in China and must be subject to personal foreign exchange control limits. Even if products such as HyperCard are borrowed from Laos to launch UnionPay U card services, they still cannot be regarded as equivalent to domestic banking products.

Popular countries such as India, Brazil and Nigeria are indeed rapidly cash-free, but it is not that stablecoins occupy the market. This part of the market is quickly divided by local central banks, banks and Fin-Tech companies, leaving only the leftovers for stablecoins.

At its core, stablecoins involve national sovereignty, and today's stablecoins are essentially variants of the US dollar and are external forms of US debt. Any country with certain pursuits will resist the US dollar stablecoins unless they are small countries such as El Salvador and Cambodia that are actually or legally dollar-based.

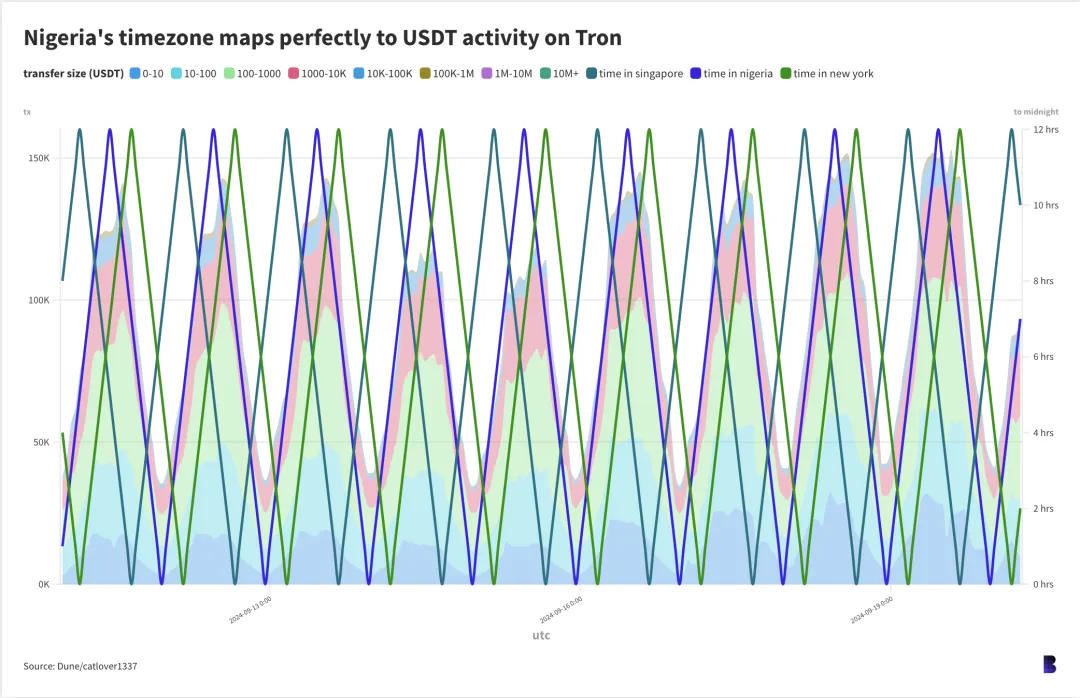

Image description: Nigeria『s timezone maps perfectly to USDT activity on Tron

Image source: Dune/catlover1337

In other words, the market for stablecoins is divided into three types. The first is China, the United States, India and Brazil. Stablecoins are just a marginal financial product. The second is a small dollar-based country. Stablecoins are more convenient than the US dollar, but the market has not yet been fully opened, and Visa/MasterCard's channel curve is still needed to enter the market. The third clock is that in middle-class countries such as Nigeria and Turkey, the currency system is chaotic, the inflation is high, but it has certain national capabilities, resulting in stablecoins having a large application market and real demand, but they cannot be completely mainstreamed and compliant.

Just as Trump targets positive and negative emotions at the same time, the biggest benefit of stablecoins is stability. Compared with cryptocurrencies that need to prove their value through currency prices, the demand for stablecoins has taken root.

Just as Paypal and others completed the surprise attack on the card organization at the beginning of the century by first attracting customers without any threshold, defending the established market, and then complying with regulations, cryptocurrencies are also going through this process.

Moreover, BTC and ETH have completed the initialization stage of user education. BTC has proved the feasibility of network effects from nothing to something. ETH has amplified the network effects to millions of real users. TRC-20 USDT stablecoin does have daily real users around the world.

Inevitably, before the encryption field was used by hundreds of millions of people around the world, it was meaningless to just shout Mass Adaption, otherwise there would be no COM bubble at the beginning of the century. Please believe me, the speculative nature of Web2 was not weaker than it is now, and it was not until Google established an advertising system that it found realistic logical support for the value of the entire industry.

Escape single point concepts and embrace group intelligence

The reason why we have made a lot of argument for stablecoins is that the current public chain and DeFi have developed to a bottleneck period. After the upgrade of Solana's Firedancer is completed, Solana 2.0 and ETH 2.0 are the two fastest and most stable chains, which are enough to meet any needs of most users and developers.

Only stablecoins can extend the network effect of cryptocurrencies to the extreme. Blockchain does not actually need to discuss how to achieve externality. As long as there are enough people, a group application paradigm will naturally be born. From ant colony, bee colony to human tribes and urban civilizations, it is proving the reality of group intelligence.

Of course, there is a paradox here. We cannot explore the possibilities of mainstreaming all stablecoins, but if you don’t explore them, you cannot know which possibilities are worth exploring. At present, it can actually be reduced to a battle between pure on-chain adoption and off-chain real scenarios.

This question cannot be discussed and answered, but there is one thing that is very effective: only by treating the product as a service can the best results be achieved. Taking Deepseek as an example, the most accurate comment I have seen is: "Deepseek is a feature, not a product."

I give a version of blockchain. We don’t need to pay attention to the dynamics and technological progress of public chains, Uniswap, Binance. We are concerned about their connection with everyone in the world. Why Binance has achieved such a huge commercial success is because it really has more than 100 million crypto users. They may not be on-chain users, but their existence makes Binance’s network effect extremely close to traditional Internet companies.

The only problem is that we need to find feasible promotion and application scenarios for stablecoins in practice while not knowing how to expand them.

For example, in the regulatory cracks, stablecoins need to complete their original accumulation with anti-fragility, take advantage of the disorder in the gray area, deconstruct the order and arrogance of traditional finance, and undercurrents always find penetration paths outside the high-voltage barrier. Compliance is not a priority breakthrough and a gimmick to show off.

To reconstruct the payment ecology in the sunny area, we need to face the iron wall of vested interests. Technical efficiency is just an entry ticket. What is really a competition is patience in institutional games. When the supervision cost itself has become a moat, subversives either wait for the metabolic cracks of the old order, or use capillary penetration in the marginal areas to disguise the revolution as improvement, just like Paypal to card organizations, now it is a stablecoin to banks.

Stablecoins are standing at this intersection. The success of black industry is precisely its original sin, and the price of whitewashing may be to bow to Trump's rules to the west.

In every era of thought, there will be a certain style of thinking that tends to become the common standard of cultural life, and cryptocurrency, technology, and way of thinking will definitely become the iconic characteristics of this era.

May we find Strawberry Fields of this era in the world of cryptocurrencies.

chaincatcher

chaincatcher

jinse

jinse