The pledged APY is as high as 22,037%, and the currency price surges 46% against the trend. This article reveals the mathematical magic of USUAL

Reprinted from panewslab

12/20/2024·5MAuthor: Azuma, Odaily Planet Daily

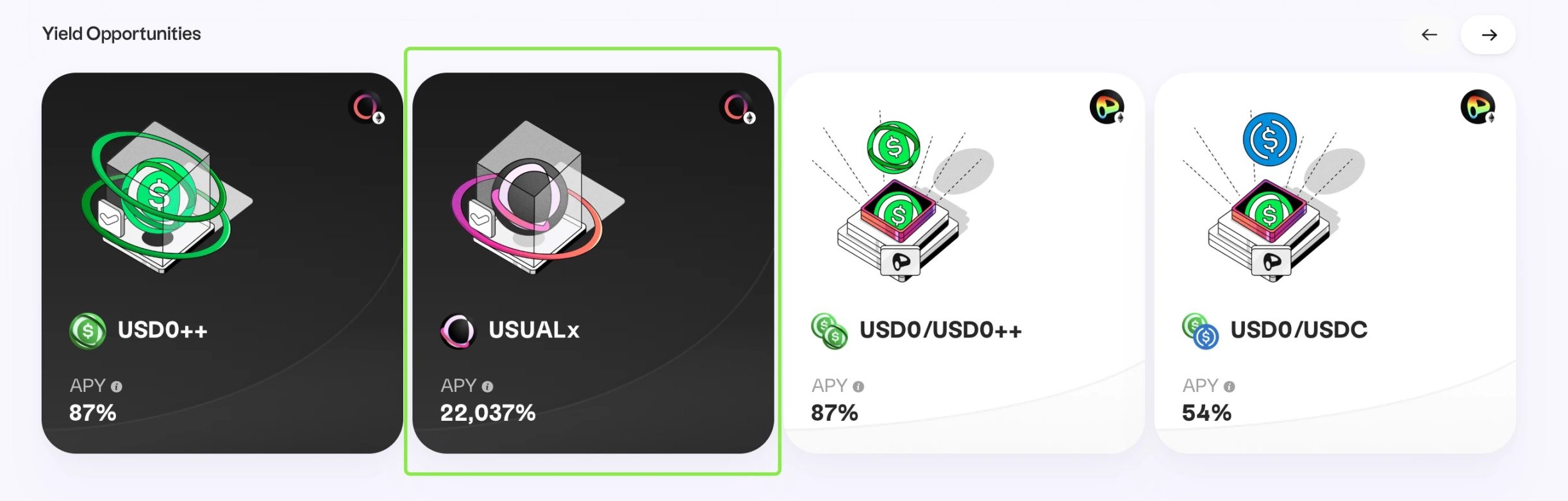

Usual (USUAL), a new player on the stablecoin track, has performed well recently. While the currency price has risen sharply, the amazing rate of return presented by USUAL's official pledge channel has also attracted the attention of many users.

As shown in the figure below, Usual official website information shows that the current real-time APY of USUAL pledged is as high as 22037%.

Odaily Note: Staking USUAL can unlock governance rights and obtain 10% of newly issued USUAL, which is also the source of USUAL staking income.

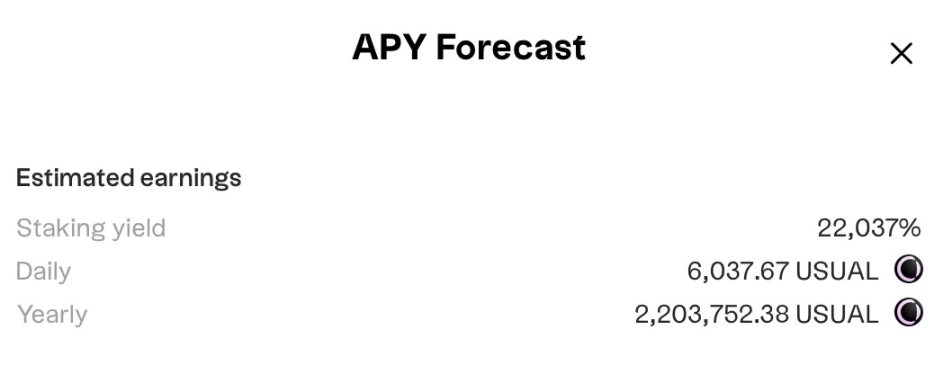

After clicking on the staking homepage and entering the amount of pre-deposited USUAL, the calculation simulation results are exaggeratedly more intuitive - assuming 10,000 USUAL is pledged, it is expected to obtain 2,203,752 USUAL in one year, and 6,037 USUAL can be obtained every day...

When many users first see these numbers, their reaction is "Isn't this picking up money?", but is this really the case? In the following, we will unveil the USUAL staking yield digital magic through a series of calculations.

APR vs. APY

The older generation of DeFi players may be well aware that although APR and APY, two seemingly similar indicators, are often used to measure the returns of cryptocurrency investments, in fact, their impact on returns is very different.

In short, APR does not take into account the impact of compound interest, while APY does incorporate the effect of compound interest into the calculation, often resulting in APY's returns tending to appear higher.

For example, if you deposit US$1,000 into a pool with an APR of 100%, then your principal plus income after the end of one year will be US$2,000; but assuming that the pool adopts a daily compound interest mechanism, that is, it will be settled every day. If you reinvest the interest and reinvest it, your principal plus income after one year will be approximately $2,718, corresponding to an APY of 171.8%.

The conversion between APR and APY can be calculated based on the following consensus, where n is the frequency of compound interest. If the daily compound interest mode is adopted within a one-year time period, n is 365.

APY = (1 + APR/n)^n - 1

USUAL’s Math Magic

Returning to USUAL's staking scenario, the 22037% here is the APY income, and the official clearly mentioned that interest will be automatically compounded every day.

Calculated according to the formula in the above figure, APY is 22037%, n is 365, and the calculated APR result is 543.65%, corresponding to a daily rate of return of approximately 1.49%.

Some friends may ask, USUAL’s staking mechanism clearly provides a daily compound interest mechanism, why should it be ignored? The reason is that in the compound interest model, daily returns will gradually increase as the timeline is lengthened, and when evaluating short-term returns, the APR number is actually more reliable.

Let’s briefly expand on the example of “Assuming 10,000 USUAL is pledged, it is estimated that 6,037 USUAL will be obtained every day within one year” mentioned above.

If the deposit is really full for one year, the calculation result will indeed hold true if the income situation remains unchanged, but in fact, after the user pledges 10,000 USUAL, he will not receive an equal amount of 6,037 USUAL every day.

The real situation is that after staking 10,000 USUAL, the user will only receive about 149 USUAL on the first day (daily yield 1.49%). After that, the daily income will gradually increase with compound interest, because the pledged principal will increase with the re-investment. It continues to grow, and the number 6037 is just the daily average over a one-year period - note that all this is based on the premise that the income situation remains unchanged.

Potential risks

Ignoring users who make long-term pledges for other needs, if you are rushing to buy coins and pledge just because of the high interest rate of 22037%, please be sure to understand the following risks.

Eliminate pledge wear risk

It is worth mentioning that USUAL’s unstaking requires a 10% fee, which means that based on a daily rate of return of 1.49%, it will take at least a week for users to recover the 10% unstaking cost after staking.

Risks of expanding pledge scale

USUAL's pledge size may further expand, diluting yields.

The current size of USUALx (pledged version of USUAL) is about 26 million, corresponding to the pledged number of USUAL about 27.81 million; the initial circulating supply of USUAL is 494.6 million. In addition, Binance has not yet opened USUAL withdrawals. This means that the subsequent USUAL staking scale is expected to have large room for growth, which may seriously dilute the real-time yield of the staking pool.

Odaily Note: The pledged APY number on the USUAL official website is not updated in real time, and the update frequency is temporarily unknown.

Risk of currency price decline

We cannot predict the market, but the current buying attracted by high interest rates may be an important buying force for USUAL.

All the above calculations are based on the USUAL currency standard. If the downward risk of currency prices is taken into account, there may be a possibility that the real income will be significantly reduced or even the principal will shrink.

jinse

jinse

chaincatcher

chaincatcher