Puffer Finance: How Does Based Rollups Help Ethereum Integration?

Reprinted from panewslab

12/19/2024·6M

Author: Roland Roventa

Trump’s victory has set off a wave of DeFi renaissance, making Ethereum (accounting for 63% of the total global DeFi lock-in volume) expected to leverage this momentum to achieve a breakthrough. Since the results of the U.S. presidential election were announced, the Ethereum ecosystem has continued to exceed expectations.

However, Ethereum’s rollup-based scaling route, although crucial to scaling, faces a significant challenge: fragmentation. The current rollup ecosystem is in a winner-take-all state, resulting in liquidity, user attention, and user groups being scattered across isolated L2 chains. To fully exploit the potential of DeFi's resurgence, Ethereum must address these fragmentation dynamics. Ethereum needs to resolve its current fragmentation issues and build a more unified and open network.

**Bridging the Gap: Solving Ethereum’s Fragmentation and Liquidity

Challenges**

Puffer Finance’s innovative solution – UniFi, directly faces Ethereum’s fragmentation challenge. We believe that once the market realizes that Puffer is not just another liquid heavily collateralized token (LRT), but an innovative infrastructure solution, it will outperform expectations.

Puffer’s past : Puffer started out as a leading LRT protocol focused on providing decentralized staking solutions.

Puffer now : Puffer has now evolved into a unified Ethereum-centric solution. Puffer has evolved from the first native liquid-heavy staking protocol to a comprehensive Ethereum integrated extension ecosystem, consisting of the following three core components:

1. Decentralized Liquid Re-Pledge Protocol (LRT)

Puffer's flagship product is slash-proof, provides high returns and security, and supports decentralized heavy staking in the Ethereum ecosystem.

2. UniFi Based Rollup Stack

An L2 based serialization solution that enables seamless interaction between L2<>L2 and L2<>L1, and supports atomic composability of efficient cross-chain operations.

3. UniFi Pre-Confirmed AVS

The industry's first pre-confirmed AVS provides near-instant transaction finality for L1 and L2 transactions, significantly improving the speed and reliability of the Ethereum network.

With UniFi’s rollup-based stack, Puffer Finance transforms Ethereum’s fragmentation into a positive-sum ecosystem.

Puffer UniFi Based Roll-up Stack – What is it? How does it work?

What are based roll-ups?

Based rollups is an advanced scaling method that integrates directly with Ethereum's shared orderer without relying on other centralized orderers commonly used by L2 (such as optimistic or zero-knowledge proof L2). The core idea was first proposed by Justin Drake in a research article in March 2023:

"Based rollup, or L1 sorted rollup, means that its sorting is driven by the underlying L1. Specifically, based rollup means that the next L1 proposer can cooperate with the L1 searcher and builder to move the next L1 proposer without permission. The rollup block is included in the next L1 block." -Justin Drake.

To those with a non-technical background, the above description may appear complex. Simply put, transactions are verified directly on L1 based on the aggregation of the main chain, giving full play to the efficiency of Ethereum's existing mechanism. In contrast, other common aggregation schemes (such as optimistic & ZK) usually verify transactions in L2 before submitting them to L1.

Through based sorting (using Ethereum L1 validators for sorting), the following advantages can be obtained:

● Inherit the activity and decentralization characteristics of the Ethereum network: ensuring reliability and not being affected by single points of failure.

● Simplified infrastructure: No need to run a separate sequencer.

● Faster execution speed: faster transaction finalization through pre-confirmation (more on this later).

● Aligned with L1’s economic interests: Creates new revenue opportunities for existing validators through non-intrusive MEV (Maximum Extractable Value).

● Reduce operating costs: because transaction sequencing is responsible for L1.

Based Rollups > Optimistic Rollups

tl'dr:

characteristic

|

Based Rollups

|

Optimistic Rollups

---|---|---

sorting mechanism

|

Managed by Ethereum’s decentralized L1 validators

|

centralized sorter

Confirmation time

|

There is a pre-confirmation mechanism, almost instant confirmation (within 100 milliseconds)

|

Longer due to fraud proof delays

security model

|

Inherit the security and decentralization of Ethereum L1

|

Assumed validity; relies on proof of fraud

Interoperability

|

Synchronous composability across L1 and Rollup

|

Limited, usually asynchronous due to validation

composability

|

Liquidity unification between L1 and Rollup

|

Liquidity dispersion among rollups

user experience

|

Seamless experience, speed up with pre-confirmation

|

Slower, affected by fraud proof verification

By optimizing the underlying transaction sorting process, costs can be reduced and speed increased, while retaining the inherent security and decentralization features of the Ethereum network.

Puffer is Based

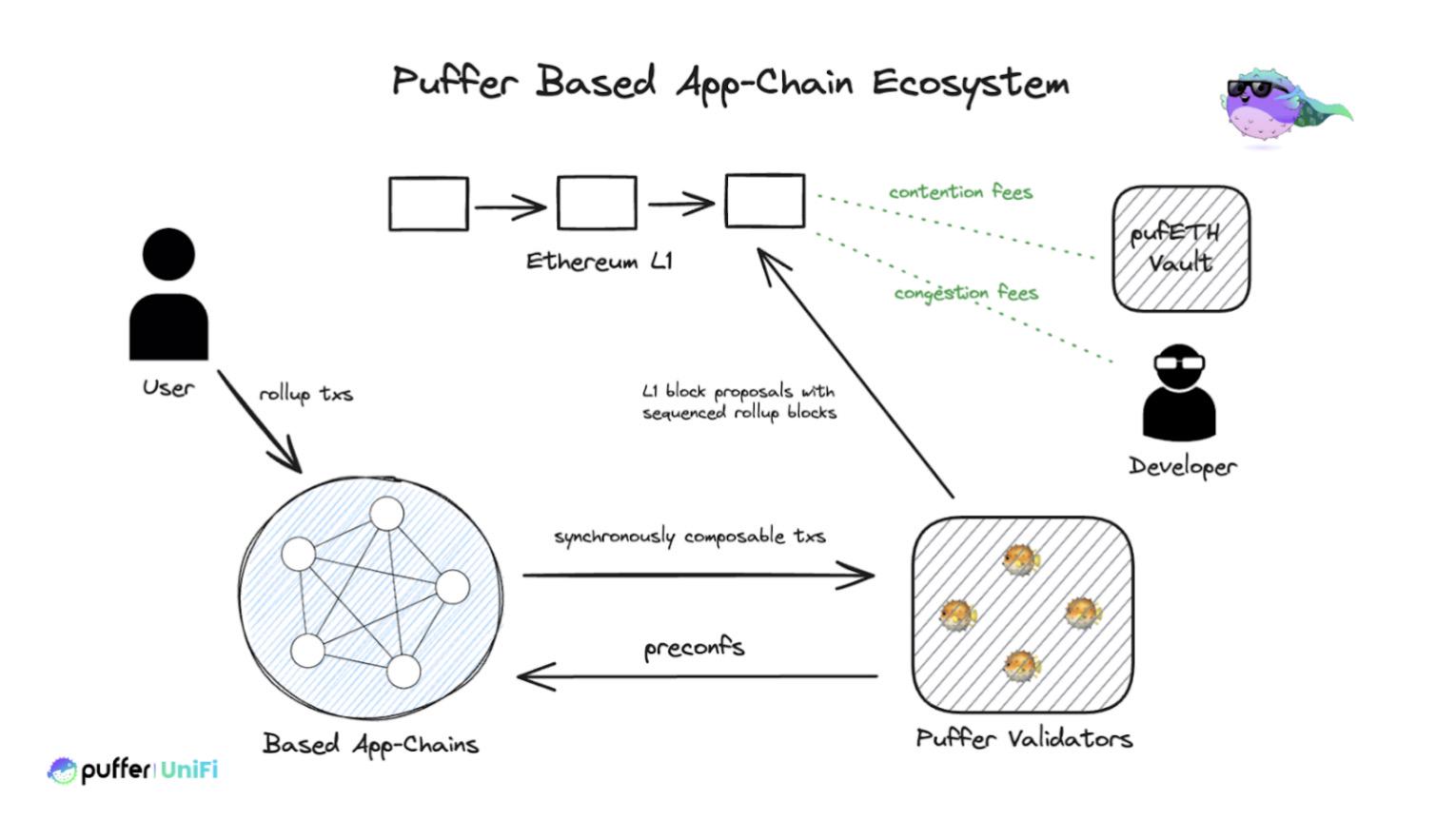

Puffer UniFi is a rollup based on Ethereum, which realizes the creation of application chains through its technology stack.

It solves the problem of Ethereum liquidity fragmentation by enabling synchronized composability. Transactions on UniFi can interact directly with other based rollups without the need for bridges, thus creating a unified liquidity and application layer. Developers can easily launch their own application chains, capture transaction fees and take advantage of shared liquidity.

UniFi’s goal is to bring atomic composability to the Ethereum chain – redefining the possibilities for on-chain interaction. Through atomic composability, UniFi will allow Layer 1 and Layer 2 to achieve smooth, integrated interactions within a single Ethereum block. For example, a user or protocol can deposit assets from L1 to UniFi, perform complex operations (such as exchanges or liquidity mining), and then withdraw the assets back to L1 within the same 12-second Ethereum block. Not only is this fast, it’s a breakthrough in blockchain interoperability.

Puffer does not compete with L1, but collaborates with L1 to extend its functionality in an integrated manner.

How does it work?

Inspired by collaborative research with Justin Drake, Puffer UniFi uses Trusted Execution Environments (TEEs) in its processing stack. In order to achieve real-time proof, Puffer plans to use TEEs as a temporary auxiliary tool. The implementation of real-time proofs can significantly improve interoperability. Once zero-knowledge proof (ZK proof) technology reaches sufficient speed, provers will be able to shift from relying on trusted hardware to a scheme based entirely on zero-knowledge.

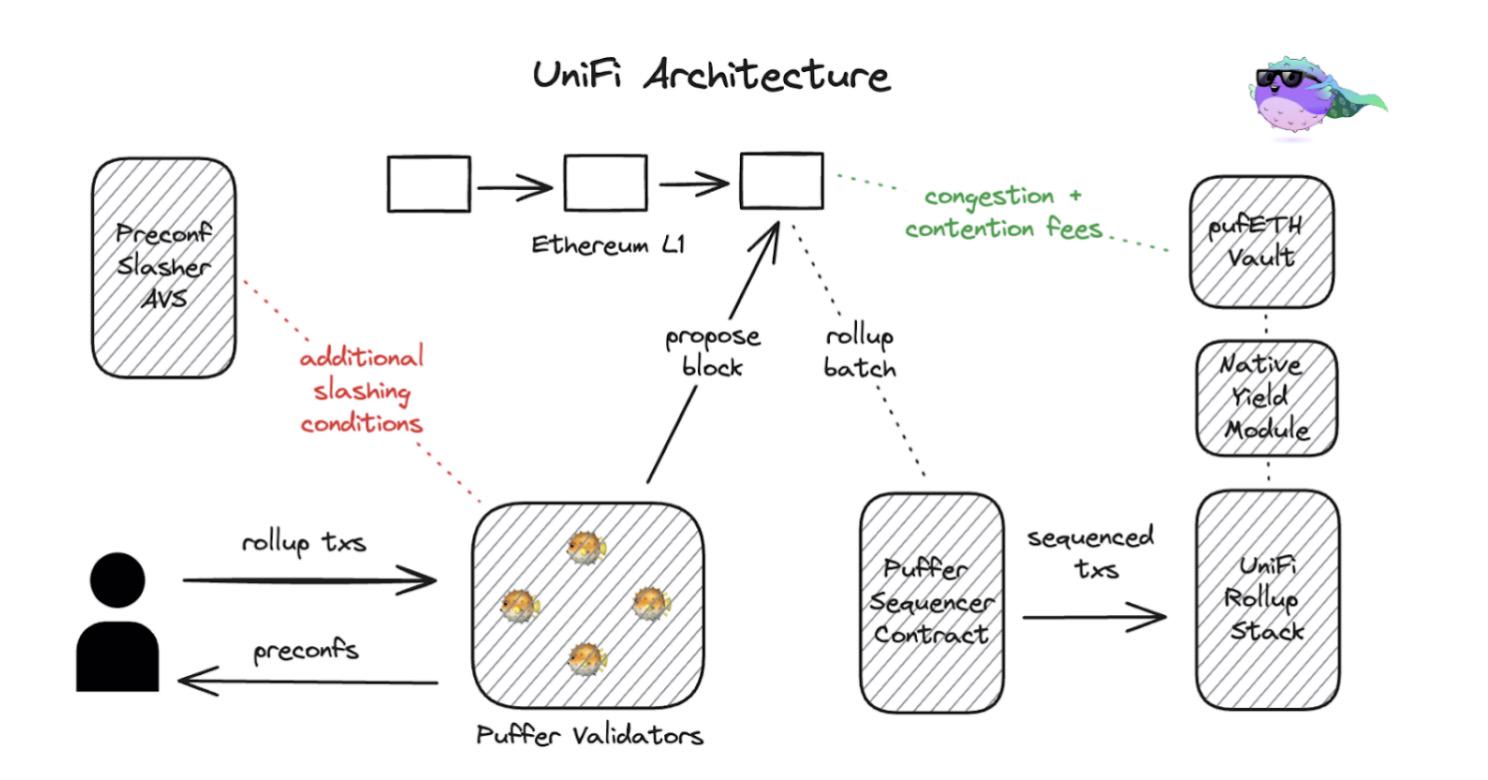

Architecture analysis of Puffer UniFi

Architecture Overview - Puffer's UniFi Pre-Confirmation AVS provides users with L2 execution confirmation services. Users can experience sub-second transaction speeds when interacting through UniFi. In UniFi Universal Rollup, native revenue tokens can be used as gas tokens.

The consensus layer, data availability layer and settlement layer are all handled by the base layer (Layer 1, i.e. Ethereum). Rollup, on the other hand, focuses on execution layer functions.

This is the unique feature of the Puffer app-chain.

Why is this important?

Puffer is using based rollups to build its own application chain (app-chain) to achieve seamless integration of the EVM protocol. This gives everyone in the ecosystem the opportunity to participate and benefit from a faster, more efficient and more decentralized Ethereum, whether individual validators or large dApps. Ethereum has been fragmented for too long, and it’s time to change that.

Ecosystem overview

Growth will occur in phases:

Phase 1: Puffer will introduce based rollups to users and developers. For protocols that are not ready to run their own application chains, they can be deployed directly on UniFi.

Phase 2: UniFi will launch an SDK to enable any dApp developer to quickly build and deploy their own application chain in a simplified way.

UniFi Pre-Confirmed AVS

UniFi provides near-instant execution confirmation through preconf technology. This is not just a speed increase, but a new scalability solution for Ethereum. Pre-confirmation technology solves Ethereum’s fragmentation problem while providing extremely fast transaction confirmations.

How to achieve? Since Ethereum’s 12-second block time limits the finality of fast transactions, preconfs have become critical to improving user experience. To solve this problem, Puffer has developed a proprietary pre-confirmation AVS technology that provides near-instant (approximately 100 milliseconds) transaction confirmation guarantees that transactions will be included in the next block. This innovation greatly improves the speed and reliability of the rollup-based ecosystem.

If it works?

Preconfs are divided into two types: Execution and Inclusion . Both can be used to provide users with faster transaction confirmations on L1 or L2: the advantage of execution pre-confirmation is to provide users with a final and guaranteed commitment, including status confirmation after transaction execution. For example, it can confirm the price at which trades are executed, significantly improving the user experience.

Implementing L1 execution pre-validation is challenging; however, L2 execution pre-validation effectively solves this problem. Puffer UniFi AVS leverages this capability to provide a more optimized user experience.

Pre-confirmation guarantee mechanism: Pre-confirmation represents the promise of the proposer (verifier or authorized proposer) to the user. Failure to fulfill this commitment should result in penalties such as slashing. Re-staking protocols like EigenLayer play an important role in providing slash guarantees for pre-confirmations. Notably, Puffer UniFi pre-confirms AVS as the first service of its kind to run on EigenLayer.

Puffer UniFi: The Catalyst for Ethereum’s Next Chapter – Unification

UniFi’s synchronized composability is a game-changing innovation. Interactions across Rollup are like operating on a unified chain without the need for L2 bridges (no one likes cross-chain bridges), thus reducing costs and mitigating security risks associated with asset transfers. UniFi's approach unifies liquidity and enables developers and users to interact seamlessly between chains, improving Ethereum's liquidity and user experience like never before.

What it means for developers: UniFi provides developers with a unique opportunity to scale applications in a unified and low-friction environment. By eliminating the centralized sequencer, UniFi significantly reduces operating costs, allowing developers to focus on the product itself without worrying about the complexity of application isolation L2. In addition, UniFi's architecture makes the deployment of based rollup almost as simple as deploying smart contracts, greatly lowering the entry barrier for developers and encouraging innovation.

**Revenue Gain: How Puffer’s Based Rollups and Pre-Confirmations Drive

Value in the Ethereum Ecosystem**

All revenue sources will be converted into earnings for the treasury, which will be governed through the $PUFFER token.

Puffer's upgraded revenue model (note, not just an LRT) fully leverages based rollups and pre-confirmation technology to create sustainable value within the Ethereum ecosystem. Through based rollups, Puffer generates ordering fees thanks to a mechanism that allows Ethereum validators to manage transaction ordering. UniFi not only supports seamless interoperability between Ethereum L1 and L2, but also interoperability between L2, thereby achieving the unification of liquidity and composability. By integrating ordering fees into the Ethereum validator network, Puffer captures transaction-based revenue while reinforcing the value of Ethereum’s native economy.

Users can also pay preconfirmation tips to prioritize their transactions. This provides Puffer with an additional revenue stream that diversifies along with transaction inclusion fees. These fees and tips will be reinjected into Puffer's ecosystem, further enriching the value of its native tokens pufETH and unifiETH, while providing additional benefits to token holders.

As Puffer core contributor Amir explains:

“If every user pays a premium for these pre-confirmations to ensure faster and more reliable transactions on Ethereum, then AVS becomes tightly tied to every transaction a user makes on Ethereum. This builds a very powerful Efficient revenue-oriented AVS can stably output organic income.”

About vePuffer

One of the key factors that enables a protocol to achieve sustainable long-term price growth is tokenomics. A good protocol must have a well-designed token model that focuses on creating value for long-term holders. At Mechanism Capital, our core focus is on token economics design, supporting teams that can innovate and maximize token value capture.

Puffer Finance is launching vePuffer as an update to Token Economics. The goal is to deliver value to token holders and align incentives across the ecosystem. To do this, they introduced the following innovations:

Decentralized governance:

vePUFFER enables the community to participate in voting on the allocation of PUFFER points, consistent with Puffer's decentralization goals.

Tradable points:

ERC20 PUFFER points in the second quarter support trading, allowing users to earn early gains or make additional purchases through trading, thereby increasing flexibility and arbitrage potential.

Flexible strategy :

Tradable points allow users to decide to hold, sell or buy based on personal strategies and market sentiment, enhancing risk management capabilities.

Bribery market :

The protocol can provide incentives to vePUFFER holders to increase the number of votes in their pool, thereby increasing APR and liquidity.

Competitive Agreement :

Bribery mechanisms allow protocols to attract votes to increase APR, promote user participation and create aligned incentives.

Community driven reward mechanism :

The vePUFFER model supports governance, speculation, and diversification strategies, empowering users to shape the ecosystem’s incentive mechanisms.

Why Puffer’s UniFi is unique: Reshaping Ethereum’s rollup landscape

By launching UniFi, Puffer creates opportunities for Ethereum to transform from a fragmented rollup environment to a unified, positive-sum ecosystem. This ecosystem brings developers, users, and liquidity together like never before. The end result? A stronger, more resilient Ethereum capable of meeting the needs of billions of users.

Disclaimer : The content of this article does not constitute any investment advice.

jinse

jinse

chaincatcher

chaincatcher