Preview of the main theme of 2025: Make DeFi great again

Reprinted from panewslab

12/20/2024·5MAuthor: YBB Capital Researcher Ac-Core

TL;DR

-

World Liberty Financial, jointly launched by the Trump family and top figures in the crypto industry, is gradually affecting the development trend of the industry, and its recent currency purchases have also driven increases in the secondary market;

-

After Trump wins the election, potential short-term positive crypto policies include: the establishment of a strategic Bitcoin reserve in the United States, the regular legalization of crypto, and debt issuance plans to cooperate with ETFs;

-

The new interest rate cut cycle will allow DeFi to attract more capital injections, similar to the macro environment during the DeFi Summer period from 20 to 21;

-

Many lending agreements such as AAVE and Hyperliquid have attracted widespread attention from the market, showing strong recovery and outbreak potential;

-

The recent currency listing trend of Binance and Coinbase is more towards DeFi related tokens.

1. The impact of off-chain situations on the overall trend:

1.1 World Liberty and the Trump Administration

Source: Financial Times

World Liberty Financial is positioned as a decentralized financial platform that provides fair, transparent and compliant financial tools, attracting a large number of users and symbolizing the beginning of the banking industry revolution. Launched by the Trump family and top figures in the crypto industry, it aims to challenge the traditional banking system by providing innovative financial solutions. Expressing Trump’s ambition to make the United States a global leader in cryptocurrency, it aims to challenge the traditional banking system by providing innovative financial solutions.

At the same time, due to the recent purchase by World Liberty Financial in December, the prices of related DeFi tokens have also rebounded, including ETH, cbBTC, LINK, AAVE, ENA, and ONDO.

1.2 Favorable encryption policies to be finalized

The 47th President of the United States, Donald Trump, will hold an inauguration ceremony on January 20, 2025. There are three main positive policies to be implemented in crypto:

- Trump reiterates plans to establish U.S. Bitcoin strategic reserve

Strategic reserves are reserves of critical resources that are released in times of crisis or supply disruptions, the most well-known example being the U.S. Strategic Petroleum Reserve. Trump recently stated that the United States plans to make major moves in the field of encryption and may establish a cryptocurrency reserve similar to oil reserves. According to data from CoinGecko in July this year, governments hold a total of 2.2% of the global Bitcoin supply, and the United States owns 200,000 Bitcoins worth more than US$20 billion.

- Crypto normalcy legitimizes

When the Trump administration comes to power again, it may implement the complete legalization of cryptocurrency, and may adopt a more open policy in this field in the future. Trump’s speech at the Blockchain Association’s annual gala: affirmed the Blockchain Association’s contribution to the United States Cryptocurrency legislation efforts; says real use cases like DePIN legalize cryptocurrencies and is on the priority list for legislation; promises to ensure Bitcoin and cryptocurrencies thrive in the United States.

- Crypto Combination Boxing: Stabilizing US Dollar Hegemony + Bitcoin Strategic Reserve + Crypto Legalization + ETF = Bond

Trump’s public strong support for crypto-assets has brought him many benefits:

- During his tenure, he better consolidated the status of the US dollar and the US dollar pricing power of the crypto industry; 2. Layed out the crypto market in advance to allow more funds to enter; 3. Forced The Fed moves closer to itself; 4. Forces past hostile capital to move closer to itself.

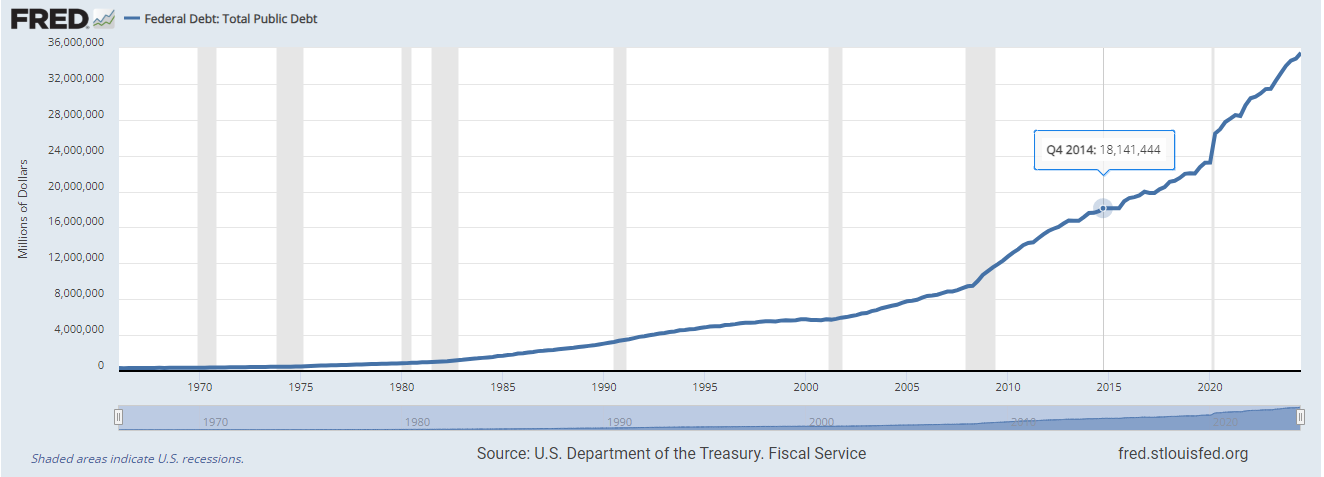

As shown in the figure below, the U.S. dollar index in 2014 was around 80 and the U.S. debt was only about 20 trillion. Now the U.S. debt has increased to about 36 trillion U.S. dollars, an increase of 80% month-on-month, but the U.S. dollar continues to appreciate uncharacteristically. If the U.S. dollar continues to strengthen, combined with the U.S. Securities and Exchange Commission’s approval of a spot Bitcoin ETF, it is entirely possible that the new incremental portion will cover the cost of future debt issuance.

Source data: investing

Image source data: fred.stlouisfed

1.3 The new interest rate cut cycle makes DeFi more attractive

Data released by the U.S. Bureau of Labor Statistics showed that core inflation rose by 0.3% for the fourth consecutive quarter in November, rising 3.3% year-on-year. Housing costs fell, but commodity prices excluding food and energy rose 0.3%, the largest increase since May 2023.

The market reacted quickly and believed that the probability of the Federal Reserve cutting interest rates next week increased from 80% to 90%. Investment manager James Assi believes that a rate cut in December is almost a foregone conclusion. Short-term U.S. Treasuries first rose and then fell as market expectations for the Federal Reserve to cut interest rates this year increased due to mixed employment data. At the same time, JPMorgan Chase expects the Federal Reserve to cut interest rates on a quarterly basis after its December policy meeting until the federal funds rate reaches 3.5%.

The recovery of DeFi is not only driven by internal factors, but external economic changes also play a key role. As global interest rates change and riskier assets like cryptoassets, including DeFi, become more attractive to investors looking for higher returns, the market is bracing for what could be a period of low interest rates, similar to the push The environment for the 2017 and 2020 crypto bull markets.

The recovery of DeFi is not only driven by internal factors. The three factors of Bitcoin ETF, the legalization of crypto assets, and changes in global interest rates will also subject the future crypto market to more external influences. As interest rates fall, riskier assets become more attractive to investors, similar to the environment of the overall crypto bull market in 2017 and 2021.

Therefore, DeFi benefits from two points in the low interest rate environment:

-

Reduced opportunity cost of capital: Returns from traditional financial products decline, and investors may turn to DeFi in search of higher returns (this also means that the profit potential of the crypto market will be further compressed in the future);

-

Lower loan costs: Financing becomes cheaper, encouraging users to borrow and activate the DeFi ecosystem.

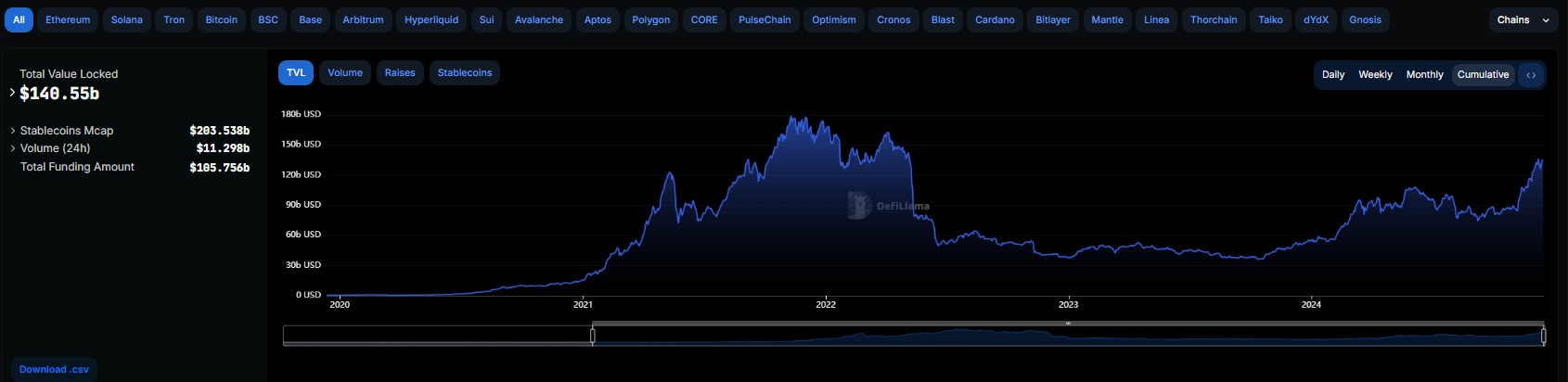

After two years of adjustment, key indicators such as total value locked (TVL) have begun to rebound. The trading volume of DeFi platforms has also increased significantly.

Image source data: DeFiLlama

2. In-chain growth drives market trends:

2.1 The recovery of lending protocol AAVE

Source: Cryptotimes

AAVE V1, V2 and V3 share the same architecture, and the main upgrade of V4 is the introduction of a “unified liquidity layer”. This feature is an extension of the Portal concept in the AAVE V3 version. Portal, as a cross-chain function in V3, aims to realize the supply of cross-chain assets, but many users are not familiar with it or have never used it. The original intention of Portal is to complete the cross-chain bridging operation of assets by destroying and minting aToken between different blockchains.

For example, Alice holds 10 aETH on Ethereum and she wants to transfer it to Arbitrum. She can submit the transaction through the whitelisted bridge protocol, which then performs the following steps:

-

The contract on Arbitrum will temporarily mint 10 aETH without underlying asset support;

-

These aETH are transferred to Alice;

-

Batch bridge transaction to transfer actual 10 ETH to Arbitrum;

-

When funds become available, these ETH are injected into the AAVE pool, providing backing for minted aETH.

Portal allows users to transfer funds across chains and pursue higher deposit interest rates. Although Portal achieves cross-chain liquidity, its operation relies on the whitelist bridging protocol rather than the AAVE core protocol, and users cannot use this function directly through AAVE.

V4's "Unified Liquidity Layer" is based on this improvement and adopts a modular design to uniformly manage supply, lending ceilings, interest rates, assets and incentives, so that liquidity can be dynamically allocated more efficiently. In addition, the modular design also allows AAVE to easily introduce or remove new modules without the need for large-scale liquidity migration.

With Chainlink's Cross-Chain Interoperability Protocol (CCIP), AAVE V4 will also build a "cross-chain liquidity layer" to allow users to instantly access all liquidity resources across different networks. Through these improvements, Portal will further evolve into a complete cross-chain liquidity protocol.

In addition to the "unified liquidity layer", AAVE V4 also plans to introduce new features such as dynamic interest rates, liquidity premiums, smart accounts, dynamic risk parameter configuration, non-EVM ecological expansion, etc., and build the Aave Network with the stablecoin GHO and the AAVE lending protocol as the core.

As a leader in the DeFi field, AAVE has occupied approximately 50% of the market share in the past three years. The launch of the V4 version aims to promote the further expansion of its ecosystem and serve potential 1 billion new users.

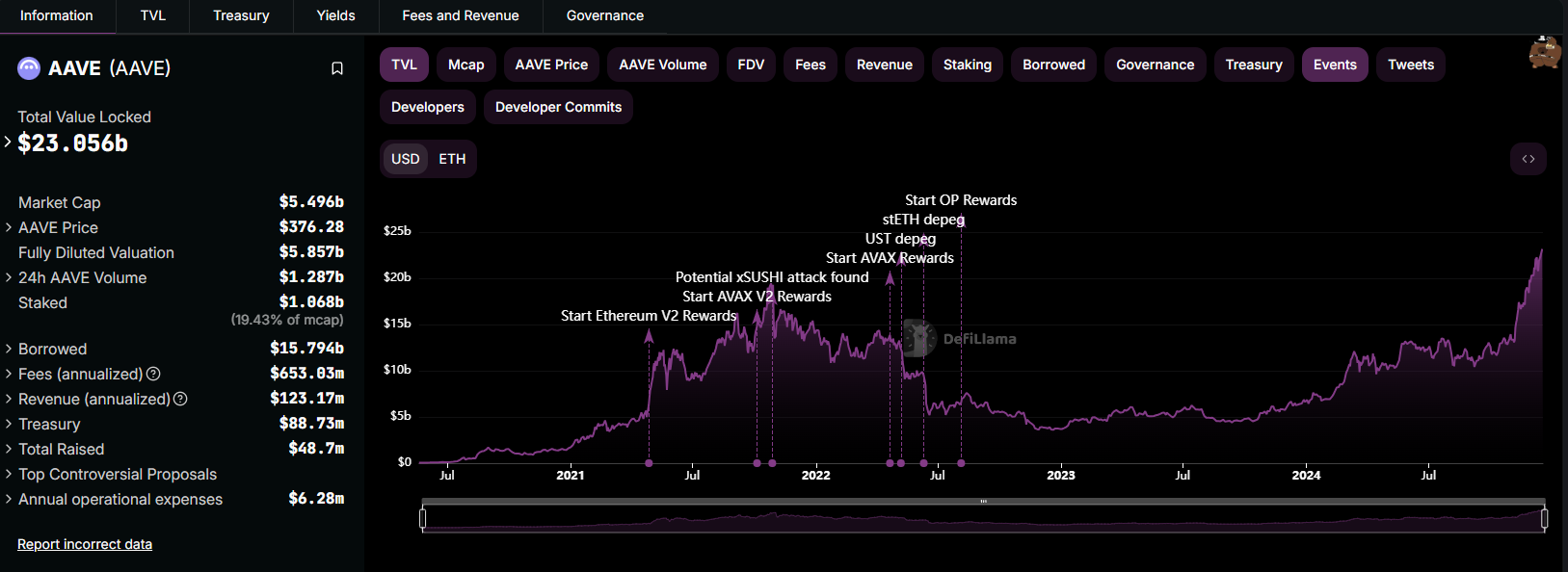

Image source data: DeFiLlama

As of December 18, 2024, AAVE's TVL data has also grown significantly, currently exceeding the 30% level during the peak of DeFi Summer in 2021, reaching $23.056B. Compared with the previous round, the changes in this round of DeFi protocols are more biased towards modular lending and better capital efficiency improvements. (For the modular lending protocol, please refer to the content of our previous article "Derivation of Modular Narrative: Modular Evolution of DeFi Lending")

2.2 Hyperliquid, the strongest derivative dark horse of the year

Image source: Medium: Hyperliquid

According to research by Yunt Capital@stevenyuntcap, the revenue sources of the Hyperliquid platform include instant listing auction fees, HLP market makers’ profits and losses, and platform fees. The first two are public information, and the team recently explained the last revenue source. Based on this, we can deduce that Hyperliquid’s total revenue year-to-date is approximately US$44 million, of which HLP contributed US$40 million; HLP strategy A lost US$2 million and strategy B made US$2 million; income from liquidation was US$4 million. . When HYPE launched, the team bought back HYPE tokens on the market through the Assistance Fund wallet. Assuming the team has no other USDC AF wallets, USDC AF’s year-to-date profit and loss is $52 million.

Therefore, combined with HLP’s $44 million and USDC AF’s $52 million, Hyperliquid’s total year-to-date revenue is approximately $96 million, surpassing Lido to become the ninth most profitable crypto project in 2024.

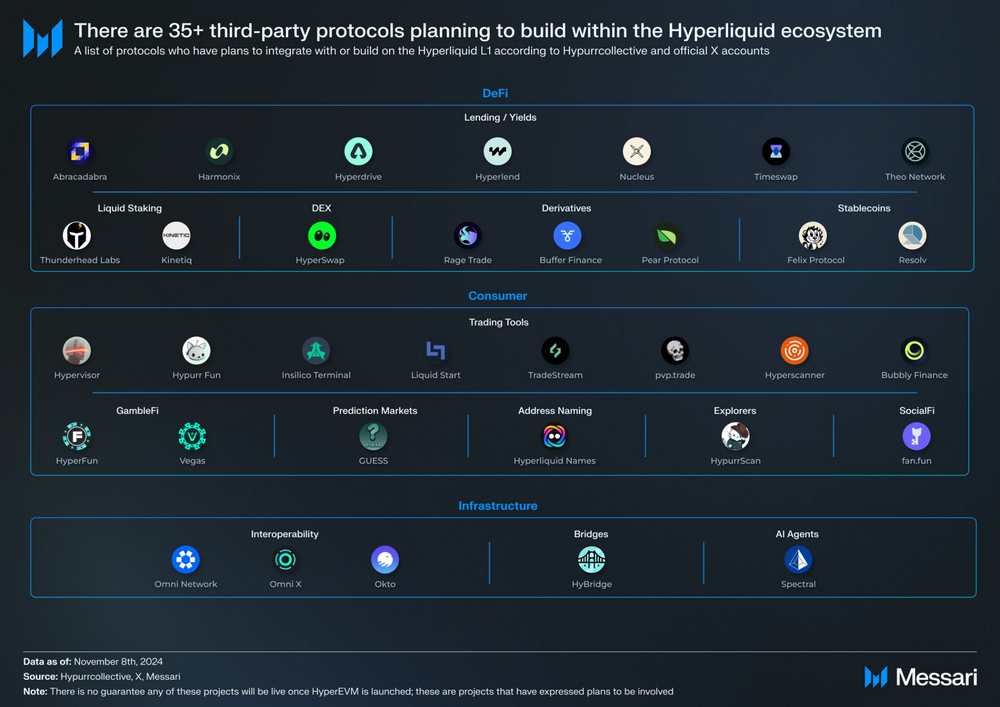

A recent valuation study by Messari Research@defi_monk on the HYPE token puts its fully diluted market capitalization (FDV) at around $13 billion, which could exceed $30 billion under the right market conditions. In addition, Hyperliquid also plans to launch HyperEVM through TGE (Token Generation Event). More than 35 teams plan to participate in this new ecosystem, which makes Hyperliquid closer to a general L1 chain, not just an application chain.

Source: Messari

Hyperliquid should adopt a new valuation framework. Usually the killer application and its L1 network are independent, the revenue of the application is attributed to the application token, and the revenue of the L1 network is attributed to the network validators. Hyperliquid integrates these revenue streams. Therefore, Hyperliquid not only owns the leading decentralized perpetual contract trading platform (Perp DEX), but also controls its underlying L1 network. We use the sum-of-the-parts valuation method to reflect its vertically integrated nature. First, let’s look at the valuation of Perp DEX.

Messari’s overall view on the derivatives market is consistent with that of Multicoin Capital and ASXN. The only difference is Hyperliquid’s market share. The Peap DEX market is a “winner takes all” market for the following reasons:

-

Any Perp DEX can list any perpetual contract, and there is no blockchain fragmentation problem;

-

Unlike centralized exchanges, no permission is required to use a decentralized exchange;

-

There are network effects in terms of order flow and liquidity.

Hyperliquid's dominant position will become stronger and stronger in the future. Hyperliquid is expected to account for nearly half of the on-chain market in 2027, bringing in $551 million in revenue. Transaction fees currently belong to the community, so they are considered actual revenue. Based on the 15x magnification of DeFi valuation standards, the valuation of Perp DEX as an independent business can reach US$8.3 billion. For enterprise customers, check out our complete model. Next let’s look at L1’s valuation:

L1 is typically valued using a premium for DeFi applications, and with the recent increase in activity from Hyperliquid on its network, its valuation may increase further. Hyperliquid is currently the 11th largest TVL chain, with similar networks such as Sei and Injective valued at $5 billion and $3 billion respectively, while similarly sized high-performance networks such as Sui and Aptos are valued at $30 billion each and $12 billion.

Since HyperEVM has not yet been launched, a more conservative premium of US$5 billion is used for Hyperliquid's L1 valuation. But if evaluated at the current market price, L1's valuation may be close to US$10 billion or higher.

Therefore, under the base scenario, Hyperliquid’s Perp DEX is valued at $8.3 billion, the L1 network is valued at $5 billion, and the total FDV is approximately $13.3 billion. The valuation in a bear market scenario is about $3 billion, while in a bull market it could reach $34 billion.

3. Summary

Looking forward to 2025, the comprehensive recovery and take-off of the DeFi ecosystem will undoubtedly become the mainstream theme. With the Trump administration's policy support for decentralized finance, the U.S. encryption industry has ushered in a more friendly regulatory environment, and DeFi has ushered in unprecedented opportunities for innovation and growth. As the leader of lending protocols, AAVE has gradually restored and surpassed its past glory with the liquidity layer innovation of the V4 version, becoming a core force in the DeFi lending field. In the derivatives market, Hyperliquid has quickly emerged as the strongest dark horse in 2024 with its excellent technological innovation and efficient market share integration, attracting a large number of users and liquidity.

At the same time, the currency listing strategies of mainstream exchanges such as Binance and Coinbase are also changing, and DeFi-related tokens have become a new focus, such as the recent ACX, ORCA, COW, CETUS, and VELODROME. The actions of the two major platforms reflect the market’s confidence in DeFi.

The prosperity of DeFi is not limited to the lending and derivatives market, but will also bloom in multiple fields such as stable coins, liquidity supply, and cross-chain solutions. It is foreseeable that, driven by policy, technology and market forces, DeFi will become great again in 2025 and become an indispensable part of the global financial system.

jinse

jinse

chaincatcher

chaincatcher